See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

The Problem with MiningIf you can believe the screaming headline, one of the gurus behind one of the gold newsletters is going all-in to gold, buying a million dollars of mining shares. If (1) gold is set to explode to the upside, and (2) mining shares are geared to the gold price, then he stands to get seriously rich(er). We are not mining experts, but we will address (2) by saying that mining shares only go up if the input costs don’t go up as much as the price of gold. And if the company keeps efficiency up, and costs down. And if local tax authorities don’t get greedy. And if mine labor unions don’t get violent, environmental regulators don’t make expensive demands, etc. And if the company finds new ore bodies at the same rate it depletes them. |

As this book attests to, some people have a very cynical view of mining… We would say there is a time for everything. For instance, when gold went from $270 to $320 in 2001-2002, the HUI index went from 35 points to 150 points, in a show of rather noteworthy outperformance (something similar happened in 2016). The “sweet spot” for gold mining shares is usually early in gold rallies, before input prices catch up (empirically, gold has a habit of leading price moves in the main mining inputs) [PT] |

Gold Price vs. VanEck Vectors Gold Miners ETF (GDX)Here is a graph showing the price of the VanEck Vectors Gold Miners ETF (GDX) against the price of gold. We have plotted both price as a percentage of the start price to put them both on the same scale. You can see the problem. The price of gold from late May 2006 through present. In five years, the price of gold rose to 288% of its starting level. GDX was more than 100% behind, at only 170%. Note that the GDX is more than 40% down from its level in 2006. For comparison, the price of gold is just under double over the same period. If this is gearing, then it looks like the gear box was bolted on backwards. To bet big on gold mining shares now, your bet includes another conditional: (3) if the gearing has since been fixed… Anyways, this is not really our wheelhouse. We focus our commentary on (1). Did something change in the market, that will drive the price much higher? Before that can happen, we would have to see something happen to put a bumper under that falling silver elevator. |

Gold vs GDX(see more posts on Gold, ) |

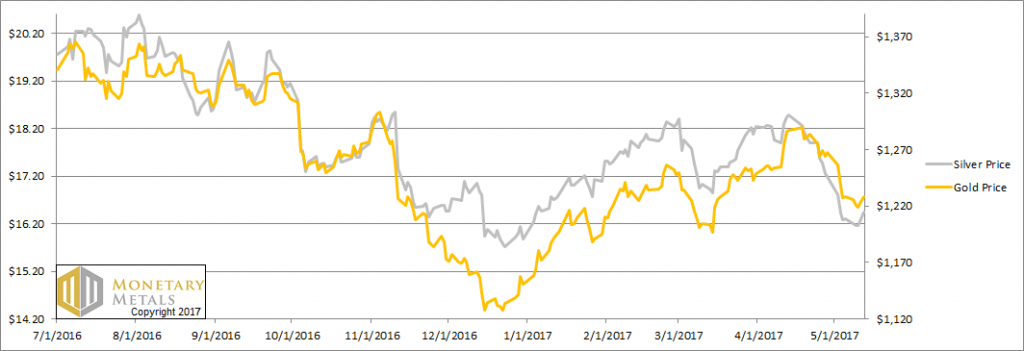

Fundamental DevelopmentsBelow is the only true look at the supply and demand fundamental of the metals, but first, the price and ratio charts. |

Gold and Silver Prices(see more posts on gold price, silver price, ) |

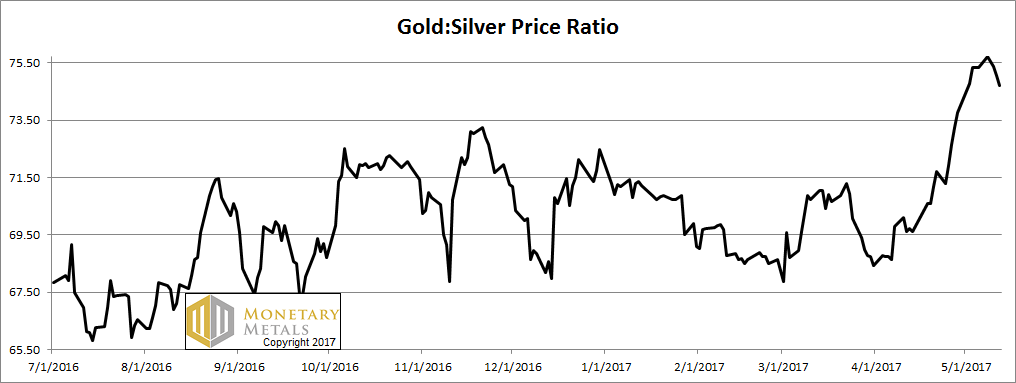

Gold:Silver RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It began the week moving up, but then reversed and ended lower. Last week, we said:

