Top Chinese leadership is taking further shape. With Xi Jinping’s continuing consolidation of power going on right this minute, most of the changes aren’t really changes, at least not internally. To the West, and to the mainstream, what the Chinese are doing seems odd, if not more than a little off. Unlike in the West, however, there is determined purpose that is in many ways right out in the open.

Many here had been expecting that outgoing PBOC Governor Zhou Xiaochuan would be replaced by Liu He. Called Uncle He by many close to him, it has been said that Liu was a close fried of Xi’s since the two were boys. In 2013, just after Xi took power during the 18th Communist Party Congress, Uncle He was made deputy director of China’s crucial National Development and Reform Commission (NDRC), the government’s top economic central planning agency.

Last fall, at the 19th Party Congress, Liu skipped several steps in further rise through the Communist ranks. He was placed as a member of the Communist politburo, one of only twenty-five on China’s second most powerful of governing councils.

But control over the People’s Bank of China is now passed to Yi Gang, the central bank’s current deputy. Taking over for Zhou seemed the logical next progression in Liu’s accompanying of Xi Jinping’s spreading policies. In the West already, Yi’s ascent is taken as a good sign, the sort of continuity clueless Western commentary assumes is the highest quality. This is, it is already being written, the same as Jerome Powell taking over for Janet Yellen.

That’s not what’s happening, though. Yi Gang provides the PBOC with operational continuity. A new Communist official, however, takes over one step above him on the government org chart – Liu He.

While Yi is given the central bank, Uncle He is being made one of China’s four Vice-Premiers and being handed its most powerful domestic portfolio. He will immediately be made the Chair of China’s Financial Stability and Development Commission that among other tasks oversees the coordination between the PBOC and the country’s various financial regulators.

The Financial Times classifies Yi in this new role as China’s “economic tsar.”

To “globally synchronized growth”, the expected contribution from the Chinese is straightforward. That economy is to lead the world out of the rut and malaise of the last decade. The US and European economies (mistakenly thought of as separate systems) are finally inching forward, it is believed, so the upturn in those plus China’s re-invigoration is being counted on for something like global economic synergy.

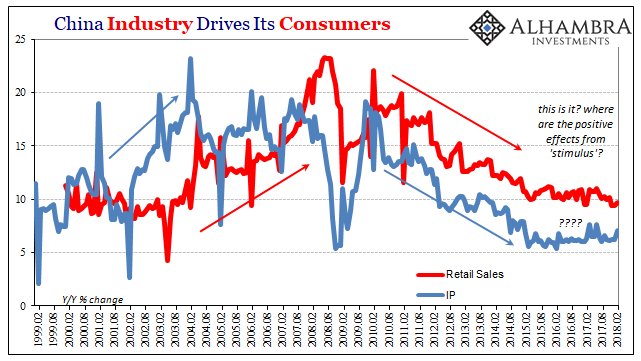

It was supposed to happen last year but didn’t. Among the major disappointments was the lack of acceleration in China. The government had expended considerable resources for “stimulus” in early 2016, both monetary as well as fiscal. As always, it was immediately accepted as powerful, successful, and clear in its intent before it ever really got started. Western Economists cannot conceive of these things in any other way; and so, they are written about only in that fashion.

In early May 2016, a strange article had appeared on the front pages of the People’s Daily, the Communist Party’s propaganda outlet. Written in the form of a Q&A with an anonymous “authoritative figure”, the very fact of its publication in that place could only mean some degree of high up official approval – if not of Xi Jinping himself.

The article was, it appeared, a total rebuke of what the government was doing at that very moment; the “stimulus” expense and the shift in role of the PBOC from passive (2015) agent to more aggressive. One of the most widely cited metaphors contained within the diatribe was how there always seemed to be this idea a country could be “growing a tree in the air”; building an economy out of none but finance.

