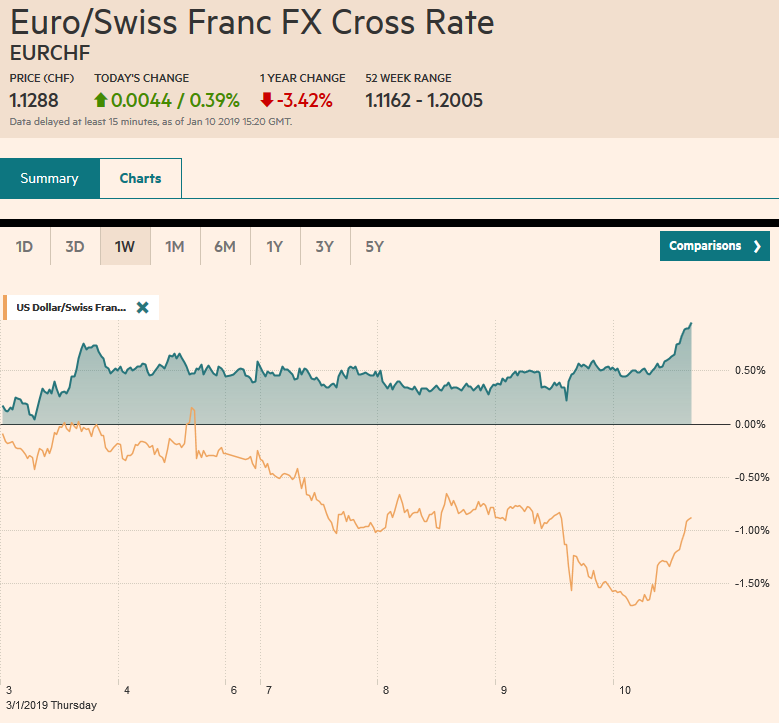

Swiss FrancThe Euro has risen by 0.39% at 1.1288 |

EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: Equities, bonds and the dollar are consolidating the moves seen earlier this week. This means equities are trading heavy and bonds firmer. The euro is paring gains that carried it to its best level (~$1.1570) since mid-October. After stalling near JPY109 in the last two sessions, the greenback slumped to almost JPY107.75 before finding a better bid. Sterling remains capped in front of $1.28. The Canadian dollar and crude oil’s eight-day rally is at risk. |

FX Performance, January 10 |

Asia Pacific

US-China trade talks in Beijing concluded, and both sides seem constructive. China appears to have agreed to buy more US agriculture, energy, and manufactured goods. However, this is low-hanging fruit as China had previously agreed to this before US President Trump rejected the agreement negotiated by Treasury’s Mnuchin. The non-tariff barriers to trade, such as subsidies, and other structural reforms may still be sticking points. China’s statement indicated that the foundation of a resolution is in place, which seems to be further than American statement went. Recognizing the challenge is with the operational policy not so much with the declaratory policy, the US appears to be looking for a timetable for other reforms and an ongoing surveillance/monitoring regime.

Separately, China reported softer than expected price pressures, which are seen as consistent with the economic weakness. December consumer prices eased to 1.9% from 2.2% in November. The Bloomberg median forecast was 2.1%. Producer prices pressures evaporated. The year-over-year increase in December was 0.9%, the lowest since September 2016. It looks like the decline in energy prices and some reduction of taxes and administered prices were the drivers. Excluding food and energy, CPI was flat for the third month at 1.8%. In December, non-food prices were key, easing to 1.7% from 2.1%, food prices were steady at 2.5%. China is expected to continue to take new measures to support the economy. A cut in taxes for small businesses was announced yesterday.

