Swiss FrancSpeculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts.The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The reverse carry trade in form of the Long CHF started and lasted - without some interruptions - until the peg introduction in September 2011. In mid 2011, the long CHF trade became a proper carry trade - and not a reverse carry trade anymore - because investors thought that the SNB would hike rates earlier than the Fed. CHF Speculative PositionsLast data as of March 21: Speculators continued to reduce their net short euro exposure until March 28. Apparently they do not understand the difference between core inflation and the headline figure. |

Speculative PositionsChoose Currency source: Oanda |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

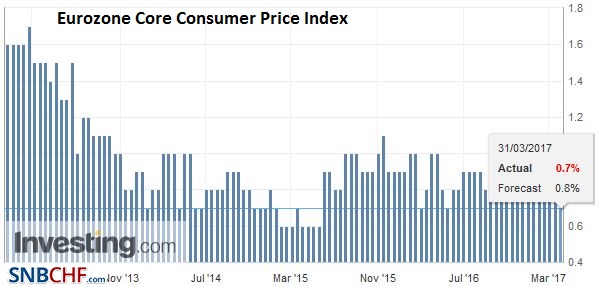

| After March 28, Eurozone inflation data was released. Core inflation has even fallen from 0.9 to 0.7%; therefore a ECB rate hike will not come soon. For the next week, we expect far more Euro shorts.

Speculators increased their CHF net short position to 16K contracts (against USD). |

As European Core Inflation Remains Low, EUR/CHF May Tend Towards Parity(see more posts on Eurozone Core Consumer Price Index, ) Source: Investing.com - Click to enlarge |

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

(I am beginning a three-week business trip to Asia, so, while committed to the blog, the updates will be irregular. Thanks for your patience.). In the CFTC reporting week ending March 28, speculators mostly added to gross long currency futures and covered gross short positions. Although most positions adjustment were modest, tit continued a recent trend, and positioning is not the kind of headwind it was at the start of the year.This is especially true in the euro. Speculators hold a net short position of less than 8k contracts. It was 137k at its recent peak before the US election last November and 69.4k at the end of 2016. The change this is due in equal measure to the longs rising and the shorts falling.The gross position adjustment in the Mexican peso was easily the largest among the currency futures. Here too the longs and shorts were adjusted by nearly the same amount, leaving speculators net short 4.7k peso futures contracts from a peak near 73.3k in late January. The bulls added 15.0 contracts, taking the gross long position to 72.7k contracts. The bears added 16.5 contracts to their gross short position, which now stands at 77.5k contracts.Meanwhile, speculators continue to amass a large long Australian dollar position. At 90.8k gross long contracts, it is the second biggest bullish bet (gross longs) behind the euro. The gross shorts were pared by 2.7k contracts to stand at 37.7k contracts. The 53.1k contracts which speculators are net long is the most in nearly a year. The largest net short position is with sterling at 104.1k contracts. It has nearly doubled since the start of the year. The gross short position was reduced by 1.3k contracts, leaving 139.1k contracts. This remains near record set in Q3 16 of 154k. The gross long position rose from its lowest level since last July by 2.5k contracts, leaving a the bulls with 35.1k contracts. Of the eight currencies we track, speculators added to gross longs in six. The exceptions were the Swiss franc (-2.2k contracts) and the New Zealand dollar (-0.4k contracts). The gross shorts were mostly reduced. There were three exceptions: Swiss franc, Canadian dollar and Mexican peso. Bulls in the light sweet crude oil futures market reduced longs by 11k contracts, giving them 648.6k contracts. The record high was set in February ears 713k. The shorts added 9.4k contracts to their gross short position, raising it to almost 250k. Oil rallied another 2% since the end of the reporting period. There has been a dramatic position adjustment in the US 10-year Treasury note futures. The speculative market is still short, but the 69.4k contract net short compares with the record of 410k at the end of February. In the most recent week, the gross longs rose by 24.7k contracts, while the short covering by the bears slowed to 6.2k contracts.

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

Full story here Are you the author? Previous post See more for Next post

Tags: Commitment of Traders,newslettersent,Speculative Positions