There is little doubt after the Federal Reserve Chairman Powell’s testimony last week and the FOMC minutes that a rate cut will be delivered at the end of the month. Similarly, after comments by several ECB officials and the record of their recent meetin.g confirms it too is prepared to adjust policy. The timing of the ECB’s move is more debatable, an adjustment at the July 25 meeting appears to have increased.

While a debate over what officials should do, often swamps discussions, market participants know the key to profitable activity is not to be found in what central banks should do but rather what they will likely do. We have found ourselves more sympathetic with those Fed officials that played down the need to cut rates under current conditions. These conditions are characterized by a record-long expansion, a robust labor market, and price pressures not far from the quantitative target the Fed adopted in 2012.

Nor are we persuaded that a rate cut can really work as an insurance policy to extend the recovery in the face of the uncertainty that the Fed recognizes and emphasizes. We suspect a rate cut at this point in the cycle, given the current “cross-currents,” will simply mean that rates will be lower at the end of the business cycle. The weakness in business fixed investment and housing is not caused by too high of interest rates, so a rate cut is unlikely to spur new activity. A rate cut will not offset tariffs and trade tensions, which are likely to intensify in the coming months. Neither will lower US rates re-invigorate the stalled talks on the US debt ceiling and spending caps.

Just like above-trend growth in Q1 19 did not improve the Fed’s outlook, a soft Q2 GDP ought not to be too worrisome either. The pace of growth looks to have been halved or so from the 3.1% Q1 rate. This is all historical. Surely, the key to the extent of the Fed’s easing will have little to do with data from the first half. That means that next week’s June retail sales, industrial production, and housing starts, may pose headline risk but will likely have little lasting impact. The same ironically is true of the Beige Book, the largely anecdotal survey of the economy compiled ahead of Fed meetings by one of the regional Federal Reserve banks.

Instead, new information will in the July Empire State manufacturing survey, and the Philadelphia Fed survey. Both are expected to have improved over June. There is no need to exaggerate the significance of soft data. The point the US economy is not falling off a cliff. Though long-in-the-tooth, there is still life in the business and credit cycle. St. Louis Fed’s Bullard was the dove that dissented from the June decision to leave rates on hold. Although he pushed against a 50 bp cut, Bullard does argue that a 50 bp lower funds rate by the end of the year is appropriate.

The frequency of the use of the term “uncertainty” in the FOMC minutes may also help the point investors toward the kinds of information that may be important for the Fed’s reaction function. Developments that reduce uncertainty, like a resolution, one way or the other, in US trade negotiations with China, Europe, and Japan, or the successful lifting of the debt ceiling and spending caps, and end of the cloud hanging over Brexit. These are not the things that will be found in high-frequency macroeconomic data.

United StatesThe formal start to the US earnings season is also upon us. The consensus anticipates a contraction of around 1.7% and another decline in Q3 for what the street would regard as an earnings recession. It is not clear that if the Fed would not have hiked rates last December, in what Bullard and many other observers say was a mistake, though many were not so bold with the “I told-you-so” comments when the US posted Q1 GDP with a 3%-handle, that US corporate earnings would have been stronger. Separately, but related, we need to update our understanding of how the economy works to recognize that the vast amount of savings that lie within the corporate sector. It has become a net saver and provider of funds than a net borrower of others’ savings. The game that seems to be played is that businesses tend to guide too pessimistically and often beat on the upside. If the average undershoot continues, the decline S&P 500 earnings may not materialize. |

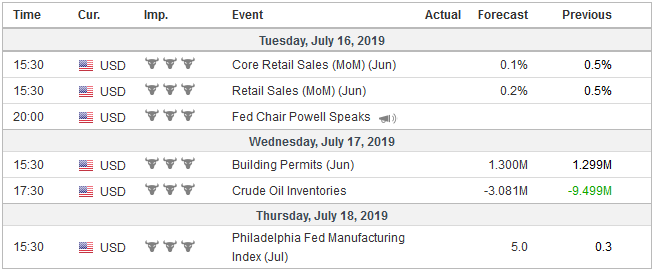

Economic Events: United States, Week July 15 |

EurozoneThe market is not convinced that the ECB will take new action this month. Interpolating from the derivatives market, there around a 20% chance of a 10 basis point cut in the deposit rate (now minus 40 bp). The market may be under-appreciating the determination of the ECB. Both Lane, the chief economist, and Coeure, the head of operations, appeared to make the case for some urgency. Economic data from the region is limited in the days ahead to May trade figures and construction output, with a final reading of June CPI. The closest to real-time data is the July ZEW survey. However, hard data continues to perform better than the survey data suggest, as exemplified by the 0.9% rise in EMU’s May industrial output, the fourth best since the beginning of last year, and more than four times the increase expected by the median forecast in the Bloomberg survey. That said, the flash July PMI readings will be published the day before the ECB’s meeting. Recall that the composite in June was at its highest level since last November, helped by an eight-month high in the service sector, while the manufacturing industry was still said to be contracting. The point is the economic releases before the ECB meeting not going to drive expectations. Instead, it appears that other forces that will shape the expectations going forward. First, comments by ECB officials may be more impactful. Second, investors will try to game out the different scenarios, with considerations such as Draghi’s term winding down, and under the rotating voting system at the ECB, the Bundesbank’s Weidmann does not vote at the July 25 meeting. We would play down both considerations. Institutional continuity surely allows the ECB to act decisively if needed, and others have noted the collegiate style at the central bank means that it never actually comes to a vote. Third, global developments, including if the US escalates its rhetoric following France’s tax on the large and mostly American digital companies (after launching a formal investigation). |

