Bogus Jobs Pay Big BucksThe political differences of today’s two leading parties are not over ultimate questions of principle. Rather, they are over opposing answers to the question of how a goal can be achieved with the least sacrifice. For lawmakers, the goal is to promise the populace something for nothing, while pretending to make good on it. |

|

| Take the latest tax bill, for instance. The GOP wants to tax less and spend more. The Democrat party wants to tax more and spend even more. We don’t recall seeing any proposals to tax less, spend less, and shrink the size of the state. And why would we? | |

| Today’s central planners and social engineers are enlightened and progressive. They know much more about anything and everything than the rest of us. In particular, they share a general sense that they know how to spend your money better than you.

At best, the central planners call your money to Washington so they can then distribute it back to your friends and neighbors. In reality, the lawmakers call your money to Washington where they distribute it to their friends and neighbors – not yours. This is not a matter of opinion. It’s a matter of fact. Is it a coincidence that the top three wealthiest counties in the country are in the shadow of the Capitol in the D.C. suburbs? What exactly the residents of these counties do that is of tangible value is unclear. However, what is clear is that bogus government jobs in Loudoun County and Fairfax County, Virginia, pay big bucks. But that’s not all… |

If you’re not familiar with those, watch the Harry Potter documentaries to get up to speed. And as everybody knows, since nothing bad has happened yet, nothing bad can or will ever happen… until it does. |

