For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so.

| Bureaucratic inertia means a lot more than just resistance to change, it also means, at times and in certain capacities, all sorts of biases. When the bureaucracy predicts one set of circumstance, it is as likely if not more likely to hold to them at the expense of incoming contradictory information.

Central bankers claim to be data dependent. It is true but only in the narrowest sense; only when the data is overwhelming does it seem to matter. Thus, when a central bank changes course you really have to wonder just how obvious it must be that they should. Yet, that’s now how “stimulus” is viewed or characterized. In the mainstream media it is uniformly described as helpful even powerful. Most in the public just accept that view, oblivious and unaware they are content to take their cues from the “experts” alone. Neither the public nor the media pay close enough attention to the data, only the central banker’s interpretations of it. Fresh off her humiliating failure in Argentina, the IMF’s former head Christine Lagarde will soon become the head of the ECB. As part of her nomination process (mere formalities, of course), Lagarde appeared in front of the European “Parliament” last week and immediately called for heaping fiscal “stimulus.” |

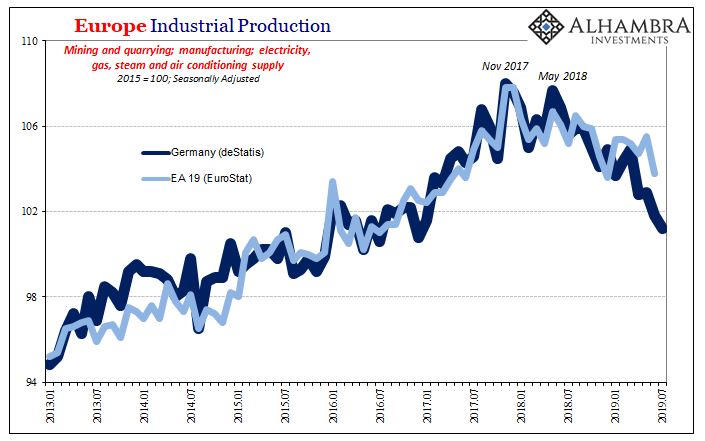

Europe Industrial Production, 2013-2019(see more posts on Eurozone Industrial Production, ) |

For some, and in some markets, this was treated as a relief; a positive sign that policymakers aren’t just downplaying risks anymore, and are finally taking the world actions seriously by setting up the “correct” reactions to them. That’s certainly how it has been written up. I wondered about it a bit differently:

Effectively, that’s just what Lagarde has done. Before ever taking office, she is saying (wink, wink) that monetary policy cannot shoulder the load alone. To Economists, R* or something. In Europe, that means Mario Draghi never got off zero (for the MRO; NIRP for the bottom end of the range, the deposit account). Faced with the prospects for another recession, without having recovered from the last two, monetary authorities are visibly unnerved. Is there such a big load that it requires an extra shoulder maybe two? In a lot of places, some are questioning whether officials are being overly cautious to begin with – even in Europe. Conditioned to see the economy through stocks, the bond market looks like it is in place all by its lonesome. When policymakers and future policymakers start to sound more like yields than equity prices, however, that’s a pretty clear signal. Stimulus isn’t an answer to the problem, it is mere recognition of it. Europe is at the leading edge and so that’s where all this is falling first and sharpest. |

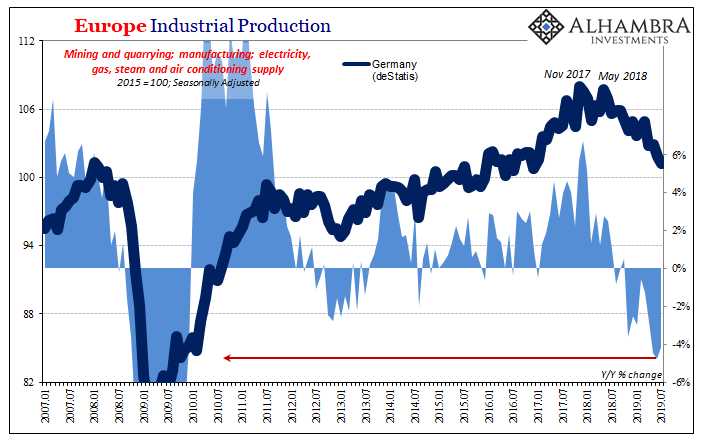

Europe Industrial Production, 2007-2019(see more posts on Eurozone Industrial Production, ) |

