Is the rate hiking cycle almost done? Not the question on everyone’s minds right now so a good time to ask it, I think. A couple of items caught my attention recently that made me at least think about the possibility.

There has been for some time now a large short position held by speculators in the futures market for Treasuries. Speculators have been making large and consistent bets that Treasury prices would fall. That short position covered shorter-term Treasuries such as the 2-year note we track in our yield curve analysis all the way out to the 30-year bond. Basically, speculators were betting en masse that interest rates had no where to go but up. What has happened over the last few weeks though is that the shorter dated Treasury short position has been largely covered. The 2-year note actually showed a net long spec position two weeks ago although it has backed off to about flat as of last week. There is still a fairly substantial short position further out the curve in the 10-year and particularly the really long-dated maturities.

The 2-year note is influenced heavily by expectations regarding Fed policy. The short position existed in the first place because it was obvious that the Fed was going to hike rates. It is interesting – at least to me – that even as the Fed hiked rates and the financial press became convinced that two more hikes are coming this year, that the folks who bet on such things have suddenly lost their confidence. I don’t really know what this means and there may be a more benign explanation. Speculators still hold large short positions in other short-term instruments, such as Eurodollars and the 5-year note. But this is interesting and bears watching.

Another item that has piqued my interest is the action in the longer end of the curve. The 10-year note yield traded to almost 3.12% in early May but fell back below 3% on May 23rd. It briefly traded above 3% in the wake of the Fed meeting and press conference but couldn’t even hold at that level for an entire day. I have been skeptical from the beginning that tax reform would provide anything more than a temporary lift in growth so the lack of follow-through just confirms my own bias. But that certainly isn’t the prevailing view or at least I didn’t think so; the large speculative short position in the 10-year Treasury futures is evidence of that. But it is interesting, again, that despite the widely accepted view that the Fed is talking and acting hawkish, that the 10-year yield hasn’t been able to push above 3% and stay there. And at some point, those short futures positions are future demand on the long side.

Of course, there are other things going on in the world and maybe those things mattered more to the market than whatever Jerome Powell had to say at his press conference. Italy is in the headlines again and the mess that is US trade policy makes the front page on a daily basis. It seems the narrative has shifted from, “well he won’t actually impose the tariffs” to “well he’ll only leave them in place until he gets the deal he wants”. The next iteration may well be “oh darn, he really believes this stuff” but I hope not. My guess is that Mr. Trump will get some concessions and declare victory so China can buy some beans before the election.

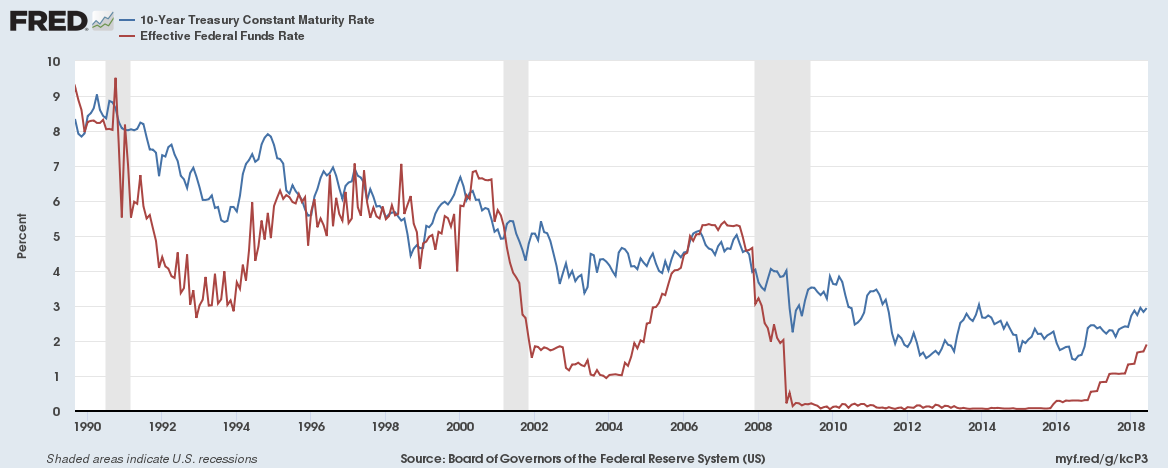

| I would also point out that there are plenty of indications that this rate hiking cycle still has plenty to go. In every recession back to at least 1970 the Fed Funds rate has exceeded the 10 year Treasury yield prior to recession. As you can see below, we aren’t close to that yet.

