Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 17(see more posts on EUR/CHF, ) |

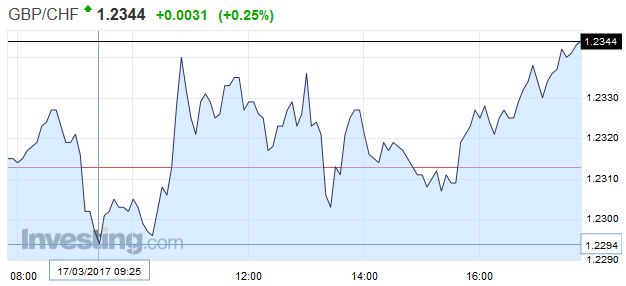

GBP/CHFArticle 50 – Invocation Imminent With the House of Commons voting against amendments to the brexit bill, it was passed to the Queen for approval which was really a formality, more a mark of respect to a bygone age. Article 50 is now ready to be invoked at anytime. It is anticipated to be next week. I am of the opinion that brexit is already factored into current levels and I would not expect a huge drop in Sterling value. It is important to remember the market moves on rumour as well as fact. It could be the case that Sterling strengthens against the Swiss Franc following invocation of article 50 as more certainty returns as to the future of the UK economy. No doubt there are investors waiting on this announcement so there is sure to be volatility. If you have a currency requirement over this period it may be wise to hedge your bets. Perform a tranche of your trade before the triggering of article 50 and a tranche after. I recall the the day of the Brexit vote, when some clients were adamant on trading after the vote, confident on a win for the remainers. As we all know, the vote went against the polls and some clients lost thousands. Hedging is a wise move. It has always baffled me as to how some would never be willing to put £20 on a horse, but would be willing to gamble huge sums of money on the currency market. Swiss Data releases of Consequence Next week on Tuesday we will see the release of economic forecasts from the Swiss State Secretariat for Economic affairs. It looks at all measures of GDP. It gives an indication as to the growth of the Swiss economy and if there is a positive outlook we could see the Swiss franc strengthen. Following the economic forecast we will see trade balance data. A measure between import and export. any significant change from the previous month can create volatility. |

GBP/CHF - British Pound Swiss Franc, March 17(see more posts on GBP/CHF, ) |

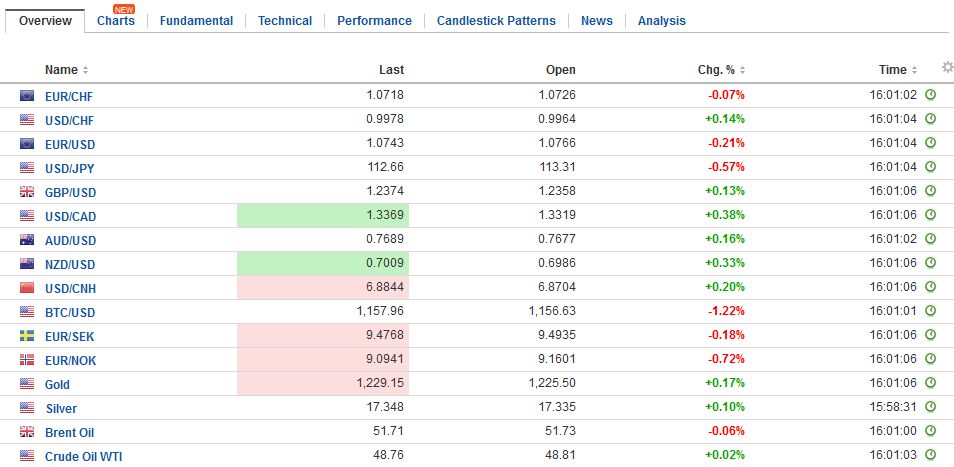

FX RatesThe dollar is softer against most of the major currencies to cap a poor weekly performance. The Dollar Index is posting what may be its biggest weekly loss since last November. The combination of the Federal Reserve not signaling an acceleration of normalization, while the market remains profoundly skeptical of even its current indications, and perceptions that the ECB and BOE can raise earlier than anticipated weighed on the dollar. The PBOC surprised many by lifting some operational interest rates. It also contributed to the sense that the divergence theme has run its course. We are somewhat skeptical of the sustainability of that new narrative, but recognize it has emerged while the short-term market was carrying significant long dollar (and short Treasury positions). We expect EMU headline inflation to peak in the coming months. Similarly, we expect UK data to soften and not give the MPC a compelling reason to lift rates. Next week’s numerous Fed officials are speaking, including Yellen. Given the market’s reaction to the statement and forecasts, it would not be surprising to see some push against the dovish hike interpretation. Comments from Austrian central bank governor Nowotny showed where the ECB hawks are trying to lead. As we heard recently, some ECB board members have chosen now to talk about an exit process that still seems premature for a majority. The argument is that the US sequence of finishing QE before increasing rates may not be suitable for Europe. Nowotny went a little beyond earlier comments to suggest that not all rates would necessarily rise. The deposit rate, for example, could be raised without having to lift the refi rate. EONIA would likely adjust to such a development. |

FX Daily Rates, March 17 |

| Nowotny’s comments reinvigorated the euro’s advance. The single currency is rising for third sessions, the longest streak since late January. It is the third weekly advance. The euro is approaching the early February high near $1.0830. Above there is the high from the ECB’s December meeting and the taper and extension, set near $1.0875. The two-year rate differential has narrowed nine basis points this week to one-month lows (2.09%)

In addition to Forbes and Nowotny, US Treasury Secretary’s comments late yesterday were also important, even if the market’s response was mute or overshadowed by other developments. Mnuchin’s remarks sounded very much like many of his predecessors and not from an administration that seemed intent on breaking from American tradition. The US Treasury Secretary endorsed the strong dollar, saying it was good for the US in the long-term. That he recognized that the strong dollar could pose problems in the short-run is not so different from the G7/G20 caution against excessive volatility. Still, it would be even more helpful, if Mnuchin decoupled the strong dollar policy from prices, and endorsed the original intent: a commitment not to weaponize the dollar, which made possible the new orthodoxy of letting markets determine exchange rates. |

FX Performance, March 17 |

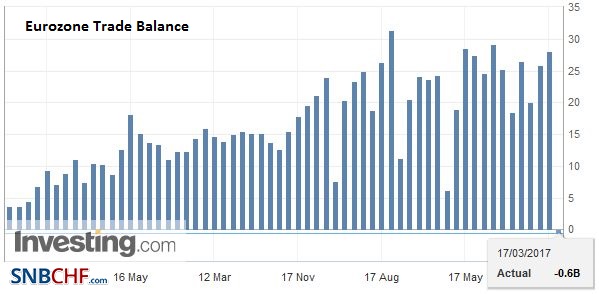

EurozoneMnuchin also seemed to embrace the process that the Treasury Department had developed to determine manipulation in the foreign exchange market. If the criteria are maintained, it suggests that China will not be cited as a manipulator in next month’s report. Meanwhile, Trump and Merkel will meet, after the initial timeframe for earlier this week had to be postponed due to weather. Trump has been critical of Germany and Merkel personally. Trump’s protectionist rhetoric, doubts about NATO, possible overtures to Russia, and efforts to dilute financial regulation don’t set well with the German Chancellor. However, expect a “very good” and “productive” meeting even if not “tremendous.” Another draft G20 statement may be leaked, but the impact on the market is likely to be modest at best. Its importance lies with changes from the last G20 statement as the most important change since then is the new US administration. |

Eurozone Trade Balance, January 2017(see more posts on Eurozone Trade Balance, ) Trump might be happy given that the euro zone has suddenly a trade deficit. But this is a normal behaviour in January. Chinese New Year is the solution: Chinese are not importing from Europe, because their factories are closed. Source: Investing.com - Click to enlarge |

