| Weak inflation data pose a conundrum, both in terms of the growth outlook and the ECB’s policy stance. We believe the ECB will stay on hold in 2020.

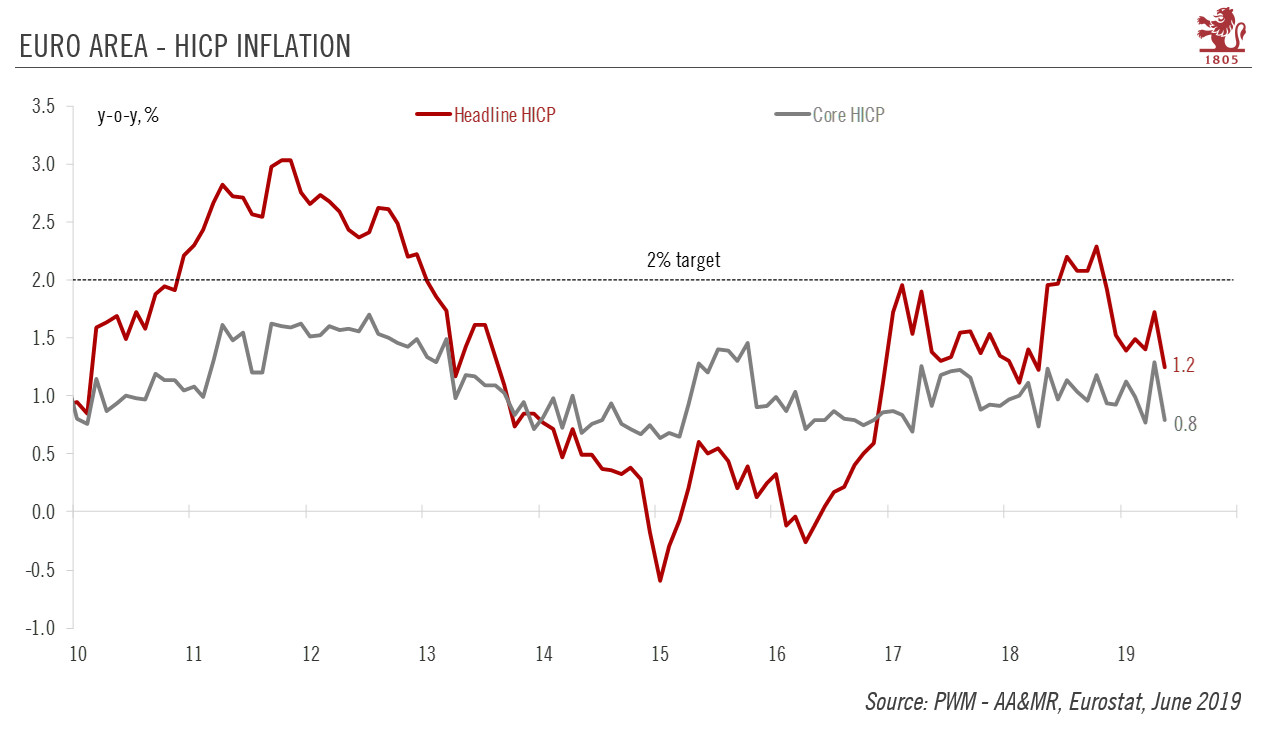

The euro area headline flash Harmonised Index of Consumer Prices (HICP) dropped to 1.2% year on year in May from 1.7% the previous month. Core inflation fell by 50bp to 0.8% y-o-y. While this reflects volatility stemming from the date of Easter this year, one can legitimately ask why inflation remains so low in the euro area, with the underlying inflation trend remaining close to 1.0% y-o-y. This remains a conundrum for the euro area’s outlook and the European Central Bank’s (ECB) next monetary policy moves, especially as several measures show that wage growth started to pick up last year. Recent research by the ECB may provide an answer. It found that firms’ willingness to absorb labour cost increases by squeezing their profit margins was delaying the pass-through to inflation. The softening of economic activity as 2018 likely held firms back from raising prices. |

Euro Area - HICP Inflation, 2010-2019 |

Overall, we expect May’s fall in core inflation to prove temporary. We expect it to bounce back to 1.0% y-o-y in June, which is probably more representative of the underlying trend. We still expect strengthening wage growth to support a gradual recovery in core inflation. Firms should be able to rebuild margins gradually if demand recovers and the downside risks (US auto tariffs, disorderly Brexit, intensification of the US-China trade dispute…) to our outlook do not materialise. However, those downside risks have increased significantly. An uncertain growth outlook as external risks increase could challenge the inflation outlook. We forecast headline inflation to average 1.2% in 2019 and 1.4% in 2020, with core inflation at 1.2% and 1.4%, respectively.

Amid growing external risks, potential ‘insurance’ rate cuts by the Federal Reserve and renewed signs of inflation expectations de-anchoring, we have changed our ECB rate call. Instead of starting to raise the deposit rate in 2H 20, we now expect the ECB to stay on hold throughout next year.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newsletter,Pictet