The start of the year has seen the Japanese yen and Swiss franc appreciate strongly against the US dollar (they rose by 5.6% and 4.4% respectively between 1 January and 22 February) despite higher US yields. However, this rise in US yields came with heightened market volatility, favouring safe haven currencies such as the yen and franc.

Indeed, both currencies are characterised by structurally large domestic current account surpluses and positive net international investment positions. At a time of low global risk appetite, the lack of recycling outflows (investors normally seek higher yields elsewhere when global risk appetite is high) to counter the upward pressure stemming from current account surpluses and the potential repatriation of foreign investments tend to support the yen and franc, despite their low yields.

Although we continue to believe global risk appetite will remain healthy during 2018, the risk of additional spikes in market volatility has increased given the recent dynamics in US Treasuries and potential changes in the global growth regime. Consequently, while we still believe the yen and franc will depreciate, we are lowering our forecast for the magnitude of the depreciation of these defensive currencies in 2018. We now see a move towards JPY115 and CHF0.98 per USD in 2018, compared to current spot prices of JPY107 and CHF0.93 per USD.

Interest rate differential still matters

We believe that, in general, interest rate differentials are a significant driver for currencies. The relationship between exchange rate moves and rate differentials is definitely not linear, but the latter do provide a good guide to the outlook for a currency. As a reminder, the Swiss National Bank (SNB) in particular uses interest rate differentials to limit the attractiveness of the Swiss franc investments. The success of this policy may be open to question— but that may reflect the impact of other drivers such as global risk appetite.

The recent rise in US yields is due to an improving US growth outlook but also to inflation fears and concerns about the deteriorating US budget deficit. In particular, the liquidation of US Treasuries by foreign investors amid fears about the worsening budget deficit has led to an environment supportive of defensive currencies, and comparatively less so of the US dollar.

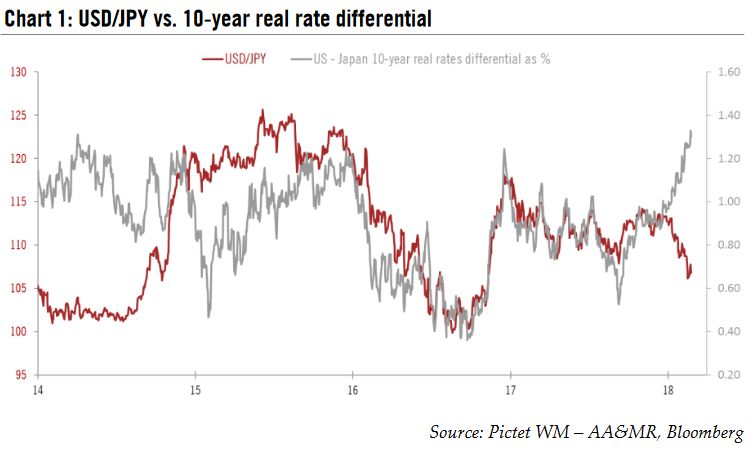

| Our baseline scenario that global risk appetite will remain robust should mean any rise in market volatility is temporary. Thus, the negative correlation seen since the start of the year between interest rate differentials and the USD/JPY rate (see chart 1) is unlikely to last. Looking at historic precedents, high volatility has a tendency to weaken the link between rate differentials and currencies. For example, in September 2008, at the height of the financial crisis, the tight positive correlation between rate differentials and exchange rates seen over the preceding nine months broke down due to the sharp rise in market volatility. However, we acknowledge that the speed of the recent increase in US yields may not leave much room for a further rise in yields without triggering another decline in global risk appetite. |

Unchanged scenario for Japanese yen and Swiss franc

Although we have decided to lower our expectations for yen and franc decline, we believe the environment remains rather negative for defensive currencies. Indeed, our scenario of strong US growth together with a gradual rise in inflation should support capital flows into US assets, supporting the US dollar in 2018. Indeed, the attractiveness of US equities has significantly improved thanks to the US tax cuts, while US fixed income, with its current elevated carry, offers a decent cushion against a potential decline in bond prices.

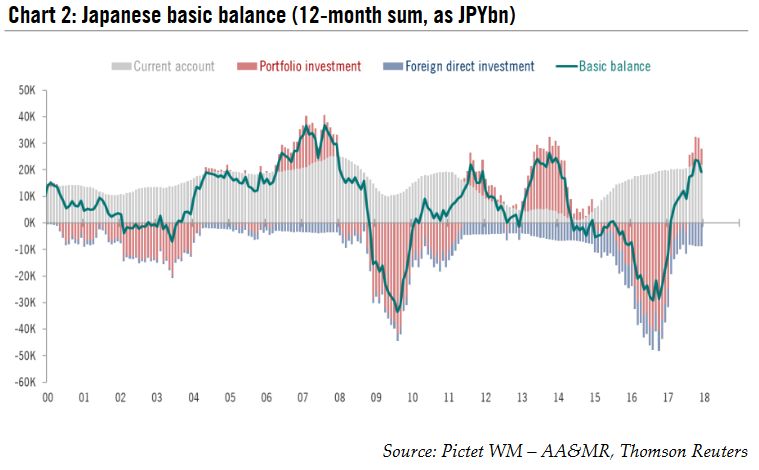

To put it another way, the scope for further improvements in the Japanese basic balance (the sum of the current account, net portfolio investments and net foreign direct investments) due to positive portfolio flows seems rather low, especially as portfolio investments are already net positive (see chart 2)

Furthermore, we expect the Bank of Japan (BoJ) to keep its yield-curvecontrol framework broadly unchanged in 2018 as domestic inflationary pressure remains weak. The likely reappointment of Haruhiko Kuroda as BoJ governor and the government’s nomination to the post of deputy governor of Masazumi Wakatabe, a strong supporter of pro-reflation policies, tend to support the status-quo.

| Meanwhile, we continue to expect the SNB to start raising rates at the end of the year, reducing downward pressure on the Swiss franc.

In light of the aforementioned elements, we have decided to lower our expectations for the decline of the yen and franc. We now expect a USD/JPY rate of JPY115 instead of JPY119 and a USD/CHF rate of CHF0.98 instead of CHF0.99. The changes in the yen exchange rate are most drastic than to the franc mostly because of valuations. Indeed, the yen remains highly undervalued (it is more than 20% undervalued against the dollar according to purchasing power parity estimates based on consumer price index inflation), whereas the franc is still overvalued against the dollar (by roughly 15% according to the same metric). |

Japanese Basic Balance, 2000 - 2018 |

Full story here Are you the author? Previous post See more for Next post

Tags: Japanese yen,Macroview,newslettersent,Swiss Franc,usd-jpy