| Happy 2nd Birthday Bail-in Tool! We Suggest Gold As The Perfect Gift

– Two years since bail-in rules officially entered EU regulations |

- Click to enlarge |

| Ah, New Year’s resolutions, what fun. For some reason we opt to commit to fairly big life changes at some point between Christmas and New Year. This is a time when the real world seems a lifetime away from the cosiness of the holiday season. We often make a resolution when we have had too much of something, perhaps booze, perhaps food or perhaps it is based on regrets from the previous year. Despite best intentions, rarely do we stick to them.

May we make a suggestion? If you’re going to make any resolutions this year make one that is pretty easy to stick to and that won’t make too much of a short-term impact on your life: resolve to pay attention to and to protect yourself from the threat that is ECB bail-in tools. In the long-term you’ll be more grateful you did this than if you had given up cursing or drinking for a month. On the 1st January 2018 the ECB bail-in tool will be two years old. That’s right just over two years ago the ECB decided that it was better to force the financial burden of banks’ failures away from the state and instead onto bondholders and creditors i.e. those with money in the bank. The ECB was following in the footsteps of the US where bail-ins have been part and parcel of financial legislation since the crisis of 2007-08. Canada has more recently joined the party. We have relentlessly covered the threat of and developments in bail-in legislation over the last two years. It is perhaps the most shocking decision to come out of regulators and central banks since the financial crisis. It is even more shocking when one considers the lack of uproar from the financial media who continue to peddle the myth that the financial system is more secure than pre-financial crisis. The bail-in legislation has been put in place because the EU, along with the rest of the world, has been through a horrendous financial crisis. It exposed such dangers in the banking system that it has taken nearly a decade for global regulators to agree to post-banking crisis rules. Just this month Basel III was agreed. The whole aim of the agreement is to protect governments by having private investors suffer losses first during banking crises. One has to ask, if politicians are so keen for us to believe in the stability of the financial system in those problem areas why the need for legislation that not only places depositors at risk but has been updated continuously to put them at even more of a disadvantage? 2018 should be a time when investors and savers resolve to take charge of their wealth and hold it outside of the banking system. Physical gold that is allocated and segregated is able to offer this, as well as zero exposure to the bail-in regime. You can hear more about our expectations for 2018 in our new Goldnomics podcast. |

|

| What is a bail-in?

A quick refresher from our free guide to bail-ins:

The original bail-in legislation stated that a bail-out using public funds was not an option until creditors accounting for at least 8% of the lender’s liabilities had paid up (the bail-in). At the moment €100,000 or £75,000 is protected per depositor, this amount is known as a ‘covered deposit’. Deposits soon to be more exposed, as decided by bureaucrats In terms of who pays what it is no longer down to the sovereign government, the introduction of bail-in legislation made clear that that responsibility now lies with the Single Resolution Mechanism. So not only are your government unable to act in your best interests when it comes to a bail-in but you are now at the mercy of the ECB who will decide on a bail-in based on the Union’s best interests. This was most recently reminded to us when the ECB proposed that ‘covered deposits’ should be replaced to allow for more flexibility. Essentially under the new proposals depositors and savers will no longer be guaranteed any amount of money should a bank go under.

Quick and dangerous fixes to cover loopholes and prevent further insubordination Unsurprisingly bailing-in has been politically tricky, to say the least. Efforts of governments to avoid any awkwardness when it comes to bail-ins has most prominently been seen in Italy. Earlier this year the country’s clean-up of the two largest lenders, Banca Popolare di Vicenza SpA and Veneto Banca SpA, saw the government enact a loophole. Rather than use the EU’s Bank Recovery and Resolution Directive (which would have put the EU in control of the rescue attempt and forced even more losses on more bondholders) domestic insolvency laws were used. The EU had been hoping for a ‘success’ story as seen with Banco Popular Espanol SA. This saw the bank sold to a bigger competitor in June 2017. The sale promptly wiped out shareholders and about 2 billion euros ($2.3 billion) owed to bondholders (who are often Joe Bloggs depositors). Needless to say the EU were not happy when the Italian bank rescues did not go the same route. They have no doubt since been working on amendments to ensure that such insubordination cannot happen again. Italy’s moves did not stop savers from being hurt, the banking meltdown in Veneto Italy destroyed 200,000 savers and 40,000 businesses. Meanwhile, since the financial crisis regulators have been so busy putting in place rescue agendas and items like Basel III they have lost control of what now puts the financial market at risk. As GoldCore CEO Stephen Flood reminds us:

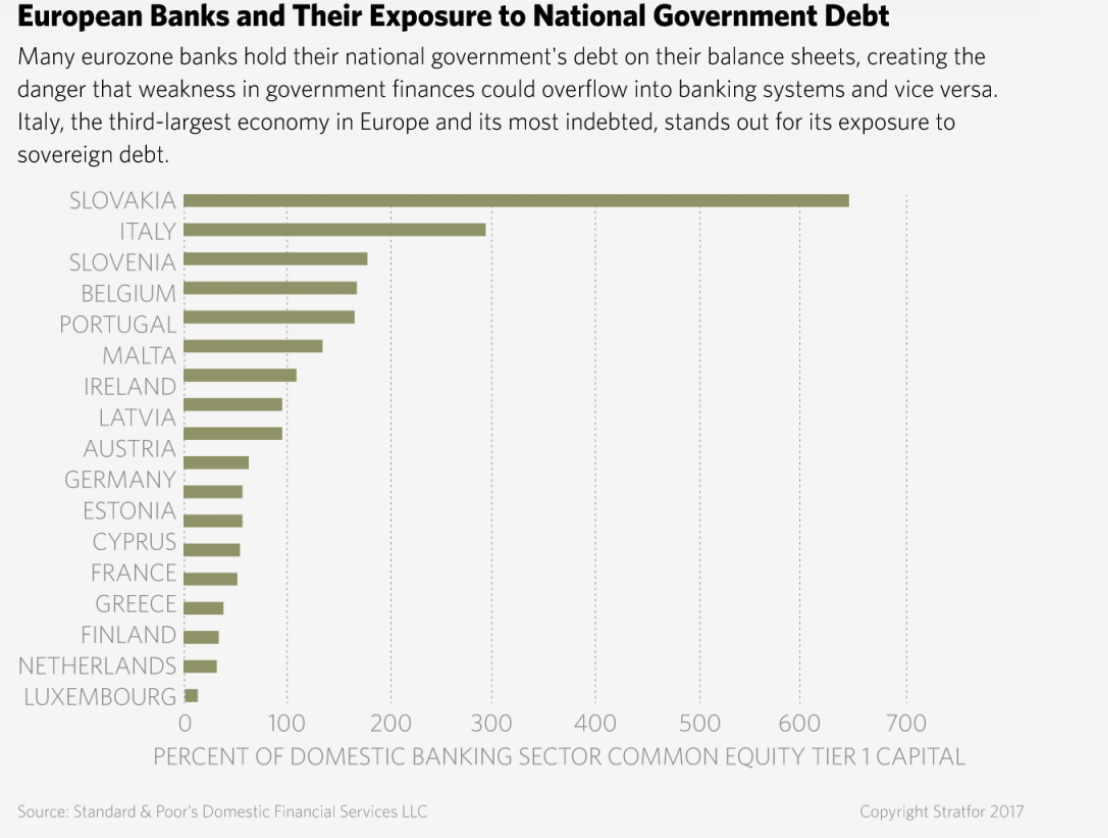

There are two key issues that place the bail-in agenda at even greater likelihood of being enforced in a more extreme way, across the EU. These are so great that last month the removal of covered deposits was suggested (see above and read more here) as a means to prevent a run on the banks should depositors get wind of how dangerous a situation many banks find themselves in. These two issues are thanks to sovereign government debt and the rapid growth of the shadow banking system. What lies in the shadows There is a ‘doom-loop’ in existence. In need of safe assets, banks often hold lots of government debt, which is generally deemed risk free. Risk-free? As my 14 year old cousin would say ‘Mega-lolz’. Stratfor explains the doom-loop as follows:

It was actually the doom-loop which originally inspired the bail-in legislation, launched to prevent such a scenario. The concern now is that it might be too little too late or just the wrong tool for the job. |

European Bansk and Their Exposure |

| The second issue is the shadow banking system. Despite the heralding in of Basel III it has done little to restrict the growth of the lesser regulated shadow banking system. The system involved financial intermediaries ranging from hedge funds to special purpose vehicles. Generally they have to abide by by less regulation and lower liquidity requirements than their banking contemporaries.

As a result of this relaxed stance on the shadow banking system, outpaced regular lenders in international credit growth for most of the past decade. Here in the EU they are estimated to hold more than €40 trn on assets. So far, no one has asked what will happen when this bubble bursts. The loop will no doubt tie-in with the banking system, putting depositors once again at risk. However, as with government debt, we are more likely to see greater restrictions on savers and depositors than we will on additional controls on the shadow banking system. There is no short-term panacea, prepare for the long-term |

|

| Sadly the EU seems to believe that a banking system can be propped up by control of and reduction in the rights of hardworking savers when it comes to their money. This is instead of actually dealing with the crux of the matter – too much debt in the system.

