New Zealand holds elections at end the of next week as well. While the German contest does not appear close and the odds on the most likely scenario are a return of the Grand Coalition, in New Zealand, the center-right’s decade-long rule is being seriously challenged by a resurgent Labour Party.

The New Zealand dollar fell by around 5.7% in August. The pullback was twice as deep and lasted twice as long the as the correction in the Australian dollar. However, ahead of the election, the technical tone is constructive, and before the weekend, the Australian dollar posted a downside reversal pattern against the New Zealand dollar. The Aussie closed below its 20-day moving average against the Kiwi for the first time in two months. The Kiwi is technically positioned to outperform the Aussie by 3%-5% in the period ahead.

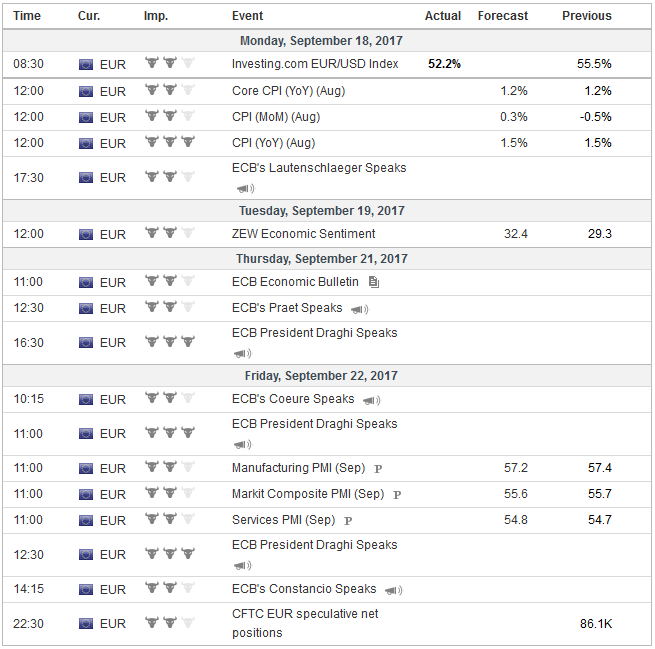

EurozoneThe days ahead are historic. By all reckoning, Merkel will be German Chancellor for a fourth consecutive term. Many observers expect the election to usher in a new era of German-French coordination to continue the European project post-Brexit and in the aftermath of the Great Financial Crisis. A reanimated European project is also informed by a sense that America may be a less reliable partner, and a strong Europe is needed to secure the gains of multilateral institutions and the rule of law. Although Kohl also served four terms as Chancellor, and oversaw the reunification of Germany, Merkel plays a critical role in shaping Europe. |

Economic Events: Eurozone, Week September 18 |

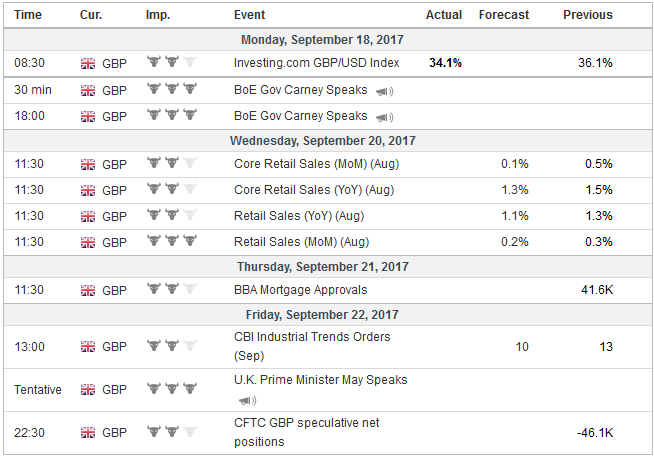

United KingdomAt the end of the week, UK Prime Minister May is expected to deliver one of her most important speeches about Brexit. Expectations are so high that the next round of UK-EU negotiations was postponed to give May this opportunity. She is expected to present a vision of the post-Brexit relationship between the UK and Europe. It will be grist for op-eds, but will do little to push negotiations forward, which are still stuck on the terms of the separation. UK officials seem to resist the notion of sequencing on which the EU negotiators insist. Neither sterling nor UK asset markets are being driven by Brexit. Sterling rallied nearly 3% last week to brings its gains here in September to 5.1%, the best in the world. The main driver was surprisingly hawkish MPC minutes. There have been several times over Carney’s tenure as Governor that the BOE has sent such a signal to the market. It has not delivered, but of course, this time, like every time could be different. Here in Q3, the Bank of Canada has taken back the two rate cuts it delivered in 2015. It provided accommodation to help the economy through a transition. It judged that the economy no longer needed that accommodation and removed it. The Bank of England cut rates as part of its precautionary measures after last year’s referendum. It is not unreasonable to judge that that accommodation is not required. Alternatively, Carney can do what he has successfully done before: Show a pragmatic flexibility and trust the data. It is not unreasonable to expect last year’s currency depreciation to have nearly run its course, and for price pressures to peak shortly. The market will likely be particularly sensitive to the UK’s high frequency data in the coming weeks, as the BOE is perceived to be as well. |

Economic Events: United Kingdom, Week September 18 |

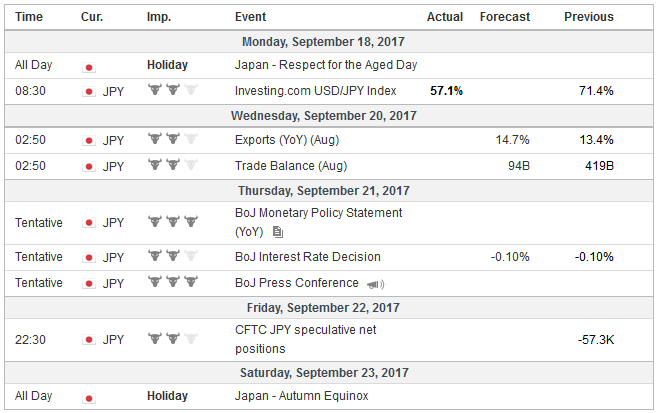

JapanThree major central banks meet in the week ahead: Norges Bank, Norway’s central bank, the Bank of Japan, and the Federal Reserve. Soft inflation data last week underscore the Norges Bank is on hold. The Bank of Japan is also not expected to change policy. The BOJ does not need to buy JPY80 trillion of JGBs a year to keep the 10-year yields in a 10 bp band around zero. Some see this as evidence of stealth tapering. We are not convinced that this is the best way to understand what the BOJ is doing, but we recognize the BOJ has been reluctant to formally acknowledge this by scaling back its announced target. |

Economic Events: Japan, Week September 18 |

United StatesIn any event, the FOMC meeting will be historic. We have been suggesting since June that the Federal Reserve would announce the beginning of its balance sheet reduction at the September meeting. Although the BOJ had been engaged in preliminary forms of quantitative easing, the Federal Reserve codified it, elaborated on it early in the Great Financial Crisis. Although there were several rounds, it did cease, despite the mocking by the skeptical that, once begun, it would be impossible to stop, as in QE-infinity. The Fed has not only stopped, but it is in a position to begin to generally unwind some of it. The unprecedented nature of what is about to happen seems to be under appreciated by many investors. Of course, other central banks will not simply follow it, they will elaborate and modify according to idiosyncratic factors, pre-existing conditions, and institutional arrangements. However, the Fed’s conduct will be part of the information set they will have that the Fed does not. The Fed has made clear how and at what pace its balance sheet will shrink. It will simply not recycle the full amount of maturing bonds and MBS in its portfolio. It seeks to put the program on near automatic pilot; not to be influenced by the vagaries of the economic data or the proximity to its goals. The pace will begin slowly at $10 bln a month ($6 bln Treasuries and $4 bln MBS). The pace will increase by $10 bln a month every quarter until reaching the $50 bln a month. We suspect in the initial period the market impact will be minor, but as the terminal velocity of $ 150 bln per quarter is approached, the risk of disruption seems to be greater. Admittedly there are a number of moving parts and imponderables, like the Treasury’s issuing schedule, fiscal policy, global development, and the regulatory treatment of Treasury assets for financial institutions. Tax considerations and investment strategies that have led to vast amounts of cash on corporate balance sheets (a recent Financial Times report found that 30 US companies had accumulated a combined portfolio of cash and financial assets worth more than $1.2 trillion) are also important factors in trying to anticipate the impact of the shrinking of the central bank’s balance sheet. The Fed’s main tool for monetary policy will remain the Fed funds target (range). A September rate hike has long been ruled out by investors, with guidance by the Fed officials. Investors ought not expect any clues for the December FOMC meeting, the next one that is followed by a press conference. Shaping expectations for the December meeting can wait until at the November 1 meeting. |

Economic Events: United States, Week September 18 |

Switzerland |

Economic Events: Switzerland, Week September 18 |

However, through its new forecasts (represented in the dot plot), the Federal Reserve will be providing important information. For the first time, it will be providing forecasts for 2020. What is the importance of Fed forecasts, one may wonder, given that the forecasts are often wrong as much if not more than market economists? It is through the forecasts that investors will have a better idea of the terminal rate for Fed funds that the current Fed members have.

The reference to current members is a reminder that the Board of Governors is about to have a major makeover. With Fischer stepping down next month, and Quarles likely to join by the November meeting, there are still four appointments that have to be made, including the Chair. In our calculus, we see the reappointment of Yellen as the path of least resistance. It does not appear to be particularly salient to the President’s base. Some argue that Trump wants low interest rates and his appointments will reflect this. It may be difficult to find people with the requisite skills and experience that would have raised rates much slower than Yellen. Also, some of the more rule-based approaches, like the Taylor Rule, would imply higher rather than lower rates.

The FOMC statement itself will likely recognize the distortions in the high frequency data due to the intense storms in Texas, Florida and South Carolina. The pre-weekend double whammy of disappointing retail sales and industrial output may already reflect some early signs of the weather disruption. The Fed’s chief task is not so much predicting the future, but trying to steer monetary policy through the changing business cycle and structural evolution of the economy. The severe storm makes the Fed’s task focusing on the economic signals more difficult.

Despite downgrades in Q3 GDP forecasts (NY Fed GDP tracker to 1.34% from 2.06% the previous week, and Atlanta Fed to 2.2% from 3.0%), the underlying economic trend has not changed. It is growing slightly faster than what economists estimate is trend growth. Therein lies the problem. Trend growth has slowed, and monetary policy can do very little to boost trend growth.

Our argument that the odds of a December rate hike are greater than many others is not because we see higher inflation or faster growth. Our view, spurred by comments in Fed speeches and FOMC minutes, is that the easing of financial conditions in the face of the Fed’s considered judgment that the economy requires less accommodation, is significant. Just as investors are aware of the Fed’s reaction function, so too are Fed officials aware of investors’ reaction function. Its institutional credibility is being challenged in a way vaguely similar to what Greenspan called a “conundrum” in 2005. Given our collective experience, financial stability is central.

Full story here Are you the author? Previous post See more for Next postTags: #GBP,#USD,$JPY,Bank of Japan,FOMC,Germany,newslettersent,NZD