| To stabilise growth, the Chinese government will likely put more focus on infrastructure investment. A new policy announced recently could give a further boost to this sector.

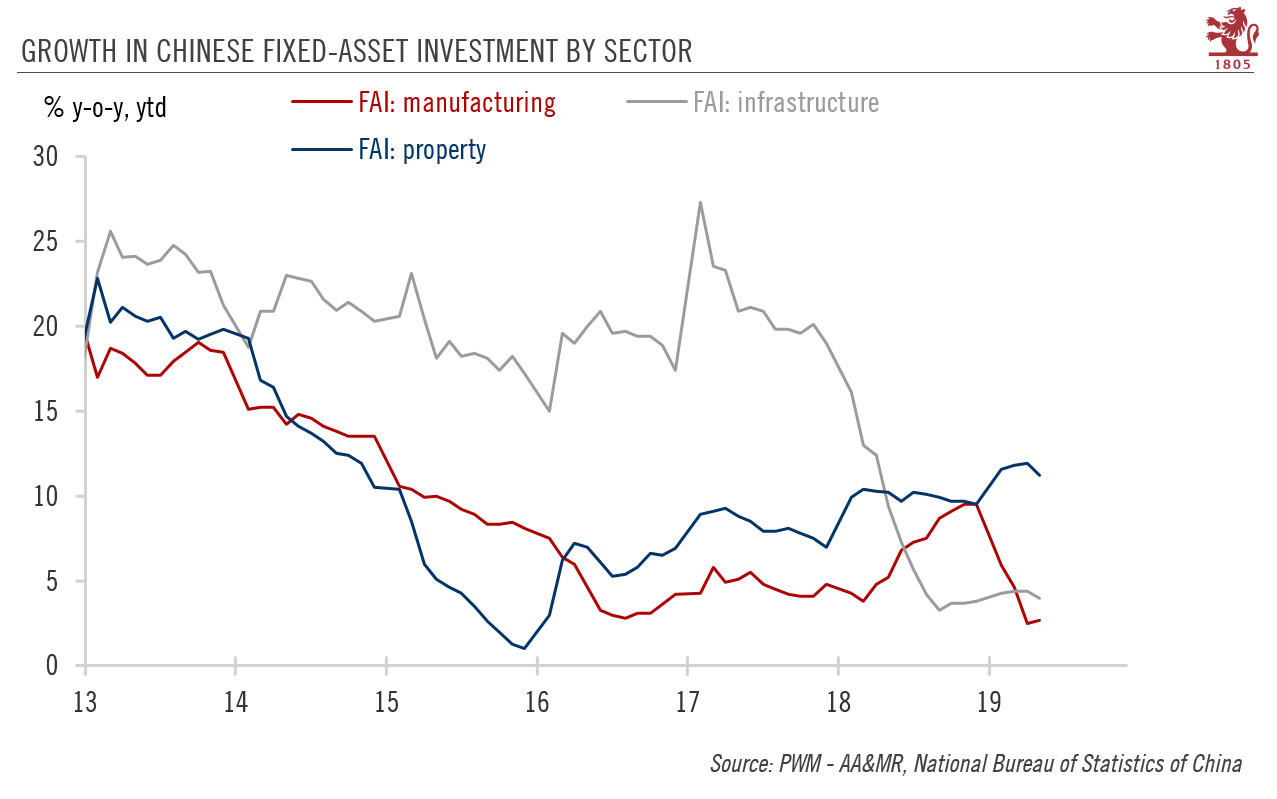

Activity data in May point to continued weakness in Chinese economic momentum, with growth in both fixed-asset investment and industrial production slowing last month. The only positive news came from retail sales, where growth picked up after the slump in April—but this rebound was probably due to seasonal effects. After taking into account special seasonality, growth in retail sales slowed in the first two months of Q2. In our view, to stabilise growth, the Chinese government will likely put more focus on infrastructure investment going forward, given that the collapse in infrastructure investment was one of the main reasons behind the growth deceleration in 2018. While infrastructure spending is stabilising, clear signs of a rebound are still lacking. The latest data from May actuallyshow a deterioration in momentum. In our view, the main reason is the lack of financing by local governments, which are facing financial constraints as the central government tries to rein in ballooning local government debt by putting restrictions on local government financing vehicles. In addition, the cooling of the land sales market likely has also weighed on local governments’ revenue. |

Growth in Chinese Fixed-Asset Investment by Sector, 2013-2019 |

To help boost local government infrastructure spending, the central government has accelerated the issuance of special local government bonds (SLGBs), which are intended specifically for infrastructure. In the first five months of the year, SLGBs issued amounted to Rmb859.8 billion, compared to Rmb1.3 trillion for full-year 2018. The full-year target for 2019 is Rmb2.15 trillion, roughly Rmb800 billion more than last year.

A new policy announced recently could give a further boost. Specifically, the policy allows the proceeds from SLGBs to be used as seed capital for certain infrastructure projects, which then can seek additional market financing (such as bank loans).

While the direct impact of this new policy may be fairly modest (eligible projects must have the potential to generate sufficient future revenues, which means no more than 30% of all SLGBs may qualify), it represents a significant change in the central government’s attitude to infrastructure financing. The is the first time in the current easing cycle that the government has encouraged market financing of infrastructure investment. We estimate that the new policy could help boost growth in infrastructure to about 8% annually from the current level of 4%.

Our 2019 GDP forecast for China remains unchanged at 6.3% for the time being.

Full story here Are you the author? Previous post See more for Next postTags: Macroview,newsletter,Pictet