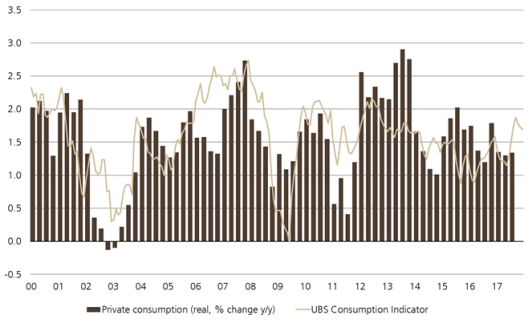

The Swiss consumption indicator by UBS shows improvements. The indicator is still distant from the highs in 2012. At the time stronger growth in Emerging Markets and the weaker franc helped the Swiss economy.

At 1.69 points, the consumption indicator lay well above the long-term average in December 2017, conveying an optimistic snapshot of Swiss private consumption. Weaker figures for new car registrations prevented an even higher value.

|

Zurich, 31 January 2018 – The consumption indicator fell slightly in December 2017 to 1.69 points from 1.73. However, values had been revised upward in the past few months. An improvement in retail business and an increase in the number of overnight stays since the weakening of the Swiss franc in the summer of last year supported the consumption indicator. By contrast, the fall in the number of new car registrations in comparison to the same month last year had a negative impact. The 12% drop is considerably above the long-term average. For the current year, the UBS Chief Investment Office Wealth Management (UBS CIO) expects solid economic growth that will be partly supported by private consumption. However, the UBS CIO anticipates weaker growth in private consumption than the indicator shows. For this year, UBS economists expect consumption growth of 1.4%. Falling unemployment and the solid economic trend should support private consumption. As the expected nominal wage increase is only slightly above the inflation rate of 0.6%, the real wage increase will likely dampen private consumption. |

Switzerland Private Consumption and UBS Consumption Indicator, December 2017 Source: ubs.com - Click to enlarge |

How the UBS Consumption Indicator is calculated

The UBS Consumption Indicator signals private consumption trends in Switzerland with a lead time of one to three months on the official figures. At more than 50%, private consumption is by far the most important component of Swiss GDP. UBS calculates this leading indicator from six consumer-related parameters: new car registrations, business activity in the retail sector, the number of domestic overnight hotel stays by Swiss residents, the consumer sentiment index, employment figures and credit card transactions made via UBS at points of sale in Switzerland. With the exception of the consumer sentiment index and employment figures, all of this data is available monthly.

Full story here Are you the author? Previous post See more for Next postTags: newslettersent,Switzerland Private Consumption,Switzerland UBS Consumption Indicator,U.S. Consumer Spending