| One day short of one year ago, on September 16, 2019, China’s National Bureau of Statistics (NBS) reported its updated monthly estimates for the Big 3 accounts. Industrial Production (IP) is a closely-watched indicator as it is relatively decent proxy for the entire goods economy around the world. Retail Sales in the post-Euro$ #2 context give us a sense of the Chinese economy’s persistent struggle to try to “rebalance” without the pre-2008 boost China had obtained through actual global growth contributing to its export orientation.

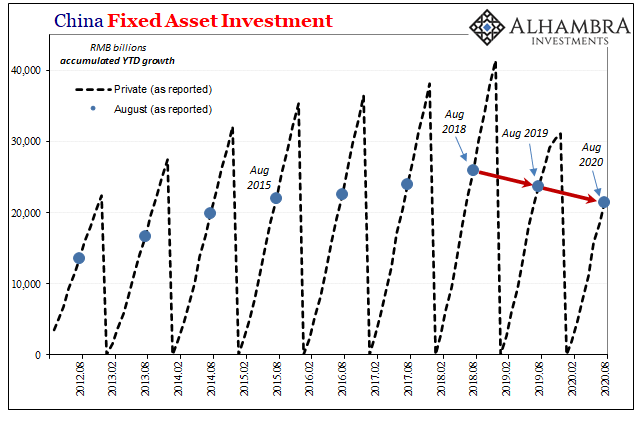

The third of the Big 3 is Fixed Asset Investment (FAI), the real secret behind the country’s rapid modernization. FAI is how the Chinese view their own future, whether that’s as a rebalanced consumer-led economy leaping off into a brand new paradigm; or one slowing itself down to a crawl that wouldn’t require nearly so much new fixed investment in glittering new cities filled with new middle class inhabitants and the sparkling new factories where they were all supposed to work (leaving hundreds of millions of China’s poorest citizens stranded in the largely the same subsistence-level agricultural existence their ancestors lived). Last September, the NBS was, as usual, filled with glowingly positive descriptions of how the country’s Communist authorities had done a masterful job navigating tougher times – at least for everyone outside of China. In terms of Private FAI up to August 2019, the agency specified an accumulated year-to-date (January through August) total of RMB 23.7 trillion; a reported increase of 4.9% from the same months in 2018. |

China Fixed Asset Investment, 2012-2020 |

| One year later, suffering a massive contraction in between, leaving the entire world with questions about the global economy’s ability to dig itself out from it, the NBS today says that Private FAI from January to August 2020 in China totaled RMB 21.5 trillion; down a reported 2.8% from those same months in 2019.

Hold up; from the numbers I’ve given you (and you can check them for yourself), you probably are already scratching your head since they don’t seem to add up. Comparing the accumulated total through August 2020 with the reported total accumulated through August 2019, you get -9.5% instead. That’s not all. If you go back to the figure the NBS published in September 2018 for YTD August of that year, RMB 26.0 trillion, it doesn’t work out, either; we end up with -8.8% last year rather than the +4.9% that was put out in its press release. In fact, the August 2020 estimate for accumulated Private FAI is lower than what the NBS had reported all the way back in September 2015 for that particular YTD August. As you can see above, something changed in the reporting starting with 2019. Curious timing already. Now what the government has said is that those prior numbers are no longer comparable. The makeup of each individual account’s survey panel has been changed. Worse, it changes every year (or every month). As a consequence, we have to rely on the NBS’s word that there really was 4.9% growth January to August 2019 and that Private FAI only shrunk 2.8% and not 9.5% in those same months of 2020. Otherwise, you might be left with the impression China’s all-important secret economic sauce of Private FAI has been going the wrong way for two years running; not just the latest COVID challenge to the global marketplace. One key problem with this explanation, of course, is how the Chinese economy seems to have responded (as in, not responded) to the coronavirus reopening rebound. |

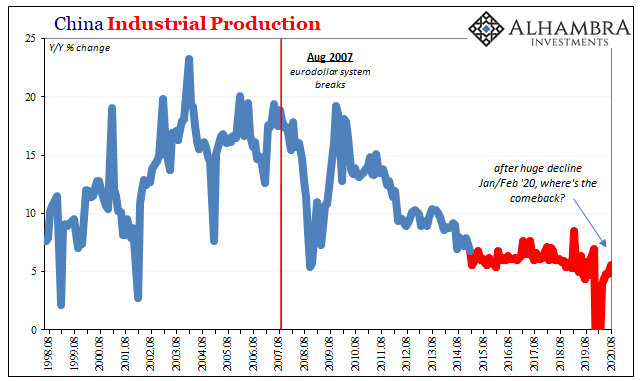

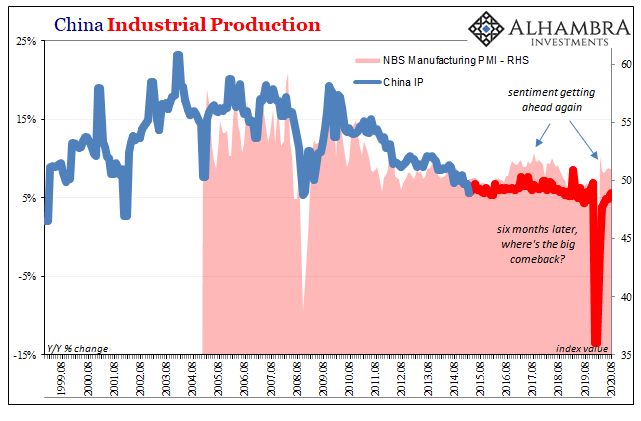

China Industrial Production, 1998-2020 |

| Like all other parts of the world, China is coming back – but, curiously, it’s not really coming back. And remember, the Chinese began their reopening all the way back in March while everyone else was shutting down.

