We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners.

Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially true. Recently Europeans started to increase their savings rate, while Americans reduced it. This has led to a rising trade and current surplus for the Europeans. But also to a massive Swiss trade surplus with the United States, that lifted Switzerland on the U.S. currency manipulation watch list.

To control the trade balance against this “savings effect”, economists may look at imports. When imports are rising at the same pace as GDP or consumption, then there is no such “savings effect”.

After the record trade surpluses, the Swiss economy may have turned around: consumption and imports are finally rising more than in 2015 and early 2016. In March the trade surplus got bigger again, still shy of the records in 2016.

Swiss National Bank wants to keep non-profitable sectors alive

Swiss exports are moving more and more toward higher value sectors: away from watches, jewelry and manufacturing towards chemicals and pharmaceuticals. With currency interventions, the SNB is trying to keep sectors alive, that would not survive without interventions.

At the same time, importers keep the currency gains of imported goods and return little to the consumer. This tendency is accentuated by the SNB, that makes the franc weaker.

Texts and Charts from the Swiss customs data release (translated from French).

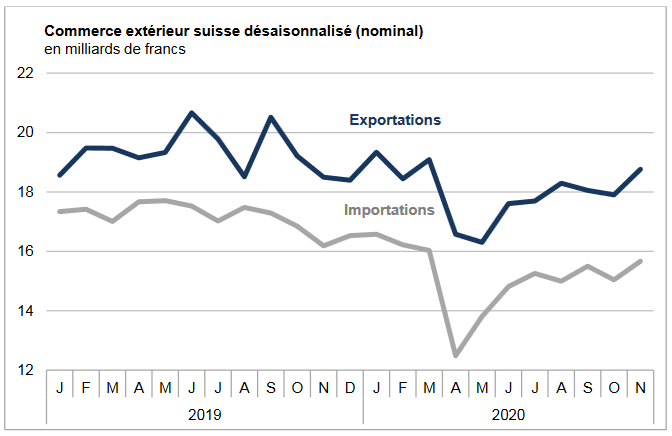

Exports and Imports YoY DevelopmentIn November 2020, Swiss foreign trade stood out with an increase in both directions of traffic. In seasonally adjusted terms, exports advanced 4.8% and imports 4.2%. Falling over the previous two months, exports resumed their growth path and the trade balance closed with a surplus of 3.1 billion francs. In short ▲ Foreign trade in November: highest level since March 2020 ▲ Chemicals-pharma sector: jump in entry and exit exchanges ▲ Watchmaking exports have peaked at 1.6 billion francs since July ▲ A surge in vehicle imports as well as jewelry and jewelry |

Swiss exports and imports, seasonally adjusted (in bn CHF), November 2020(see more posts on Switzerland Exports, Switzerland Imports, ) |

Global evolutionIn November 2020, Swiss foreign trade stood out with an increase in both traffic directions. In seasonally adjusted terms, exports advanced 4.8% and imports 4.2%. Falling over the previous two months, exports have returned to growth. The trade balance closed with a surplus of 3.1 billion francs. |

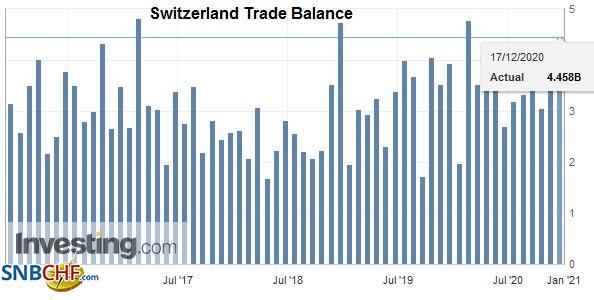

Switzerland Trade Balance, November 2020(see more posts on Switzerland Trade Balance, ) Source: investing.com - Click to enlarge |

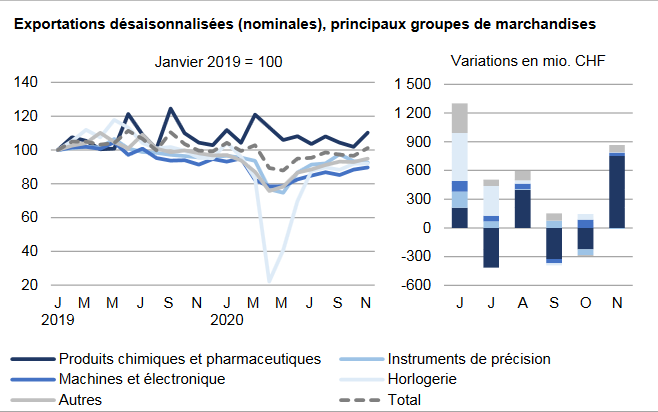

Exports to China hit new peakTwo out of three commodity groups progressed in November 2020. The strongest contribution to growth can be attributed to chemicals and pharmaceuticals (+751 million francs or + 8.2%), which had again suffered a heavy setback during the year. the previous two months Medication and active ingredients swelled by one-sixth over one month. As in the previous month, turnover in the machinery and electronics sector increased (+ 1.5%). Watch sales have stagnated; These have been moving within a range of between 1.5 and 1.6 billion francs since July 2020. In the other goods group, the vehicle sectors (+66 million francs; airliners), jewelry and jewelry as well as metals stand out. In November 2020, Swiss exports strengthened to the three main markets, with the prize going to Asia (+ 13.5%). Sales with China jumped half a billion francs (+ 45.1%; previous month: -21.2%) to an all-time high. Here, chemicals and pharmaceuticals, as well as watchmaking in particular, were very successful. The increase in Singapore (+95 million francs) should also be noted. Deliveries to North America increased by 4.5%, driven by the boom in those to Canada (+ 183million; mainly chemicals-pharma). Europe grew by 3.1% (+324 million), where the United Kingdom (+130 million) and Spain (+107 million) moved to the forefront. |

Swiss Exports per Sector November 2020 vs. 2019(see more posts on Switzerland Exports, Switzerland Exports by Sector, ) |

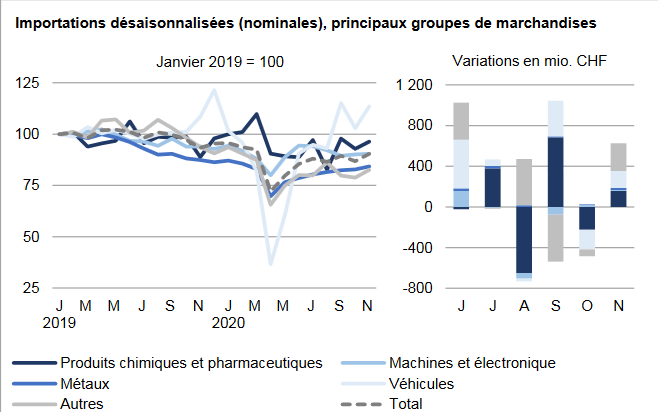

Imports: Passenger cars rise above their ‘pre-coronavirus’ levelThe increase at entry was based on three groups of goods: vehicles (+168 million francs), chemicals and pharmaceuticals (+157 million) as well as jewelry and jewelry (+152 million). In the former, passenger car arrivals increased by 103 million francs over one month (at the same time reaching their highest level since July 2018) and those of aeronautics by 90 million francs. Within the second, immunological products gained 198 million francs while the active ingredients fell by 112 million. In November 2020, imports from the three main supply markets gained ground. Asia posted growth of 8.2% (+ CHF 242 million), which proved to be largely sustained at the country level. Arrivals from Europe increased by 4.8% or around half a billion francs. France (+122 million) and the United Kingdom (+107 million) in particular contributed to the increase. As for deliveries to North America, they increased by 4.4%. |

Swiss Imports per Sector November 2020 vs. 2019(see more posts on Switzerland Imports, Switzerland Imports by Sector, ) |

Tags: Featured,newsletter,Switzerland Exports,Switzerland Exports by Sector,Switzerland Imports,Switzerland Imports by Sector,Switzerland Trade Balance