Pictet Wealth Management’s latest positioning across asset classes and investment themes.

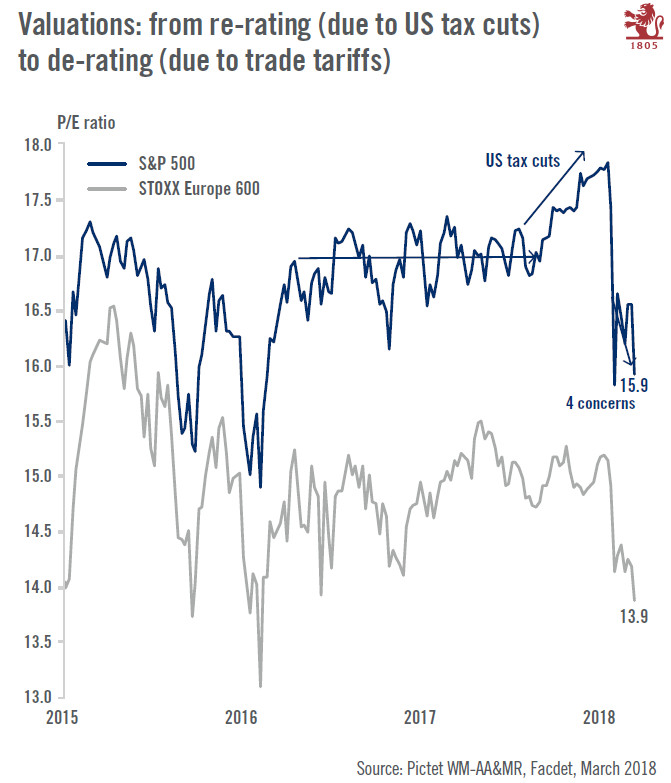

- While macroeconomic and corporate fundamentals still favour risk assets, challenges have been steadily increasing and a lot of good news is already priced into valuations. We sold part of our equity overweight during the early March rally.

- Even though we have become more prudent about equities’ short-term prospects, we expect to be able to redeploy the cash generated from this sale as new opportunities arise.

- The rise in volatility was fully expected but emphasises the need for caution. We are closely monitoring the market’s perceptions of the competitive and regulatory risks emerging for the small number of high-growth tech stocks that have led market performance.

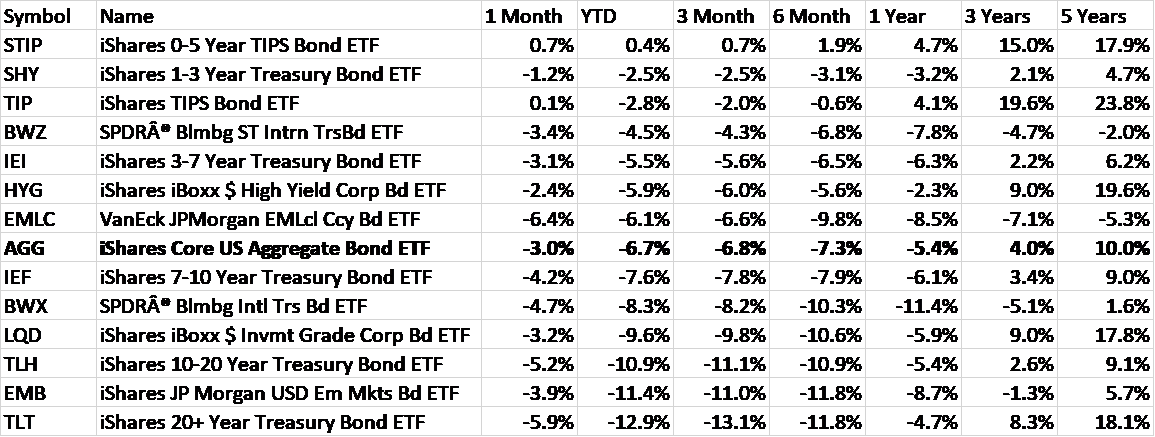

- We remain optimistic about select parts of the US high-yield universe (less so euro high yield), with a particular emphasis on bond issuers in the upper reaches (BB) of the non-investment-grade ratings scale.

Commodities

Currencies

Equities

|

House View Equities, April 2018 |

- The Fed’s quarter-point rate rise initially pushed bond yields higher, but political and market tensions mean long-term yields fell in March and the yield curve flattened.

- Renewed cautiousness among investors has led to a widening of spreads in the credit market. They may continue to increase, although credit fundamentals remain good and credit ratings have been moving upwards.

Alternatives

- In hedge funds, relative-value credit books have held up well in spite of the VIX spike in February. We are maintaining our focus on arbitrage strategies.

- We also see opportunities in the convertibles space, with robust issuance providing fodder for managers. Meanwhile, fixed income arbitrage has been looking particularly attractive.

- In private equity real estate, investors’ concerns about valuations, deal flow and interest rates are still being tempered by longer-term trends such as co-working, which could boost demand for buildings to be adapted to better suit modern needs.

Tags: Asset allocation,Macroview,market stance,newslettersent,Pictet positioning,Pictet strategy