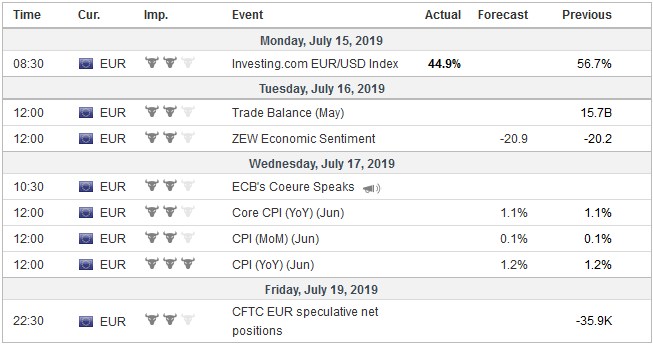

Economic Events: Eurozone, Week July 15 |

United KingdomThe next chapter in the Brexit story is about to begin. There has been a bit of an intermission in the tragic comedy as the Tories pick a new leader following the inability of May to go forward. Next week is the last week that party members vote. There is little doubt that Boris Johnson will be the next head of the Tory Party and the next Prime Minister. Whether he can succeed where May failed, or even hold together the minority government with DUP support, let alone go forward on Brexit is a different matter. The Tory Party seems more desperate to avoid national elections, and Parliament approved an amendment to prevent its suspension (which could be a tactic used to leave the EU without an agreement). Johnson’s other proposed ways forward, like re-negotiating the Withdrawal Agreement or jettisoning the backstop plan, seem like non-starters, which speaks to the downside risks the ECB sees and the uncertainties the Fed recognizes. The UK data is unlikely to change the fundamental picture of an economy with a robust labor market and CPI around two percent. Average weekly earnings are growing at a similar rate as in the US, around 1.5% year-over-year. The other story that is unlikely to change is the slump in retail sales. After an average monthly increase of 0.8% in Q1, retail sales fell in April and May and are expected to have declined again in June (-0.3%). While the market expects the BOE to be on hold for the year, PreditIt.Org wagers are almost 2:1 in favor of the UK not leaving the EU on October 31. |

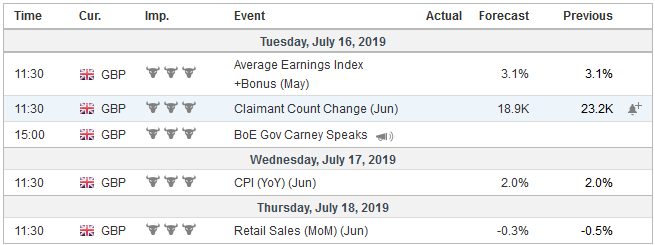

Economic Events: United Kingdom, Week July 15 |

JapanJapan reports trade and CPI, but these are unlikely to move the markets or policymakers. Within the context of the Fed and ECB preparing the market for more monetary support, the BOJ is maintaining course with mostly technical tweaks. Japan’s upper house election is on July 21, and after it, the bilateral trade talks will begin in earnest. |

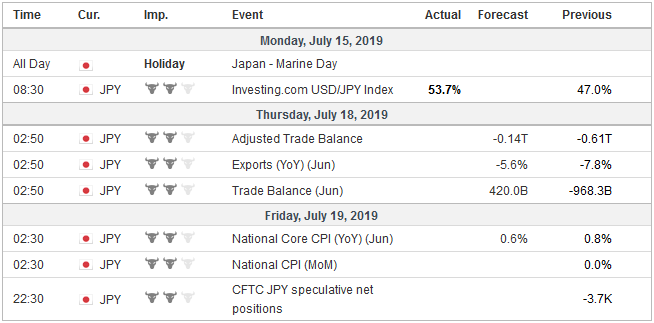

Economic Events: Japan, Week July 15 |

ChinaChina will release its June macroeconomic readings, but they will be captured in the Q2 GDP estimate. To no one’s surprise, the Chinese economy probably slowed from the 6.4% year-over-year pace in Q1 to closer to 6.2%, according to the median forecast in the Bloomberg survey. On a quarterly basis, the economy has slowed for since Q2 18. Growth in line with the median forecast (1.5% quarter-over-quarter) would end the downdraft and suggest the economy may be stabilizing, perhaps signaled by the surge in aggregate financing in June (CNY2.26 trillion vs. CNY1.40 trillion in May). While the US and China trade talks have resumed, both seem to be waiting for the other to make the first good faith move. Trump complained that China had not yet stepped up its agriculture purchases while the US has not granted a single license to US companies to sell to Huawei. Many seem to be pessimistic about the probability of an agreement any time soon. |

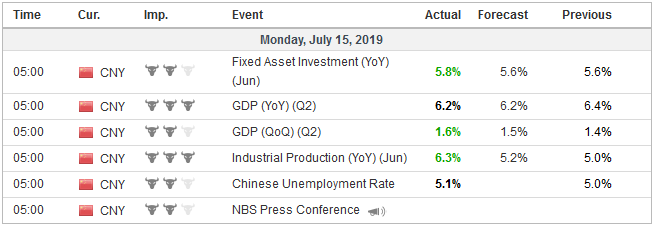

Economic Events: China, Week July 15 |

Switzerland |

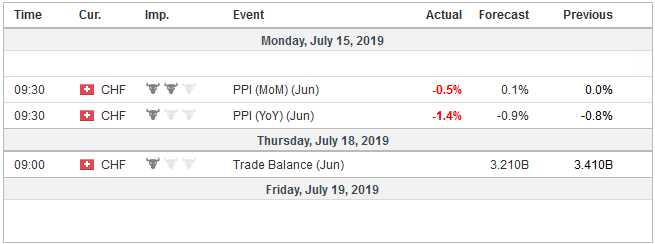

Economic Events: Switzerland, Week July 15 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bank of England,Bank of Japan,China,ECB,Federal Reserve,newsletter