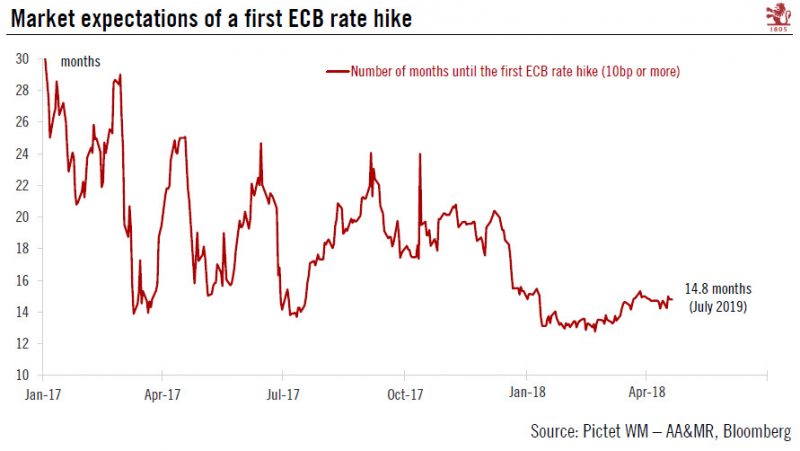

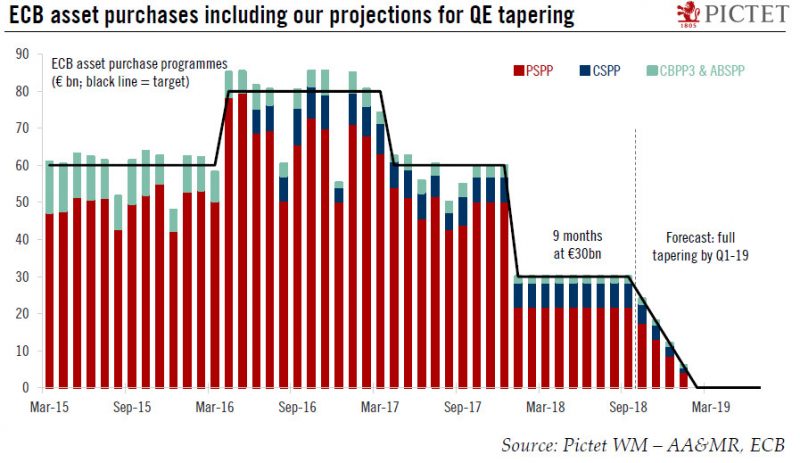

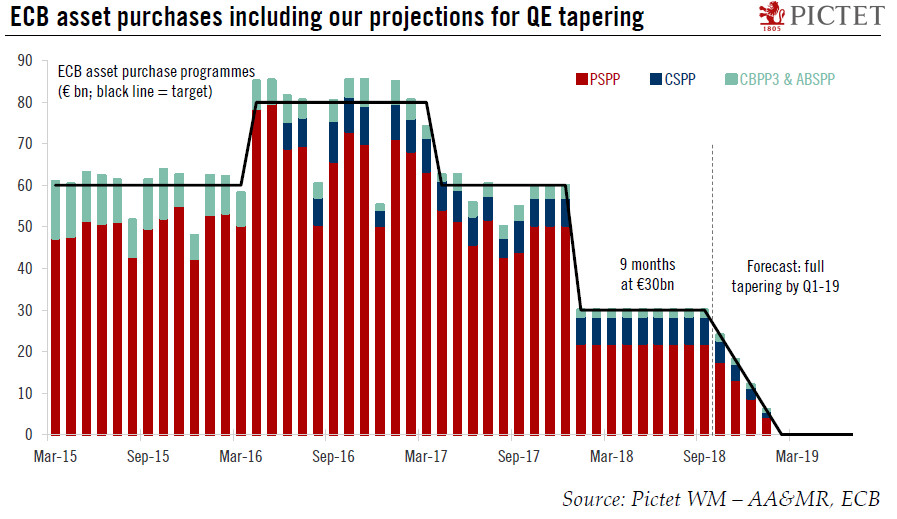

With the ECB’s asset purchases due to end this month and forward guidance set to remain unchanged, a focus at next week’s policy meeting will be staff forecasts for growth and inflation. At its Governing Council meeting next week, we expect the European Central Bank (ECB) to confirm that its asset purchases will cease at year’s end.

Read More »

Tag Archive: ECB asset purchases

ECB policy: Stop Worrying and Love the Soft Patch

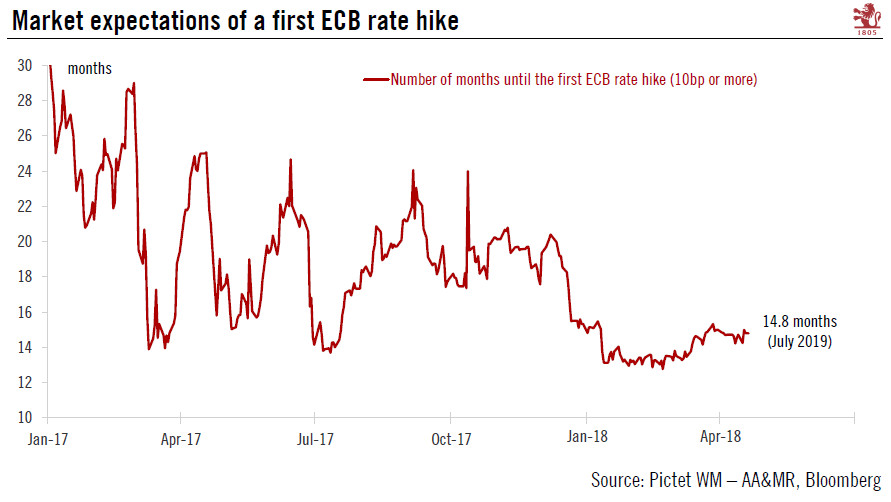

For all the talk about weaker economic momentum and low inflation in the euro area, we would not jump to conclusions in terms of ECB policy. True, downside risks have re-emerged over the past couple of months, generating understandable concerns and frustration in Frankfurt. However, the ECB is unlikely to respond unless those risks materialise, which is not our central case.

