Peak Gold: 2017 Supply Flat As China Output Falls By 9%

– China gold production falls by 9% to 420.5t in 2017

– Chinese gold demand rose 4% to 953.3t in same period

– China is largest producer and accounts for 15% of global gold production

– China does not export gold. Increasing foreign gold acquisitions to meet demand

– Global gold production flat – 3,269t in ’17 from 3,263t in ’16, smallest increase since ’08

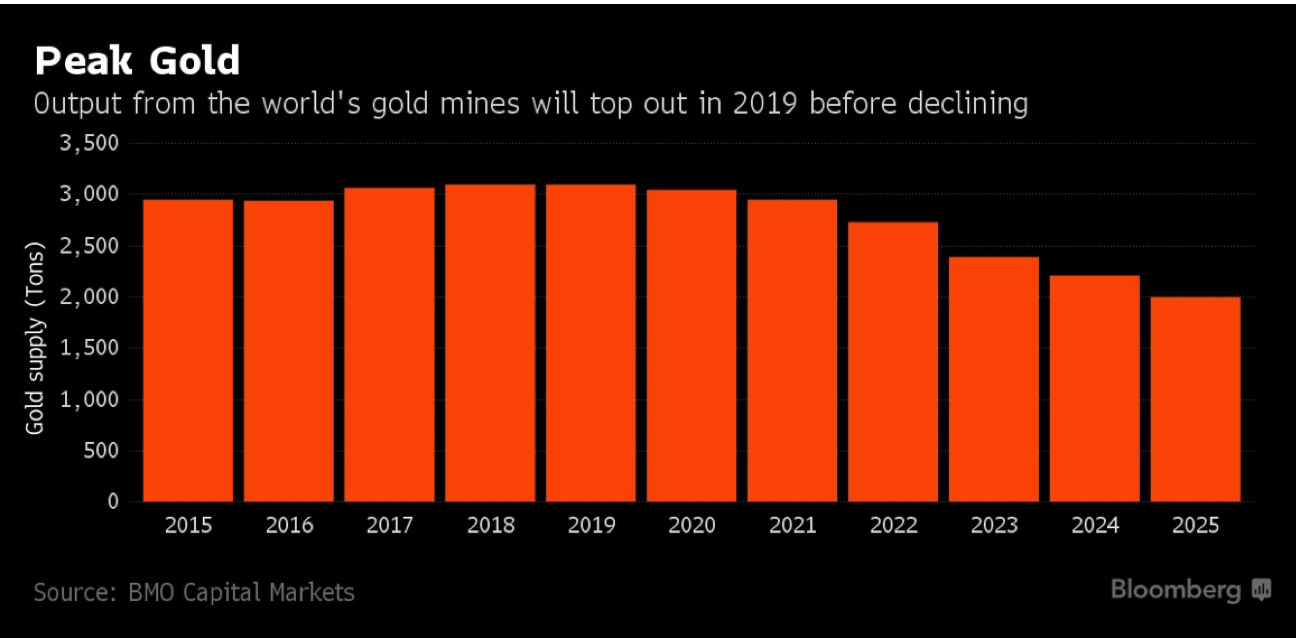

– Peak Gold is here: supply set to fall gradually while global demand remains robust

Editor: Mark O’Byrne

| Financial markets are abuzz with how much money the global economy lost earlier this week when the Dow Jones Index had a bit of a crash – ahem – ‘correction’. Luckily it has (temporarily at least) recovered but there are many other threats to financial markets in 2018 that suggest the ‘Everything Bubble’ is set to burst.