Overall, given the recent economic data, it is hard to see any reason for the rate hiking cycle to be near its end. But, in general, the market leads and the Fed follows so if the 2-year note yield stops rising here or soon, that is more important than anything Jerome Powell has to say. Could that by now? Probably not but this cycle has been so unlike any before it that I refuse to be surprised by anything. |

10-Year Treasury Constant Maturity Rate 1990-2018 |

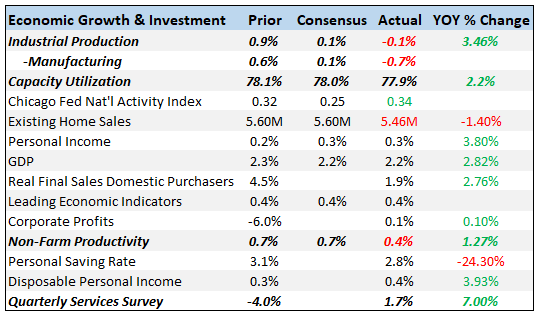

Economic ReportsEconomic Growth & InvestmentIndustrial production was highly disappointing as an auto slowdown took a big bite out of the manufacturing segment. I’ve seen a lot of reports dismissing the drop because of a fire at a major auto supplier but there was plenty of weakness outside of autos too. Business equipment was down 1.1% for instance and one wonders where that surge of investment spending is. There were also some pretty obvious tariff issues with the report; primary metals were down big for the second straight month. What continued to do well are the things that have been leading for months – mining and utilities. Mining is oil drilling and what accounts for the utility production I don’t know unless it is maybe bitcoin mining. Productivity growth was again disappointing, up 0.4% in the quarter and 1.3% year-over-year. Until we see some sustained investment in the economy, I would not expect this number to improve and that just isn’t happening right now. Unit labor costs, which are reported at the same time, actually moderated a bit which might be good for companies but not so much for the folks getting paid. Real compensation remains in the negative column at -0.2%. The quarterly services survey measures information services revenue and showed an improvement in the first quarter. |

Economic Growth & Investment |

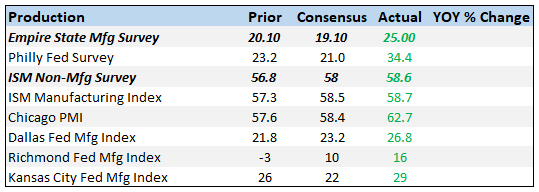

ProductionThe Empire state survey was good and better than expected but until some of this survey optimism shows up in the real numbers – i.e. the industrial production report – they mean absolutely nothing. |

Production |

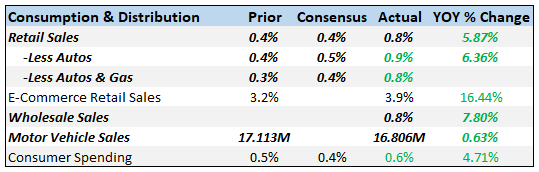

Consumption & DistributionNow that was a good retail sales report for a change. With the exception of the post hurricane bump in November last year, this is the best year over year change since 2012. And it was pretty much strong across the board. I am only guessing but the timing makes me think tax refunds played a role here. The most interesting thing about the report was the bond market reaction which was….nothing. Rates actually went down after the report. Either the bond market is looking past this and thinking of it as a one off tax refund bonus or there was something else moving the bond market. |

Consumption & Distribution |

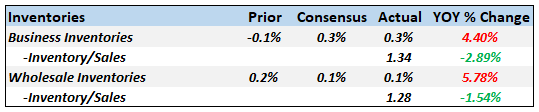

InventoriesInventory/sales ratios are falling again but just marginally. Year over year sales are up 6.7% while inventories grew by 4.4%. |

Inventories |

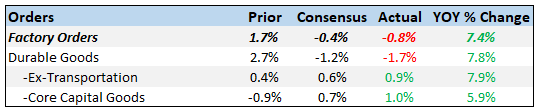

OrdersTake out aircraft and factory orders look better but there are still problems. Non-durables were up 0.1% but durable orders were down 1.6%. Orders for primary metals were skewed higher as companies placed orders in advance of the tariffs. The most positive aspect of the report were orders for core capital goods, up 1%. |

