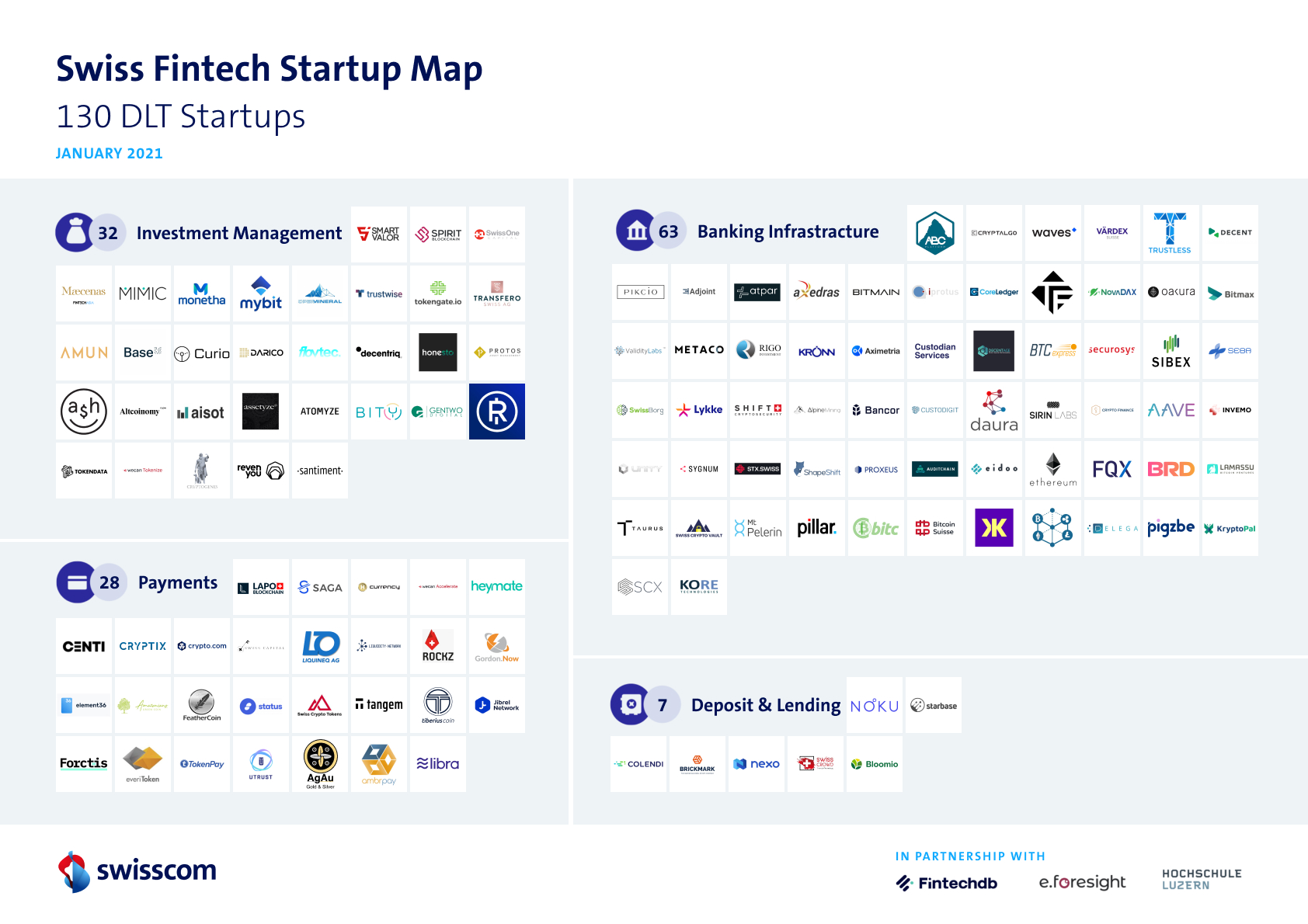

| Switzerland is home to 130 startups that are applying blockchain and distributed ledger technology (DLT) to finance use cases, new data from Swisscom show. Most of these companies (48%) operate in the banking infrastructure vertical, followed by investment management (24%), and payments (21%).

The largest vertical, banking infrastructure, comprises companies tackling tokenization, with the likes of Axedras and dauras; custody services with players like Taurus and Custodigit; and crypto banks, including Seba and Sygnum. Roland Cortivo, head of blockchain infrastructure for digital business at Swisscom, said in a recent Q&A that he expects the segment to continue growing with more bank-related services emerging including multi-bank signature management solutions. Deposit and lending, though the smallest segment, could further grow in the future on the back of a booming decentralized finance (DeFi) sector, according to Thomas Ankenbrand of the Institute of Financial Services Zug (IFZ) at Lucerne University of Applied Sciences and Arts. Another key development Ankenbrand outlined is the use of blockchain in capital markets, citing the tie-up between SIX and daura, a digital share platform for financing and investing in Swiss small and medium-sized enterprises (SMEs). SIX, which operates the infrastructure for the Swiss financial center, acquired a stake in daura in 2019. The company has been working on the SIX Digital Exchange (SDX), an integrated financial market infrastructure for digital assets, which, once fully launched, will allow companies to issue digital securities tokens. |

|

How the Swiss blockchain fintech sector has evolvedThe Swiss blockchain sector has significantly grown over the past four years, Ankenbrand said. In particular, 2017 and 2018 are the two years that saw the strongest uptick in the number of blockchain fintech companies being founded with 80 ventures, or more than 60% of all existing companies. Over the last two years, however, the number of new DLT fintech startups being launched has stagnated. Instead, existing startups have evolved and developed, and capitalization of these companies has grown, showcasing that the sector is maturing and stabilizing, Ankenbrand said. He added that merger and acquisition (M&A) deals and company closures have been few and far between, implying that the market hasn’t shown any notable sign of consolidation yet. In terms of geographical distribution, most of Switzerland’s blockchain fintechs (57%) are unsurprisingly based in the canton of Zug with 75 companies choosing the location to base their venture. Zug is followed by Zurich with 19 companies, Geneva with 12 companies, and Ticino with 7 companies. |

DLT bill entering into force

On February 01, 2021, some parts of the so-called DLT bill will enter into force. More particularly, the amendments to the Code of Obligations, the Federal Intermediated Securities Act and the Federal Act on International Private Law, will formally allow for the introduction of ledger-based securities represented in a blockchain.

In September 2020, the Swiss Parliament passed an amending act aimed at strengthen Switzerland’s position as a leading DLT/blockchain hub by incorporating crypto assets and DLT into Swiss law. The adopted act will amend several existing laws ranging from company bankruptcy to banking regulation.

The remaining provisions of the DLT bill, which are set to enter into force on August 01, 2021, will bring, among other things, the introduction of a new authorization category for “DLT trading facilities.” These will function similarly to existing multilateral trading facilities but will allow for direct access of retail participants and the provision of further services on the trading value chain such as clearing, settlement and custody services.

Blockchain-focused venture capital firm CV VC identified 835 blockchain companies in Switzerland as of September 2020, making the country one of the biggest blockchain hubs in the world.

Full story here Are you the author? See more for Next postTags: Blockchain/Bitcoin,Featured,newsletter,Switzerland