| According to the State Secretariat for Economic Affairs (SECO)’s quarterly estimates, Swiss real GDP rose by 0.6% q-o-q in Q4 (2.4% q-o-q annualised; 1.9% y-o-y), above consensus expectations (0.5%). The Swiss economy expanded by 1.0% in 2017 overall, in line with our own forecast. This comes after GDP growth of 1.4% in 2016 and 1.2% in 2015.

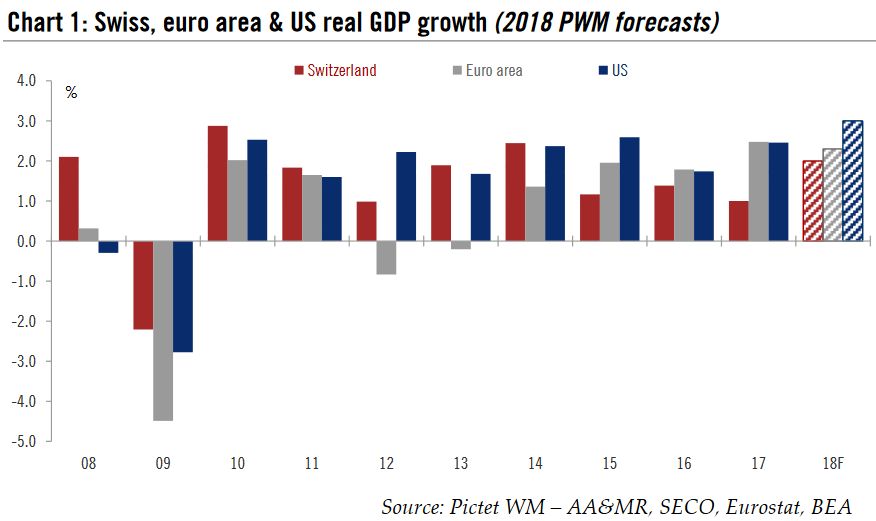

Two aspects of today’s report are worth mentioning. First, on the expenditure side, both domestic demand components and foreign trade helped to boost Swiss growth in 2017. Second, the largely export-oriented manufacturing sector was the main driver of GDP growth in 2017. The service sectors such as accommodation and food services and financial services also provided substantial support to growth. Switzerland lagged the US and the euro area in terms of annual GDP growth for the third consecutive year in 2017 (see Chart 1), but today’s data confirm that the Swiss economy is continuing its recovery. Economic prospects for this year look promising. We expect growth in the Swiss economy to accelerate from 1.0% in 2017 to 2.0% in 2018, reducing the gap with other economies. |

Swiss, euro area & US real GDP growth (2018 PWM forecasts), 2008 - 2018(see more posts on Eurozone Gross Domestic Product, Switzerland Gross Domestic Product, U.S. Gross Domestic Product, ) |

Q4 GDP growth surprised on the upsideSwiss real GDP expanded by 0.6% q-o-q (2.4 % q-o-q annualised, 1.9% y-o-y) in Q4 2017. This comes after an upwardly revised figure of 0.7% q-o-q in Q3 and 0.5% q-o-q in Q2. The breakdown by expenditure components should be taken with a pinch of salt as they are particularly volatile in Switzerland. Nevertheless, several observations can be made. Private consumption expanded moderately by 0.2% q-o-q (after 0.4% q-o-q), while government consumption rose by 0.5% q-o-q, in line with its in long term average. The disappointment came from total investment, which was negative for the first time in almost three years (-0.4% q-o-q). The main culprit was investment in equipment (-1.3% q-o-q), while investment in construction accelerated in Q4. According to the SECO press release, the contraction in investment in equipment “was largely due to a steep decline in the volatile research and development segment”. Foreign trade in goods and services (excluding non-monetary gold and valuables) was a drag on GDP growth in Q4. On the production side of GDP, growth was broad based across sectors, with manufacturing providing the most substantial boost to growth (see Chart 2). |

Swiss real GDP growth (production approach), 2007 - 2018(see more posts on Switzerland Gross Domestic Product, ) |

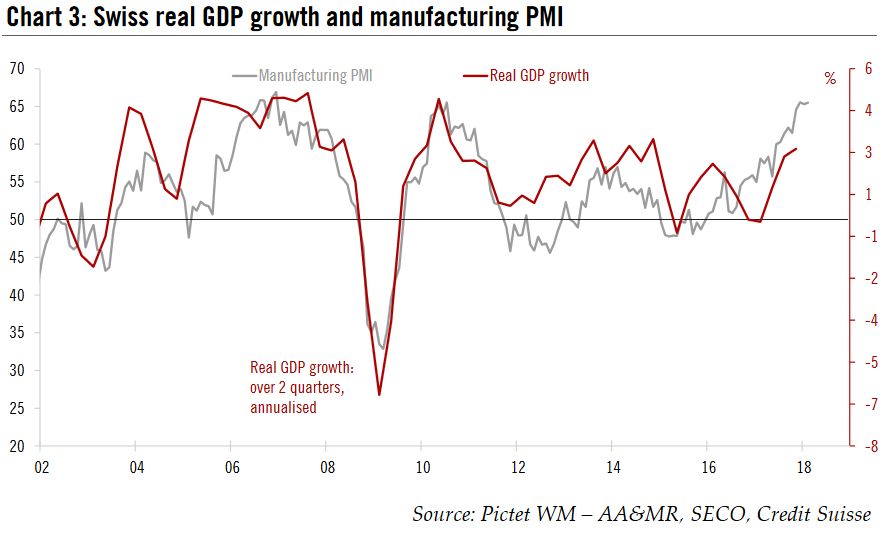

| Looking ahead, the latest key Swiss sentiment indicators such as the manufacturing PMI (see Chart 3) and the KOF economic sentiment index point to solid expansion in Q1 2018. |

Swiss real GDP growth and manufacturing PMI, 2002 - 2018(see more posts on Switzerland Gross Domestic Product, ) |

Sport events will make the quarterly profile more volatile

Since last year, the “Art, entertainment, recreation and other services” sector now takes better account of the impact of sporting events. In particular, the sale of trademark and broadcasting rights for major international sporting events is now taken into consideration, reflecting the fact that international sporting associations like FIFA, UEFA and the International Olympic Committee (IOC) have their headquarters in Switzerland. The economic activity they generate is recorded where these events take place, which is rarely in Switzerland. However, the income generated by licensing does go to the respective sports associations and can have an impact on the Swiss economy.

The holding of the Winter Olympics in South Korea and the football World Cup in Russia in 2018 will boost Swiss annual GDP growth, but make quarterly growth more volatile.

If the timing of a particular sport event is known in advance, the exact duration of its contribution to Swiss value added is not limited to the period of the event itself. As a result, SECO makes certain assumptions when estimating quarterly GDP. In years when the Winter Olympics (February) and football World Cup (June or July) take place, the value added of such events reaches its maximum in Q2, while in years when the Olympic Games (usually Summer) and the UEFA European Championship (June or July) are held, the maximum impact is in Q3.

These effects fall outside cyclical economic factors, but have to be taken into account when forecasting annual Swiss GDP growth in 2018 and beyond.

2018 economic outlook is promising

Switzerland’s economic prospects look promising this year. Swiss exporters are set to benefit from the global economy’s solid momentum, all the more so if the Swiss franc remains around its current level or depreciates further. Importantly, export growth is expected to remain broad based: in addition to the chemical and pharmaceutical industries, the machinery, electronics and metal as well as the watch-making industries should contribute to a greater share of export growth. Domestic demand is expected to gain momentum as well, mainly due to a pick-up in investment in equipment and research and development (R&D). In this regard, the latest KOF investment Survey provides a glimpse of how much Swiss businesses plan to invest in 2018. The survey indicates that the quality of investment is set to improve. Confidence regarding investment has never been higher since the Frankenshock in 2015 (see Appendix for further details). All in all, we forecast Swiss annual GDP growth of 2.0% in 2018, after 1.0% in 2017.

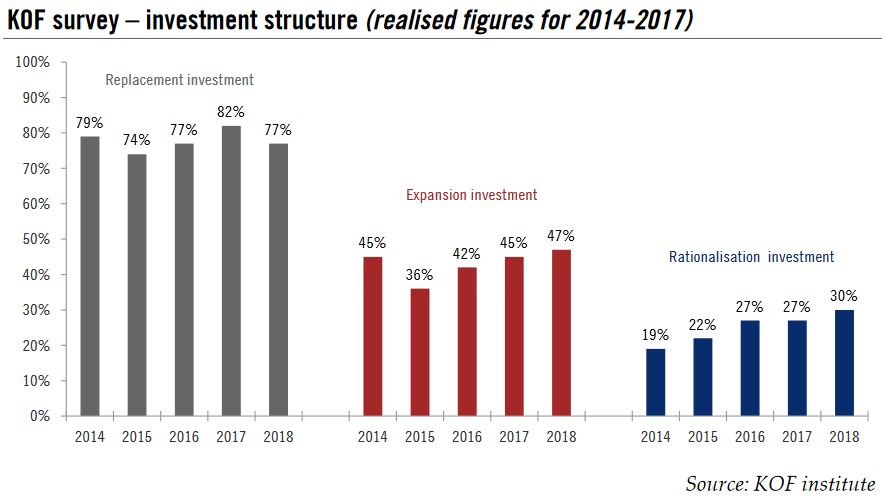

Appendix: Swiss private investment – more and betterThe latest KOF investment Survey provides a glimpse of how much Swiss businesses plan to invest in 2018. The survey indicates that companies are much keener to invest this year than last. Confidence regarding investment has never been higher since the Frankenshock in 2015. According to KOF survey calculation, private companies will increase their capital investments by some 8%* (in nominal terms) this year, after 8.5% in 2017. Importantly, the quality of investment will also improve. Looking at the three types of investment, namely replacement, expansion and rationalisation, Swiss companies mentioned that they want to increase their investment in expansion (see Chart). Indeed, KOF mentions that “among the survey participants, more than 47% are planning to make expansion investments in 2018. This is the highest level since 2010, and indicates companies’ increased optimism. This bodes well for the future, as investment in expansion increases an economy’s production capacity (unlike replacement investment). Overall, KOF investment survey reinforces our view that private investment will be an important driver of GDP growth in 2018. |

KOF survey – investment structure (realised figures for 2014-2017) |

Full story here Are you the author? Previous post See more for Next post

Tags: Eurozone Gross Domestic Product,Macroview,newslettersent,Switzerland Gross Domestic Product,U.S. Gross Domestic Product