Orders |

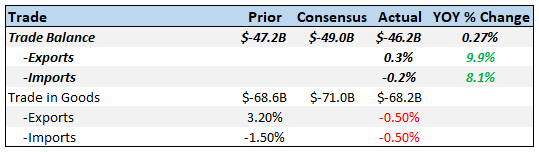

TradeThe large improvement in the trade deficit will be a large positive for Q2 GDP but the tariffs are causing so many distortions it is impossible to determine the underlying trend. For instance, there was a $2.2 billion drop in cell phone imports but I have no idea why. Is that a function of the ZTE issue? We also saw a continued surge in iron and steel imports as users try to get ahead of the tariffs. |

Trade |

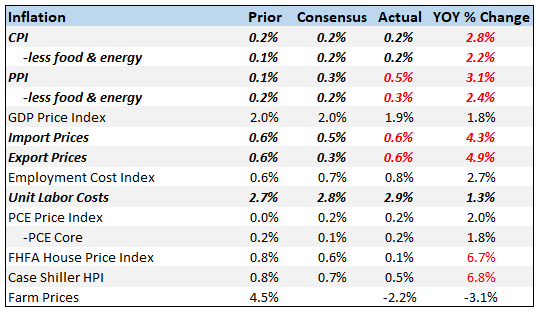

InflationI know everyone is afraid of inflation, but there really isn’t anything here that should be concerning. Most of the change in the headline is due to oil prices being up from the $40s last year. On the producer side, costs are rising and that may hit margins at some point but at least we have the cushion of margins near all time highs. |

Inflation |

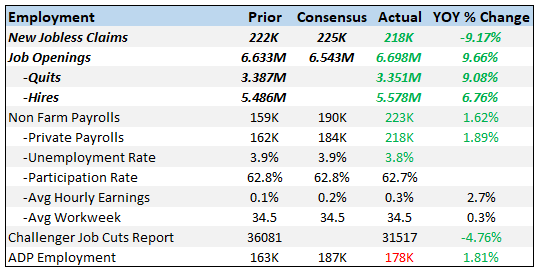

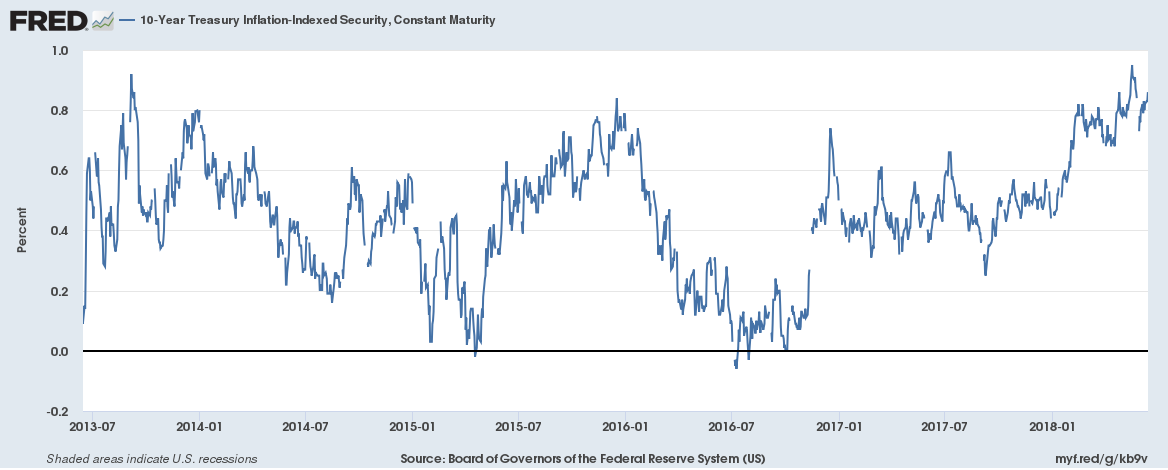

EmploymentThe JOLTS report was as good as it has ever been with opening exceeding the number of unemployed looking for a job. Quits and hires look pretty healthy too. There may be problems with the jobs market but it is hard to find any fault in this report. |

