Tag Archive: Crisis

War is the health of the State

Part I of II by Claudio Grass

For any reasonably well read adult, any amateur student of history or any responsible citizen for that matter, the idea that ”war is the health of the State” should be adjacent to a truism. After all, literally nobody benefits from violence and bloodshed apart from those at the heart of any State that is directly or indirectly involved and their cronies. In fact, the more horrific the violence and the more...

Read More »

Read More »

Rethinking “safe” investments

Part II of II by Claudio Grass, Hünenberg See, Switzerland. For those of us who have studied history, these Ingenuous beliefs and expectations likely bring a smirk to our face. However, these are entirely reasonable assumptions for most citizens, as the majority of the population is blissfully unaware of the numerous real-life examples that clearly demonstrate just how capable and how eager the government is to do these things – to fail, or to lie,...

Read More »

Read More »

US Banking Crisis Swamps Other Considerations

Overview: The US banking crisis has overwhelmed other

market drivers. The strong measures announced as Asia Pacific trading got under

way was embraced by the market even though moral hazard issues and gaps in the

Dodd-Frank regulatory framework were exposed. The dollar is trading heavily. The

prospect of a 50 bp Fed hike next week has evaporated and some are doubting

that a 25 bp increase will be delivered. Rate hike expectations for the ECB

this...

Read More »

Read More »

“Keynes is the winner of the day, not Milton Friedman”

To many of us, no matter how well versed in history, in political affairs or in socioeconomic issues, the present conditions in the West, and especially in Europe, can sometimes seem like the plot of a bad movie. It is often said that history doesn’t repeat itself, but it does rhyme, and what we’re seeing today is a great example of that.

Read More »

Read More »

Claudio Grass – The Movement Is Spreading World Wide, The Great Awakening, The [DS] Has Failed

Claudio begins his discussion with the pandemic, the people are waking up and they are now seeing that the criminals lied to them. The war is a show and as the economy implodes on itself the people understand that its not Putin fault, it is the criminal politicians that are causing the problem. Claudio says that more and more people are waking up.

Read More »

Read More »

“Whatever it takes” – Part II of II

The Fascist Boogeyman awakes again

The threat of a far-right takeover has been around for at least three decades in Europe and Italy has been one of the best “candidates” for the “beginning of the end” since the last European crisis ten years ago. Back then it was the Lega, led by Salvini, that fueled the scaremongering campaigns of the mainstream press, labeling every conservative policy point as basically pure fascism. Of course, none of those...

Read More »

Read More »

Parity hysterics: What it means and what it doesn’t – Part II

Part II of II, by Claudio Grass, Hünenberg See, Switzerland

“Reverse currency wars”?

Although the parity event may have captured the attention of the mainstream financial press and most western citizens, there’s a much bigger shift that has been going on in the background, which received much less coverage.

Read More »

Read More »

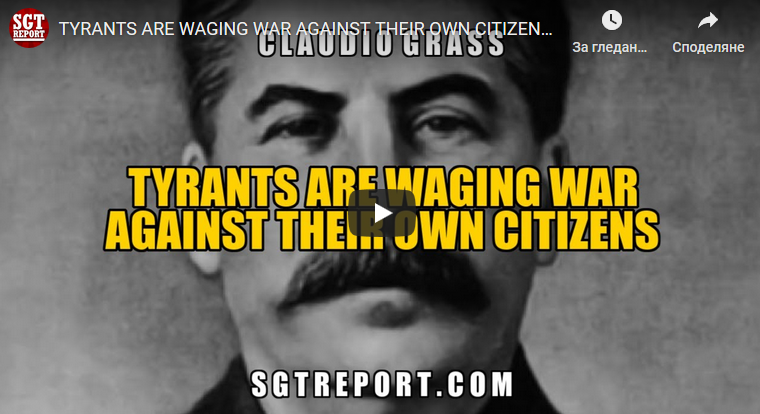

Tyrants Are Waging War Against Their Own Citizens

As [D] Mayor de Blasio shuts down schools and restaurants in NYC yet AGAIN, and as cops in Australia arrest women on beaches for traveling outside of 5 KM from their homes, it’s clear that tyrants around the world are openly waging war against their own people. Claudio Grass joins me to discuss.

Read More »

Read More »

“We are expecting a new wave and we’re prepared for it.”

Interview with Robert Hartmann, Co-Owner ProAurum, Over the last couple of months, we’ve witnessed unprecedented changes in the global economy, in the markets and in our societies. The corona crisis and the governmental measures that were introduced had a dramatic and direct effect on all of us, as investors and as citizens.

Read More »

Read More »

A crisis is a terrible thing to waste – Part I

“You never want a serious crisis to go to waste. And what I mean by that, it’s an opportunity to do things you think you could not do before.” -Rahm Emanuel, Barack Obama’s Chief of Staff from 2009 to 2010. Only a couple of weeks ago, if anyone told you that your entire country would be basically shutting down, that events and public gatherings would be outlawed, that you’d be looking at empty shelves in your local supermarket and that the global...

