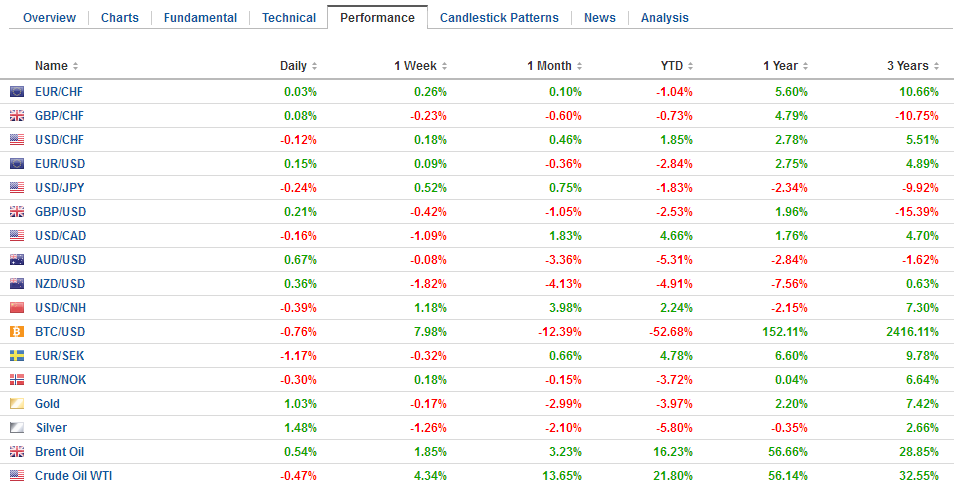

Swss FrancThe Euro has risen by 0.03% to 1.1565 CHF. |

EUR/CHF and USD/CHF, July 03(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesThe global capital markets are trying to stabilize. US equities recovered from early losses yesterday but this was not enough to stop Asian equities from extending recent losses. The MSCI Asia Pacific Index slipped 0.2% for the sixth decline in the past seven sessions, However, several local markets, including China, Australia, and Korea advanced. European bourses are mostly higher, and the Dow Jones Stoxx 600 is up 0.5% near midday in Europe. All of the industrial sectors but materials are advancing. US shares are extending yesterday’s gains. The US dollar is softer against all the major currencies. The Swedish krona is the strongest of the majors in response to the Riksbank, which was more hawkish than the market expected. The Riksbank signaled its intention to raise rates later this year and anticipates the repo rate (now minus 50 bp) will be near zero by Q3 19. Two policymakers want to move earlier. The euro is testing support near SEK10.33, and a break would allow for SEK10.28 and, possibly SEK10.24. The euro recovered from a brief foray below $1.16 yesterday but recovered late and has remained above $1.16 today. There are large options maturing today at $1.1650, $1.1675, and $1.1700 (for roughly 800 mln euros, 875 mln, and 670 mln, respectively). More options that will be cut above $1.17. Merkel managed to find a compromise with the Seehofer and the CSU in immigration, and although many expected an eventual deal, it was more protracted than anticipated. The compromise includes setting up transit centers for refugees and being able to turn away refugees who had been registered in other EU countries on the basis of bilateral agreements. The Bavaria-Austria border becomes the new flashpoint. The dollar pushed through the JPY111 again but appears to be going nowhere quickly. Although it reached its best level since May 22 near JPY111.15, participants seem reluctant to challenge the earlier high in May near JPY111.40. There is not much confidence at the moment in the typical drivers of a weaker yen, like rising US rates and bullish stocks. There is an option struck at JPY111 for about $545 mln that will be cut today. |