Employment |

SentimentNothing special here. Sentiment has been and remains high. And it will be so right before the next recession too. |

Sentiment |

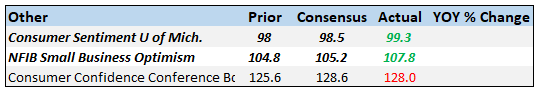

Market Indicators10-year note yields spiked back above 3% very briefly after the Fed meeting but fell back quickly. I suspect there is one more upleg in rates before we peak for the cycle but it isn’t happening right now. 10-Year Treasury Note Yield |

10-Year Treasury Note Yield 2018 |

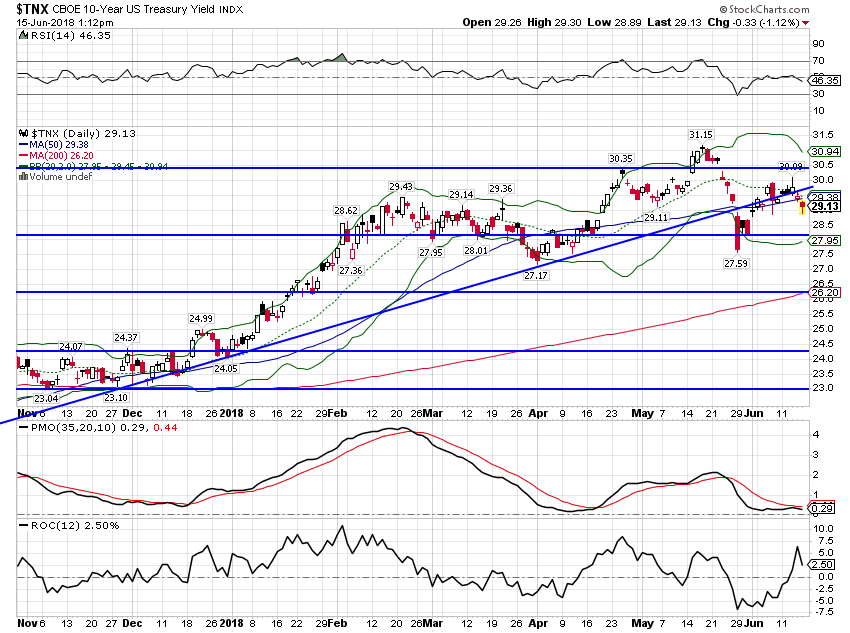

10-Year TIPS YieldTIPS yields are still near the top of the range that has prevailed since 2013. Real yields are an indication of real growth expectations and while current readings are positive for this cycle, they are very subdued when compared to previous cycles. Until the 2008 crisis, 10-year TIPS yields rarely fell below 1.5%. Now they’d have to nearly double to get to that level. |

10-Year TIPS Yield, 2013-2018 |

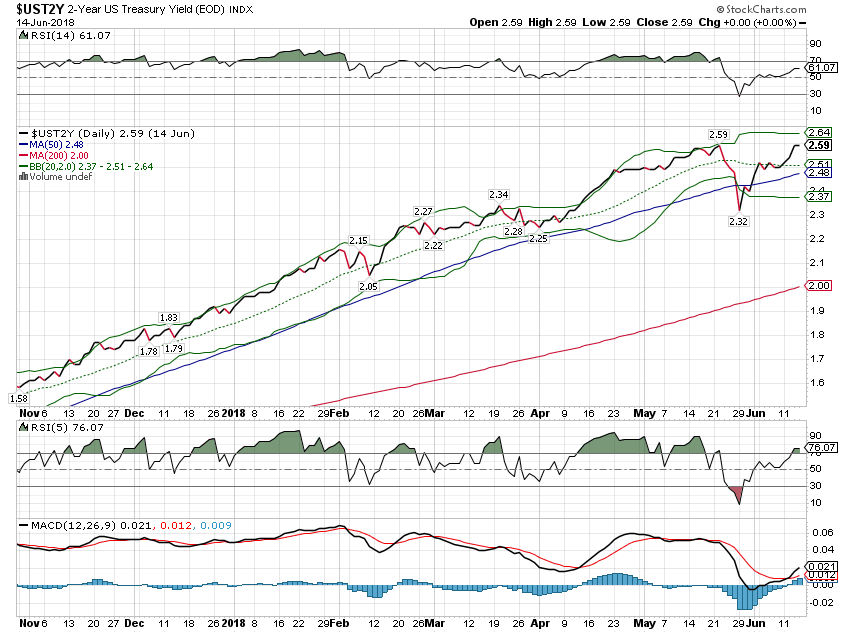

2-Year Treasury YieldAs I noted above, the 2-year Treasury yield seems to have stalled a bit. |

2-Year Treasury Yield |

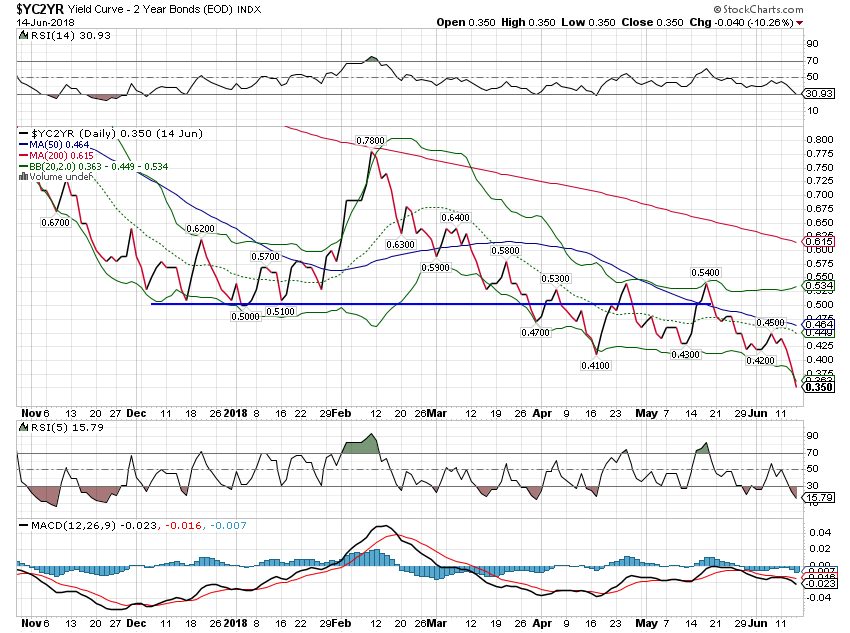

10/2 Yield CurveThe yield curve continues to flatten but is far from flat or inverted. |

10/2 Yield Curve 2018 |

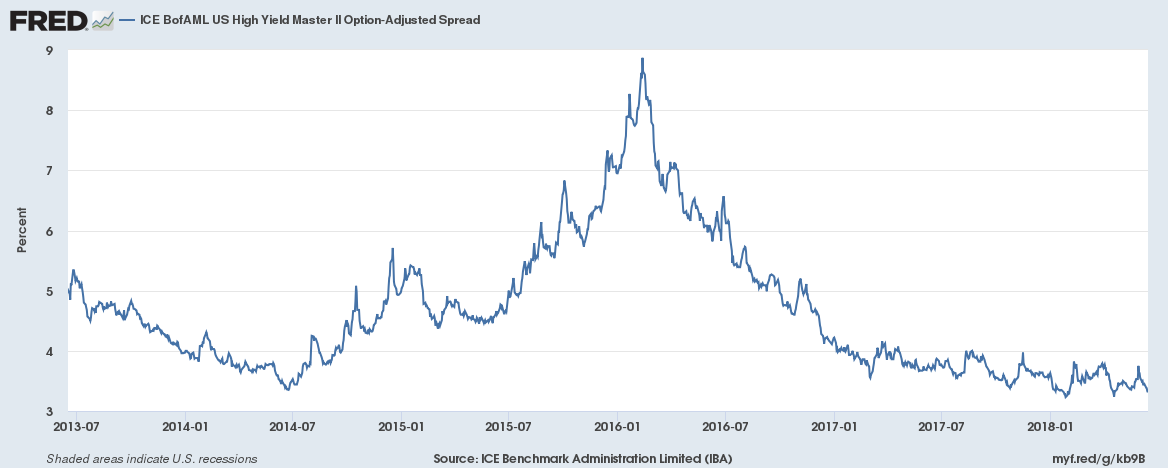

Credit SpreadsCredit spreads are back near the lows of the cycle. It should be noted though that spreads were lower in the last two cycle so there is room for more. |