Read More »

Read More »

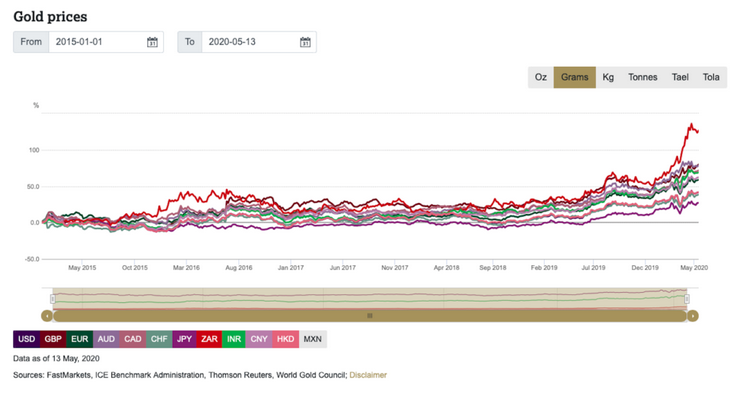

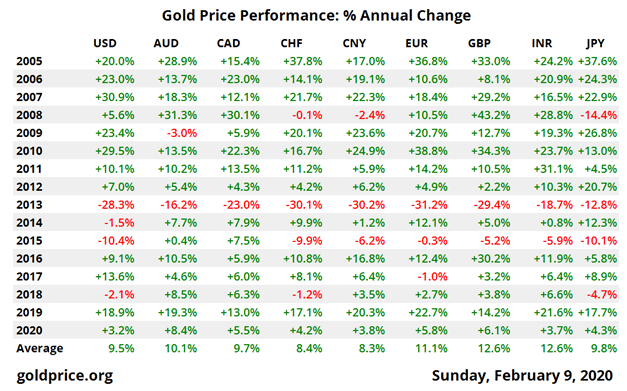

Gold is the 7th sense of financial markets

As we embark on this new decade, there are plenty of good reasons to be optimistic about gold’s prospects. The global economy and the financial system are already stretched to a breaking point and demand for precious metals is heating up. This, of course, is plain for all to see, even as mainstream investors and analysts still refuse to face facts and prefer to focus on naïve hopes of an eternal expansion.

Read More »

Read More »

Ein rationaler Erklärungsansatz für negative Zinsen

In einem Beitrag auf LinkedIn am 29. Dezember 2019 wirft Prof. Erwin Heri von der Universität Basel in die Runde, dass negative (Real-)Zinsen möglicherweise vernünftig sind. Sie wären das natürliche Ergebnis der Präferenzen der Wirtschaftssubjekte – und nicht primär das Ergebnis einer Manipulation von Zentralbanken.

Read More »

Read More »

The ECB’s “mea culpa”

Economists, conservative investors and market observers have been issuing stern warnings for years regarding the severe impact of the current monetary policy direction. In a recent statement, ECB Vice President Luis de Guindos warned of potential side effects and risks to the economy resulting directly from the central bank’s policies.

Read More »

Read More »

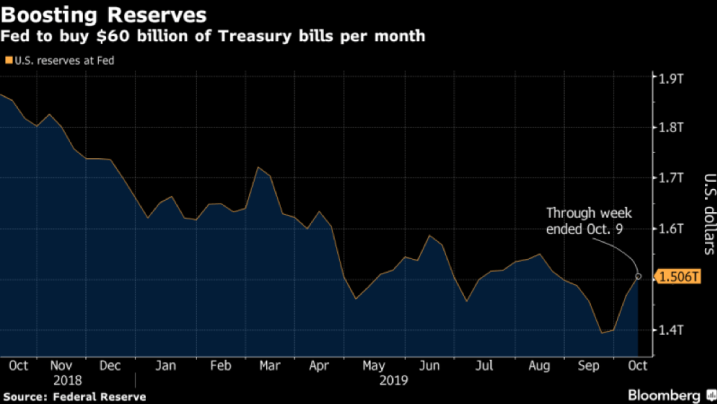

QE by any other name

“The essence of the interventionist policy is to take from one group to give to another. It is confiscation and distribution. “ – Ludwig von Mises, Human Action In less than a year, we have witnessed an unprecedented monetary policy rollercoaster by the Federal Reserve, which began with a momentous U-turn in the central bank’s guidance in January, and has continued to escalate ever since.

Read More »

Read More »

THE FED’S CAPITULATION: WHAT IT MEANS FOR GOLD INVESTORS

After the Federal Reserve’s monetary policy U-turn earlier this year and the central bank’s decision to cut interest rates for the first time in a decade, mainstream investors and analysts believe that holding rates lower and for longer will help keep stock markets afloat and the economic expansion alive.

Read More »

Read More »

“More of the same” at the ECB increases gold’s appeal

“The intellectual leaders of the peoples have produced and propagated the fallacies which are on the point of destroying liberty and Western civilization.” Ludwig von Mises, Planned Chaos. It took multiple meetings and over 50 hours of official negotiations for EU leaders to reach an agreement on the appointments for the top jobs of the EU and the ECB, but in mid-July the results finally came in.

Read More »

Read More »