Ignore Black Friday and Cyber Monday. Those are merely an appetizer, an intentional preamble to whet the appetite of hungry consumers looking to splurge. The real action comes in December. People look, some buy, after Thanksgiving, but as anyone counts down the actual twelve days of Christmas and celebrates the eight crazy nights of Hanukkah that’s when the retail industry makes its bank.

In 2016, the month of December was just one-twelfth of the calendar, 8.3% of all months, but counted for 9.8% of all US retail sales. It was almost exactly the same ten years before. December 2006 brought in 9.73% of all revenues estimated for that whole year.

While there were some whispers about housing during that particular holiday season, the noise was deafening one year forward as the Christmas 2007 season unfolded. There was no longer any doubt that market volatility and uncertainty were carving into the US economy. Many hoped and prayed Ben Bernanke could limit the damage with his genius inputs, maybe avoiding a nasty recession in 2008, but it was already bad by then.

Consumers had begun to react negatively. On January 15, 2008, the Census Bureau reported the sad news. Christmas had been a bust, economic dangers were growing and even the holiday shopping season hadn’t been spared. The advance estimate for retail sales showed they had declined by 0.4% month-over-month on a seasonally adjusted basis. Unadjusted, total sales had gained just 4.1% from the year before or far below the 6% level which historically indicates trouble.

As we know now, just as many had surmised back then, December 2007 was the first month of the Great “Recession.” Over the many years that have followed, Census Bureau economists have recalculated retail sales (and other accounts) to more accurately reflect that sordid state.

| The latest benchmarks show retail sales were up just 1.93% year-over-year that particular December, half the initial unadjusted estimates. The monthly change in the seasonally-adjusted series was marked down to an enormous decline, -1.20% or three times worse than the original -0.4%. The economic damage was already deep long before the FOMC truly reacted.

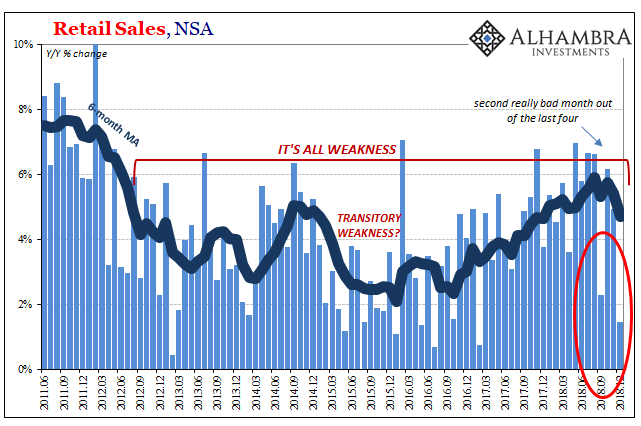

According to figures released today, the Census Bureau puts Christmas 2018 as slightly worse than Christmas 2007 – the revised estimates. Unadjusted, retail sales year-over-year gained a shockingly small 1.44% for any crucial December. While surprising to some in the media, this is actually the second really bad month out of the last four. |

Retail Sales, NSA 2011-2018 |

| The first of those, September 2018, was put down as bad weather meaning hurricane. It’s going to be very hard for people to spin this Christmas disaster as anything else, but they’ve already tried. The President’s Economic Advisor Larry Kudlow says these retail sales estimates are a “glitch” (one need only review his 2007 and 2008 comments); some are attributing them to the government shutdown; still others are talking about gasoline. |

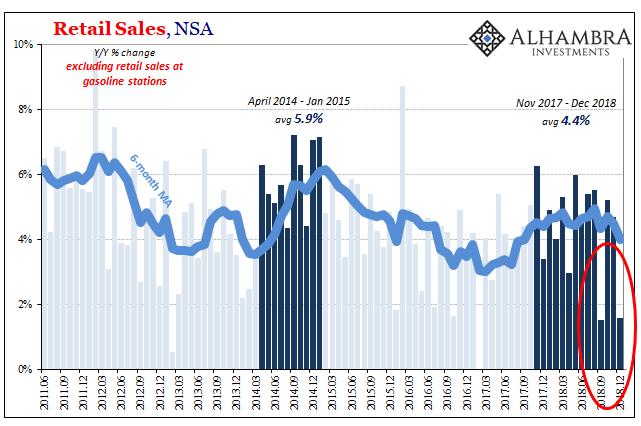

Retail Sales, NSA 2011-2018 |

| All of those things may be true, but cannot account for 1.44% in the biggest month of the retail calendar. Factoring out the very small 0.4% annual rate of decline in retail sales recorded by gasoline stations, December was (above) still the second really bad month out of the last four. This weakness has been broad-based. Online retailers saw the lowest growth in half a decade.