Credit Spreads 2013-2018 |

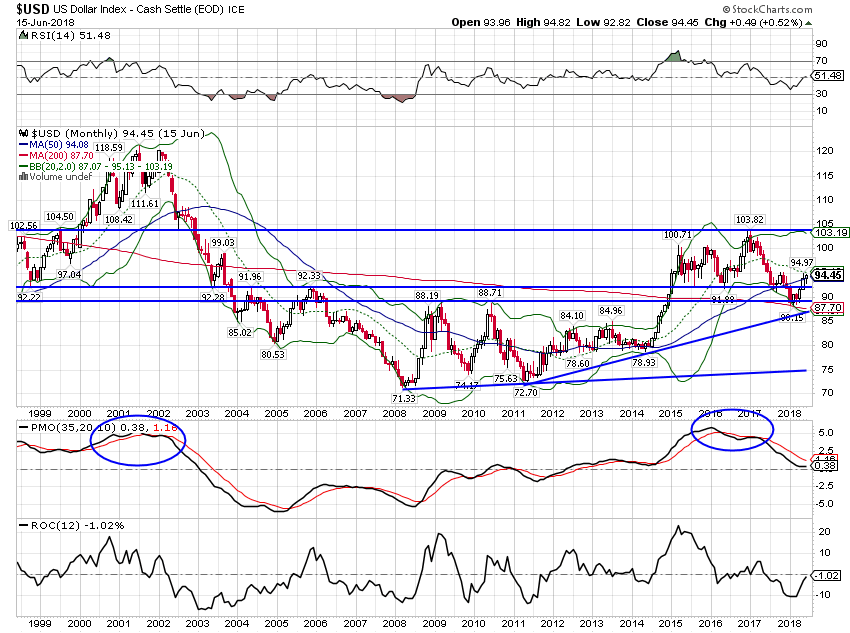

US DollarThe dollar rally has put a crimp in global growth but momentum continues to point lower. |

|

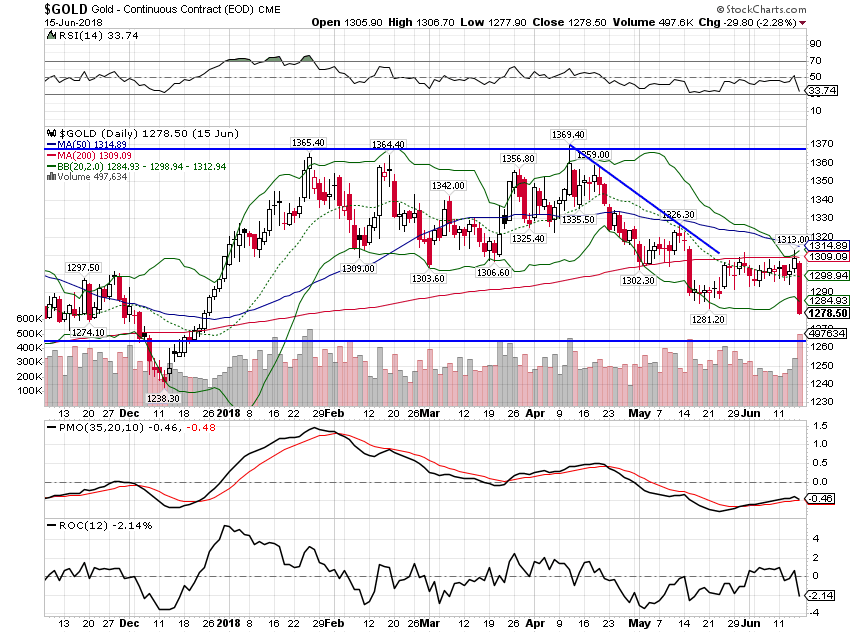

CommoditiesCommodities had held up well with the dollar rally…until last week. Gold is now flat for the year. |

Gold Continuous Contract 2018 |

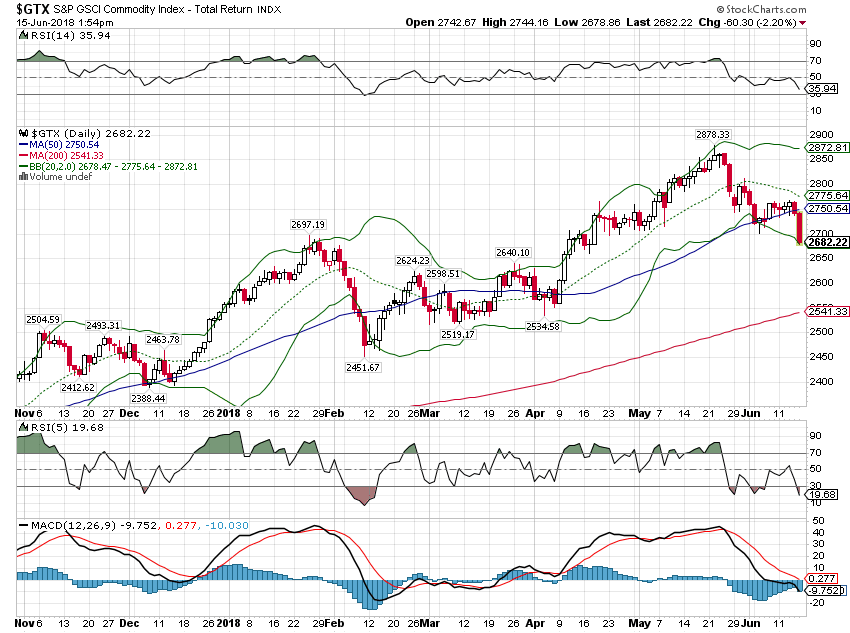

| But the GSCI commodity index is still up on the year. |

S&P GSCI Comodity Index 2018 |

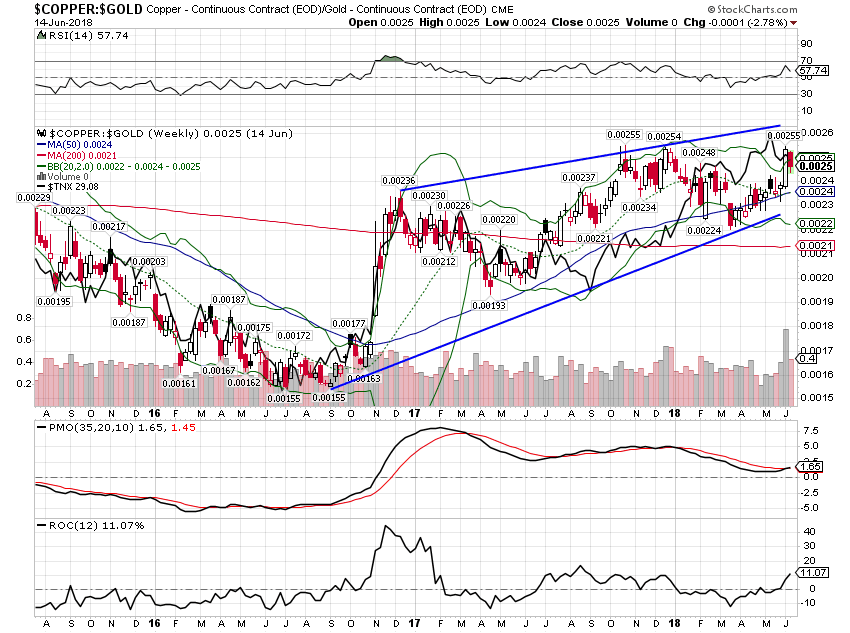

| Copper also rallied until last week and then underperformed even gold. The trend here is obviously still higher but it hasn’t broken out yet. The 10-year Treasury yield tracks this ratio pretty closely so watch here for a heads up on rates. |

Cooper/Gold 2016-2018 |

The US economy shows no signs of impending recession and markets are still largely positioned for higher rates. However, the lack of follow-through in the 10-year yield is somewhat worrisome. I said some weeks ago that if we got a rate hike and the long end rallied that would be a signal that the end of the hiking cycle is near. That’s exactly what we got but it wasn’t much of a rally and it was based on fears about things other than US growth (Italy and trade wars mostly). If history is any guide, we’ve still got a ways to go.

Tags: Alhambra Research,Bi-Weekly Economic Review,commodities,Consumer Sentiment,copper to gold ratio,credit spreads,industrial production,inflation,Inventories,jolts,Markets,newslettersent,productivity,Retail sales,TIPS,Trade,treasuries,US dollar,Yield Curve