“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos

It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the Eurozone economy and markets increasingly look to the central bank for help. Thus, international headlines were dominated by the selection of Christine Lagarde as Mario Draghi’s successor at the helm of the ECB.

It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in. The ECB was particularly in focus, as bad news keeps piling up for the Eurozone economy and markets increasingly look to the central bank for help. Thus, international headlines were dominated by the selection of Christine Lagarde as Mario Draghi’s successor at the helm of the ECB.

Lagarde: A politician in charge of the economy

Due to succeed Mario Draghi this fall, the ex-IMF chief has some considerable baggage and has attracted intense criticism over her past performance, qualifications and professional conduct. For one thing, she is a lawyer with no economics background nor any experience in monetary policy. She has served as finance minister in France and she led the IMF for eight years, however, she has mostly been seen as a highly skilled political player, with a flair for mastering the media game, rather than a leader who focused on and delivered results in the economic sphere. Her nomination to lead the ECB, which is supposed to be strictly independent of politics, arguably signals a significant shift in priorities, especially as the other candidate, whom she successfully displaced, was François Villeroy de Galhau, an actual macroeconomic and monetary policy expert and current Governor of the Bank of France.

As for her record, it is far from spotless. Christine Lagarde was accused of allowing the misuse of public funds in her role as finance minister. In 2016, she was tried in France and found guilty of “negligence by a person in position of public authority”. Although the charges carried a potential sentence of a year in prison and a fine of €15,000, the court handed down no punishment at all, despite the guilty verdict, and she continued her tenure as IMF chief without any disruptions.

The outlook of policy normalization seems bleak under Lagarde. In the past, she has openly praised the negative interest rate policy and more recently expressed very dovish views, focused at protecting the euro and keeping easy money circulating to support the Eurozone economy. She is widely expected to lean on Philip Lane, the newly-installed chief economist of the ECB, for her monetary policy direction and for technical guidance. The former economics professor is a vocal supporter of Mario Draghi’s past experiments, such as aggressive QE and negative interest rates, which he views as very effective and believes that there’s a lot more where they came from going forward.

As the ECB’s next step is already expected to push rates even further into negative territory, such statements provide clear signals that not much will change under the new leadership. If anything, we can expect more easing, even lower rates, even heavier manipulation of the currency and even more severe distortions in the markets.

Outlook and implications

The continuation of the easing policies seems as inevitable as it is bound to be catastrophic for the Eurozone, especially now that the most recent economic data point to a significant slowdown. After years of accommodations and extreme monetary experiments, the ECB has clearly failed to meet its own targets and to stimulate the economy in a sustainable way. In the April-June period, Eurozone GDP grew just by 0.2%, a 50% decline from the previous quarter.

And yet, the central bank seems poised to continue down the same path, and use the very same tools that did not work before even more aggressively. As growth evaporates and with Mario Draghi having already signaled fresh stimulus, widely expected in September, the bloc’s outlook is intensely worrying. The outgoing President’s strong hints at further rate cuts and the relaunch of QE have ensured that his successor will continue down the easing path. However, pushing rates even further into negative territory and resuming the asset purchasing program will not suffice this time around, as the effect of these measures is considerably diminished by their prolonged use. Mr. Draghi, for one thing, appears to be acutely aware of the bank’s depleted arsenal, as he becomes more and more vocal in directly asking governments for support through fiscal measures.

Thus, as the growth outlook keeps getting worse, it is increasingly likely that the ECB, in tandem with national governments, will go a lot further than before. In fact, the aforementioned newly-installed ECB chief economist Philip Lane has praised “non-standard” measures already in his first days on the job and provided assurances that “we certainly have the tools and we have a good performance record in responding to various sources of risks”.

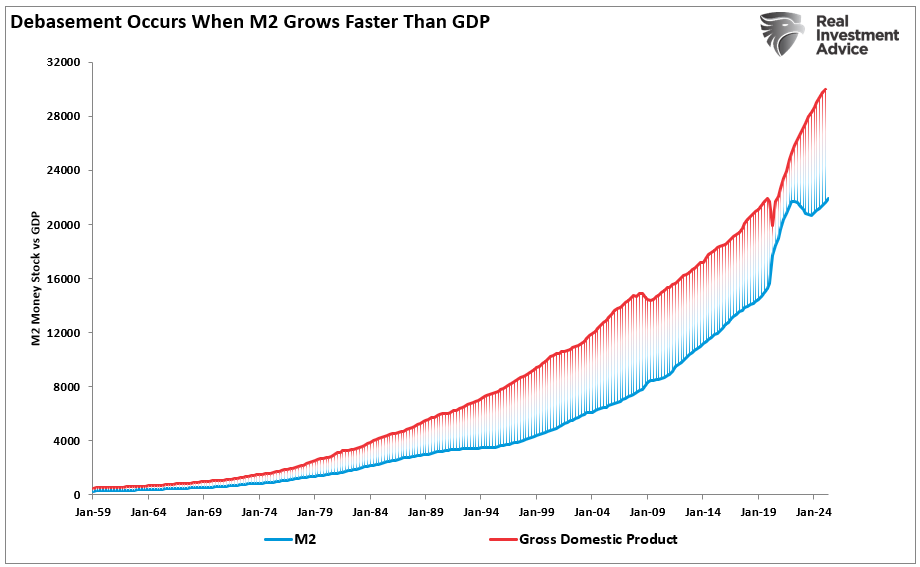

Under the mounting pressure to act and to find new ways to postpone the inevitable, exotic concepts and once-laughable ideas have entered the mainstream. One of them is “helicopter money”, a concept that up until a few months ago was considered utterly unrealistic and politically untenable. Still, the idea of a universal monetary dividend, or a sum of money that would be transferred directly to all citizens of the Eurozone, is now being promoted as a viable policy tool. Its supporters, mostly political economists, left-leaning think tanks and various “intellectuals” call the measure “democratic” and “fair”, while largely ignoring its massively inflationary and value-destroying impact. Much like the supporters of similar fringe ideas like Modern Monetary Theory, they appear to be educated beyond their intelligence and critically depend on repeating what other “intellectuals” say and on the eternal appeal of the populist free lunch promise.

All in all, the general direction of the European economy and the politicization of the ECB point to another wave of aggressive policies, focused on reckless printing and spending, in whatever form this might take. The central bank’s credibility has already come under fire and further monetary experiments are unlikely to help reclaim it. Thus, as trust corrodes in the ECB and in the Euro, gold and silver are set to enjoy a near-inevitable surge in demand.

Full story here Are you the author? Previous post See more for Next postTags: Christine Lagarde,Claudio Grass,Crisis,ECB,Economics,Finance,Gold,Helicopter Money,inflation,Monetary,Politics