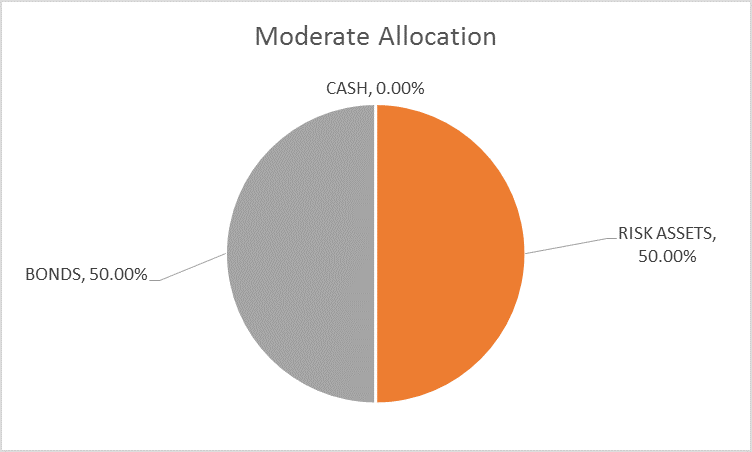

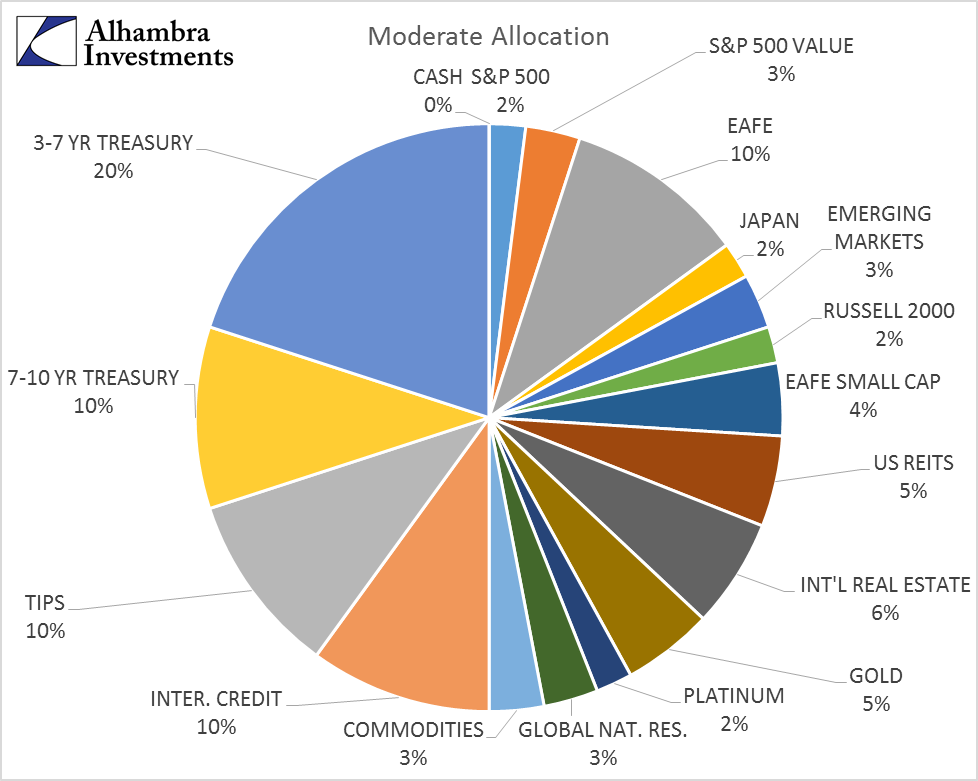

| There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are no changes to the portfolio this month. | |

| The growth and inflation outlook continued to weaken somewhat since last month’s update. Certainly nothing very dramatic though, just a general, gentle trend of weaker growth and inflation expectations within the US. International markets continue to outperform their US counterparts as the dollar continues to weaken. Commodities confirm the weaker growth view although there does seem to be a subtle momentum shift toward natural resource stocks. That, combined with firmer action in the Canadian and Aussie dollars, may be pointing to future gains in the commodity complex.

