| The Federal Reserve delivered the much-anticipated rate hike. There was one dissent, the Minneapolis Fed President Kashkari.

In the first paragraph of the FOMC statement tweaked the assessment of business fixed investment, saying that it appears to have “firmed somewhat,” while in February it characterized it as having “remained soft.” The statement also recognized that inflation is moving closer to the Fed’s target. In the second paragraph, the Fed retained its risk assessment, which is roughly balanced. The Fed reiterated its commitment to gradual increased (though previously it said the approach was “only gradual.” The statement also inserted a new phrase regarding its monitoring of inflation developments: “about is symmetric inflation goal.” This seems to reiterate its anti-inflation commitment and leans against those interpretations suggesting the Fed is willing to let the economy run hot. Otherwise, the statement, allowing for the rate hike, was little changed.

Of the 17 Fed officials, nine now look for three hikes this year. In December only six did. What happened was that some of the more dovish members moved in line with the consensus, while the more hawkish members remained. Both in December and now, five members would above the median. For 2018 now there are only three dots below 2.0%. In December there seven below 2% in 2018. In 2019, there were four dots below 2.5%, and now there are three. The average fed funds dot edged higher, by four basis points this year to 1.404%, and nine basis points in 2018 to 2.316%. In 2019, the average dot rose to 2.89% from 2.801%.

On balance, while the Fed did hike rates and the dot plot for Fed funds were upgraded, it does not meet our threshold for a hawkish hike. After seeing the statement and dots, the market concluded that there was a somewhat less chance of a June hike. The dollar retreated, and the yields eased with a slight flattening of the 2-10 yr curve. The 10-year bond yield remained above 2.50%. |

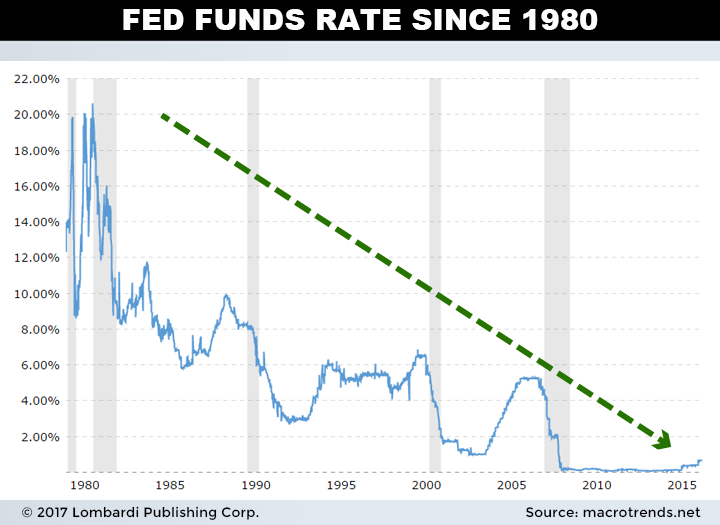

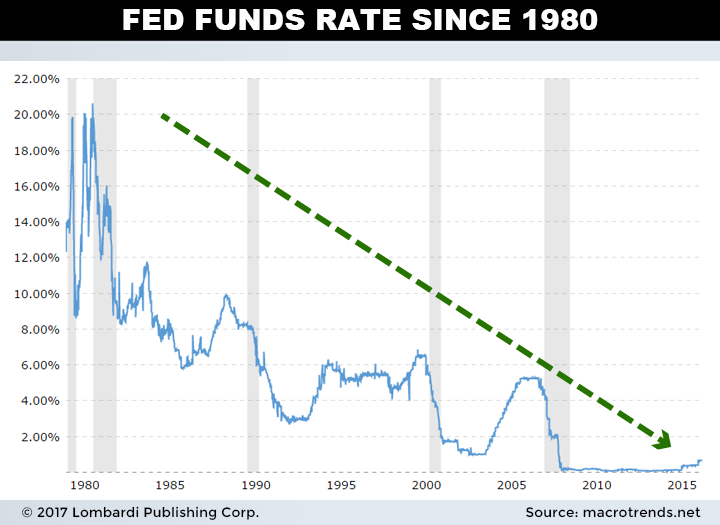

Fed Funds Rate Since 1980-2015 - Click to enlarge |