It did not break 76. It closed Monday at 75.7, but ended the week below 75.

|

Gold:Silver Ratio(see more posts on gold silver ratio, ) |

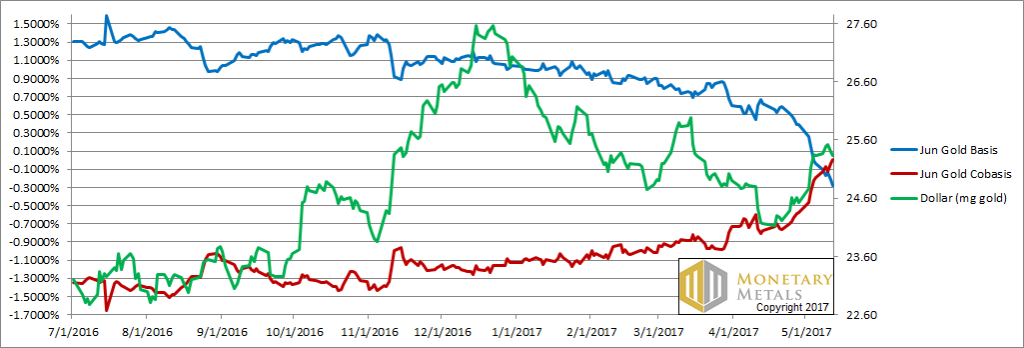

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. Note that the June contract has just a touch of backwardation, with the co-basis now at + 0.01%. Back in early 2013, we dubbed this new normal behavior, when each contract would go into backwardation before it expired, temporary backwardation. That is all this is, and not a very impressive specimen either. Yes, it is true that the scarcity of gold has been rising for about a month (look at the red line, the co-basis). However, that corresponds to the rise in the price of the dollar (which is the inverse of what most people measure, the price of gold in dollars). On April 12, the dollar was 24.18 milligrams gold, corresponding to a price of gold at $1286. The co-basis — our measure of scarcity — was at -0.81%. Since then, there has been a run up in the price of the dollar (which most people perceive as a run down in the price of gold), to 25.52mg gold (which people generally think of as a price of gold of $1,219). When we see such a clear correlation between the price of the dollar and the co-basis, we know that the move is just speculators repositioning (in this case, obviously selling). The more the price of gold is down, the more speculators liquidate their futures, the scarcer the metal becomes. Our calculated fundamental price closed the week up $3, to $1,254. While this may be welcome news for gold speculators after a few weeks when it fell, it’s hardly the stuff of making million-dollar bets. Far be it from us to get in the way, when there’s serious money to be made. It’s a (more or less) free market. Where there’s an opportunity, people will take it. We refer, of course, to the newsletter hawkers and their explosive upside calls. We assume this is a lucrative business. However, unlike the opportunity to sell newsletters to gold speculators who don’t know what most newsletters have been promising over the last 6 years, the opportunity to bet on a gold price increase looks rather less likely, at the moment. |

Gold Basis and Co-basis and the Dollar Price(see more posts on dollar price, gold basis, Gold co-basis, ) |

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. Silver does not yet show any backwardation, though it’s close at -0.03%. However, the sharp and sustained rise of the co-basis is notable—along with the sharp and sustained rise in the dollar. Measured in silver, the dollar has risen from 1.68 grams of silver to 1.92 grams earlier this week. That’s a big run up (i.e. run down in the price of silver as popularly perceived). We have been talking about an ongoing flush in the silver speculators. The price fell through Wednesday, then rallied sharply on Thursday and Friday. Perhaps that elevator has found a rubber bumper? Significantly, our calculated fundamental price rose a buck this week. From around $15 last week, it’s now $16. We will end on an amusing note. Last week, we said:

Assuming he shorted it early on Monday morning, he might have top-ticked it at $16.40. On Tuesday, he could have closed at $16.05, for a gain of 2.1%. There has to be an easier way to earn a few bucks (and we never recommend naked-shorting gold or silver). |

Silver Basis and Co-basis and the Dollar Price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Keith will be speaking at the Metal Writers Conference in Vancouver, at the end of the month. And at the Mining Investment Europe event in Frankfurt in mid-June.

Full story here Are you the author? Previous post See more for Next post

Tags: dollar price,Gold,gold basis,Gold co-basis,gold price,gold silver ratio,newslettersent,Precious Metals,silver,silver basis,Silver co-basis,silver price