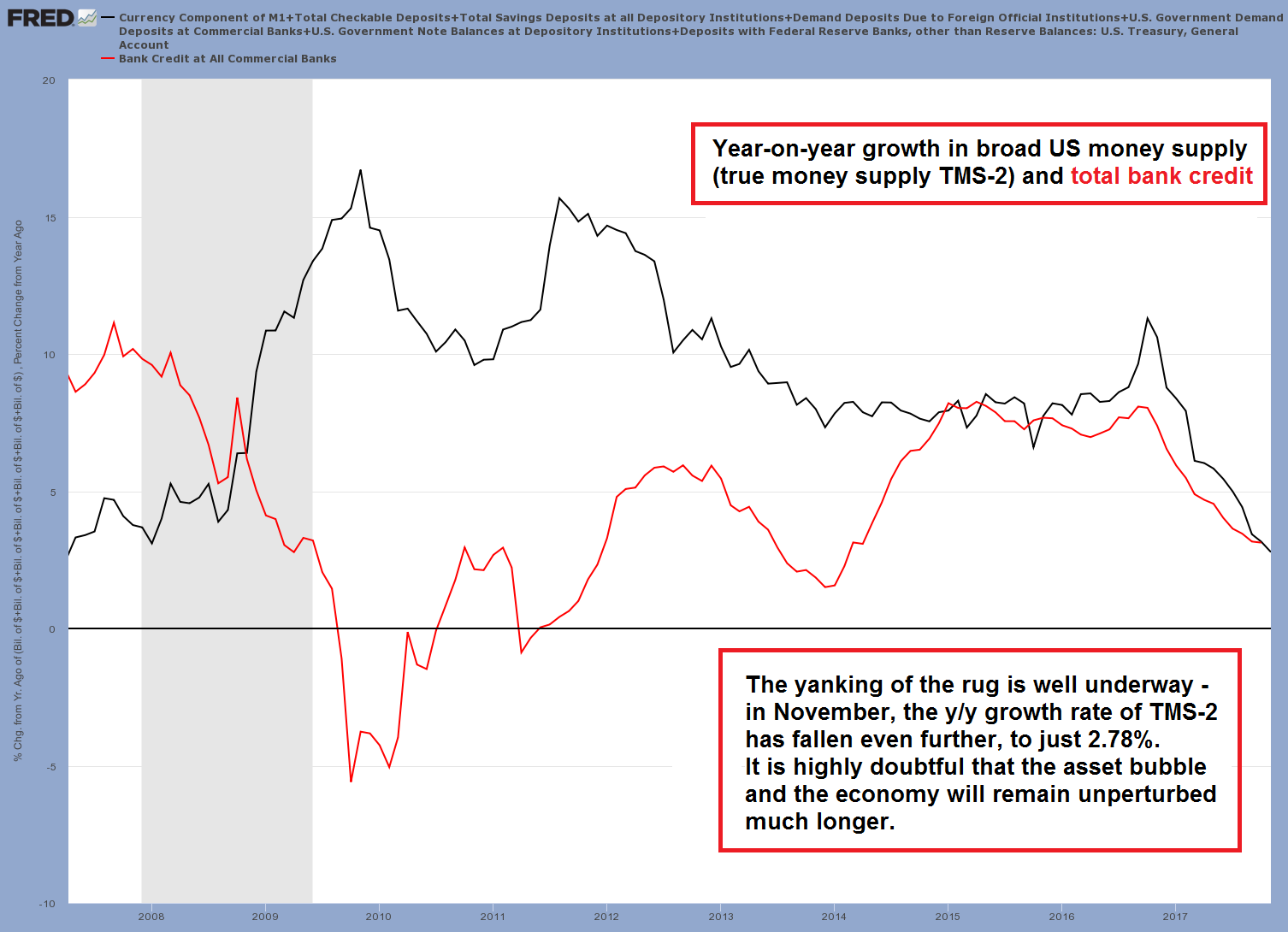

Garbage In Garbage OutFurther up the eastern seaboard, Wall Street has a good thing going too. The big bankers and brokers make big bucks extracting capital from Main Street America. That’s a fair characterization, right? Perhaps the big bankers and brokers really are efficiently allocating capital to its highest and best use. Who knows? But as far as we can tell, they are gambling with other people’s money – and collecting fees regardless of how their coin tosses fall. It’s always, ‘heads I win, tails you lose.’ Not a bad fugazi gig, if you can get it. Of course, the cornerstone of it all is the Federal Reserve. Through what they call “open market operations,” the Fed rigs the game in Washington’s and Wall Street’s favor. Indeed, the process is really quite elegant. Under the smokescreen cover of garbage in economic data, the Fed’s economists produce garbage out bar charts and line graphs. These, in short, are fabricated depictions of the economy’s growth, consumer and producer prices, personal consumption expenditures, unemployment rate, and whatever other aggregate metrics are deemed to be of vital importance. What’s more, these fabricated depictions serve as the basis for the Fed’s monetary policy decisions. Do the graphs show price inflation heating up or cooling down? What about GDP or the unemployment rate? Is one going up while the other is going down? Is one going down while the other is going up? The Federal Open Market Committee (FOMC) deliberates over these questions about every six weeks. Then the Fed goes to work inflating the nation’s money supply, with the occasional rug yank, for the stated purpose of getting the charts and graphs to illustrate the garbage data to their liking. What to make of it? |

US Money Supply and Total Bank Credit, 2008 - 2017 The yanking of the rug illustrated: US broad true money supply growth continues to decline month after month since its last peak at +11.3% in November 2016. - Click to enlarge The current growth rate of 2.78% is quite a threat to the asset bubble – particularly in view of the ECB cutting its QE operations in half from January onward, which will remove a major prop from credit spreads. |

The Rug Yank Phase of Fed PolicyFrom the outside, the Fed’s economists and planners appear to be esteemed professionals, making decisions with the intent of providing for the greater good of the country. They even attend economic conferences and forums where they present their latest research findings on abstract topics like liquidity traps. Some of their studies even include footnotes, as if the professional economists were building upon a concrete knowledge base of human intellect. Yet beneath this cover of bogus science, the real sausage is made. Capital is borrowed into existence where it is directed to Washington and Wall Street. There, having first dibs on this phony money, Washington and Wall Street get to spend it as if it had real value. However, the real value is not coming from the Fed’s phony money. In fact, as this new phony money appears on the scene, it extracts incremental wealth from the workers and producers across the country who – through their time, talent, and labor – created the wealth to begin with. At the moment, we’re in the rug yank phase of the Fed’s monetary policy. This is where they reel back credit ever so slightly after letting it run wild over the last decade. This tightening of credit markets has the effect of pulling the rug out from under financial markets and the economy. |

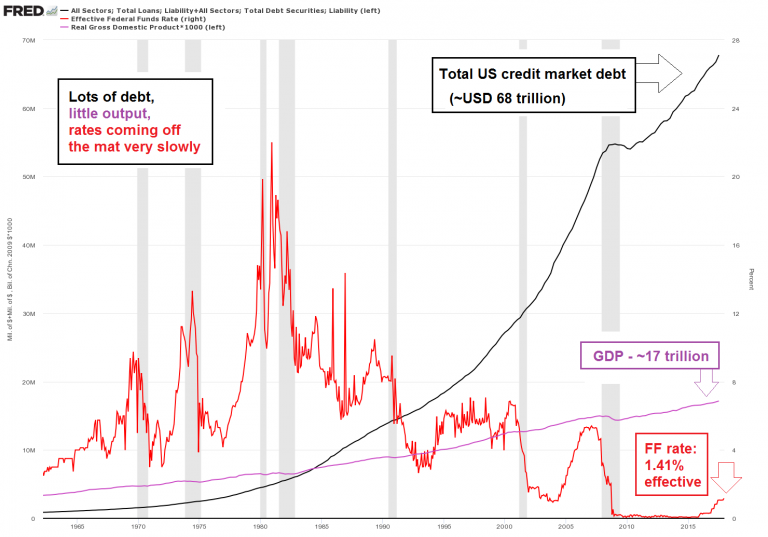

Total US Credit Market Debt, 1966 - 2017 A big debtberg, not much to show for it in terms of economic output, and a few tiny rate hikes since the abandonment of ZIRP. - Click to enlarge How many of those can the economy take? Experience suggests that the economy’s resilience to higher rates has steadily dwindled over time |

| Monetary policy, without question, is not an exact science. It is rudimentary guess work based on committee interpretations of bogus data. This week, the FOMC raised the federal funds rate by 0.25 percent to between 1.25 and 1.5 percent. This marks the third increase this year and the fifth increase of the current cycle.

Incidentally, Janet Yellen also delivered her last press conference as Chair of the Federal Reserve, though she’ll likely still chair the FOMC meeting scheduled for late January. Then Jay “Count Dracula” Powell will take over the helm of the nation’s central bank. The broad expectation is for Powell to continue the rate increase playbook that Yellen has laid out, which includes three quarter percent hikes in 2018. We wish Powell the best in his endeavors. But we suspect he’ll unwittingly pull the rug out from under financial markets and the economy before he completes his first year. After that, the fun really begins. |

Full story here Are you the author? Previous post See more for Next post

Tags: central banks,newslettersent,On Economy,On Politics