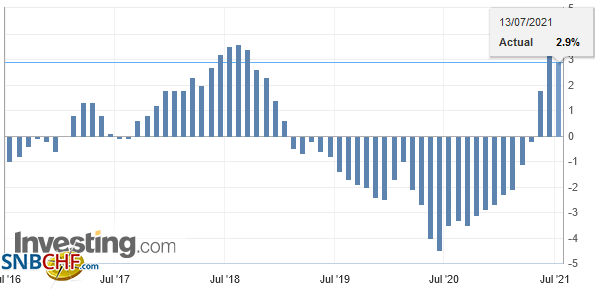

Swiss FrancSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. CHF Speculative PositionsLast data as of August 22: The net speculative CHF position has risen from 1.2K short to 2K contracts short (against USD).

|

Speculative PositionsChoose Currency source: Oanda |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Speculators continued to amass a significant short sterling position in the futures market.In the CFTC reporting week ending August 22, speculators added 11.7k contracts to the gross short position, lifting it to 107.4k contracts. It is the fourth week in the past five the speculators grew the gross short sterling position, and they have averaged a little more than 10k contracts a week.The gross long sterling position was trimmed by 2.3k contracts by speculators, leaving them with 61.5k contracts. As a result of these gross position adjustment the net short position rose to 45.9k contracts, the most since May. The US dollar’s weakness may offset the negativity toward sterling. Sterling closed the week around a cent above the previous day’s low, as the dollar was sold when neither Yellen nor Draghi changed the information set that investor had. That said, the euro closed at new highs for the year against sterling. Outside of sterling, speculators did not make other significant adjustments, which we define as 10k contracts or more. Nine of the 16 gross currency futures position we track were adjusted by less than 3k contracts. This, of course, is the likely the result of the summer lull. Nevertheless, there were a couple of larger pattern evident. Speculators mostly trimmed gross long currency futures positions. There were three exceptions, the euro, yen and Mexican peso. Speculators also mostly covered short positions. There were three exceptions, sterling as we have seen, and the Swiss franc and Mexican peso. In the Treasury futures markets the bulls charged. They added 28.1k contracts to the gross long position, while the bears felt compelled to cover 32.5k gross short contracts. The gross long position of 915.7k is just shy of the record set in May near 948k contracts. The net long position rose to 261.2k contracts from 200.6k. Bulls liquidated 22.5k light sweet oil futures contracts to reduce the gross long position to 676.8k contracts. The bears covered 4.5k, which reduced the gross short position to 231.4k contracts. The net position fell 18k contracts to 445.4k. |

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Full story here Are you the author?

Previous post See more for Next postTags: Commitment of Traders,EUR/CHF,newslettersent,Speculative Positions,USD/CHF