After discussing BofA’s view of why the market could drop to 3800, I thought it fair to discuss a more optimistic view. BofA’s view of a market correction was a function of the more exuberant “optimism” in the market. To wit:

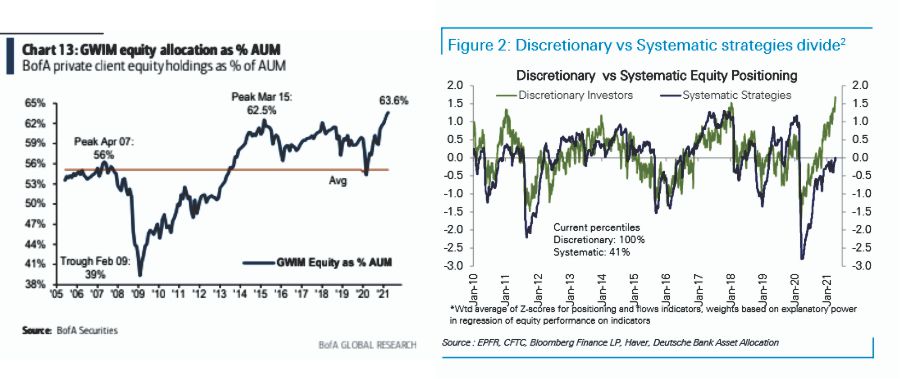

“More importantly, investors are incredibly long-biased in portfolios, with equity allocations reaching some of the highest levels in history.” What Subramanian questioned is whether all the “good news” is already “priced in?”

So, with BofA’s context in place, what is Yardeni seeing so differently? |

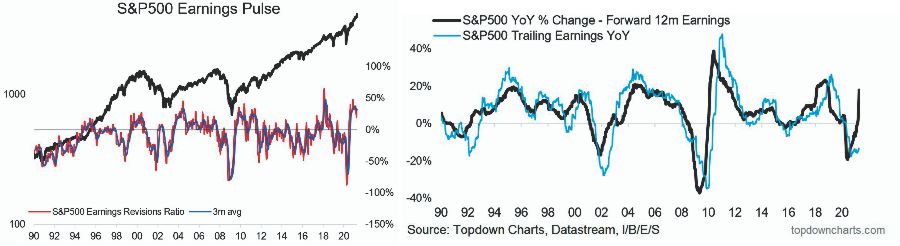

S&P 500 Earnings Revisions, 1990 - 2020 |

Yardeni’s Outlook

The basis of Yardeni’s forecast is that of a robust economic recovery that, in his words, was “much better than expected.” The other reasons supporting his optimistic view are:

|

Equity Allocations |

| Psychology Of QE

A recent commentary from Mish Shedlock on QE is key to understanding the current speculative psychology. I pulled two specific quotes from his article:

And

In other words, “Quantitative Easing” is a mental formation. The only thing that alters its effectiveness of the Fed’s monetary policy is investor psychology itself. Such was a point we made in the “Stability/Instability Paradox.”

|

|

Moral HazardThe ‘stability/instability paradox’ assumes that all players are rational, and such rationality implies avoidance of destruction. In other words, all players will act rationally, and no one will push “’the big red button.’” Importantly, what Hussman addresses when he says investors psychologically rule out the possibility of price declines is “moral hazard.” What exactly is the definition of “moral hazard.”

|

Fed Balance Sheet vs. S&P 500, 2018 - 2020 |

| The increase in the Fed’s balance sheet remains in near lockstep with the stock market’s climb.

