The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters. All that was missing by then was the economic data to confirm what markets had already priced.

That’s the thing about market data (in this case, not stocks). It tells us something important about what’s going on that we can’t see deep down underneath the invisible hand until some government agency comes along and only later puts some numbers to it (and even then we have to wait several years more for the more accurate estimates to be offered up).

I titled the work three years ago Retail Sales Landmine for what had to be obvious reasons, beginning in hindsight of the market landmine we’d already witnessed in real-time. By February 2019, Census had revised – downward, of course – its initial estimates for retail sales during the all-important consumer climax which takes place each and every December.

According to figures released today, the Census Bureau puts Christmas 2018 as slightly worse than Christmas 2007 – the revised estimates… Even if you didn’t think it was possible for the data to look even worse, seasonally-adjusted retail sales fell by 1.24% from November 2018. There’s not been a decline of similar magnitude in any month since 2009 when the global economy was first stumbling its way out of the Great “Recession.”

The market action, the real landmine, had warned us ahead of time “something” substantially indecent was brewing under the visible surface.

While each of these results confirmed this had been the case, the fact that it was set off a couple second order effects – of the negative kind. These are the self-reinforcing feedbacks that can, if they go far enough, lead an entire economy far astray, even to the point of outright recession.

| A primary feedback mechanism is always inventory. Everyone especially retailers had heard Jay Powell say throughout 2018 recovery, recovery, recovery. It was going to be so boomingly awesome, he just had to scale it back a touch with an increasingly aggressive series of rate hikes to go along with QT (these don’t actually do anything apart from signaling to the public what the Fed believes about economic circumstances).Imagine their utter shock when retail sales during that particular December ended up being more 2007 than whatever 45-degree ascent in them the FOMC had been forecasting before then.

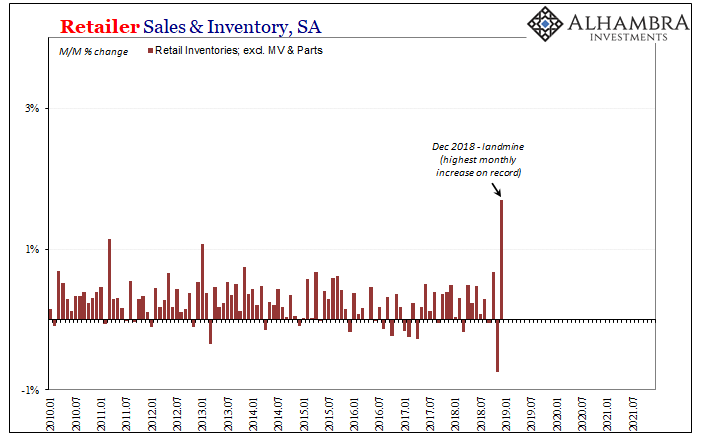

It left the goods economy to deal with this: Even though retail trade inventories had been lower in November, the increase of goods on hand during December 2018’s landmine would end up as the highest on record. Already experiencing a soft patch in the back half of that year, second order effect, the first half of 2019 could only have turned out even more in the direction of the burgeoning globally synchronized downturn. And the inventory accumulation that had already begun during the year before was from the landmine forward made into more serious “headwinds” ensuring Powell’s and the FOMC’s eventual embarrassing turnaround. |

|

| Rate cuts, not more hikes, ended up being the balance of 2019 (as markets had been predicting all along).