For a long time we have explained to readers about how it is not worth trusting that the ECB and governments have our best interests at heart. Whether you are a saver, a business or a pensioner with limited funds government institutions have shown blatant disregard for your wealth. Whilst the ECB works shamelessly to protect the bigger picture, you must make a few changes to prepare for the realistic picture. By way of reminder the ECB is proposing that in the event of a bail-in it will give you an allowance from your own savings. An allowance it will control:

i.e. no-one is saying if you will ever get that £10,000, £75,000 or €100,000 back.

|

|

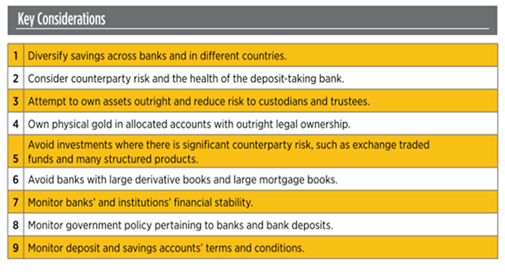

| Savers should be looking for means in which they can keep their money within instant reach and their reach only. At this point gold and silver is the clear option.

Physical, allocated and segregated gives you outright legal ownership. There are no counterparties who can claim it is legally theirs (unlike with cash in the bank or shares) or legislation that rules they get first dibs on it. Gold and silver are the financial insurance against bail-ins, political mismanagement, and overreaching government bodies. As each year goes by it becomes more pertinent than ever to protect yourself from such risks. This year make sure you’re not ignoring the birthday of the bail-in era, instead you are resolving to fight against it by buying gold to celebrate. To read more about how you can protect your savings in the bail-in era then read our free guide here. |

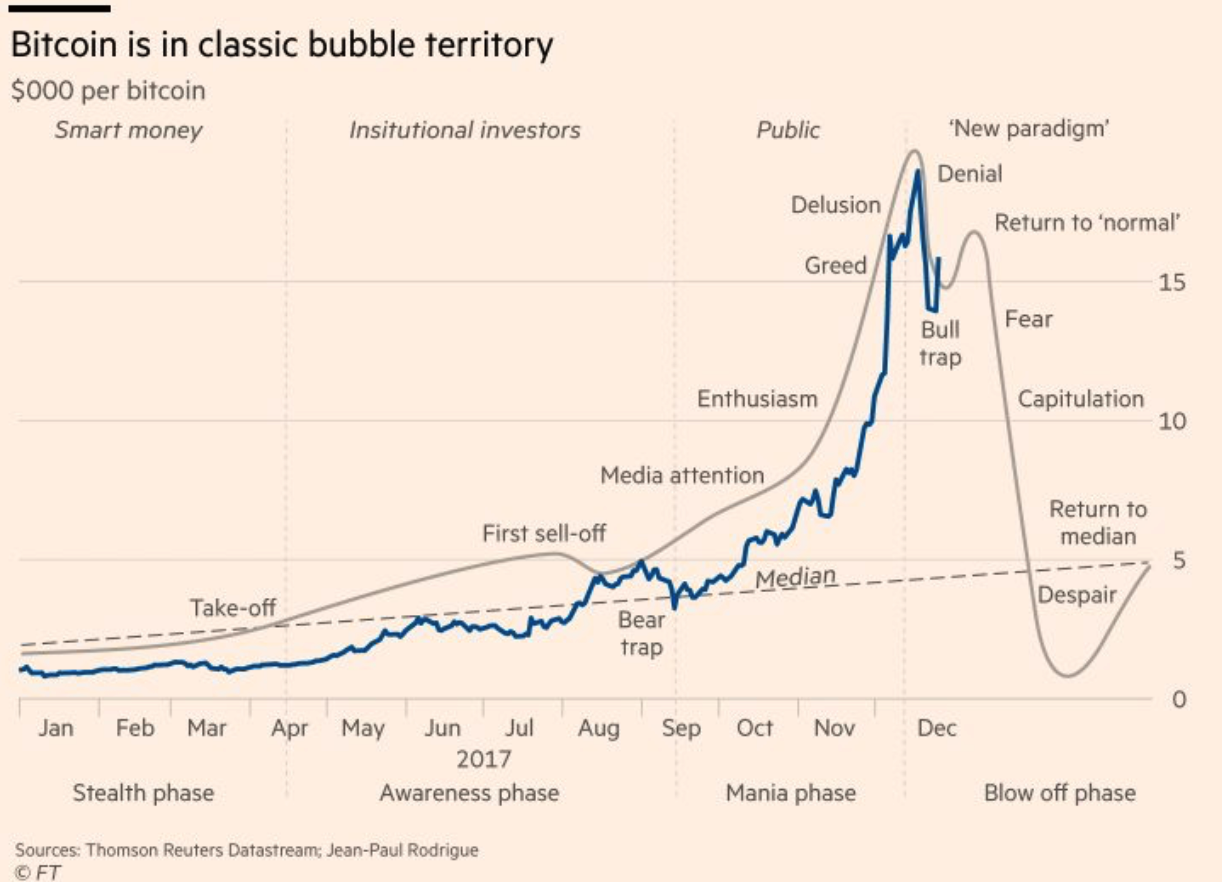

Bitcoin Bubble Territory, Jan - Dec 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent