| – British people suddenly stopped buying cars – Massive debt including car loans, very low household savings – Brexit and decline in sterling and consumer confidence impacts – New cars being bought on PCP by people who could not normally afford them – UK car business has ‘exactly the same problems’ as the mortgage market 10 years ago, according to Morgan Stanley – Bank of England is investigating to make sure UK banks are not overly exposed… – Prudent British people buying gold with cash, not cars with debt by Jim Edwards, Business Insider UK |

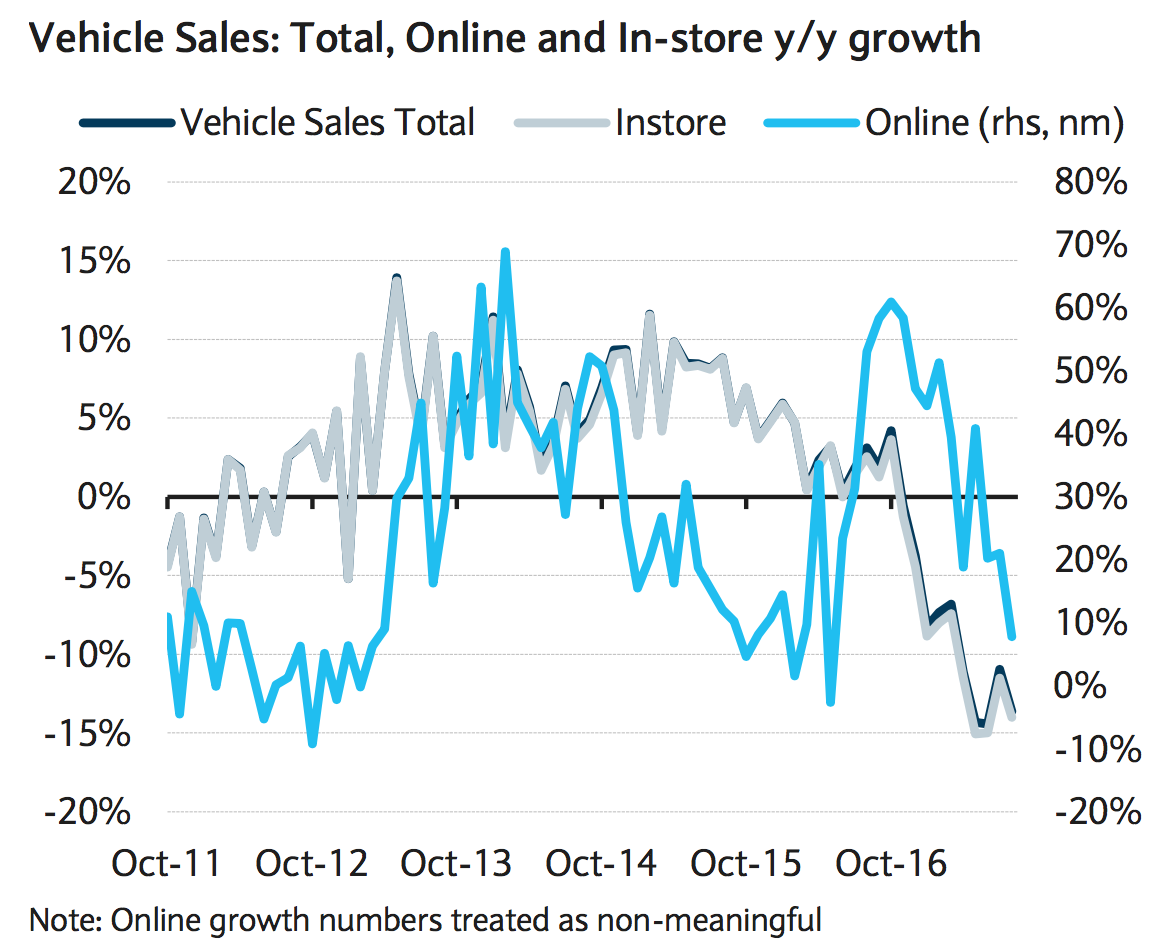

Total Vehicle Sales, Oct 2011 - 2016 |

| Vehicle Sales In UK – Barclays via Business Insider

British people have suddenly stopped buying cars. It’s not clear why. But a number of anti-car trends have hit Britain simultaneously — such as the rise of Uber and a decline in household savings — driving down car sales. The chart above of total car sales both old and new, from Barclays, says it all. On this chart, the grey-black line is the crucial one. The blue line (online sales) represents only a small number of purchases. Barclays Here’s what new car registrations look like: |

Composite index of consumer confidence and Private New car registrations, 2004 - 2018 |

Pantheon Macroeconomics via Business Insider

The prices of used/second-hand diesel cars has been particularly hard hit. On average, diesel prices are down 5.74% according to the sales site Motorway.co.uk.

Some diesel models are so unpopular that they’re trading at a 26.31% price decline.

The Motorway.co.uk data cover a recent sample of 24,000 used cars valuations of the 10 most popular cars in the UK. This year has already been a total shocker for diesel owners.

And now that most major manufacturers have launched diesel scrappage schemes, it doesn’t look like it’s about to get any better. Diesel cars are really starting to look like white elephants,” Alex Buttle, director of Motorway.co.uk, said in a press release.

A number of factors are colliding simultaneously to hurt UK car sales:

– The rise of apps like Uber, Gett, and Lyft are making car ownership in urban areas less necessary.

– British people have a close to zero household savings rate, and way too much debt, making further car purchases difficult.

– Consumers are afraid a recession might be coming and have reduced their spending on expensive items.

– The PCP car loan trend may have peaked, flooding the market with nearly new used cars.

– A number of car manufacturers are offering “diesel scrappage schemes” in which they take your old diesel car if you trade in for a newer, cleaner vehicle.

– The government announced it would ban sales of all petrol and diesel cars by 2040.

UK car sales are especially vulnerable to fluctuations in demand because Britain’s excess right-hand drive cars cannot be shipped to other areas of Europe, which use left-hand drive models.

Four out of five new cars in Britain today are bought using a credit product that has “exactly the same problems … that happened with the mortgage market” 10 years ago, Morgan Stanley automotive analyst Harald Hendrikse tells Business Insider.

He believes the current state of car credit in the UK — £41 billion ($54 billion) in loans last year — is unsustainable.

“If you’re a lease company or, a finance company, you would potentially have to take very large losses to try and get rid of those cars from your balance sheet.”

The Bank of England is investigating to make sure UK banks are not overly exposed.

Full Articles on Business Insider UK here and here

Full story here Are you the author? Previous post See more for Next post

Tags: Daily Market Update,newslettersent