Monthly Archive: November 2017

Hochriskante SNB-Verschuldung: von Herrn Jordan selbst bestätigt!

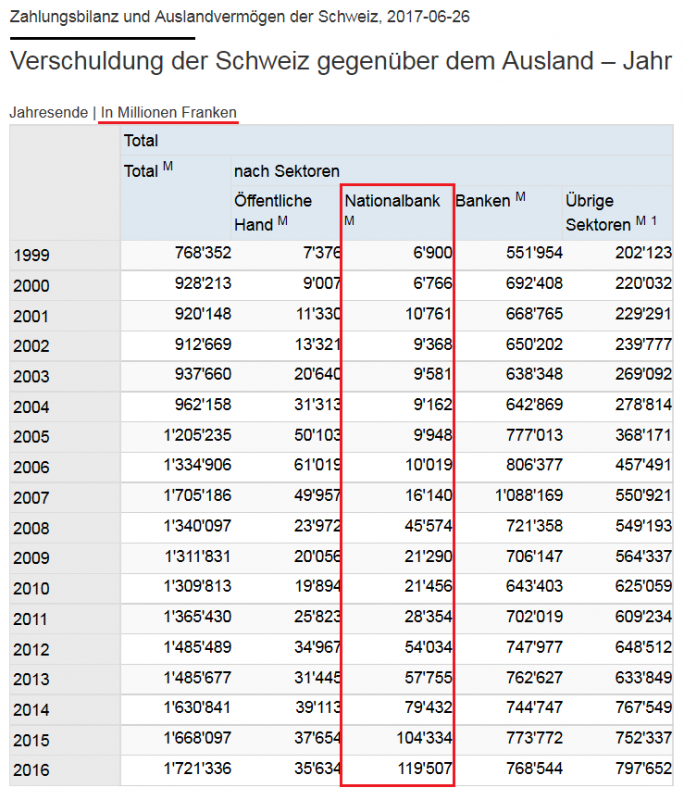

Wer ist sich in unserem Land bewusst, dass Ende 2016, die Gesamtverschuldung der Schweiz gegenüber dem Ausland den imposanten Betrag von 1‘721 Milliarden (!) Franken erreichte? Diese, auf dem Datenportal der SNB für alle zugängliche Info, darf mit einer weiteren bemerkenswerten Beobachtung vervollständigt werden.

Read More »

Read More »

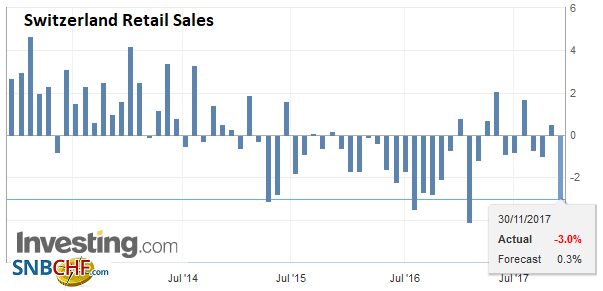

Swiss Retail Sales, October: -2.7 Percent Nominal and -1.6 Percent Real

Turnover in the retail sector fell by 2.7% in nominal terms in October 2017 compared with the previous year. Seasonally adjusted, nominal turnover fell by 1.6% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »

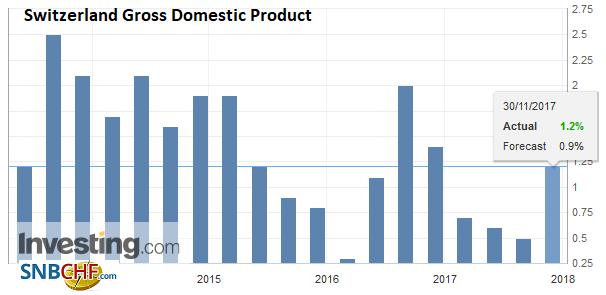

Switzerland GDP Q3 2017: +1.2 percent QoQ, +1.2 percent YoY

Switzerland’s real gross domestic product (GDP) grew by 0.6 % in the 3rd quarter of 2017,* boosted by manufacturing in particular. Many service sectors also contributed to growth, including trade, business services and healthcare. By contrast, value added fell slightly in construction and the financial sector.

