|

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon.

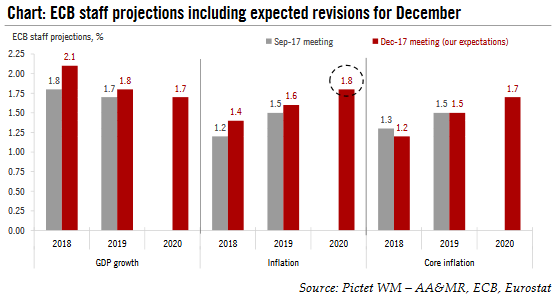

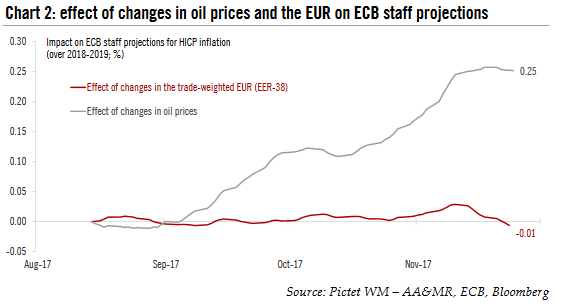

We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone. Euro area real GDP growth forecasts will likely be revised higher for the fifth consecutive quarter, on the back of very strong economic data, to around 2.1% in 2018 (up from 1.8%) and 1.8% in 2019 (up from 1.7%), with upside risks. Headline inflation should be revised higher, too, based on the financial inputs used by the staff (see “ECB cut -off date ”; 24 November 2017). We expect the roughly 20% rise in oil prices to push ECB staff forecasts for HICP inflation higher by about 20bp in 2018 (from 1.2% to 1.4%), and by 10bp in 2019 (from 1.5% to 1.6%).

More important to the monetary policy outlook will be the new staff projections for core inflation following a couple of disappointingly low prints, at 0.9% y-o-y in October and November. We expect a slightly lower starting point for core inflation (1.0% on average in 2017) to be partly offset by a faster closing of the output gap, and possibly some modest second -round effects from oil prices. Still, new staff projections are likely to reflect a steeper trajectory for core inflation , rising only slowly to 1.2% in 2018 (down from 1.3% three months ago), and to 1.5% in 2019 (unchanged).

But there is another figure that the Governing Council will also use for communication purposes – the 2020 projections which will be published for the first time this week. We expect the 2020 headline inflation to show further convergence toward the ECB’s target to close to 1.8%.

|

ECB Staff Projections, Sep 2017 |

|

Alternatively, the median projection for 2020 headline HICP could be set at 1.7%, with inflation rising closer to target by Q4 2020. Over the long-term, inflation forecasts are anyone’s guess anyway.

Meanwhile 2020 GDP growth could ease to around 1.7%, still comfortably above potential which most international institutions estimate to be below 1.5%. In all, 2020 staff projections should be consistent with the ECB’s mandate of maintaining price stability over the medium-term.

The trade-weighted exchange rate of the EUR has remained remarkably stable in the past three months, ending up only a touch higher than the level assumed by the ECB staff in September. As a result, the impact of currency changes is likely to be minimal leaving higher oil prices as the main exogenous driver of any revisions to the inflation outlook.

|

Effect of Changes in Oil Prices, Aug 2017 - Dec 2017 |

Adjusting forward guidance is a debate for 2018

Having managed to sell QE recalibration as a non-event at its 26 October meeting, while making it clear that policy rates will not move before the end of net asset purchases, the next step for the ECB will be to make incrementally hawkish changes to its broader communication.

For now, the ECB will likely downplay the urgency of communication changes at the December meeting, in effect postponing a premature debate to 2018. To be sure, the discussion has started several months ago within the Governing Council (GC), not only among the hawks. A larger group ranging from hawkish-leaners to centrist GC members have expressed some discomfort with the ECB’s guidance, including Executive Board member Benoît Coeuré in a number of speeches and interviews. Coeuré’s main argument is that forward guidance should be credible, adjusting to reality, if anything because markets should be prepared for higher rates by 2019. In other words, forward guidance should be used to a void complacency.

The disagreement with more dovish GC members, including Mario Draghi and Vitor Constancio, should not be overstated. After all, Draghi’s key message in Sintra back in June was that the ECB should “adjust the parameters of its policy instruments” as the recovery proceeds, in order to maintain a “broadly unchanged” monetary stance. As a result, we expect the debate to focus on the calibration of each policy tool in 2018, and the interactions between them. Only a few hawks will argue for outright tightening, in our view, as long as inflation remains far from target.

This view was backed by “ several” GC members in the accounts of the October meeting who argued that “the present forward guidance linking the APP purchases to the criteria for a sustained adjustment in the path of inflation should be replaced over time with a reference to the monetary policy stance, in all its dimensions”. This is the main reason why the ECB has been insisting on QE stock versus flow effects recently, with the former expected to contribute to a highly accommodative policy stance overall.

Moreover, some elements of the ECB’s forward guidance are all-but-symbolic anyway, including the pledged to increase asset purchases in terms of size and/or duration, given the legal and political constraints facing the programme, including the 33% issuer share limit. Other elements are much less relevant than before, including the one many GC members would like to abandon, namely the link between the horizon of QE and inflation.

We expect the ECB to ‘de- link’ QE and the inflation outlook at some point in H1 2018, shifting to a more explicit state-dependent link between policy rates and the long-awaite d “self-adjustment” in inflation (Draghi’s four inflation criteria). That said, we have little doubt that if wage growth and/or core inflation disappoint again, the monetary stance would have to be eased anew. If so, we have argued that the easiest way forward would be for the ECB to extend QE at an even slower pace of, say, EUR15bn per month beyond September 2018, effectively pushing the timing of the first rate hike further out into 2019 (or even 2020). Our estimates suggest that this would be technically possible before the ECB hits the scarcity constraints in 2019.

Our baseline scenario remains for the ECB to terminate QE by early 2019 and to deliver a first rate hike in Q3 2019, with risks tilted towards an earlier move. Even if cyclical inflation surprises to the upside next year, we are not convinced that the ECB will be in a position to end as set purchases in September 2018 without risking unwarranted market tightening. Ending QE in September would also contradict Draghi’s pledge not to taper the programme abruptly – this is a commitment he could reiterate this week before leaving on a well-deserved Christmas break.

Tags: ECB asset purchases,ECB staff forecasts,Macroview,newslettersent