While Fed officials tacitly deny any correlation between their monetary interventions and the stock market, the evidence is quite clear. However, as stated, the consequences of monetary policy longer-term gets set aside for the short-term benefits of inflated “psychology.” |

|

The Flies In The OintmentI would be remiss in not briefly addressing some of the concerns in Yardeni’s views. Productivity is deflationary. As I discussed in “The Roaring ’20s Aren’t Coming:”

Furthermore, a sustained spike in inflation, which drives rates higher, will negatively impact both the markets and the economy. As Michael Lebowitz noted in “What Interest Rate Will Matter,” rate increases have a history of financial events. |

Stock Bond Ratio vs. S&P Index, 1997 - 2021 |

To wit:

|

Productivity & Wages in The "New-New Normal", 2000 - 2021 |

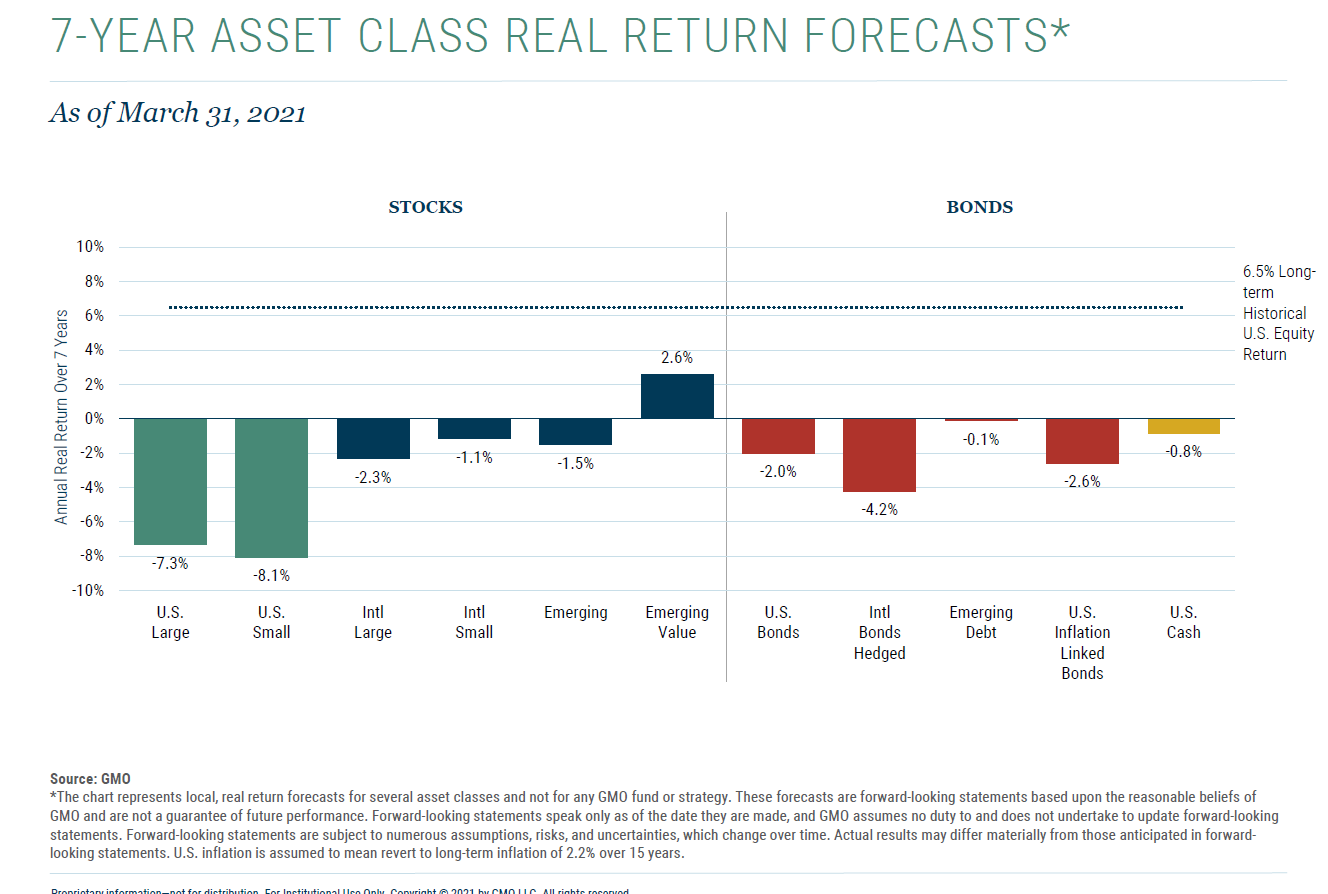

Yes. Valuations Are Expensive.While Yardeni suggests valuations are cheap, there is little evidence that such is the case. Most of the assumption is that earnings and the economy will “catch up” with prices. Such would suggest that prices remain stagnant during that process, yet Yardeni assumes prices will surge to 4500 in 2021, eclipsing the benefit of assumed growth. Therefore, valuations are not only high by historical standards but will remain high as prices rise along with economic and earnings growth. The consequence of over-paying for valuations today is substantially lower long-term returns from asset classes in the future. The eponymous GMO noted such in their most recent 7-year forecasts. Furthermore, given the extremely high correlation between stocks and bonds, a level of extreme not seen since the “Dot.com” peak, future outcomes seem poor. |