Read More »

Read More »

FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time since mid-September. Since the end of last week, been capped at the 200-day moving average against the yen, found near JPY111.70, but yesterday it pushed past. There are nearly $1 bln of options struck between...

Read More »

Read More »

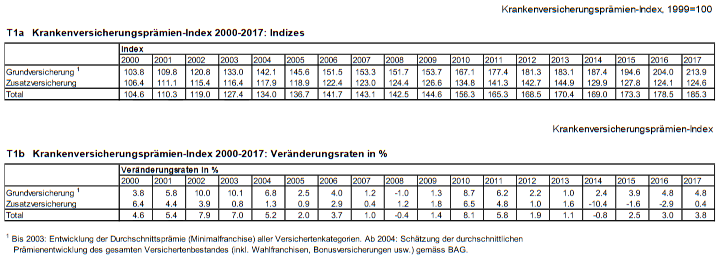

Health insurance premium index 2017: Premium increases from 2016 to 2017 curb growth in disposable income by 0.3 percentage points

The health insurance premiums index (CIPI) recorded a growth of 3.8 percent over the previous year for the 2017 premium year. The KVPI thus achieved an index level of 185.3 points (base 1999 = 100). The impact of premium development on the growth of disposable income can be estimated using the CIPI. According to the KVPI model calculation by the Federal Statistical Office (FSO), the increase in premiums reduces the growth in average disposable...

Read More »

Read More »

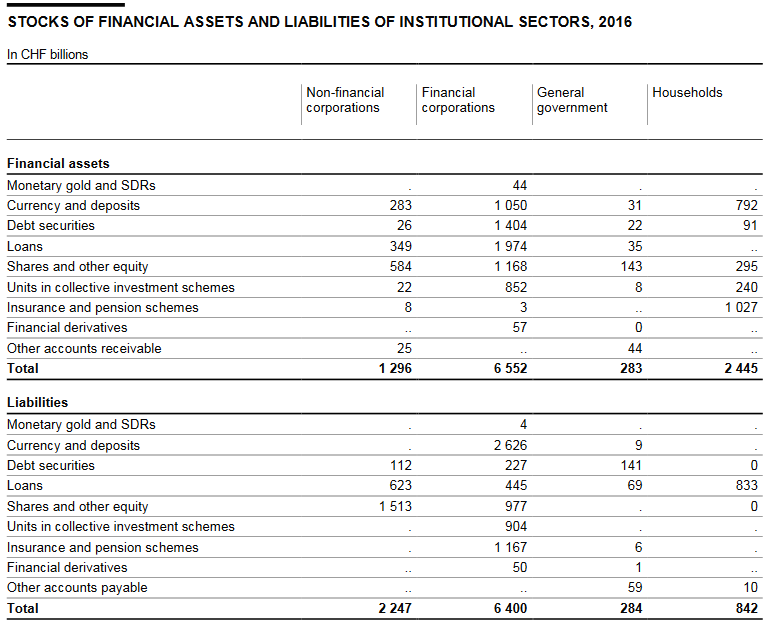

Swiss Financial Accounts, 2016 edition

Financial assets and liabilities of the institutional sectors The financial accounts form part of Switzerland’s system of national accounts. They show the financial assets and liabilities of the economy’s institutional sectors, which are non-financial and financial corporations, general government and households. The major developments in the financial accounts are outlined below.

Read More »

Read More »

Bitcoin – Die Tulpenknolle des Computerzeitalters

Von 10 auf 100 auf 1’000 auf 10’000 Dollar. Das ist die Kursentwicklung von Bitcoins in den wenigen Jahren seit ihrem Bestehen bis gestern früh. Der Vergleich mit der Tulpenmanie in der Hochblüte Hollands ist nicht mehr fern. Der Preis einer kostbaren Tulpenzwiebel stieg im 17. Jahrhundert in Holland auf das über 60-fache eines durchschnittlichen damaligen Jahressalärs.

