| Buy Gold, Silver Time After Speculators Reduce Longs and Banks Reduce Shorts

– Gold and silver COT suggests bottoming and price rally coming |

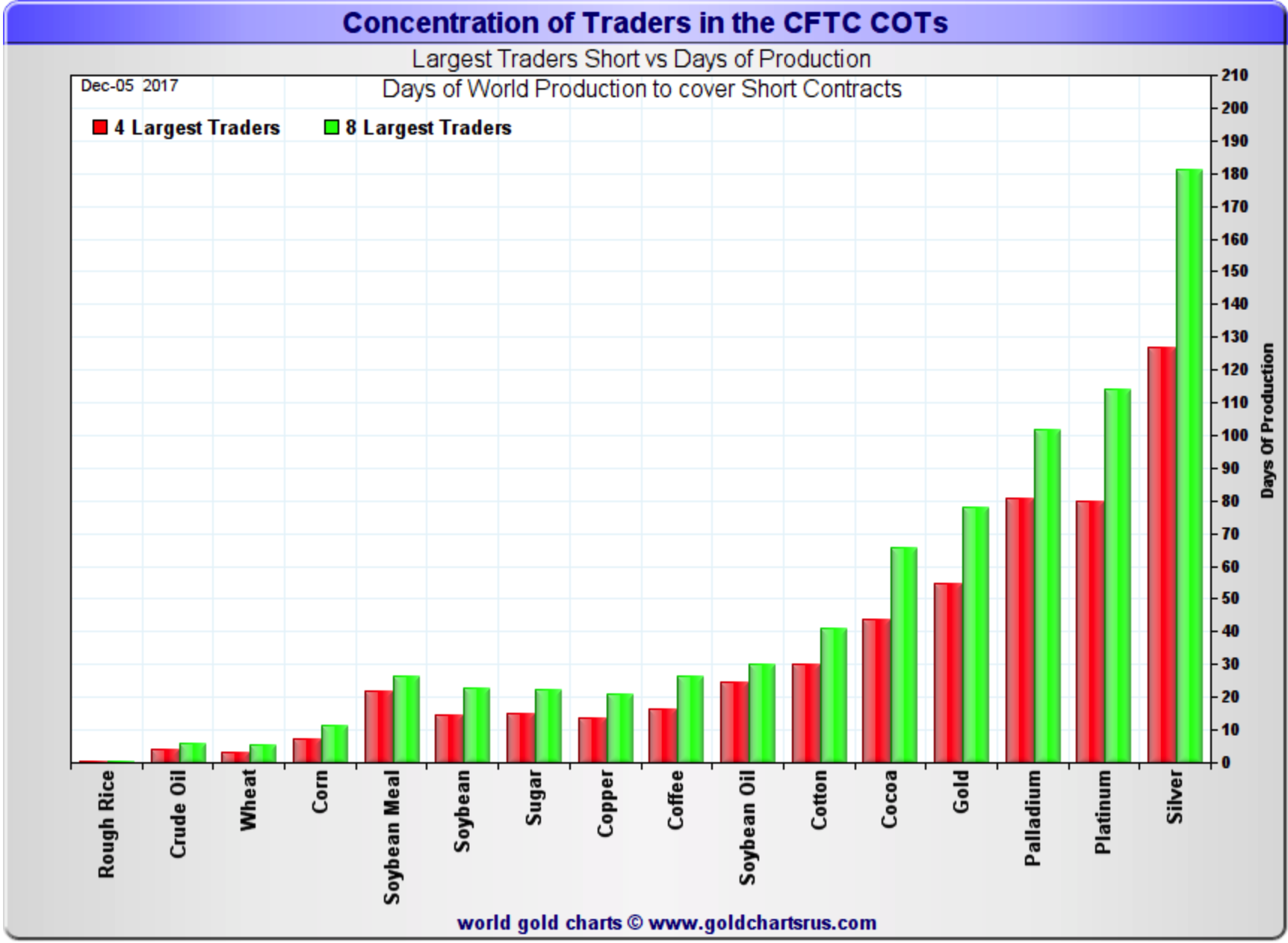

Concentration of Traders in the CFTC COTs |

| Have you found the gold price in the last few months to be particularly boring? Well, fear not as it looks like it might all be about to take a turn upwards. Last Friday’s Commitment of Traders (COT) report signaled we are close to bottoming and suggest that both gold and silver should have a positive January and Q1, 2018.

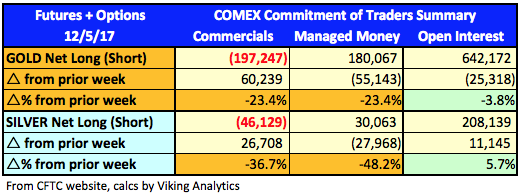

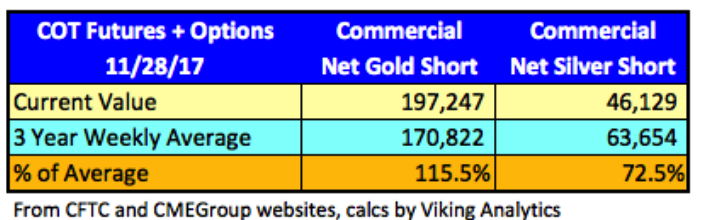

As John Rubino wrote in his latest note, ‘gold futures traders have finally started behaving “normally.”’ This simply means that speculators are finally beginning to cut back on long bets whilst commercials and large bullion, the “smart money” and the “inside money” have reduced their shorts dramatically. |

|

| This was seen in gold and also in silver, the industrial, technological precious metal. Historically when commercial and speculator positions are brought into balance then this has proven to be bullish for the precious metals.