The dollar recovered in Europe from the dip to almost JPY107.75 in late Asia, which is the low for the week. Heavier equities and softer yields seemed to be the ostensible driver. Initial resistance now is seen in the JPY108.20-JPY108.40 area. There is a roughly $545 mln option struck at JPY108.50 that will expire today. Australia reports retail sales first thing in Sydney tomorrow. The median forecast is for a 0.3% increases, though we suspect the risk is on the downside. The Australian dollar is firm and remains within spitting distance of $0.7200, which was also the high from the second half of December. A break above there, which we don’t anticipate today, could spur gains toward $0.7240. The Chinese yuan is trading at five-month highs. In each of the past three weeks, it has been allowed to weaken in one session. This week the yuan slipped on Tuesday. Although the currency is closely managed, the renewed narrowing of interest rates differentials with the US may temper the yuan’s gains from here.

Europe

The UK government is on the ropes. It suffered a second defeat in Parliament this week and had to accept an amendment to the Withdrawal Bill that seems to give the House of Commons the ability to veto key elements of the backstop over the Irish border. However, like the deference to the (suspended) Northern Irish assembly, these measures do not appear sufficient to prevent a defeat in the vote that is currently planned for January 15. A loss by more than 60 votes is thought to be particularly problematic. Labour’s Brexit spokesperson played up the chances that the March 29 exit day is postponed.

Separately, the UK BRC reported like-for-like sales fell 0.7% in December, which is more than twice the decline the market expected. It is the poorest since last April, and it is the first back-to-back decline in the year-over-year pace since Q1 17. Tomorrow the UK provides an overview of the economy with November industrial/manufacturing output, construction, services, and monthly GDP figures. After a poor October, a rebound in industry and construction is expected, while service output may have slowed.

Although the media and economists await the record from the ECB’s meeting last month, however, it tends not to be a market mover. The ECB downgraded its projections for growth and inflation, but yesterday’s employment report saw the unemployment rate dip below 8.0% for the first time in a decade, and the ECB may have to adjust its forecasts (in March). Meanwhile, France reported a simply dreadful industrial output report for November. Economists were looking for a flat report, but industrial production slumped 1.3%, and manufacturing alone fell 1.4%. The 2.1% decline of industrial output year-over-year is the largest contraction since late 2014.

Italy offered a contrast. Its retail sales jumped 0.7% in November, the biggest increase in six months. Separately, the Italian government continues to debate how to address the banking issue posed by Carige. It is particularly challenged because the Five Star Movement and the League have been critical of previous government support for the banks. The index of Italian bank shares though is up about 0.4% today and has traded higher for four of the past five sessions.

The euro’s advance has stalled in front of $1.16, where a 1.2 bln euro option will be cut today. The roughly 500 mln euro option struck at $1.1525 is in play, and there is another expiring option for 1.2 bln euros at $1.15. The North American participants seemed particularly dollar negative yesterday, and they may press further today, taking advantage of the euro’s pullback. Momentum players likely have stops below $1.1480. Sterling is blocked at $1.28, but with poor dollar sentiment, support is seen close by in the $1.2720-$1.2740 area.

North America

The economic calendar is light for North America today. The US reports weekly jobless claims and Canada reports new home prices. Investors may be more interested in the six Fed officials, including Powell and Clarida, speaking today (mostly around mid-day). Recent comments and the FOMC minutes lend underscore that when the Fed says it can be patient, it is signaling no hike in March. However, that does not mean that it is going to cut rates, which is what the market had begun discounting. Assuming the trade tensions can be addressed or stabilize, and the government shutdown (day 20) can be resolved without too much damage to the economy, a hike around the middle of the year (June/July) still seems like a reasonable scenario.

The US dollar fell to CAD1.3180 yesterday, its lowest level in a little more than a month. The magnitude and speed of the fall from CAD1.3655 a week ago were surprising. Technical indicators are stretched, and the Bank of Canada indicated less urgency to return its monetary setting to neutral. A move now back above CAD1.3260 would help stabilize the tone, and suggest the down leg is complete. After a poor three-year note auction earlier in the week, reception at the 10-year note sales yesterdays was much better, with the bid-cover near recent averages. Today the US sells $16 bln 30-year bonds and $70 bln of four- and eight-week T-bills. The Dollar Index tested 95.00 earlier today, and the 95.50-95.60 area is the nearby hurdle.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,$AUD,$CAD,$EUR,$JPY,$TLT,EUR/CHF,newsletter,USD/CHF