They are two months further along in the process, and… |

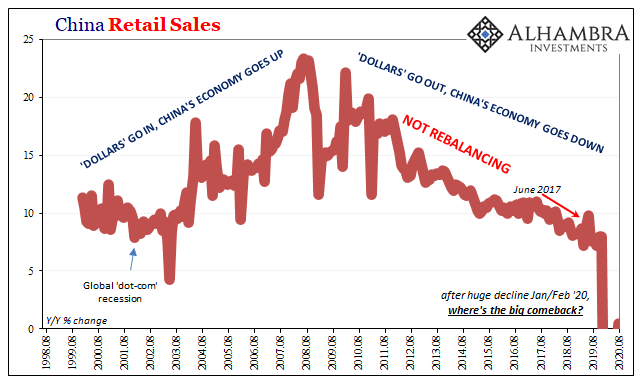

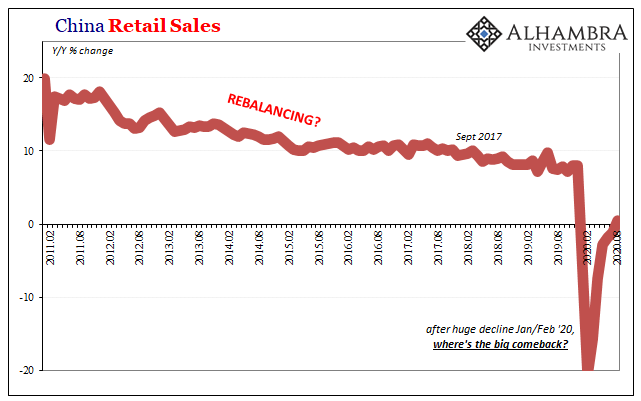

China Retail Sales, 1998-2020 |

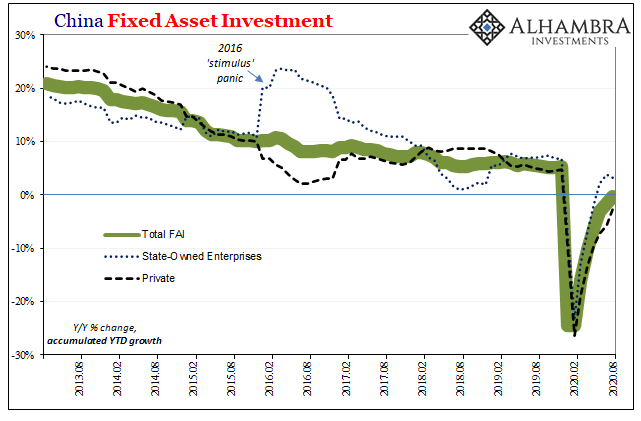

China Fixed Asset Investment, 2013-2020 |

|

| Industrial Production, for example, accelerated to +5.6% year-over-year (single month, not accumulated) in August. That’s up from +4.8% in July, and it’s being described as some kind of monumental achievement. Six months into reopening, and IP after suffering its worst two-month period ever (January-February), to have “achieved” no better than a level equal with some of its otherwise worst months in modern history is puzzling to say the least.

After having contracted by 13.5% year-over-year during that Jan-Feb period, where’s the +20% to balance it out? Getting back to 2019 isn’t what everyone seems to think. |

China Industrial Production, 1999-2020 |

| The discrepancy is by far the worst in Chinese retail sales. For the first time this year, in August, retail sales managed a plus sign if only barely. At +0.5% year-over-year, again, the lack of acceleration is truly puzzling; as are all these declarations that this is some sort of confirmation of a “V.” If you are saying the economy is robustly rebounding, then where’s the rebound inside China’s interior?

The absence of it is what stands out, not the tiniest positive number. After all, before 2019, retail sales growth had never been less than +7.7% (except for one quirky month in 2003). Six months into reopening, and consumer spending isn’t even anywhere close to that one month in 2003! |

China Retail Sales, 2011-2020 |

We’d like to have some idea, therefore, about how Chinese companies and the government are not just interpreting these conditions but acting on those interpretations; what they might actually be doing – rather than what everyone is saying – in anticipation of how they perceive the future for the global economy. FAI.

Instead, all we know is that in August China’s government has admitted in its published numbers how it must have cut back (accumulated YTD +3.2% in August vs. +3.8% in July) on the FAI activity of State-owned businesses. Decelerating fiscal “stimulus” spending is at least consistent with the my-way-or-the-highway anti-stimulus stance Xi Jinping’s Party is already taking in the political realm.

Eurodollar University’s Making Sense; Episode 14: LI V XI II (Li versus Xi, The Rematch)

The global economy is really depending upon China to provide momentum and weight to recover. At best, huge questions. More likely, huge puzzles (meaning huge holes that aren’t being filled in very quickly at all). As noted yesterday, the latter really does identify with the very unhappy resurfacing of the Maoist term “rectification.”

The rectification implications will not just be felt by those arbitrarily declared disloyal in the Communist government and Party. What if Xi’s right (again; see: 19th Party Congress) about the true direction China’s economy may actually have taken?

Full story here Are you the author? Previous post See more for Next post

Tags: China,currencies,economy,fai,Featured,Federal Reserve/Monetary Policy,fixed asset investment,industrial production,Markets,newsletter,Retail sales,Xi Jinping