Previously peaks in net commercial short interest have often happened alongside sell-offs, subsequently valleys in commercial short interest have almost always coincided with nearby rises in price. This could be a positive indicator for the next few months in both gold and silver prices. |

|

| Silver: short 181 days of world silver production

According to Ed Steer:

As you can see from the chart at the top, the Big 8 commercial trader are now net short 439.8 million troy ounces of paper silver. This is equal to 181 days of world silver production or about 439.8 million troy ounces of paper silver held short by the Big 8.

Interestingly these dramatic changes in both short and long positions did not bring with them any dramatic changes in price. This is clearly something to look out for in the coming weeks. For many analysts, this latest COT report suggest we are looking at a bottom in silver as such changes in futures positions ordinarily coincide with a low in gold and silver prices and a good time to buy. Gold: short 78 days of world gold production As reported by Ed Steer:

The big chart at the top show the Big 8 are short nearly 80 days of production.

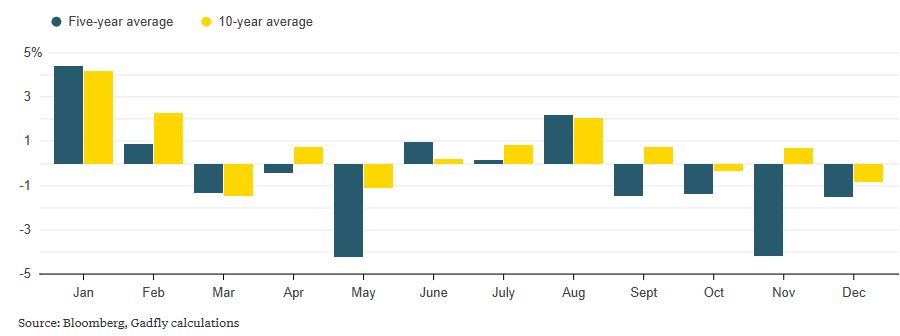

New Year’s resolution: buy gold and silver Some caution should be exercised when looking at COT reports. When released the data is three days old, published on a Friday with Tuesday’s trading data. However this does not mean that some signal can be taken from them. Seasonally, January is generally a good month to own precious metals, particularly gold. On average the gold price rises over 3% in the month and generally continues to rise into February. |

Gold Price, Jan - Dec 2017(see more posts on Gold prices, ) |

| This latest COT report is unlikely to be a one-off and should be embraced by those looking to allocate funds to own gold and silver.

As John Rubino concluded in his own coverage:

Investors and savers should keep their heads over the next few months and take solace from the fact that whilst the ‘Big’ players are gambling with paper they can in fact benefit by buying physical, allocated and segregated gold and silver. We leave you with some wise words from John Hathaway who wrote on how the phenomenon of the paper precious metals market would come to benefit those holding the real thing: “An acute shortage of readily marketable physical gold is developing that we believe will deepen in years to come. This possibility seems to be unrecognized by those who are short the gold market through paper contracts. The relentless dumping of synthetic or paper gold contracts since 2011 by speculators in Western financial markets has caused the shortage. The steady selling has driven down the price of physical gold, hobbled the gold-mining industry, and drained the stores of gold held in the vaults of Western financial centers …” Veteran gold market analyst and CFA, Hathaway concludes that: “Much of what passes for financial wealth is in our opinion imprisoned in a matrix from which there is no easy exit. The return migration of capital to real assets promises to be disruptive. The misdirection of capital could well cause losses for many but opportunity for a few. The list of opportunities is short, limited in capacity, possibly complex, and difficult to access. Among the possible opportunities, gold is accessible and straightforward. Gold has a history of responding inversely to the direction of confidence. |

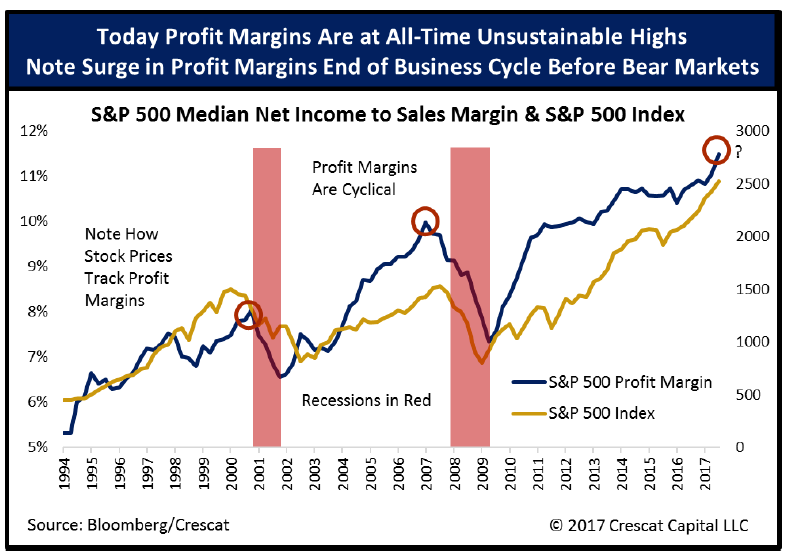

S&P 500 Median Net Income, 1994 - 2017 |

Full story here Are you the author? Previous post See more for Next post

Tags: Bitcoin,Bond,Business,Commitment of Traders,Commitments of Traders,Currency,European Union,Finance,Futures contract,Gold,Gold as an investment,Gold prices,London bullion market,money,newslettersent,North Korea,Precious Metals,Reuters,Russian central bank,Silver as an investment,Sovereigns,Switzerland,US Federal Reserve,Volatility