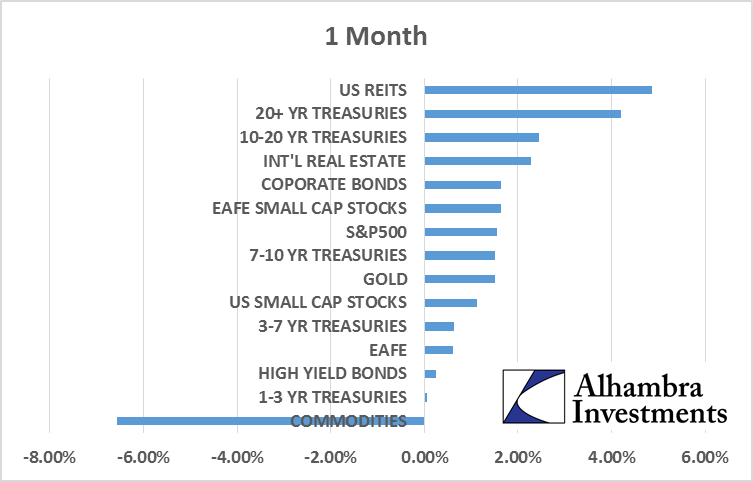

US stocks continue to perform well despite the economic environment, the S&P 500 sitting at new highs even as I write this. But the leaders of the last month are all interest rate sensitive, a reflection of the recent spate of weak data. |

|

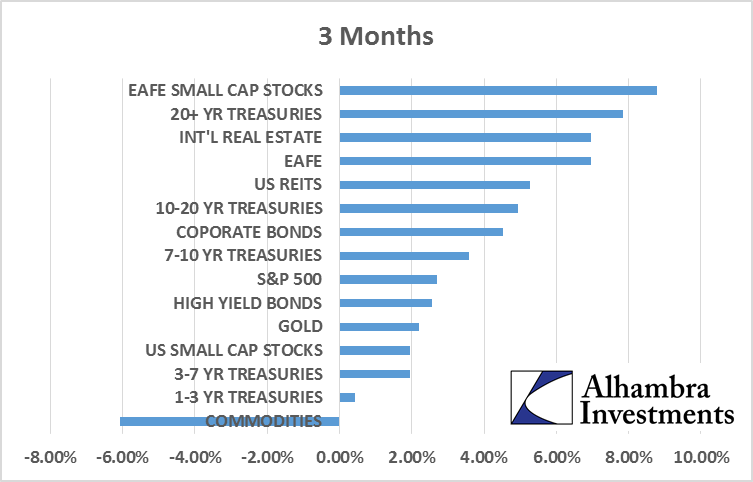

| Over the last three months, interest sensitive assets such as bonds and real estate still rank high but the leaders are international stocks. | |

| The outperformance of international markets, like the weakening of the dollar, is driven by the relative change in economic growth expectations between the US and the rest of the world. European economic growth appears to be on the rebound – a cyclical improvement – and the election results since Brexit have been perceived as positive. The EM growth and inflation outlook is also improving, allowing rate reductions in many of these countries that had jacked up interest rates in futile attempts to protect their currencies. Japan is also performing better although one might need to squint to see it.

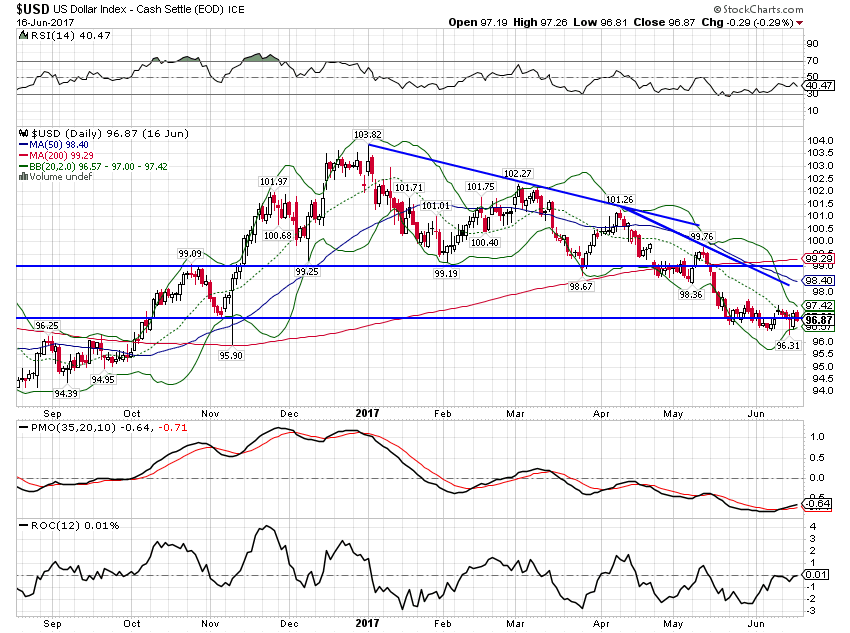

The falling dollar acts as a tailwind for the international markets we have overweighted. Owning EAFE, EM and Japan also means owning Euros, EM currencies and the Yen, all of which are rising against the dollar recently. The current downtrend in the dollar is quite young and if past is prologue probably has a long way to go. That could change if the Republicans are able to make further changes in economic policy but that seems remote, at least for this year. Politics plays no role in our investment process though so I won’t be making any changes based on what might happen. If the market deems policy changes likely it will show up in the bond, currency and commodity markets. So far, the only market that still seems optimistic about policy changes is the stock market. Without confirmation from other markets that has little impact on our process. The dollar index is a bit oversold right now and sentiment has shifted from the previously very bullish outlook. A bounce right now would not be out of line or surprising. |

US Dollar Index , September 2016 - June 2017(see more posts on U.S. Dollar Index, ) |

| I am not making any changes based on what I think will be a short-lived rally though. Longer term the dollar appears to be peaking and as I alluded to above, currency trends tend to be durable and long lasting. |

US Dollar Index, 1998 - 2017(see more posts on U.S. Dollar Index, ) |

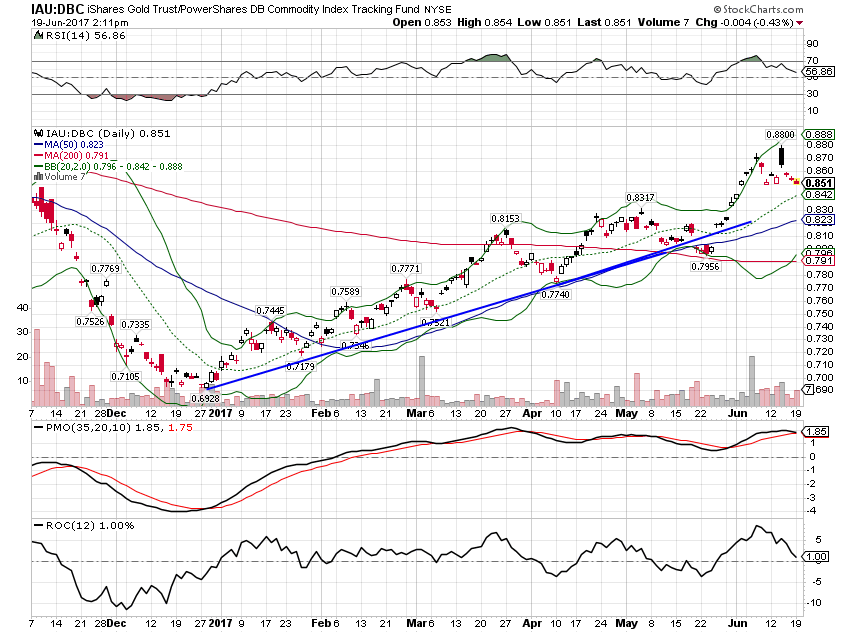

| Despite the falling dollar, the commodity portion of our portfolio did not perform well. Gold continues to outperform general commodities, reflecting the waning of growth expectations. |

