The force that had pushed the US 10-year Treasury yield to 3% and the dollar above JPY113 at the start of the month, and the euro to $1.13 a couple of weeks ago has dissipated. The 10-year yield is near 2.80%. The dollar was near two-month lows against the yen a week ago, and the euro was back toward the middle of its previous $1.15-$1.18 trading range. Even the Australian dollar, the worst performing of the major currencies last week after the Japanese yen, is back in its old trading range ($0.7300-$0.7500) despite a dramatic political wobble, a new Prime Minister, and a central bank that seems content to watch and wait.

United StatesUS economic data has been undershooting expectations, but the NY Fed’s GDP Tracker suggesting growth is slowing from 4.1% in Q2, which looks vulnerable to a small downside revision next week, to 2.0% in Q3 seems to be exaggerating while the Atlanta Fed’s GDPNow suggesting the economy is accelerating (4.6%) also appears wide of the mark. We suspect the risks are on the downside for this week’s three new data points covering July goods trade, income, and consumption. The trade deficit narrowed in Q2 but the effort to beat the sanctions appears to have faded, and the risk is that the combination of growth differentials and the dollar’s recovery spurs deterioration in Q3. Consumption rose at a 4% clip in Q2 according to the preliminary GDP estimate. It is unsustainable. A slowdown should be evident in the monthly personal consumption data. The average monthly gain was 0.5% in Q2. The Bloomberg median forecast is for a 0.4% rise in July. The overshoot to the upside is often followed by an overshoot to the downside. The weakness in many agriculture prices could be an unanticipated drag on household income. Growth seems to be moderating toward a more sustainable pace, still juiced by fiscal stimulus and deregulation. A larger trade deficit and slower consumption suggest upward pressure on inventories. Neither President Trump’s criticism of Fed policy nor Powell’s speech at Jackson Hole managed to alter investors’ view that a September rate hike is nearly a foregone conclusion (90%+). There is a clear leaning toward another move in December (~60%), but there is room for improvement. Perhaps that is the next driver-shifting expectations for the December meeting-but there are at least a couple of prerequisites. First, the September projections by the Fed will be helpful. Recall, one member changed their forecasts from March to June, shifting the median dot to favor two hikes here in H2. Second, the economic data and broader conditions are important, and the visibility may not be sufficient for confidence until early October, especially if the curve continues to slowly flatten. The drama of US politics has yet to impact the markets. The Trump Administration may feel under greater pressure to record some successes elsewhere. However, there does not appear to be much low hanging fruit. The inability to wrap NAFTA talks up earlier means that AMLO energy plans become relevant, and according to press reports, is the latest stumbling block. Even if these are overcome, there are other hurdles, and the runway is getting shorter for the current Mexican Congress (September 1) and President (December 1) and the US Congress (given the procedural requirements). And this is not even to mention the inclusion of Canada. The key may turn on how much the US wants to score a success. |

Economic Events: United States, Week August 27 |

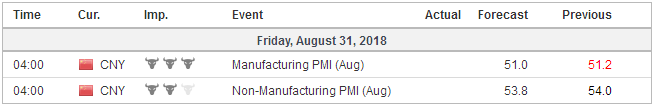

ChinaThe first US-China trade talks in a couple of months amounted to little, and it is not even clear if Trump will meet Xi before the end of the year. The risk is that the next round of tariffs, 25% on $200 bln of Chinese imports is implemented as well as China’s preannounced retaliatory measures next month or early October. It seems like little effort to diffuse the situation will take place before the US midterm elections. China’s official PMI readings at the end of next week are the focus ahead of the reserve and trade figures due in early September. Any disappointment will likely be shrugged off on ideas that officials have shifted gears and through somewhat easier monetary and fiscal policy, lending the economy greater support. China announced two measures ahead of the weekend that is unlikely to deter the trade hawks in the Trump Administration, who retain the upper hand after yet another ill-fated Treasury stab. First, the PBOC is escalating its effort to resist downward pressure on the yuan. It re-introduced the “counter-cyclical” factor in setting the yuan’s reference rate. The whole process remains a block box, but this ostensibly would give officials greater sway over market forces. Recent data does seem to suggest that the yuan’s weakness has not been driven by officials, but this has not prevented the US President from accusing China of currency manipulation. The Treasury’s report is due out in October. Many private sector observers also see the yuan’s weakness as an attempt to minimize the impact of the tariffs. We disagree and see the same forces that have lifted the dollar broadly at work the bilateral exchange rate with China. Widening interest rate differentials and policy mix drive the world’s savings to the US. There are good tactical and strategic reasons for Chinese officials to seek to temper the yuan’s decline and putting the US at the center of the narrative may be self-serving of many American observers. The second thing China did was continue a movement that has been unfolding for nearly a year with little recognition, and that is the opening of its estimated $40 trillion financial market. China lifted the cap on foreign ownership of domestic banks and asset managers. Some see these measures as during the heightened trade dispute as a way to try to split US finance capital from industrial capital, though here too there are good domestic reasons for China to attract foreign capital into its financial sector. |

