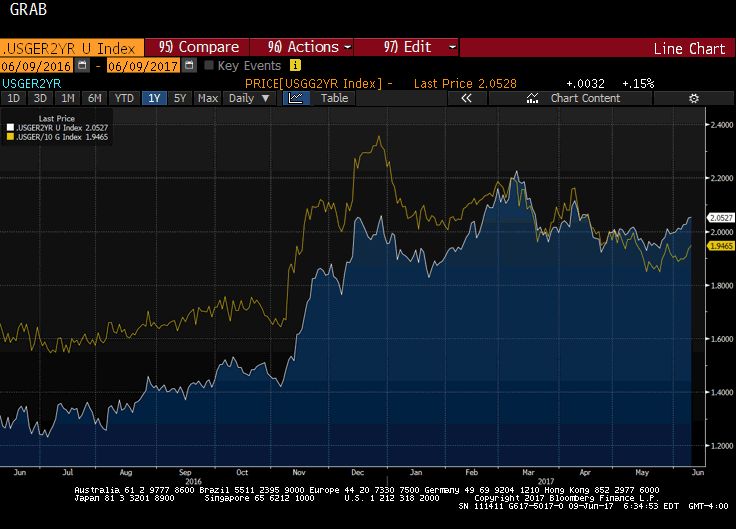

| This Great Graphic, created on Bloomberg, depicts the interest rate differential between the US and Germany. The euro-dollar exchange rate often seems sensitive to the rate differential. The white line is the two-year differential and the yellow line is the 10-year differential.

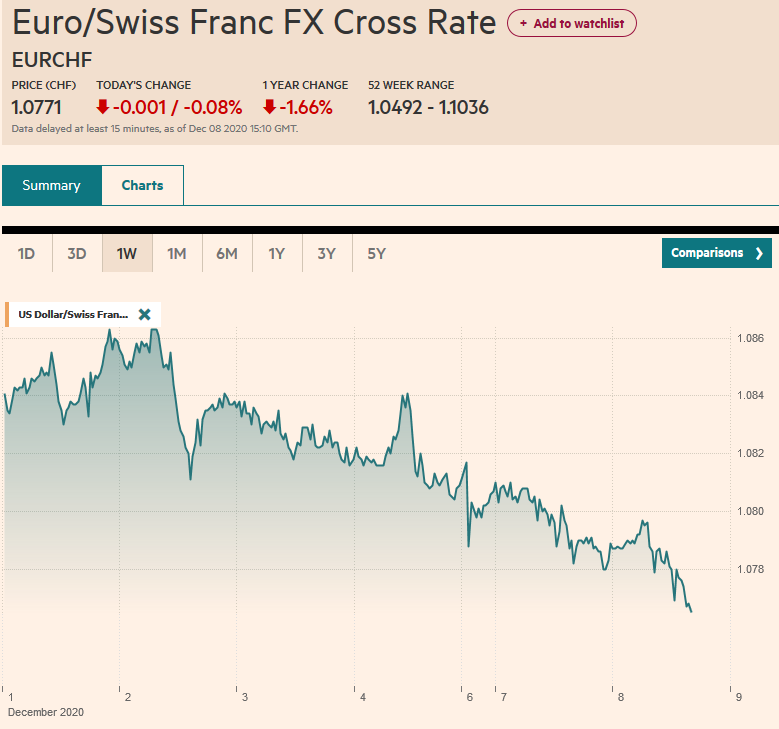

There are a few observations to share. First, the 10-year premium is often greater than the two-year premium. It has been five years since this was not the case. However, as the chart shows presently, the two-year premium is greater. The US offers about 205 bp more than Germany at the short-end of the coupon curve and about 195 bp on 10-year money. Second, both differentials have begun moving back in the US favor. The two-year differential widened from about 193 bp on May 18 to 206 bp today. The 10-year premium has widened from about 185 bp on May 17 to nearly 195 bp today. It is not so much a one-to-one correspondence between rate differentials and a particular exchange rate level. Rather, we often find the direction is more important than level. Third, the euro appears to be potentially turning. For four sessions it knocked on $1.1285, trying to clear $1.13, with some talk of a move back to $1.16, last year’s high. The euro is softening and the RSI and MACDs warned of more downside risk ahead of next week’s FOMC meeting. The euro has slipped below its 20-day moving average (~$1.1190) for the first time since April 18. It has retraced more than 61.8% of the last leg up that began at the end of May from $1.1110. That retracement objective was $1.1180. A break of the $1.1100 area could quickly see $1.1050. There is a potential double top in the euro and the $1.1110 is the neck line. If valid, the measuring objective of the pattern is near $1.0935. |

Euro-Dollar Exchange Rate, May 2017(see more posts on EUR/USD, ) |

Full story here Are you the author? Previous post See more for Next post

Tags: $EUR,EUR/USD,newslettersent