Monthly Archive: March 2018

Bankrupt Petroplus climate payments ‘non-refundable’

Climate fund payments made to now-bankrupt Swiss oil refiner Petroplus cannot be reclaimed by creditors as they constituted a business arrangement that brought benefits to contributors as opposed to a gift. This ruling from Zurich’s highest court has stopped a CH15 million ($16 million) claim in its tracks, barring an appeal to the federal courts.

Read More »

Read More »

Uncle Sam Issuing $300 Billion In New Debt This Week Alone

US needs to borrow almost $300 billion this week alone. This is the largest debt issuance since 2008 financial crisis. Trump threatens trade war with its biggest creditor – China. Bond auctions have seen weak demand due to large supply and trade war concerns. $20 trillion mark reached in early September 2017; $1 trillion added in just 6 months. US total national debt level now exceeds $21.05 trillion and is accelerating higher.

Read More »

Read More »

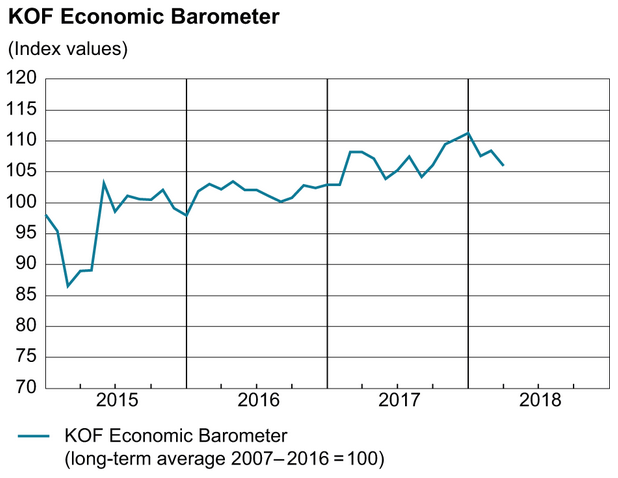

Eurozone Faces Many Threats Including Trade Wars and “Eurozone Time-Bomb” In Italy

Eurozone threatened by trade wars, Italy and major political and economic instability. Trade war holds a clear and present danger to stability and economic prospects. Italy represents major source of potential disruption for the currency union. Financial markets fail to reflect the “eurozone time-bomb” in Italy. Financial volatility concerns in Brussels & warning of ‘sharp correction’ on horizon.

Read More »

Read More »

Great Graphic: EMU Inflation Not Making it Easy for ECB

The Reserve Bank of New Zealand is credited with being the first central bank to adopt a formal inflation target. Following last year's election, the central bank's mandate has been modified to include full employment. To be sure this was a political decision, and one that initially saw the New Zealand dollar retreat.

Read More »

Read More »

GBEB Death Watch

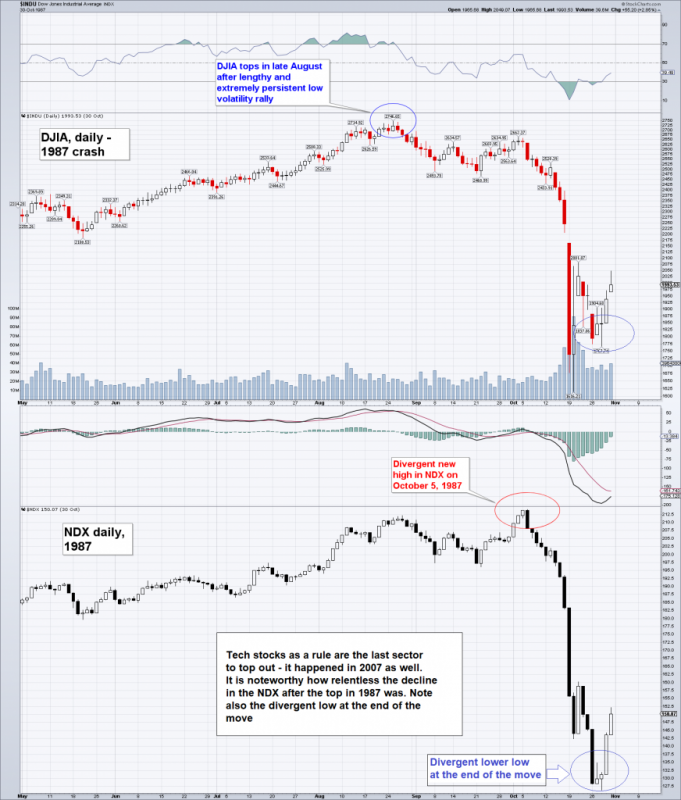

As our friend Dimitri Speck noted in his recent update, the chart pattern of the SPX continues to follow famous crash antecedents quite closely, but obviously not precisely. In particular, the decisive trendline break was rejected for the moment. If the market were to follow the 1987 analog with precision, it would already have crashed this week.