There is also an unappreciated threat to the gold market and more particularly a threat to gold mining supply and therefore the likelihood of higher gold prices – that is the threat of ‘peak gold’. The supply of gold increased last year by the smallest margin since 2008. Ourselves and other market experts who have looked at the data, have been contending for many months now that we are on the cusp of ‘peak gold’. The FT has now recognised the phenomenon of peak gold or ‘plateau gold’ and covered it this week: Global gold mine supply plateaued in 2017 as China output fell 9%. China is the world’s largest gold supplier. In 2016 the country produced 453t or 56% more than the second highest gold producing nation of Australia.In 2017 Chinese production fell 9% to just 420.5t. It also leads global gold demand. The demand comes from not only individuals but also a central bank that is determined to no longer rely on the US dollar. |

World's Gold Mines Futures, 2015 - 2025 |

The love trade

China’s love for gold is well known. Over the years, this has shown little sign of abating. According to the China Gold Association demand for gold jewellery climbed by 10% in 2017. For the final half of the year, demand climbed 9% from the previous six months, according to the World Gold Council.

The increased demand for gold comes from the desire to turn profits into value. A property boom and high stock market valuations have boosted wealth amongst the middle classes and wealthy Chinese who are now looking to secure that profit for the long term – by acquiring physical gold.

This isn’t dissimilar to behaviour we have seen during the crypto boom in recent months. Some investors in bitcoin, ether and Ripple have been keen to protect their new found wealth by diversifying into physical gold bullion with GoldCore and other dealers.

The strong buying activity is expected to continue this year as the ‘wealth effect’ encourages Chinese people to buy gold. Gold buying ahead of the Lunar new year, later this month is believed to be very robust.

Control of money

China prudently does not export any of its domestically mined gold. It continues to be somewhat secretive about the amount of gold the central bank holds in reserve and announces a large jump in gold reserves every few years.

The fact that mine supply is down in one of the world’s largest gold producing countries, suggests that the gold market is set to run into yet further supply problems as China seeks gold supplies internationally. After all, gold is clearly part of a wider Chinese plan to reduce dollar hegemony and position the yuan as a potential reserve currency.

This adds further to global monetary and geo-political uncertainties. For the last forty or so years we have lived in a world dominated by the US dollar. Now we see the likes of Russia and China not only building up their official gold reserves but also the monetary ‘systems’ to enable them to trade with each other and other economic partners using gold as a means of payment.

Peak GoldAwareness of China’s fall in supply first came about last year. At the time of reporting, we explained why this was a long-term problem for gold supply: In the short term, China may well be able to increase imports in order to satisfy domestic demand. It may struggle to increase its own production. However, in the long-term this is not a sustainable solution. Gold mines are finite and supply relies on an ever-growing number of new mines being discovered. Something which we can no longer rely on, as Pierre Lassonde recently explained:

One of the main reasons for the fall in gold discoveries and mining is clearly because there is nowhere near as much gold left to be discovered or mined. Today, the average gold mine worldwide is extracting gold at below 1 gram per ton. It is very difficult for mining companies to economically justify mining less than this. The chances of technology that will help to mine lower-grade ore, being developed is unlikely as the problem appears to be largley geological – not technological. In mid-2017, World Gold Council Chairman Randall Oliphant expressed concern that the world might have already produced the most gold in a year that it ever will, on account of increasing gold demand and declining supply.

|

Gold Discoveries, 2006 - 2015 |

| Markets are increasingly volatile and the outlook is uncertain. This is seeing more retail investors, HNW investors, UHNW investors, family offices and institutions diversify into gold.

This and peak gold bodes well for gold’s long-term outlook. The world’s central banks have been embarking on an unprecedented monetary experiment for the last decade. The true consequences of which are yet to play out. Previously gold has reacted positively to economic downturns, but previously there has been no concerns about supply. When the global financial bubble bursts then we will likely see physical gold demand vastly outstripping gold supply. |

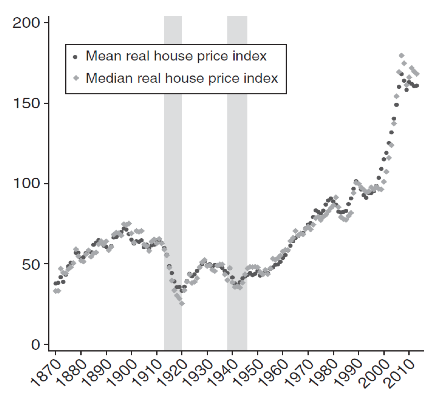

Real House Price Index, 1870 - 2018 |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent