Summary:

Nearly half of OPEC’s intended cuts are being offset by an increase in US output.

The contango rewards the accumulation of inventories.

The drop in oil prices probably weighs more on European reflation story than the US.

| Oil prices are lower for the seventh consecutive session. Light sweet crude prices had fallen 10.3% over the past two weeks, and with today’s losses are off another 1.6% already this week. There are two main considerations. The imbalance between supply and demand has not adjusted as much as expected, and the market positioning is extremely long, with many bank analysts still nursing bullish forecasts.

The April light sweet contract is trading at its lowest level since the end of last November. At $47.20 would have retraced 61.8% of the rally since shortly after the US election. Below there the risk extends to $45-$46. Over, the slightly longer term, a return toward $40-$42 cannot be ruled out. The sell-off has been very sharp, and today could be the fifth successive session that prices close below the lower Bollinger Band (~$48.15 today). The last time this took place was early last November. After the fifth close below the lower Bollinger Band, the price of oil bounced for three-four sessions and then fell to new lows. OPEC’s cuts, if fully implemented would have brought the cartel’s output back to where it was in early 2016. There were several members exempt from output cuts, and they seem to take full advantage of their allowances, if not more so. It is offset the loss of around 13% (~100k barrels) of Libyan output due to conflict. At the same time, non-OPEC producers, including the US, Canada, Brazil, the North Sea and Russia have increased output by around one million barrels, according to reports. |

|

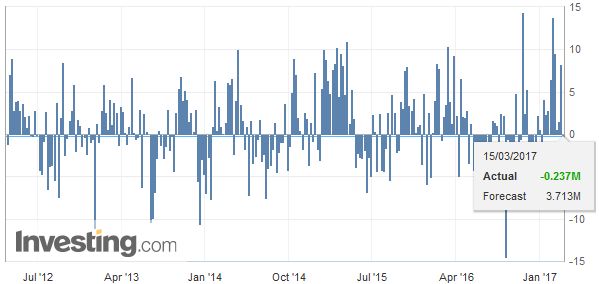

| US crude inventories are at record levels. This not only reflects the increased US output, which is the highest in more than a year but also increased imports. The US Department of Energy expects next month’s output to rise by nearly 110k barrels a day, which would lift US output to near 9.2 mln barrels a day. The Bloomberg survey found a median expectation of another three million barrel build last week when the EIA reports tomorrow. The US rig count has steadily increased and now is at its highest level since September 2015. Moreover, US shale production costs are estimated to have fallen by around 40% over the past three years. |

U.S. Crude Oil Inventories, March 15(see more posts on U.S. Crude Oil Inventories, ) Source: Investing.com - Click to enlarge |

Many investors were skeptical of OPEC’s reported cuts. The history of “non-compliance” and a vested interest in exaggerating the cuts in order to have a favorable impact on prices cast doubts. These doubts were born out today. OPEC had claimed Saudi output fell further in February to 9.8 mln barrels a day. However, Saudi Arabia’s own report showed that it had boosted production by 263.3k barrels to 10.011 mln barrels a day. In effect, this reversed about a third of the output cuts reported in January.

Although Saudi Arabia has still cut a little more than had been agreed at the end of last November, it still appears to be a reluctant leader of the output cuts. Energy Minister Al-Falih warned last week that it cannot ” bear the burden of free-riders” forever. Russia, Iraq and the UAE have not delivered what the Saudi officials believe was agreed. Several members, including Saudi ally Kuwait, have called for an extension of the agreement. So far, Saudi Arabia has not endorsed an extension.

The EIA expects US shale producers to boost output by several hundred thousand barrels this year. The Permian Basin area has added 172 rigs since last May. And the productivity of those wells is rising. The EIA projects output from the Permian Basin to increase 79k barrels a day in April, or 3/4 of the overall anticipated increase in US output. Since October, US output has grown 600k barrels a day. That offsets almost half of the cuts that OPEC had negotiated. Recent comments from the Saudi oil minister suggest officials may have been caught out by how fast US shale output has grown.

The shape of the oil curve is understood to be an important reflection of expectations and key for hedgers and producers. Think of it like a yield curve. Yield curves are mostly positively sloped. Long-term interest rates are typically above short-term rates. An inversion is often a worrying sign. In commodities, including oil, a positively sloped curve (e.g. oil for delivery in several months is more expensive than the nearby contracts) is called contango. This rewards those with inventories and who can afford not to bring a product to the market today. That is the situation now. The May contract is near $48, and March 2018 contract is a little below $50. The situation that encourages the drawing down of stocks is when the short-term price is above the long-term price. This is called backwardation. Engineering backwardation likely takes some pressure off prices.

Nevertheless, the important point here is that OPEC seemed to have the upper hand for three months (December 2016 through February 2017). However, shale producers have not been defeated by any means. Instead, they are punching back. It is a simplification to be sure, but the drama in the oil market can be seen as a battle between Saudi Arabia and US shale producers.

In a larger sense, the rise in oil prices was part of the global reflation story. If our bearish outlook is justified, that reflation story will be challenged. We suspect Europe is more vulnerable than the US. The increasing rig count and output support the economy, while the Fed looks through the price impact by focusing on the core rate of inflation. The rise in headline inflation in the euro area has prompted ideas that the ECB could hike rates (from minus 40 bp to minus 30 bp) late this year or early next year. The drop in oil prices reinforces our ideas the eurozone CPI will peak shortly.

Full story here Are you the author? Previous post See more for Next post

Tags: #USD,$EUR,newslettersent,OIL,Saudi-Arabia,U.S. Crude Oil Inventories