Read More »

Read More »

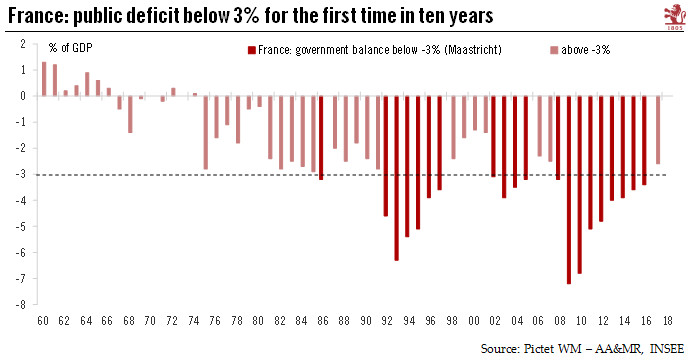

Larger-than-expected reduction in French public deficit

France’s public deficit fell to 2.6% of GDP in 2017 according to INSEE’s preliminary assessment, down from 3.4% in 2016 and below the 3% threshold for the first time since 2007. The outcome was better than the government’s estimate of a 2.9% deficit. If confirmed, France will exit the Excessive Deficit Procedure that the European Commission opened in 2009.

Read More »

Read More »

Central banks adding euros to their FX reserves

Central banks are looking beyond the dollar to grow their foreign exchange reserves for the first time in a decade. Rising trade tensions, and a recovering European economy bode well for the euro making a stronger case for central banks to diversify into the monetary union's currency.

Read More »

Read More »

Credit Suisse boss earned less last year

Credit Suisse Chief Executive Tidjane Thiam earned slightly less in 2017 during his third year on the job, the bank said on Friday. The news comes at a time of scrutiny over executive pay and bonuses. Thiam earned CHF9.7 million ($10.26 million) last year, a 5.3% drop on 2016, Switzerland’s second-biggest bank said.

Read More »

Read More »

Central Banks Care about the Gold Price – Enough to Manipulate it!

In early March, RT.com, the Russian based media network, asked me for comments and opinion on the subject of central bank manipulation of gold prices. The comments and opinion that I supplied to RT became the article that RT then exclusively published on its website on 18 March under the title “Central banks manipulating & suppressing gold prices – industry expert to RT“. This article is now transcribed below, here on the BullionStar website.

Read More »

Read More »

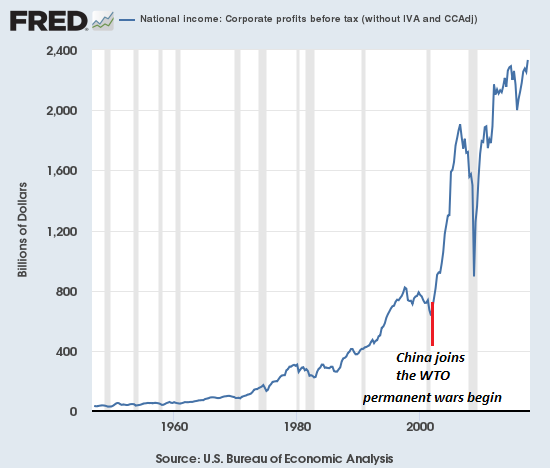

15 Years of War: To Whose Benefit?

As for Iraq, the implicit gain was supposed to be access to Iraqi oil. Setting aside the 12 years of "no fly zone" air combat operations above Iraq from 1991 to 2003, the U.S. has been at war for almost 17 years in Afghanistan and 15 years in Iraq. (If the word "war" is too upsetting, then substitute "continuing combat operations".)

Read More »

Read More »

Trendline Broken: Similarities to 1929, 1987 and the Nikkei in 1990 Continue

In an article published in these pages in early March, I have discussed the similarities between the current chart pattern in the S&P 500 Index compared to the patterns that formed ahead of the crashes of 1929 and 1987, as well as the crash-like plunge in the Nikkei 225 Index in 1990. The following five similarities were decisive features of these crash patterns.

Read More »

Read More »

Impact of recent tariffs on US and China’s GDP should be limited for now

The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD506bn of total Chinese merchandise imports). The list of products targeted, still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn.

Read More »

Read More »

FX Daily, March 29: Bonds and Stocks are Firm, While the Greenback Consolidates Upticks

The choppy US equity session yesterday, ultimately ending with modest losses as the tech sector remained under pressure, has been shrugged off in Asia and Europe, where modest gains have been seen. The dollar is little changed after yesterday's gains, and bonds are mostly firmer.