Puzzled over not just that particular quirk but others as well, almost everyone here in the West completely missed the point – even though it was spelled out for them. Whoever it was behind the words, they were authoritative at least in terms of economic expectations. The world had been counting on and waiting for China’s eventual “V” shaped recovery from the “rising dollar.” The figure in the People’s Daily warned it wasn’t the correct letter:

I need to stress, that the L-shape will last for a certain period of time, and it’s certainly longer than one or two years. [emphasis added]

| No one knows for sure who this authoritative figure was seemingly in defiance of established Chinese economic doctrine, but many including myself believe it was none other than Uncle He. |

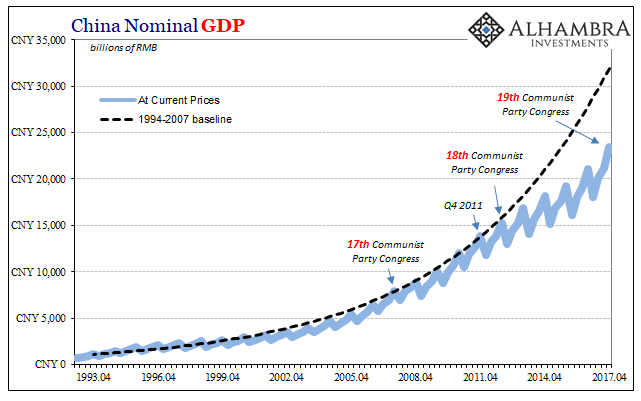

China GDP, Apr 1993 - Mar 2018(see more posts on China Gross Domestic Product, ) |

| Liu wasn’t openly contradicting the Communist economic position, either, he was instead clarifying it. |

China Industry, Feb 1999 - 2018 |

| To the West, a dangerously slowed China (with massive downside rather than upside risks) seems inconceivable. But mainstream commentary is, obviously, woefully uninformed on the economy in China as well as everywhere else. |

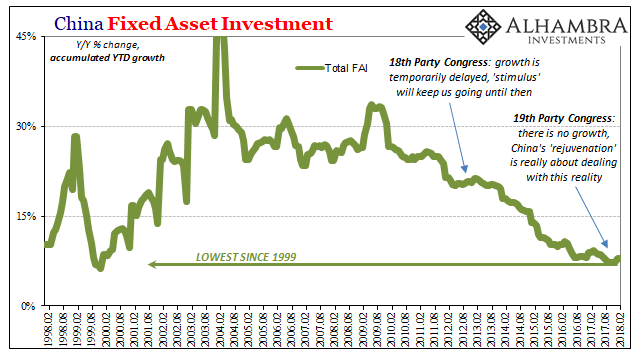

China Fixed Asset Investment, Feb 1998 - 2018(see more posts on China Fixed Asset Investment, ) |

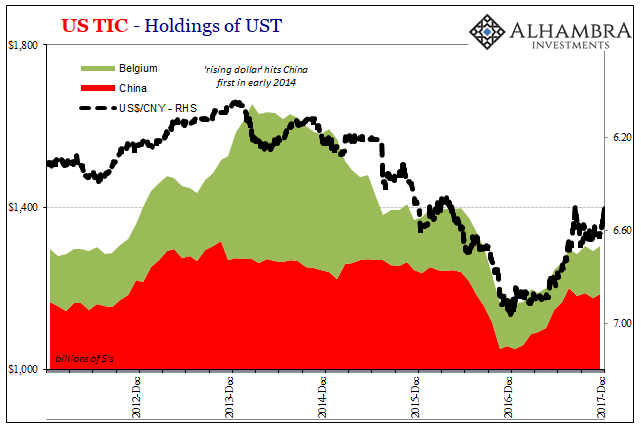

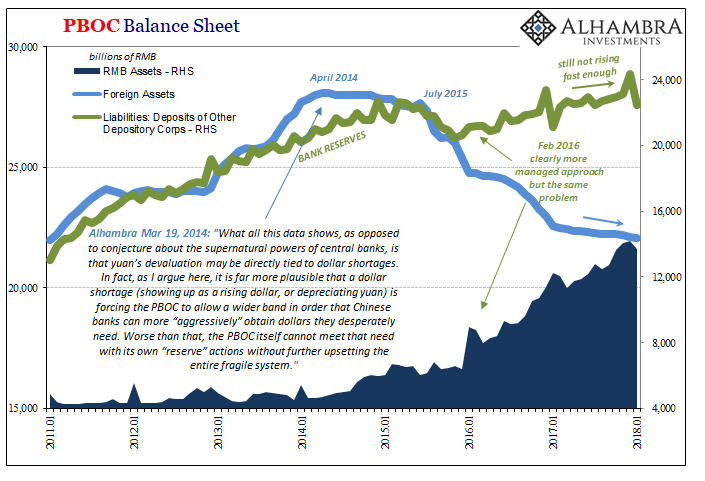

| Chinese authorities have been acting for years, several before this mysterious article ever appeared, in more realistic fashion about what’s going on in the world; particularly the monetary world. They were, as everyone else, under grand illusions about “stimulus” and monetary policy in 2009 and to some extent still in 2012. By 2014, however, it was perfectly clear especially in losing control of CNY things weren’t going nearly so well anywhere; China most of all. |

US TIC, Dec 2012 - 2017 |

| Xi Jinping spoke last fall at the 19th Party Congress about “rejuvenation”, which was not quite the same as the word implies. He was, as has been described, alluding to quality of growth over quantity, the sort of thing you do only when you can no longer count on or even opt for the latter. I said it was the official embrace of a no-growth world. Everything about that Congress from its political conclusions, and those still being done, was with the purpose of an “L” shaped global not just Chinese pattern. |

PBOC Balance Sheet, Jan 2011 - 2018(see more posts on pboc balance sheet, ) |

| Globally synchronized growth continues to be the baseline expectation in the West. Western economists are still looking for leadership from China’s economy to achieve it. They shouldn’t be, nor should they have been. Unlike our clueless technocrats who can’t seem to make sense of, let alone explain, the current economy, China’s have figured out the (monetary) puzzle. If Chinese economic statistics weren’t enough to illustrate it, they’ve been quite open about it this the whole time. |

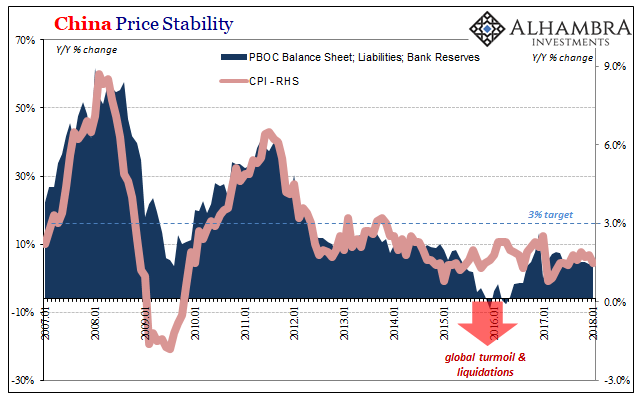

China Price Stability, Jan 2007 - 2018 |

Now they are acting on those expectations.

Instead of the Great “Recession”, perhaps it should have been called the Great L. It took several more years, but even China’s vaunted miracle growth fell victim alongside all the rest of the world. It’s a massively different outlook, this globally synchronized L. Brexit, Trump, Italy, and now Xi’s amplifying totalitarianism. They’re all very different responses to the same thing. Paraphrasing Churchill from another era, it’s gone on so long now the whole world has clearly passed into the age of consequences.

This is some boom.

Tags: $CNY,China,China Fixed Asset Investment,China Gross Domestic Product,currencies,economy,Federal Reserve/Monetary Policy,Markets,newslettersent,PBOC,pboc balance sheet,Xi Jinping