DB Commodity Index , December 2016 - June 2017 |

|

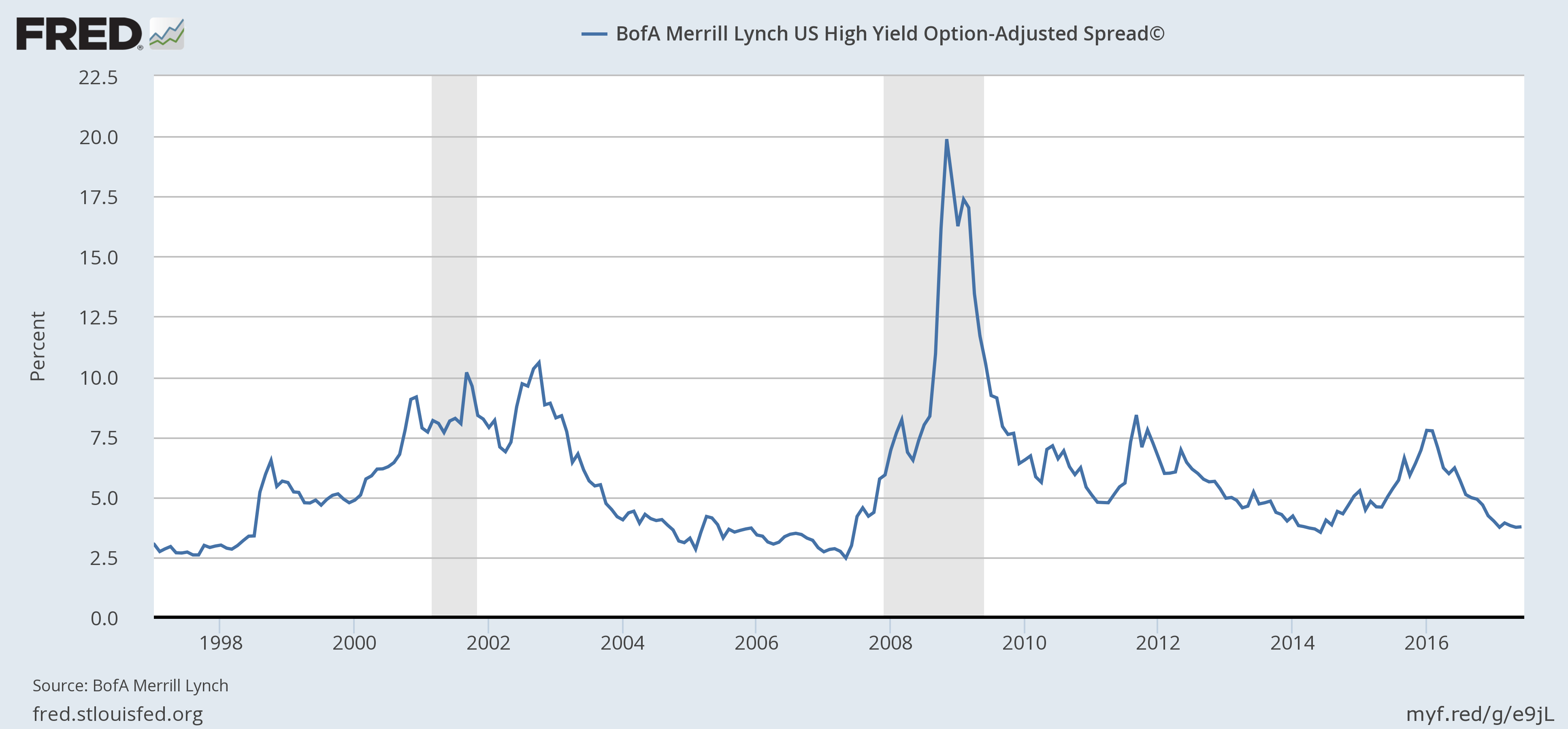

None of our main indicators changed sufficiently to warrant a change in asset allocation. I just published a Bi-Weekly Economic Review yesterday so for more commentary on credit spreads, the yield curve and other bond market indicators, just follow the link above. Credit spreads are barely changed over the last month and remain quite narrow indicating a healthy – very healthy – appetite for risk: |