10 Year Yields and Secular GDP Growth, 1977 - 2021 |

| nue to supply liquidity, which will help the market ignore the reality of the majority of return barometers. However, as we saw in March of 2020, that does not preclude hair-raising volatility and significant declines. But, to Yardeni’s point, in the short-term Fed liquidity does support prices on the margin regardless of the environment. |

7-Year Asset Class Real Return Forecasts |

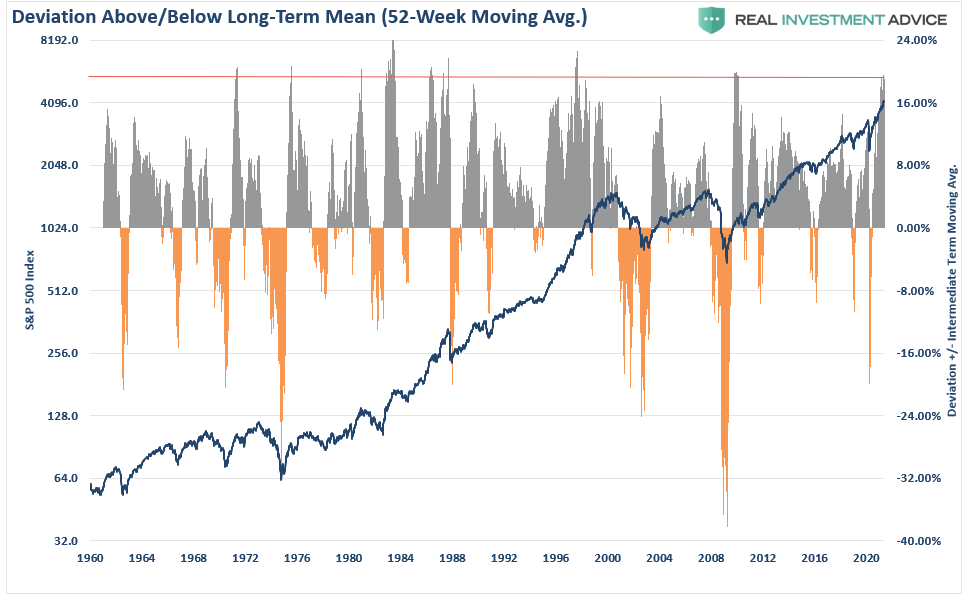

| Does that mean the market will crash tomorrow? No. However, it does strongly suggest that at some point, a mean-reverting event will occur. Such a decline will wipe out a large chunk of recent gains as markets reprice for slower future economic growth.

If you agree with Dr. Yardeni, the prescription is |

|

| ng>Does that mean the market will crash tomorrow? No. However, it does strongly suggest that at some point, a mean-reverting event will occur. Such a decline will wipe out a large chunk of recent gains as markets reprice for slower future economic growth.

If you agree with Dr. Yardeni, the prescription is simple. Buy stocks. However, as Mark Hulbert recently noted:

So, what should you do if you are close to retirement?

You have a choice. But, for now, Yardeni is correct. Just remember:

The post Technically Speaking: Yardeni – The Market Will Soon Reach 4500 appeared first on RIA. |

S&P500 Deviation 52 WMA, 1960 - 2020 |

Full story here Are you the author? Previous post See more for Next post

Tags: Featured,Investing,newsletter,Technically Speaking