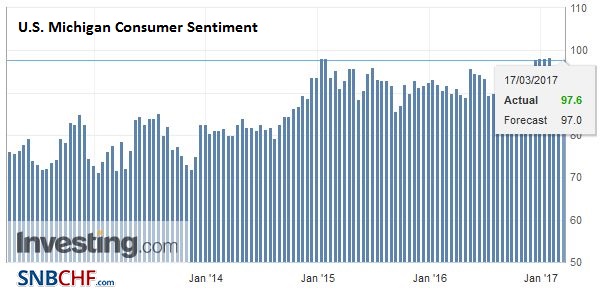

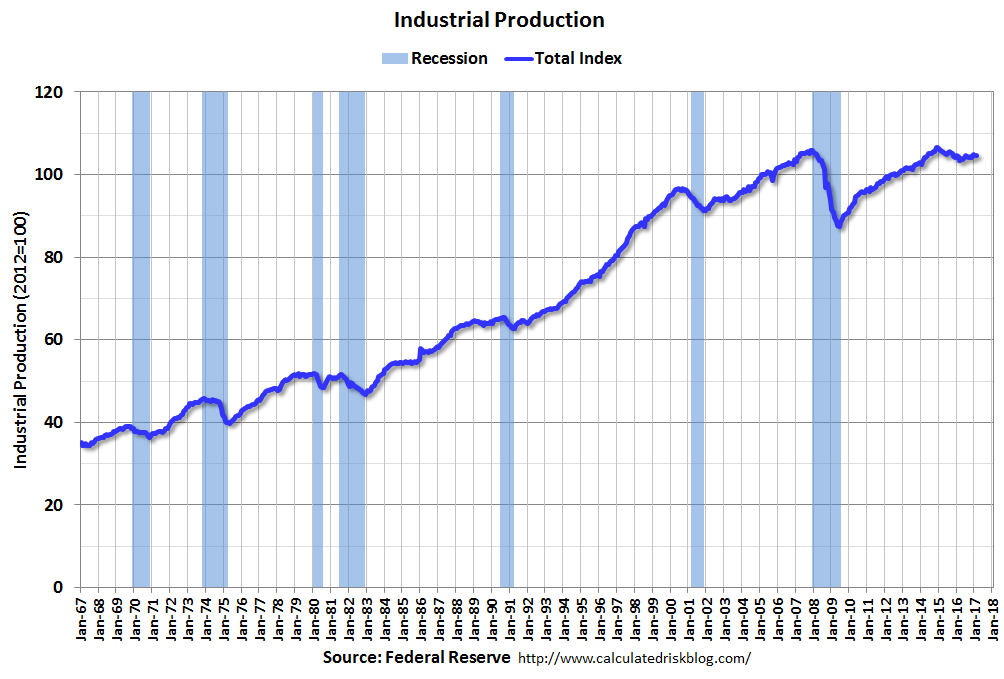

United StatesThe US reports industrial production and manufacturing output. The former is to bounce back after a 0.3% decline in January. Manufacturing employment rose more than expected (28k, matching January 2015 high, which itself was the highest since August 2013). The median from the Bloomberg survey is for a 0.5% rise in manufacturing output. The University of Michigan reports consumer sentiment and inflation expectations. The Conference Board reports February leading economic indicators. The LEI averaged 0.2% increase a month in 2016. The average over the past three months has doubled that, and it will rise further if it rises another 0.5% today. |

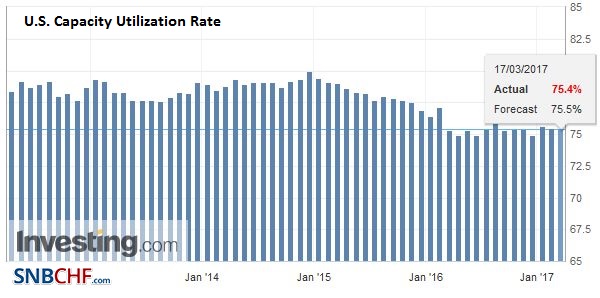

U.S. Capacity Utilization Rate, February 2017(see more posts on U.S. Capacity Utilization, ) The capacity utilization in manufacturing is still an important indicator for Fed rate hikes. Given that it is falling, rate hikes should be far. But the economy is moving towards services and this barometer is losing its importance. Source: Investing.com - Click to enlarge |

U.S. Industrial Production, February 2017(see more posts on U.S. Industrial Production, ) Source: macro.economicblogs.org - Click to enlarge |

|

| Still, remember that Q1 growth in the US has been notoriously poor since the crisis and has not a material impact on subsequent performance. Specifically, Q1 GDP has averaged 1.04% since 2010. The other quarters average 2.5% (2.5% Q2, 2.7% Q3 and 2.3% Q4). The Atlanta Fed GDPtracker is estimating 0.9% for Q1 17, and estimate we suspect will be raised as the US consumption is not as weak as the early data suggests. |

. |

Graphs and additional information on Swiss Franc by the snbchf team.

Full story here Are you the author? Previous post See more for Next postTags: #USD,Bank of England,ECB,EUR/CHF,Eurozone Trade Balance,gbp-chf,Germany,newslettersent,U.S. Capacity Utilization,U.S. Industrial Production,U.S. Michigan Consumer Sentiment