Economic Events: China, Week August 27 |

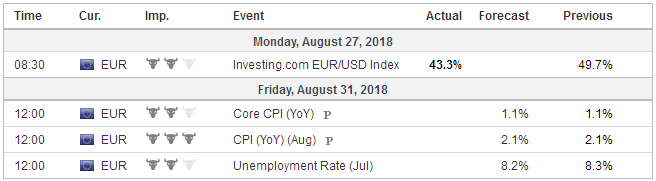

EurozoneEurope is unlikely to generate a near-term win for the Trump Administration. Trade talks have barely begun, and while this forestalls tariffs on autos, it is not sufficient to grant a reprieve from the steel and aluminum tariffs on national security grounds. Trump’s modus operandi is trying to get others to defect, and news before the weekend that a couple of weeks ago he offered for the US to buy Italian bonds is likely an effort in that regard. Outside of the Exchange Stabilization Find (the executive branch’s share of US reserves), it is not clear what funds are at the President’s disposal. And even then, the implementation would look like intervention (which is one of the factors that dissuaded Japan from buying foreign bonds that was suggested in the early days of Abenomics). The reports coincided with the dollar’s broad pullback, but Italian bonds themselves underperformed. The 10-year yield rose six basis points ahead of the weekend and ensuring that the five-week rising streak continued for the sixth week. Investors should be prepared for a confrontation between the new governments in Spain and Italy and the EC over next year’s budget. What erupted last week is a different issue and also one in which also pits Italy against the EC and that is over migrants. The EU appears to have missed the opportunity to pay the frontline states like Italy and Greece to deal with the migrants. Italy threatened to withhold its EU payments until the migrants are shared. The EC made a sharp retort but what must be a finite standoff continued. The euro still appears sensitive to the direction of the spread between German and Italian interest rates. The inverse correlation on a purely directional basis over the past 60 days is a little below 0.60 over and a bit more than 0.80 over the past 30 days. The EMU report the flash CPI for August. It is expected to be unchanged at 2.1% and 1.1% for the core and headline respectively. Oil prices were are around 2% higher, and the euro is a little firmer on a trade-weighted basis. If there is a surprise, we suspect it may be on the upside, give the still above trend growth and trade tensions. |

Economic Events: Eurozone, Week August 27 |

Switzerland |

Economic Events: Switzerland, Week August 27 |

Turkey’s markets re-open, and last week without their domestic market the lira slipped 0.2%, its smallest weekly move in about five months. We are not convinced what is tantamount to a bank holiday is sufficient to change the tide. Yes, we accept that the sharp depreciation of the lira and the likely compression of domestic demand (recession) will spur dramatic improvement in the current account, but its broader economic policies repel foreign savers. Turkey accounts for about 5% of the EMBI local currency index and many fund managers appear to been underweight.

Trump’s tweet about South Africa, like news of his offer to Italy, did not have much lasting market impact. The dollar, softer across the board ahead of the weekend, posted a bearish outside down day and its lowest close in two weeks. Initial support for the dollar is seen in the ZAR13.93-ZAR14.02 band.

Brazil’s real took a beating last week, falling 5% against the dollar, bringing the three-week slide to more than 10%. The dollar is at BRL4.10 and closing in on the 2016 high near BRL4.17 and the 2015 high of a little more than BRL4.25. The softer dollar tone fails to offset political concerns ahead of the fall election. Blackrock reported that its iShares MSCI Brazil ETF, the largest in this space, saw a 12% (~$710 mln) withdrawn this month. In the first half, the ETF took in about $600 mln, according to press reports. The market is tracking the election polls.

Full story here Are you the author? Previous post See more for Next postTags: #USD,$EUR,$TLT,Brazil,newsletter,South Africa