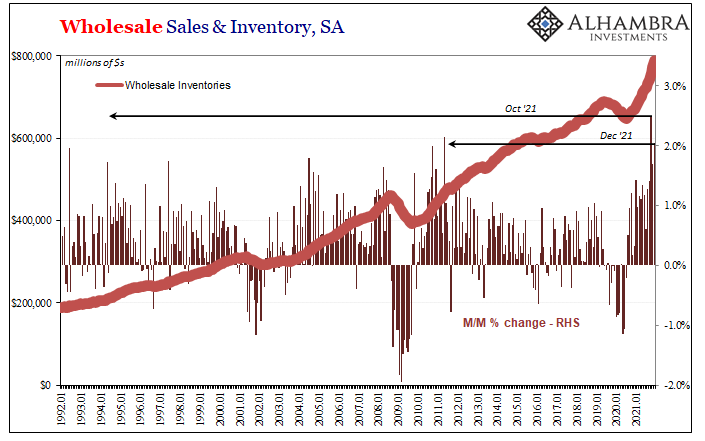

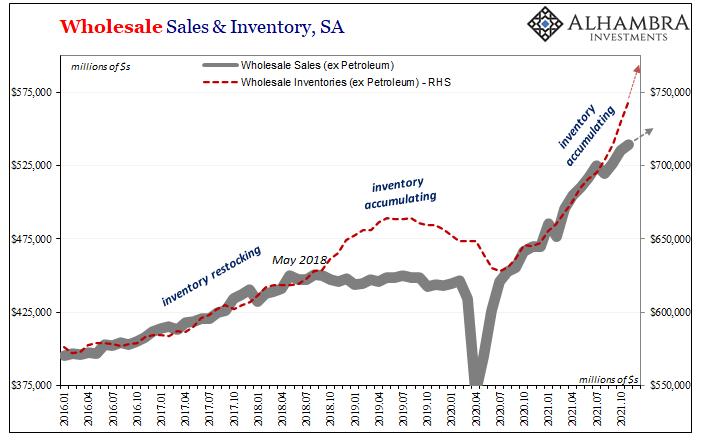

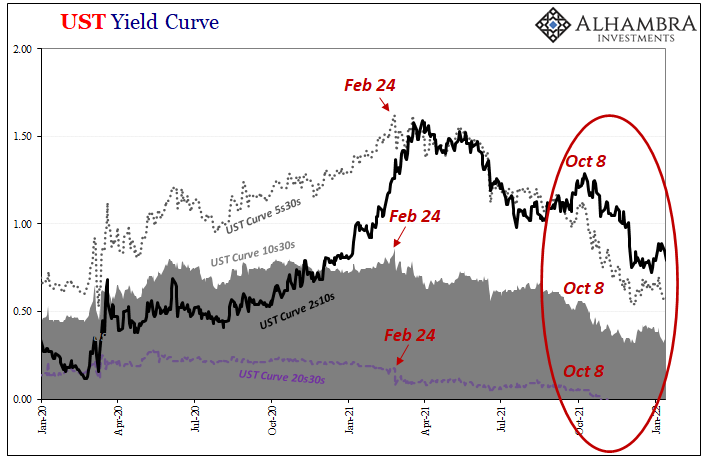

We have, of course, been following the inventory story in 2021 (now 2022) with the same fascination and worried interest. Though conditions are different this time around, with sales artificially high and the goods economy logjammed by transportation issues, the general take is the same either way. Inventory accumulation when it gets out in advance of sales becomes a primary source of marginal macro danger. Not just to the US, obviously, also worldwide since so many of these goods sold in America are produced somewhere else (like, say, China). And doubly the case when the goods economy has been the lone outlier in a positive sense. Several months ago, the Census Bureau showed us that wholesale inventory during October 2021 had increased by the most on record (month-over-month) for that series. Yet, already by then the curves had flattened going back to October even as short-term rates were rising on expectations of a set of upcoming FOMC rate hikes. It was a rather ominous start to last year’s holiday shopping season though we wouldn’t learn about it until early December when the data was published.

Today, Census gives us its preliminary estimates for wholesaler as well as retailer (we’ll get to that momentarily) inventory during December 2021 – the Big One, the holiday capstone itself. On the wholesale level, inventories just surged again, rising 2.05% month-over-month which just so happens to be the third largest monthly jump on record. In other words, two of the three biggest among the final three months of 2021. |

|

| This flies in the face of the mainstream interpretation of empty shelves sweeping social media again during January 2022. It’s not that there are no goods to stock those with, rather that it’s hard to get goods where they need to go in a timely and reliable manner.The goods have already been produced; the problem is figuring out where they are and about how many already in transit.