Read More »

Read More »

IMF forecasts 2.25 percent Swiss GDP growth in 2018 while pointing to risks

A boost to investment and net exports from the tailwind of strong external demand, together with faster expansion of household spending owing to rising employment, are forecast to lift GDP growth to around 2¼ percent in 2018, said the IMF in a statement referring to Switzerland issued on 26 March 2018.

Read More »

Read More »

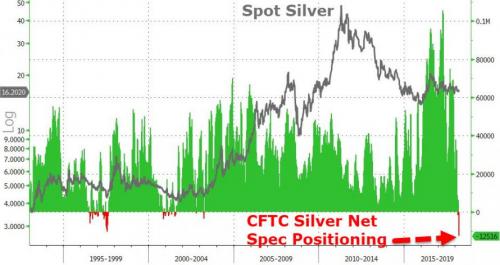

Silver Futures Report and JP Morgan Record Silver Bullion Holding Is Extremely Bullish

Silver Futures Report, JP Morgan Record Silver Bullion Holding Is Extremely Bullish. JP Morgan Continues Adding To Massive Silver Bullion Holdings (see chart). Silver Speculators Go Short – Which Is Extremely Bullish. Stunning Silver COT Report: One For the Ages (see chart).

Read More »

Read More »

Slaves to Government Debt Paper

Picture, if you will, a group of slaves owned by a cruel man. Most of them are content, but one says to the others, “I will defy the Master”. While his statement would superficially appear to yearn towards freedom, it does not. It betrays that this slave, just like the others, thinks of the man who beats them as their “Master” (note the capital M). This slave does not seek freedom, but merely a small gesture of disloyalty.

Read More »

Read More »

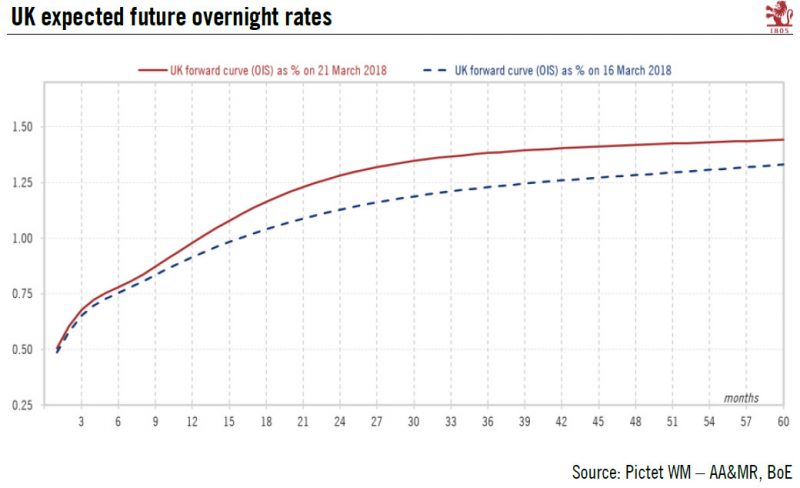

British pound – Smoother transition, stronger sterling

Recent positive developments in the United Kingdom (UK), namely the transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March, call for a more positive short-term outlook for the sterling than previously thought. We therefore revise our projections upward for the sterling on the entire time horizon.

Read More »

Read More »

FX Daily, March 28: Three Developments Shaping Month-End

Today may be the last day of full liquidity until next Tuesday, after the Easter holidays. We identify three developments that are characterizing the end of the month, quarter, and for some countries and companies, the fiscal year. Equity market sell-off, bond market rally, and the continued rise in LIBOR.

Read More »

Read More »

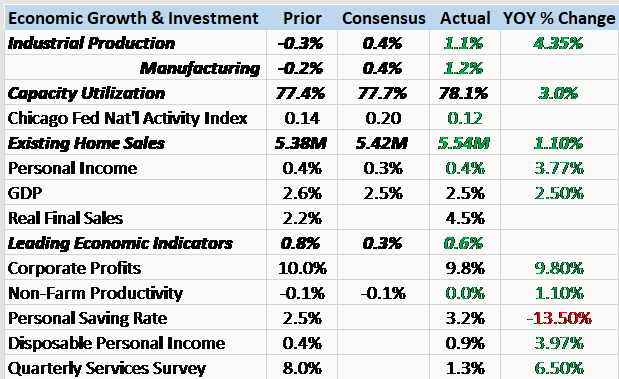

Bi-Weekly Economic Review: Embrace The Uncertainty

There’s something happening here What it is ain’t exactly clear There’s a man with a gun over there Telling me I got to beware I think it’s time we stop, children, what’s that sound Everybody look what’s going down There’s battle lines being drawn Nobody’s right if everybody’s wrong Young people speaking their minds Getting so much resistance from behind It’s time we stop, hey, what’s that sound Everybody look what’s going...

Read More »

Read More »