The euro has declined further against the dollar but should strengthen over next 12 months

The euro fell to a 20-month low against the US dollar following the European Central Bank’s (ECB) March policy meeting, given the revised forward guidance that suggests that the interest rate differential is unlikely to provide much upside to the euro in the next few months.

That being said, recent euro area PMI surveys tend to favour a stabilisation of economic activity (after a relentless decline since December 2017), which supports our rather more constructive scenario on the euro area (GDP growth at 1.4% in 2019) based on resilient domestic demand and abating external threats (China, car tariffs and Brexit). This expected improvement could also lead to a less dovish ECB later this year, reigniting the rate differential driver in favour of the euro.

However, as these developments may take time (if the US Commerce Department investigation has found that imported vehicles pose a national security threat, Trump has 90 days from 17 February to decide if he wants to impose car tariffs; a short-term extension to Brexit could last up to three months; euro area economic activity should rebound in the second half of the year), the upside appears limited in the short term.

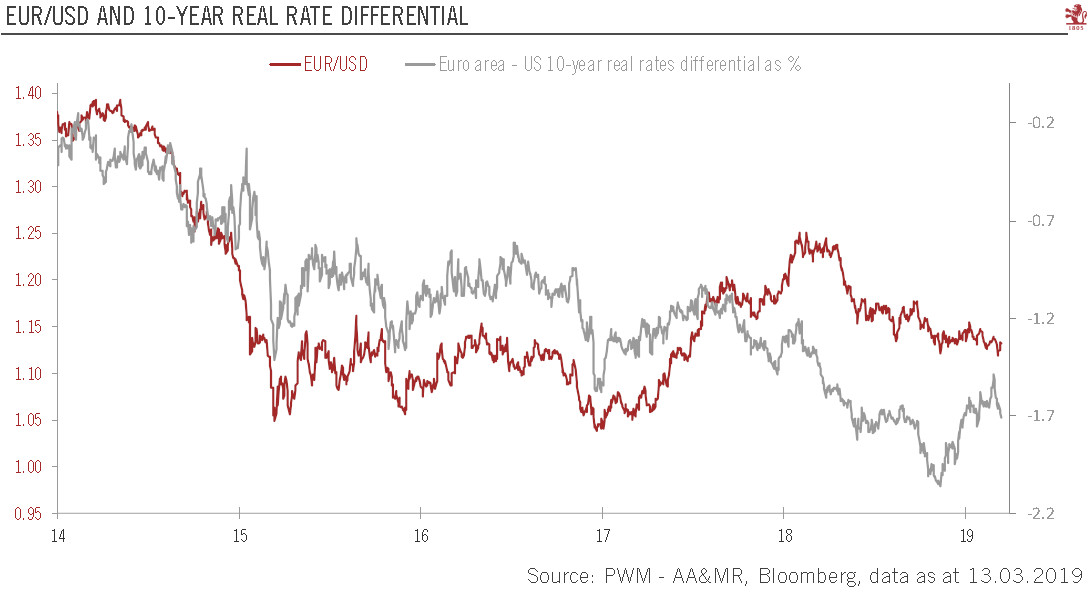

| When analysing the EUR/USD rate, the underlying assumption is that euro area growth will fare better than in the US and that the ECB will normalise monetary policy. The improvements in the rate differential between the euro area and the US since mid-November 2018 has come from a decline in US rates, rather than a rise in euro area rates. At the same time, the growth differential has deteriorated as quarterly GDP and leading economic indicators have remained thus far in favour of the greenback over the single currency. In the mid- to long-term however, the US dollar should weaken as two key drivers (growth and interest rate differentials) are likely to prove less supportive in 2019. Indeed, the Federal Reserve is less hawkish than in 2018 and US GDP growth is poised to moderate as the impact of President Trump’s tax cuts fades.

Given a less supportive interest differential, we have decided to lower our projections for the EUR/USD rate. We now favour a move towards USD1.14 in three months, USD1.17 in six months and USD1.20 in 12 months. |

EUR/USD and 10-year Real Rate Differential 2014-2019(see more posts on EUR/USD, ) |

Tags: EUR/USD,Euro,Macroview,newsletter