Read More »

Read More »

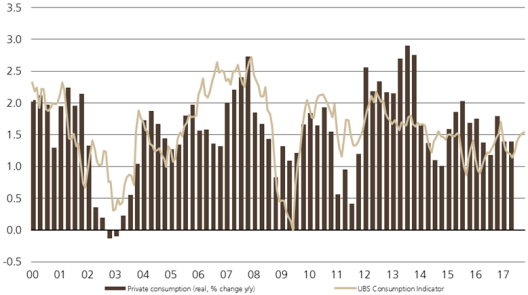

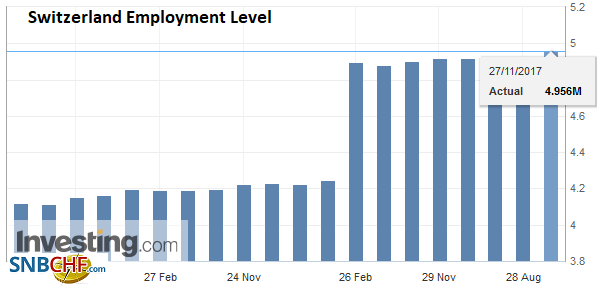

Switzerland UBS Consumption Indicator October: UBS consumption indicator trends sideways

The UBS consumption indicator was quoted at 1.54 points in October, suggesting that private consumption is growing at a solid pace in the fourth quarter. A weaker Swiss franc and a drop in unemployment provide support for it, but rising inflation and the accompanying stagnation of real wages are likely to cap any growth in it.

Read More »

Read More »

FX Daily, November 29: Sterling Charges Ahead on Brexit Hopes

Prospects of a deal with the EU has sent sterling to its best level in two months against the dollar. It reached $1.3430 in early European turnover. It had sunk to nearly $1.3220 yesterday as European markets were closing, which was a four-day low. It is the strongest of the major currencies today, gaining about 0.4%. With today's gains has met our retracement target near $1.3415. The momentum appears to give it potential toward $1.3500 in the...

Read More »

Read More »

WEF founder flags need for solidarity

In an interview with newspaper NZZamSonntag, Klaus Schwab, founder of the World Economic Forum, says that WEF is more relevant than ever. “We’re the witnesses to a transformation from a unipolar to a multipolar world. In this situation, the attempt to build bridges and work together is more important than ever,” the 80-year-old German engineer and economist told the newspaper.

Read More »

Read More »

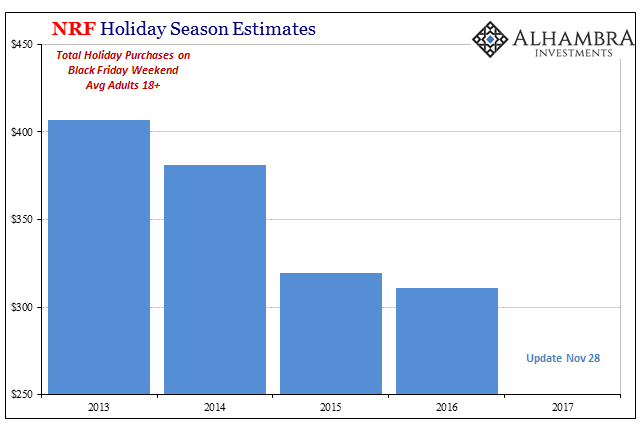

Fading Black Friday

Black Friday was once the king of all shopping. A retailer could make its year up on that one day, often by gimmicking its way to insane single-day volume. Those days, however, are certainly over. Though the day after Thanksgiving still means a great deal, as the annual flood of viral consumer brawl videos demonstrate, it’s just not what it once was.

Read More »

Read More »

Un algorithme du Credit Suisse avait pour but de gagner de l’argent au détriment de ses clients

Le grand déballage des « arrières cuisines » des marchés des changes et de leurs dérives se poursuit sur tous les continents . Les petits arrangements entre traders sur un des marchés les moins régulés, ne sont plus tolérés. Dernier exemple en date aux Etats-Unis, la banque Credit Suisse a reçu une amende de 135 millions de dollars pour la violation de certaines règles (partage d’informations des clients, manipulations de...

Read More »

Read More »

FX Daily, November 28: Greenback Ticks Up in Cautious Activity

The US dollar is consolidating its recent losses with a small upside bias. What promises to be an eventful week has begun with the Bank of England stress test and the publication of the Fed's Powell prepared remarks for his confirmation hearing to succeed Yellen as Chair. Unlike last year, this year's BOE stress test saw all seven banks pass.

Read More »

Read More »

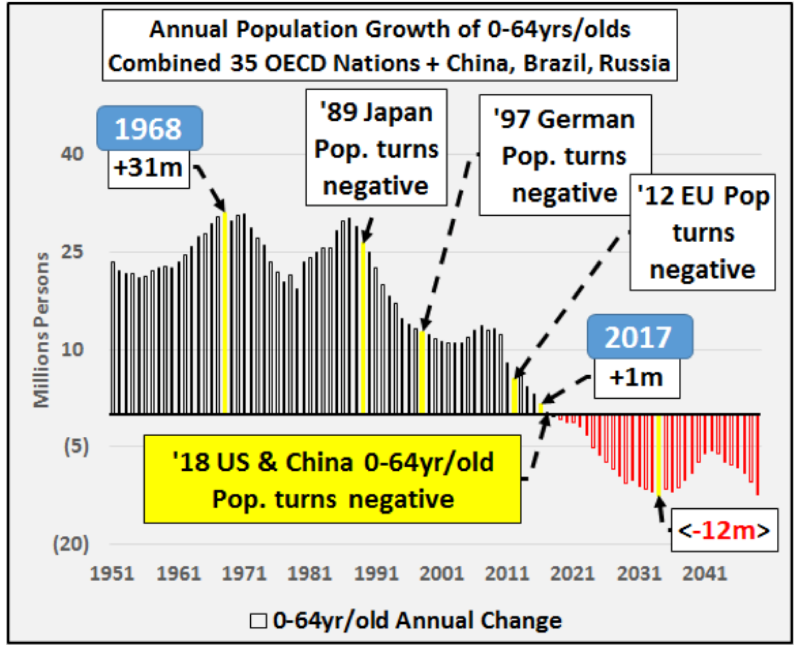

Demographic Dysphoria: Swiss Village Offers Families Over $70,000 To Live There

Across the world, demographic dysphoria is taking shape, creating numerous headaches for governments. To avoid the next economic downturn, governments are searching for creative measures to increase population growth and deliver a sustainable economy. In Europe, a near decade of excessive monetary policy coupled with a massive influx of refugees have not been able to reverse negative population growth– first spotted in 2012.

Read More »

Read More »

Bitcoin Facts

When we last wrote more extensively about Bitcoin (see Parabolic Coin – evidently, it has become a lot more “parabolic” since then), we said we would soon return to the subject of Bitcoin and monetary theory in these pages. This long planned article was delayed for a number of reasons, one of which was that we realized that Keith Weiner’s series on the topic would give us a good opportunity to address some of the objections to Bitcoin’s fitness as...

Read More »

Read More »

FX Daily, November 27: Slow Start to Busy Week

The US dollar is narrowly mixed and is largely consolidating last week's losses as the market waits for this week's numerous events that may impact the investment climate. These include the likelihood of the US Senate vote on tax reform, preliminary eurozone November CPI, a vote of confidence (or lack thereof) in the deputy PM in Ireland, Powell's confirmation hearing as Yellen's successor, the BOE financial stability report, and stress test, and...

Read More »

Read More »