Remarkable and Extraordinary GrowthGood cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas? |

Here’s what really happened: the government’s minions confiscated everything Santa had on him when he crossed the border and then added it to GDP. - Click to enlarge You know how it is… if something feels too good to be true… |

| We can’t think of one off hand. And if we could, we wouldn’t let it detract from the present merriment. Like bellowing out the verses of Joy to the World at a Christmas Eve candlelight service, it sure feels magnificent – don’t it?

The cocktail of record stock prices, robust GDP growth, and reforms to the tax code has the sweet warmth of a glass of spiked eggnog. Not long ago, if you recall, a Dow Jones Industrial Average above 25,000 was impossible. Yet somehow, in the blink of an eye, it has moved to just a peppermint stick shy of this momentous milestone – and we’re all rich because of it. So, too, the United States economy is now growing with the spry energy of Santa’s elves. According to Commerce Department, U.S. GDP increased in the third quarter at a rate of 3.2 percent. What’s more, according to the New York Fed’s Nowcast report, and their Data Flow through December 15, U.S. GDP is expanding in the fourth quarter at an annualized rate of 3.98 percent. Indeed, annualized GDP growth above 3 percent is both remarkable and extraordinary. Remember, the last time U.S. GDP grew by 3 percent or more for an entire calendar year was 2005. Several years before the iPhone was invented. |

DJIA Daily, Feb 2016 - Dec 2017 The stock market bubble takes the traditional route and evolves into a major blow-off. - Click to enlarge This is a strong hint that it is not going to end on a whimper… |

A Cornerstone Promise of the GOP Tax Reform BillBut despite closing out the year strong, 2017 won’t be the year when annual U.S. GDP growth finally eclipses 3 percent. By our rough calculations, annual GDP growth for 2017, using the Q4 estimate, comes out to 2.92 percent. What to make of it… Certainly, strong GDP growth is a cornerstone promise of the GOP tax reform bill. Specifically, the promise is that resultant economic growth will pay for the tax cuts. Yet based on the work of one group of number crunchers, the expectation that the U.S. economy will produce 3 percent economic growth in 2018 is wishful thinking. The Tax Foundation, an outfit out of Washington, offered the following assessment:

To be clear, we don’t know what assumptions went into the Tax Foundation’s Taxes and Growth Model. Does it factor in the latent effects of quantitative tightening? Does it assume a total of 3 Fed rate hikes in 2018? What about the flattening yield curve? In short, will tightening credit markets offset any boost that tax cuts are expected to deliver to the economy? In other words, will monetary policy cancel out fiscal policy? Most likely it will. Here’s why… |

It is difficult to quantify the assumptions of the Laffer curve, not least because the responses of different economic actors to lower or higher tax rates vary. - Click to enlarge It would be a very big mistake to dismiss the idea as such though, which is what the Congressional Joint Committee on Taxation likes to do (i.e., it seems to assume that changes in taxation have no effect on the performance of the economy). As Richard Baris explains in this article, this makes no sense whatsoever – in fact, numerous examples show that raising taxes into the blue yonder in order to obtain more loot or to influence the behavior of people is certain to fail in myriad ways. It follows that lowering taxes has the opposite effect, even if we cannot calculate the extent with any precision (the forecasts made by assorted crystal ball gazers are little more but guessing games). As Baris mentions, it is no coincidence that the countries with the lowest taxes and the least regulation also have the by far biggest economic output per capita. |

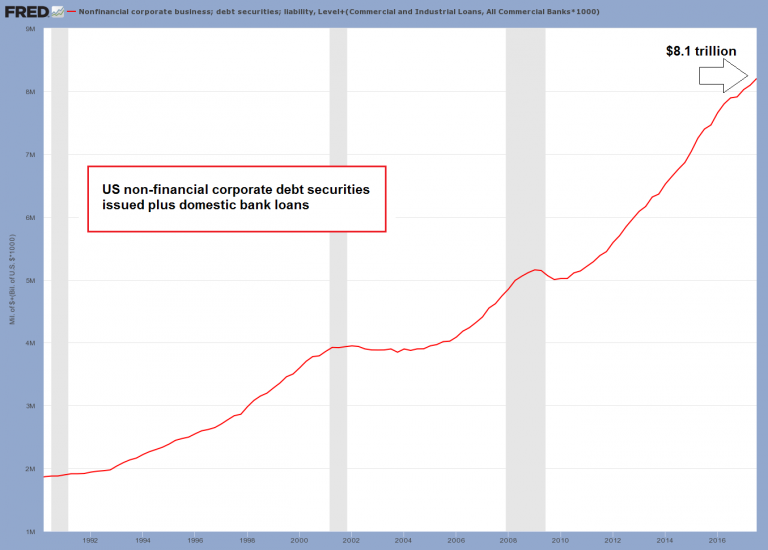

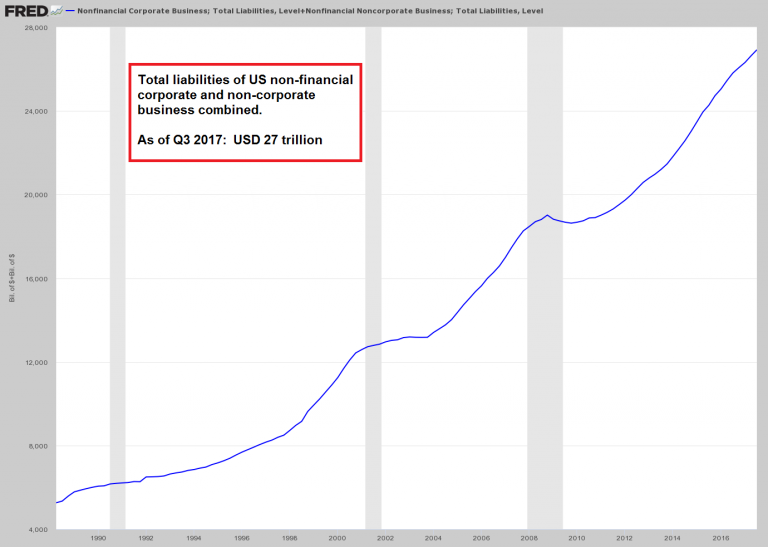

Why Monetary Policy Will Cancel Out Fiscal PolicyPlain and simple, the entire financial system and economy has become fully dependent on cheap and ever expanding credit. Consumers, the federal government, and corporations have gone hog wild gorging on a decade of artificially suppressed, cheap credit. Presently, American’s owe $3.8 trillion in outstanding consumer credit – some of which, no doubt, was used to purchase light up reindeer antlers. Of this, more than $1.2 trillion of consumer spending has been borrowed into the economy over the last decade. This is consumer spending that has been brought from the future into the present. Similarly, over the last decade the federal government has borrowed and spent over $11 trillion, bringing the federal debt from $9 trillion to over $20 trillion. That’s more than a doubling of the debt in just 10 years. But that’s not all. Corporations have been on a massive borrowing and spending binge too. Total outstanding non-financial corporate debt has jumped from about $4.4 trillion in 2007 to around $8.1 trillion today [ed note: this is only the sum of non-financial corporate debt securities issued plus domestic bank debt classified as C&I loans; total non-financial corporate liabilities stand at $19.5 trillion, up from $12 trillion in 2007; non-incorporated non-financial business debt amounts to an additional $7.4 trillion]. Again, that’s roughly a doubling of debt over the last decade. |

US Non-Financial Corporate Debt, 1992 - 2017 |

| What makes the growth of consumer, government, and corporate borrowing over this period so dangerous – in addition to its pure enormity – is that it was encouraged by the Fed’s artificially low interest rates. The scale and magnitude of this cheap credit expansion is nothing short of a manic credit bubble. |

Total US Non-Financial Corporate and Non-Corporate Business, 1990 - 2017 Total US non-financial business liabilities (corporate plus non-corporate) amount to USD 27 trillion as of Q3 2017. - Click to enlarge Every one percent increase in interest rates raises the cost of this debtberg by truly staggering amounts. It is a good bet that this latest jump in debt is going to end about as well as the last one. |

| The point is, as mentioned last week, we appear to be entering a period where the price of credit – specifically, interest rates – rise and credit therefore contracts. Naturally, this is occurring at the worst possible time; after everything and everyone has become wholly dependent on cheap, expanding credit.

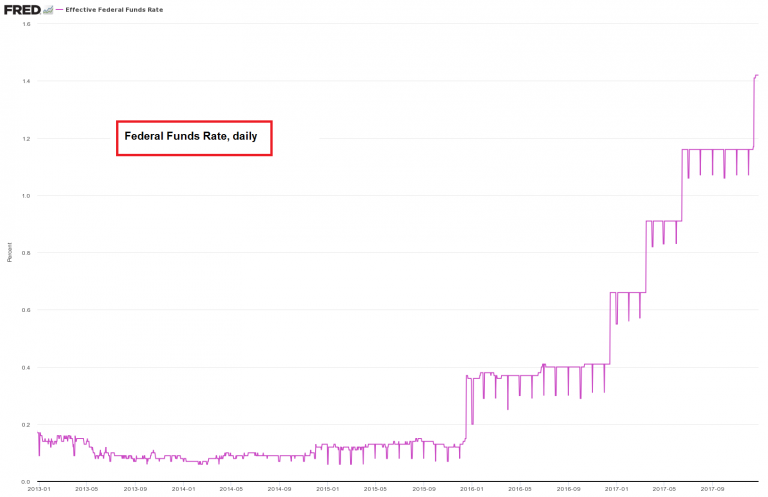

As the Fed raises interest rates, borrowing costs become more expensive. With respect to government debt, it will take a larger and larger share of the government’s budget to finance the debt. This will reduce the funds that the government can spend elsewhere. Similarly, with respect to consumers and corporations, increasing borrowing costs will subtract from spending and investment. |

Daily Federal Funds Rate, Jan 2013 - Sep 2017 As the monetary bureaucrats keep stressing in their statements, this is still a “highly accommodative” policy rate. - Click to enlarge What they neglect to mention is that both the government and businesses have to service and roll over twice as much debt as at the time when this rate was first slashed to zero. Moreover, the Fed’s loose monetary policy has distorted the capital structure of the economy and numerous business undertakings will simply turn out to be non-viable at a higher interest rate threshold combined with a sharp slowdown in money supply and credit growth. Sooner or later the “someone threw a light switch” effect will appear on the scene and economic activity will sag rapidly. As we often point out, where precisely the critical threshold in terms of money supply growth and interest rates lies cannot be determined with precision in advance. Economic laws impose constraints on future developments, but beyond that one can at best offer educated guesses largely based on historical experience. One has to keep in mind though that history won’t simply repeat, although it can be expected to rhyme to some extent. |

And this is precisely why monetary policy will cancel out fiscal policy. And this is precisely why the cornerstone promise of the GOP tax reform bill will come up empty. And this is precisely why we are all doomed. And on that cheery note, we’ll conclude our ruminations.

Merry Christmas!

Full story here Are you the author? Previous post See more for Next postTags: central-banks,newslettersent,On Economy,The Stock Market