US High Yield Option - Adjusted Spread, 1998 - 2017 |

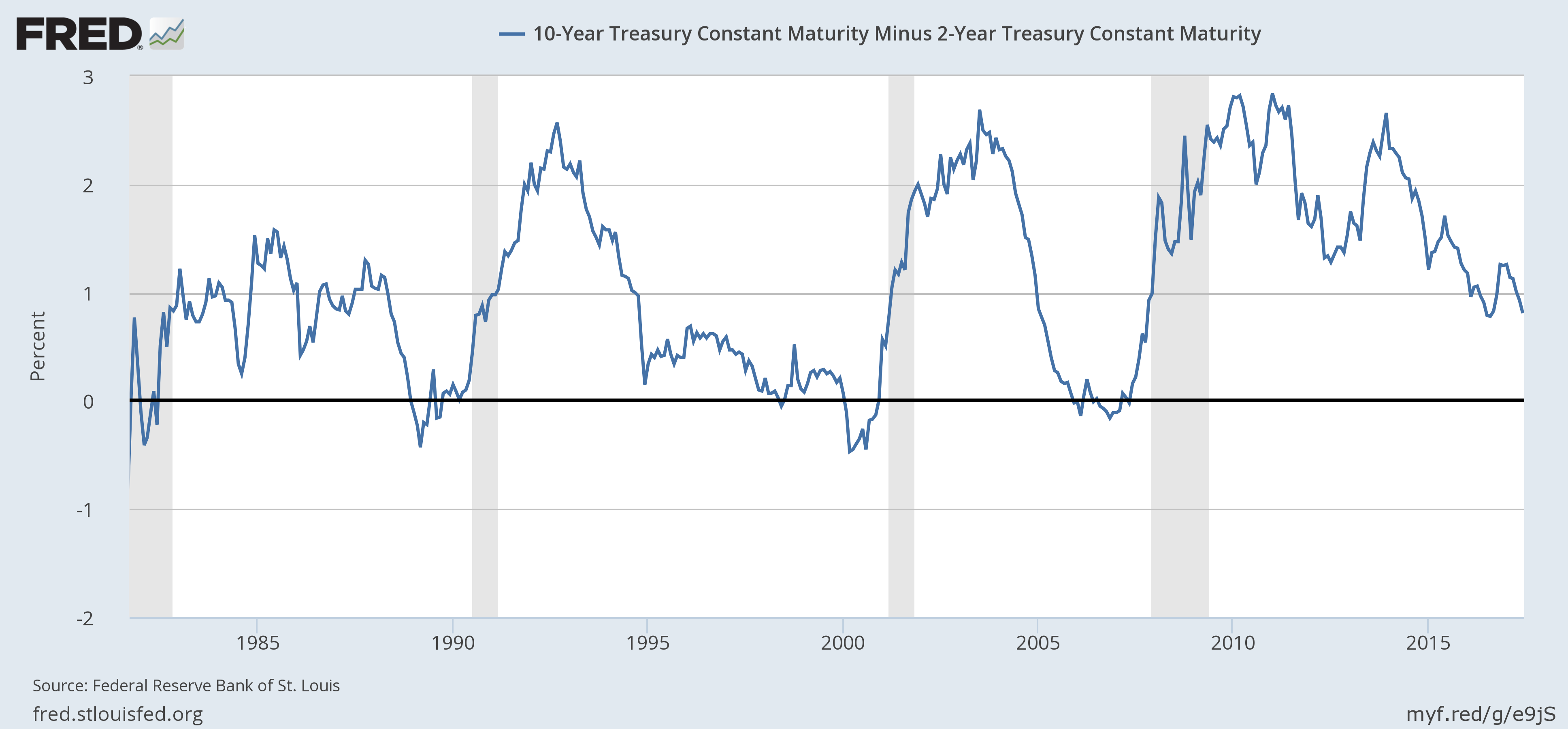

| Yield Curve – continued to flatten over the last month as the long end of the curve rallied while shorter dated paper traded in anticipation of the Fed rate hike. No warnings about recession here. BTW, two recent posts on the yield curve by Jeff Snider you might find of interest here and here. |

10-Year Treasury Constant Maturity Minus 2-Year Treasury Constant Maturity, 1985 - 2017 |

| Valuations – We just posted an article on US stock market valuations, co-authored by me, Jeff and Margie called It Is Different This Time so I won’t repeat that here. Suffice it to say that US stocks are expensive, which has been true for some time and is only getting worse. Where she stops nobody knows. International markets are much cheaper which is part of why we are overweight. We will publish a more comprehensive view of international valuations soon.

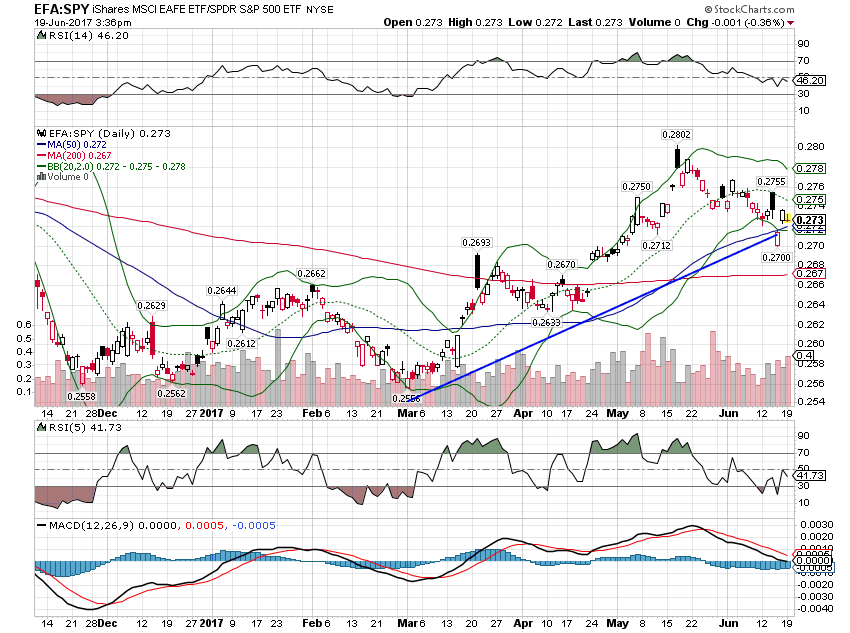

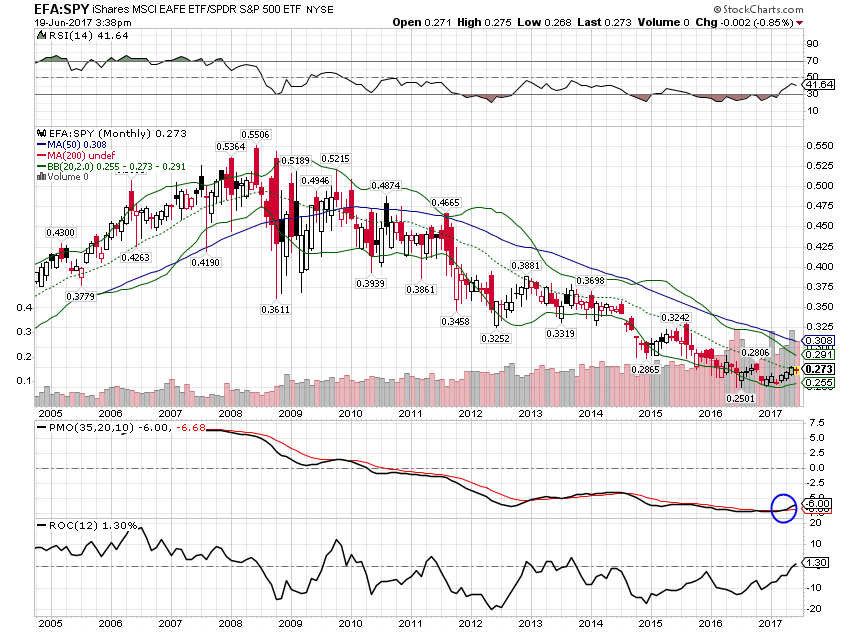

Momentum – Momentum continues to favor International assets over dollar denominated US assets. This is true across all asset classes. EFA underperformed SPY over the last month but is outperforming over the last 3 and 6 months and the last year. |

S&P 500, December 2016 - June 2017(see more posts on S&P 500, ) |

| Long term momentum is positive for EFA vs SPY |

S&P 500(see more posts on S&P 500, ) |

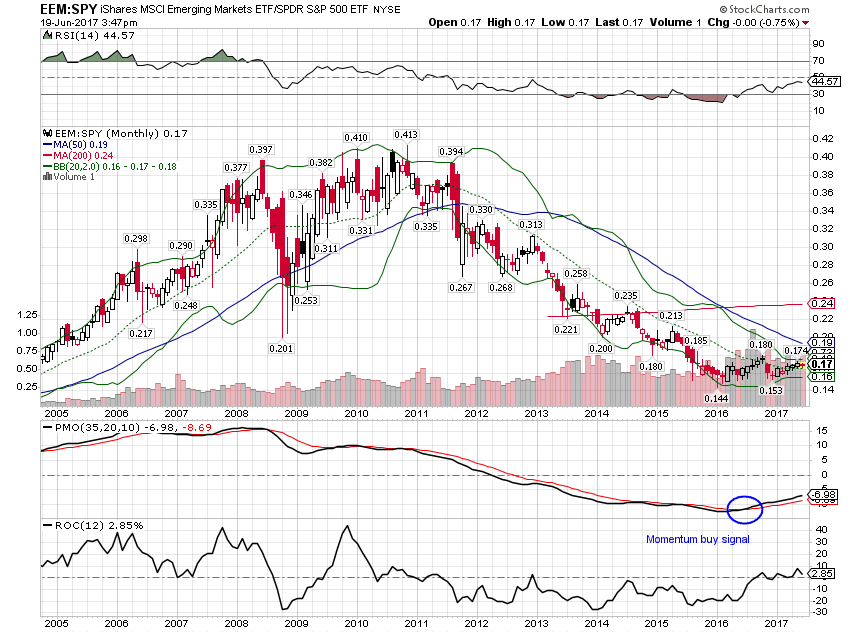

| The same is true for Emerging Market stocks: | |

| And long term momentum has shifted to EEM: |

EEM Spy, 2005 - 2017 |

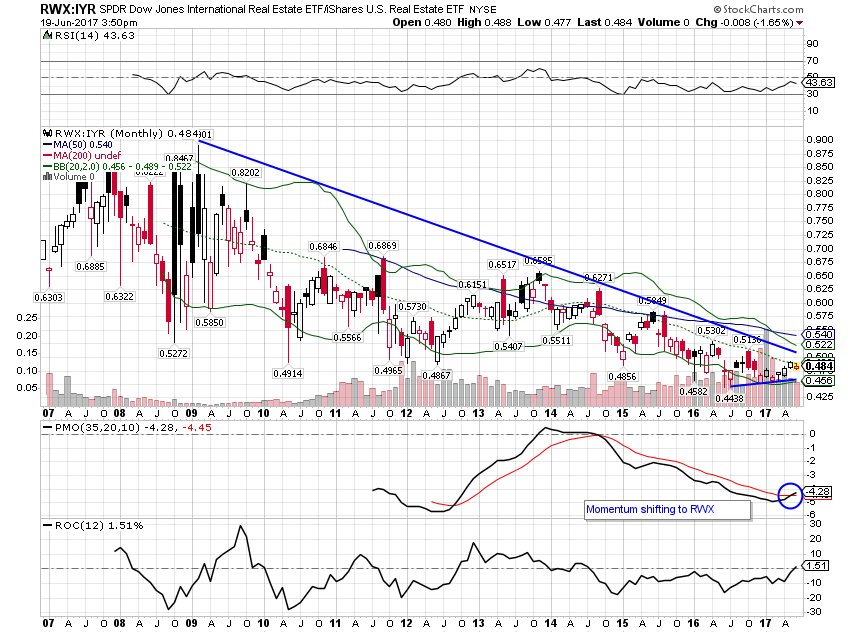

| International Real Estate is finally starting to outperform US REITs: |

Rwx Iyr Monthly, 2007 - 2017 |

|

In the very near term, if the dollar bounces from its oversold condition, it seems likely that US assets will outperform. But that is short term and longer term momentum has shifted to international. The weak dollar adds to returns but also has the potential to influence the growth picture as well. A stronger currency tends to attract capital inflows which are positive for domestic growth. Stronger domestic growth in turn gives investors further reason to invest which pushes the currency up further. This virtuous circle can go on for a long time and by my estimation it has only just begun. Unless something changes, our overweight position in international and real assets should continue to pay dividends.

|

Full story here Are you the author? Previous post See more for Next post

Tags: Alhambra Research,Bonds,commodities,credit spreads,currencies,eafe,economic growth,Emerging Markets,Euro,Global Asset Allocation Update,Gold,Investing,Japan,Markets,Model Portfolios,momentum,newslettersent,Real Estate,S&P 500,stocks,U.S. Dollar Index,US dollar,valuations,Yen,Yield Curve