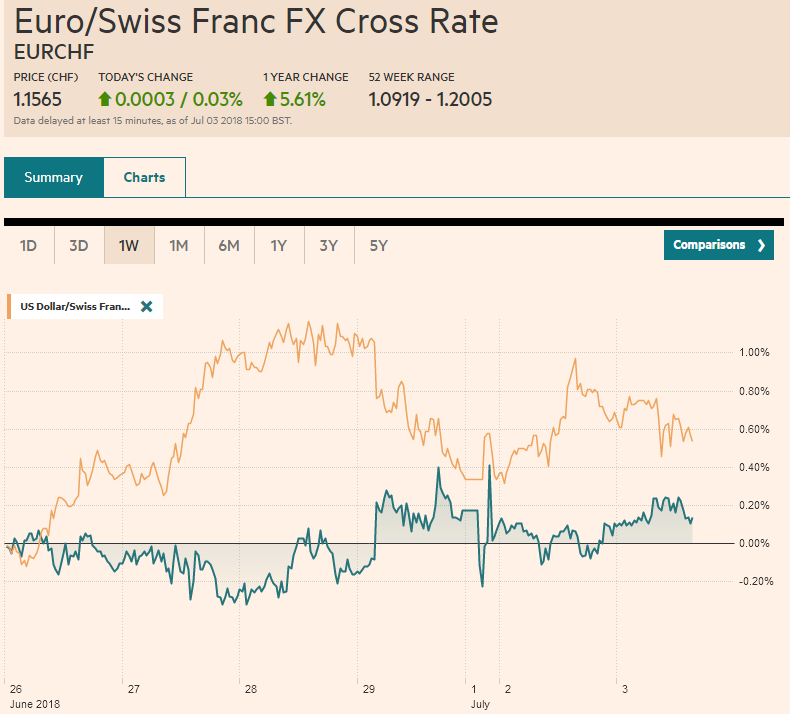

FX Performance, July 03 |

United KingdomSterling is trading firm but within yesterday’s range, which was within the pre-weekend range. The UK’s construction PMI rose to 53.1 from 52.5 in May. Investors are more interested in the services PMI that will be reported tomorrow. Meanwhile, Prime Minister May is reportedly meeting with cabinet officials one-on-one to prepare for the all-important cabinet meeting on Friday to agree on a blueprint for the UK’s future relationship with the EU. That fact that this has not been accomplished at this late date is behind the slow progress in the negotiations and the fears that the UK and EU may stumble into exit at the exit at the end of March without a deal in hand. Sterling is poised to push through $1.32. Above there, resistance is seen near $1.3260. |

U.K. Construction PMI, June 2018(see more posts on U.K. Construction PMI, ) Source: Investing.com - Click to enlarge |

The Reserve Bank of Australia left rates on hold ass widely expected and emphasized the uncertain outlook. Inflation is below target, private investment is soft, and domestic demand is weak. There are well-known international sources of uncertainty too like trade, and the outlook for the Chinese economy. The Australian dollar is benefiting from the softer US dollar. It bounced off $0.7300 support to test $0.7400. There is an A$516 bln option at $0.7395 that expires today. The next area of resistance is seen near $0.7440.

The Canadian dollar has been confined to yesterday’s range, but it appears poised to move higher. The US dollar is flirting with its 20-day average that is found near CAD1.3160. It may be bounded today by two large option expirations today: CAD1.3100 for $2 bln and CAD1.32 for $2.4 bln. Canada reports trade and employment data before the weekend. The trade balance is likely to deteriorate while job growth is expected to have bounced back after a soft May report. Although the market has been fickle, it has come around, and the Bank of Canada is now widely expected to lift rates next week.

The US reports factory goods orders and finalized the durable goods order report. Generally speaking, the corporate tax cuts not yet appear to be boosting investment, for which factory and durable goods orders are one metric. The US also reports June auto sales today. Auto sales have slowed in four of the first five months of the year. A small gain to 17.0 mln vehicles (seasonally adjusted annualized rate) from 16.81 mln in May, which was the slowest sales since last August, is expected.

Trade issues are very much in the forefront of investors attention. Yesterday, a part of the US Commerce Department recommended that the US block China Mobile’s, China’s largest mobile phone company, for operating in the US. Reports indicate that there is a broad consensus among US officials, including national intelligence. The US tariffs and China’s retaliation are due Friday. China’s currency recovered a little today (~0.25%) following comments by PBOC Governor Yi Gang, who reiterated the official intention to promote currency stability. There continues to suspicions in some circles that although divergence is driving the dollar generally higher against most currencies, its gains against the yuan are being forced by Chinese officials seeking to offset the impact of US tariffs.

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$AUD,$CAD,$CNY,$EUR,$JPY,$TLT,EUR/CHF and USD/CHF,newslettersent,U.K. Construction PMI