| The first major question to that effect is whether the entire European economy can stay out of full-blown recession with its main engine Germany almost certainly within one. What Christine Lagarde really told European “lawmakers” was that she would rather not find out. If the Germans and Dutch would just open their fiscal purse strings, and soon, then it’s her view that might give Europe some non-zero chance to avoid facing these negative prospects.

It is the seriousness of those prospects which most people keep missing. Again, stock market. What you see above appears almost otherworldly when translated through share prices, so surreal it just doesn’t compute. |

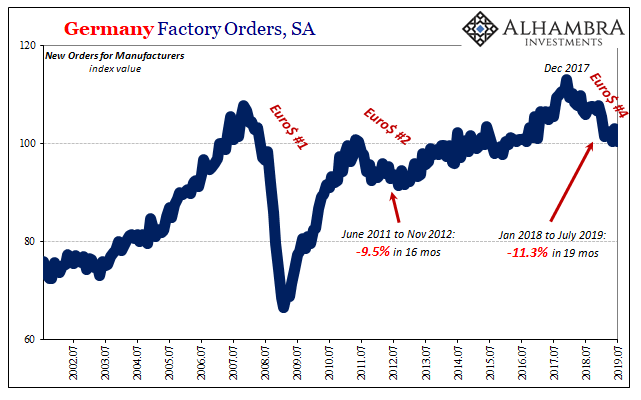

Germany Factory Orders, SA 2002-2019 |

| The economy even in Europe can’t be that bad off – and yet every indication says that it is.

And Europe, like the rest of the world, is still in the beginning stages here. It is incredible that Germany’s grand factory sector has been operating under straight contraction for more than a year and a half already. It is already worse than it was the last time the Continent was in recession in 2011 and 2012 – with no end in sight. |

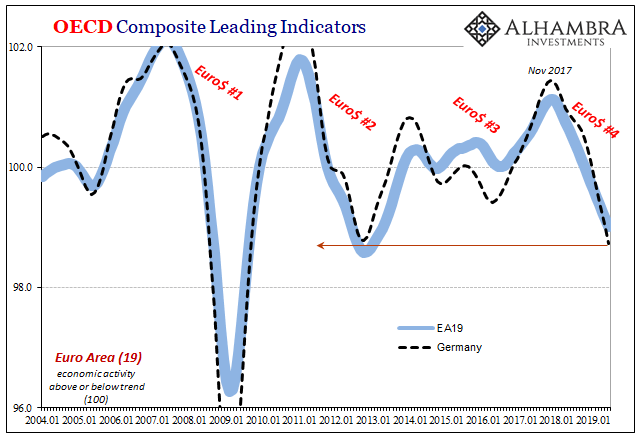

OECD Composite Leading Indicators, 2004-2019 |

| Rather than receive Lagarde’s pleas as a mark of optimism, a sign that authorities are being proactive and prudent, you have to realize that poor Christine has instead finally set her eyes upon the bloodthirsty fish for the first time. And that was all she needed.

It was far from the end of the movie when Chief Brody pleaded for a bigger boat. It was a stark reaction, a forewarning. |

Full story here Are you the author? Previous post See more for Next post

Tags: Bonds,Christine Lagarde,currencies,ECB,economy,Euro$ #4,Europe,Eurozone Industrial Production,factory orders,Federal Reserve/Monetary Policy,Germany,industrial production,Markets,newsletter,recession,stocks