Read More »

Read More »

Women’s Pension Crisis Highlights Dangers To Savers

Women’s Pension Crisis Highlights Dangers To Savers.

– International Women’s Day highlights the underreported UK Women’s pension crisis.

– 2.66 million affected by UK government’s change to state pension act.

– Women’s pension crisis is one of many in the UK, where there is a £710bn deficit for prospective retirees.

– Changes by government highlights the counterparty risks pensions are exposed to.

– Global problem as pensions gap of developed...

Read More »

Read More »

2018 ECB outlook – Mission: possible

We expect the ECB to announce a tapering of its asset purchase programme in the summer, but not to overreact to strong economic data. Our first choice as the title for our 2018 ECB outlook was “The courage not to act”, but regular readers will know that we used this hommage to Ben Bernanke earlier this year.

Read More »

Read More »

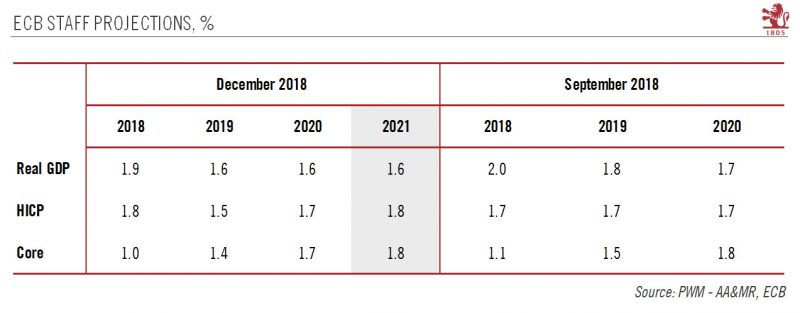

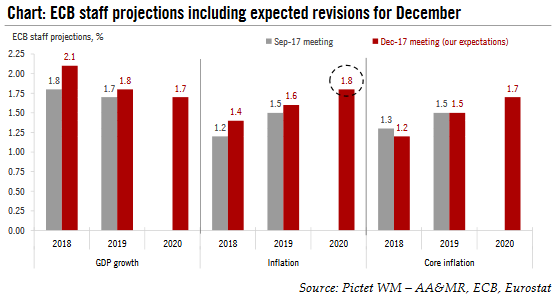

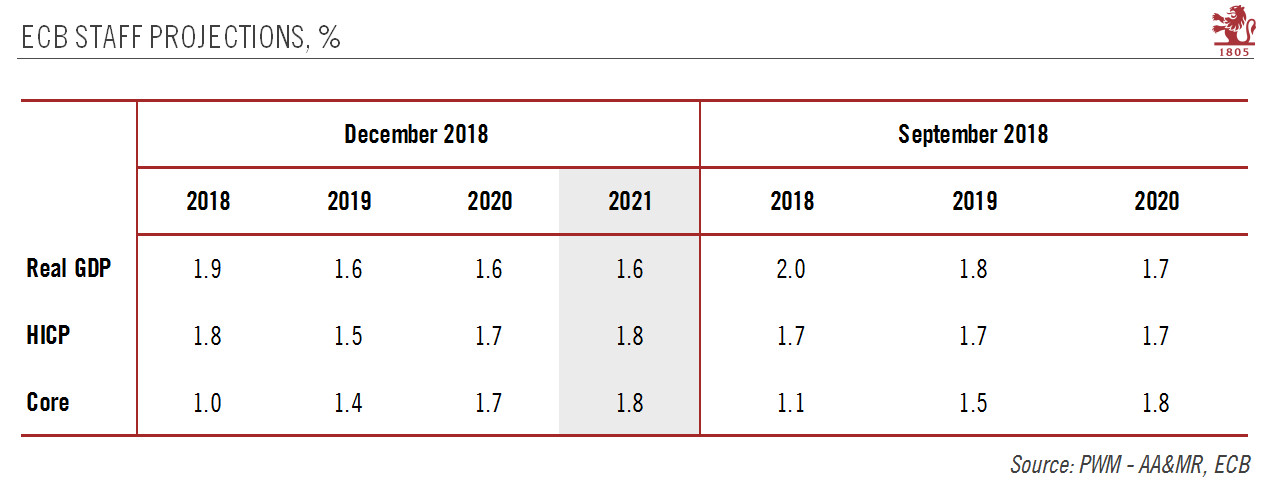

ECB preview: close to target…by 2020

The ECB’s meeting on 14 December would be a non-event if it were not for two specific points to make clear before the Christmas break – the staff forecasts for inflation, and the not-so-constructive ambiguity on QE horizon. We expect no major surprise from the new staff projections, reflecting the ECB’s cautiously upbeat tone.

Read More »

Read More »