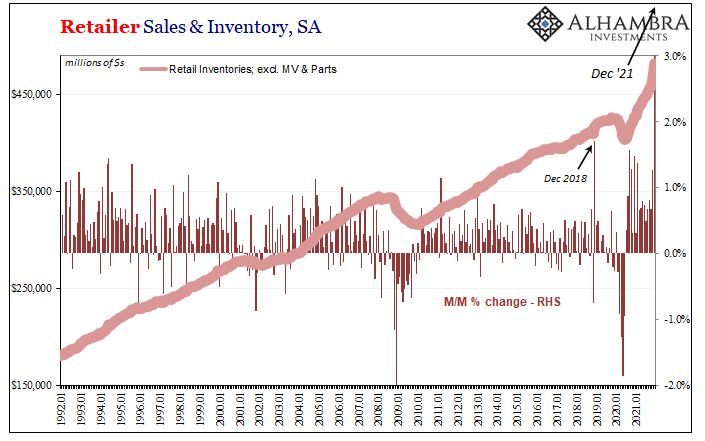

To that end, apparently it can get much worse for retailers. As already reported, retail sales had slumped in December 2021 (-1.91% m/m) at about the same rate as they had in the latest benchmarked estimates for that terrible Christmas of 2018 (-2.05% m/m). |

|

| Now, obviously the difference – and it is a big one – is how three years prior sales were falling from a weakened pace while last month they declined from still an epic, historic rate.

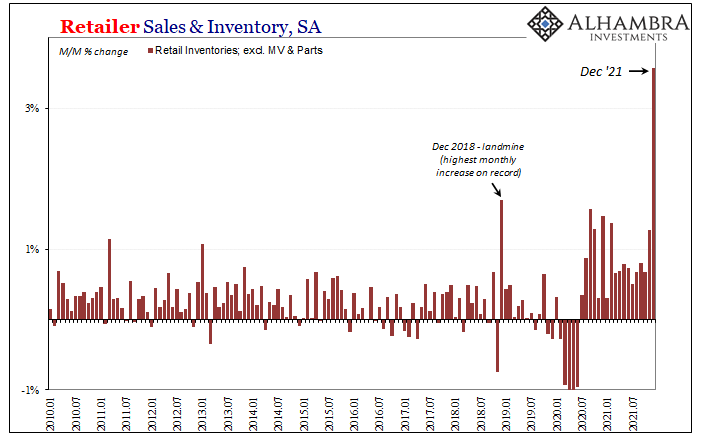

But it was still a slump and it still seems to have caught retailers off guard. Like 2018, as a consequence, Census today shows us that retail inventories rose by the most on record, absolutely obliterating the prior record jump in December 2018. It’s not even close (literally off my first chart below) in almost thirty years of retail inventory and trade data: |

|

| Excluding inventories of motor vehicles and parts, retail trade inventories gained as an astonishing 3.6% last month when compared to November! Including motor vehicles and parts, total retailer inventories surged by more, up 4.4% month-over-month because even automobiles(!) have finally begun to show up in recent months.

Back in September, I had asked:

|

|

| It’s already a mess, and because it’s already a mess the entire supply chain tries to stuff more goods through it rather than less, rather than giving the system some time and space to work out enough kinks.

This, of course, would probably convince retailers to do it all over again, ordering even more they don’t need now or in the near future, now more desperate to try and raise their chances of receiving anything. More trouble for the shippers and so on. Having intentionally over-ordered, and then over-ordered again (and again?), this time what happens when the logistics get more sorted out and then deliveries rather than trickle through come pouring out? This is the cyclical question for early 2022, not the unemployment rate. The last few months absolutely have shown a trickle transform into “pouring out”, and it’s particularly worrisome now at both the wholesaler as well as retail level. note: the complete inventory and sales data has not been released for the month of December, so I’ve added my own approximations based on what was just published on the chart below which features subsets of the overall totals Jay Powell and the FOMC, they are about to start hiking rates on the basis of the unemployment rate, referencing that thing again also today, while the deeper more relevant primary macro factor might ultimately prove to be this other. Could another embarrassing U-turn for the Fed be looming at some future point (if so, it won’t be imminent by any means)? While nothing is definitive, you have to wonder just how much history is being repeated with markets (flattening curves, falling TIPS breaks, etc.) picking up on something while the data confirms the same potential thing(s). Maybe the December inventory data doesn’t prove the “growth scare”, but it sure doesn’t do anything whatsoever to refute it, either. |

|

| Either way, goods are pouring out. And as they are, do sales now keep up or will they continue to fall off the further in time the economy moves away from Uncle Sam’s checkbook. | |

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,Business Cycle,consumer spending,currencies,economy,Featured,Federal Reserve/Monetary Policy,Inventory,inventory cycle,Markets,newsletter,Retail sales,wholesale inventory