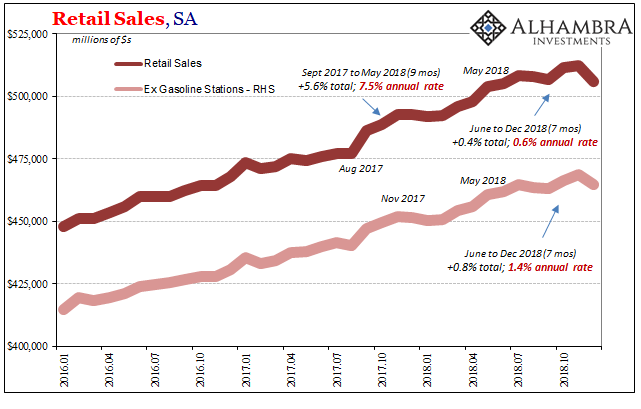

Even if you didn’t think it was possible for the data to look even worse, seasonally-adjusted retail sales fell by 1.24% from November. There’s not been a decline of similar magnitude in any month since 2009 when the global economy was first stumbling its way out of the Great “Recession.” There’s no way around it; this is Christmas 2007-level bad. |

Retail Sales, SA 2007-2018 |

| Retail sales in December were basically flat compared to May, meaning almost no growth in them over an entire seven-month period. Unlike the view perpetuated by the unemployment rate, problems with American consumers meaning workers has been apparent for some time already.

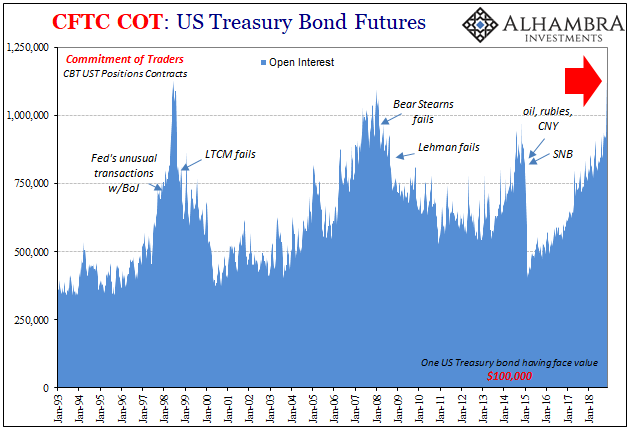

This Census data is already a month behind, but in truth we didn’t need these updated figures to tell us something was up. The bond market bending and distorting curves during this very month in question was powerful evidence that the whole global economy, US included, was going wrong right then. |

Retail Sales, SA 2016-2018 |

China imports collapsed, German industry the worst since the depths of the last recession, and now American consumers, too. I wrote about December a month ago:

And if China’s problems originate, as they always do, with a decline in US consumer spending then look out. There never was any decoupling; there cannot be decoupling. |

CFTC COT: US Treasury Bond Futures 1993-2018 |

| It’s still more evidence of the entire global economy hitting a landmine during the last quarter of last year. This doesn’t mean we are on track for a repeat of the Great “Recession”, at least not necessarily. What it suggests, strongly, is that the economic downside is escalating toward some as-yet unknown conclusion.

These aren’t typically happy endings, thus risk aversion and liquidity preferences all over the place. And the Fed, like December 2007, is already way behind; they’re still talking about resuming “rate hikes” after all this just goes away. Not that it would matter one way or the other. That’s ultimately the point. Perhaps enough people will finally get the sense they really have no idea what they are doing. |

|

Tags: consumer spending,currencies,economy,Federal Reserve/Monetary Policy,Markets,newsletter,recession,Retail sales