| Right now there are two conventional propositions behind the “reflation” trade, and in many ways both are highly related if not fully intertwined. The first is that interest rates have nowhere to go but up. The Fed is raising rates again and seems more confident in doing more this year than it wanted to last year. With nominal rates already rising in the last half of 2016, and with more (surveyed) optimism than even 2014, it may at times seem the path of least resistance.

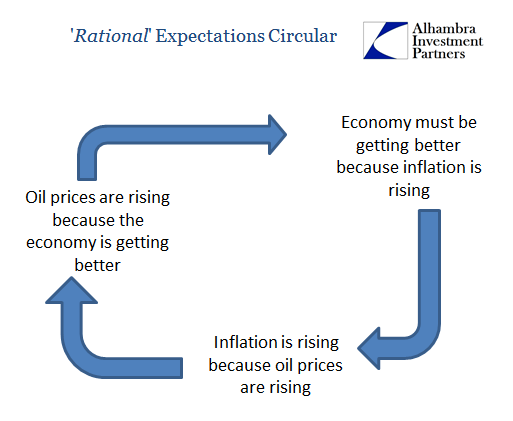

Interest rates reflect among other things inflation expectations as well as those for nominal growth. Inflation, at least as measured by imperfect statistics, has been all but captured by oil prices. That leads to the second mainstream proposition, where oil prices like interest rates have nowhere to go but up. The OPEC production cuts that do seem to be holding so far only enhance that view, where many believe there is now a hard floor under oil. Together with what reflation might propose economically, and therefore the demand side for oil, the path of least resistance also appears to be upward. It is difficult, however, not to notice some circular logic in these relationships and the assumptions that are predicated upon them. In other words, interest rates are going to rise because the economy is getting better, the economy is getting better because inflation is rising, and inflation is rising because oil prices are, and oil prices are because the economy is getting better. |

Oil Prices Oil Inflation Economy Circular |

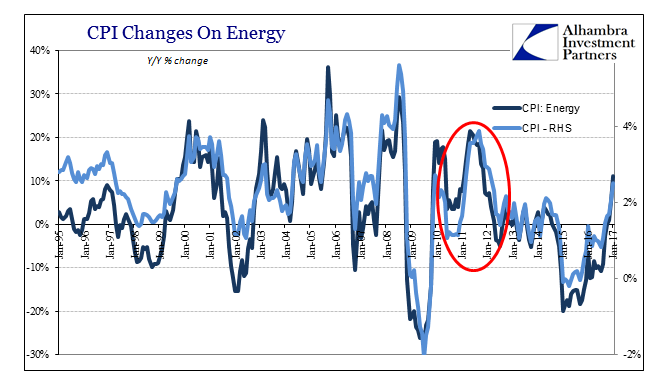

| With the lowest prices for WTI right now entering the base comparisons for annual price change measurements, the contribution of oil prices to inflation is nearing its maximum. Since acceleration in the CPI is dependent almost exclusively on changes in oil prices, that makes part of the “logic” tautological and therefore no actual help in corroboration. |

CPI Changes On Energy Jan 1995 - Jan 2017 |

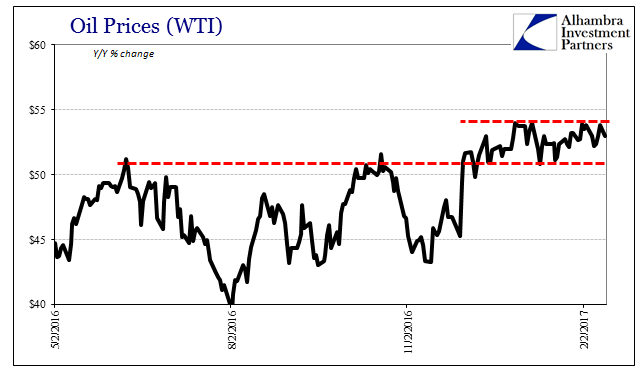

| Stepping aside all this, however, it is somewhat surprising that oil prices are not a great deal higher than they are given all that seems to be in favor of “reflation” in at least the oil part of the equation. Yet, WTI (spot) is still less than half of its 2014 peak, and for the past two months has remained stuck in a narrow range. |

Oil Prices WTI, 2011 - 2017(see more posts on oil prices, ) |

| Part of the answer for that is certainly inventory, where record high levels for this time of year continue to note caution over any possible equalization between supply and demand. Even if production were to hold at these levels (it isn’t, it is rising again domestically), demand would have to rise relatively quickly in order to start working down sufficiently those huge stores (and possibly more that may be “hidden” out in the rest of the world). |

Oil Prices WTI, May 2016 - Feb 2017(see more posts on oil prices, ) |

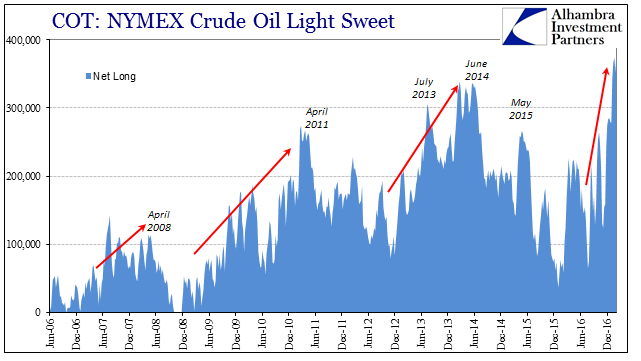

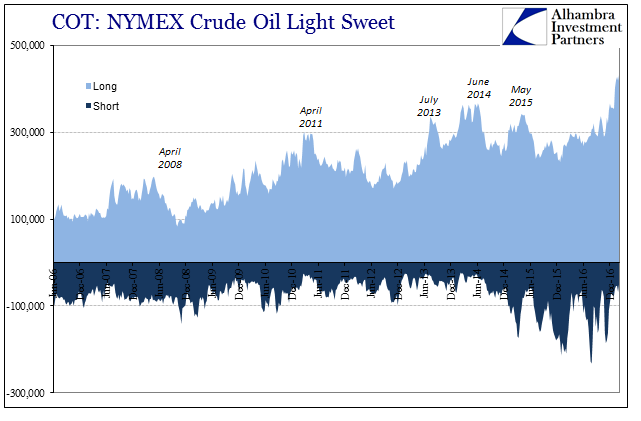

| Oil traders, however, seem supremely confident that is all going to happen, meaning that once again this all boils down to assumptions about the validity of “reflation” in macro terms. We know this because the Commitment of Traders (COT) report shows a record net long position for oil futures. |

Crude Oil Light Sweet, Jun 2006 - Dec 2016(see more posts on Crude Oil, ) |

| Part of the reason for that record is not just those jumping long side but also because there are practically no shorts right now. It is hugely one-sided.

This should be puzzling as well as alarming for oil bulls, and therefore “reflation” as a market phenomenon. How could it be that oil prices have traded in such a narrow and relatively low range all the while the futures market for it has gone completely all in on the macro story? Furthermore, the track record of futures investors doing so in the past actually repels credibility. The last time traders were this long was the middle of 2014 – right before the oil crash. And that was with oil prices (WTI) already above $105 a barrel! What were they betting on? The answer is an easy one, as they were clearly positioned for Janet Yellen being right. The oil “supply glut” was already in play at that time, yet nobody wanted to be short and everyone wanted to be long anyway. It was easy to set aside production, ignore the “dollar”, and embrace instead the unemployment rate. |

COT: NYMEX Crude Oil Light Sweet, Jan 2006 - Dec 2016 |

It was nothing more than a repeat of all the other “reflation” episodes, both 2011 as well as the one that mystifyingly developed through to early 2008 on the great myths of Federal Reserve capacity and capability just before they were put to the test. Traders clearly like the mainstream economic story, apparently having learned little from each time it fails.They did not learn nothing, however, as that is very likely why oil prices are stuck around $53. Traders are all long oil, but not at great depth of price; they can’t be given its physical dimensions even though they clearly want to believe it all over again. That baseline case as well as the extreme one-sided nature of the futures market suggests that there isn’t a floor under oil prices but rather a ceiling over them. Everyone wants to believe in reflation if not actual recovery. Maybe one of these times it will be those, though a solid $53 as well as the “logic” behind the one-sided trade is not the greatest platform for inspiring more than hope.

Tags: Commitment of Traders,Crude Oil,currencies,demand,economy,Federal Reserve/Monetary Policy,Futures market,Inventory,Markets,newslettersent,OIL,oil prices,recession,recovery,Reflation,supply,WTI