| – Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies – Gold surges 31.5% in British pounds after Brexit shock – Gold acted as hedge and safe haven in 2016 … for those who need safe haven – Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war and cyber war – Outlook for gold good during Trump Presidency (2017 to 2020) |

Gold Price Performance |

|

Gold was the best performing currency in 2016, rising as it did in all major currencies. It again performed the function as a hedge against currency devaluation and this was seen particularly in sterling terms with gold rising 31.5% in British pounds after the Brexit shock. |

Gold Chart in USD |

|

UK investors and savers who had an allocation to gold protected their wealth from the Brexit debacle and the sharp falls in sterling seen in its aftermath. Gold rose over £220 per ounce and acted as a classic safe haven for investors exposed to the pound, and markets and assets denominated in British pounds. |

Gold Chart in GBP |

|

The gains in euro terms were more modest but robust. The gains seen are likely due to the continuing massive ECB money printing and debt monetisation programme and heightened risk of contagion in the Eurozone. Brexit and the elections in France, Germany and Holland will support gold in euro terms in 2017 and there is the possibility of sharp gains in euro terms should the Eurozone debt crisis return. |

Gold Chart in EUR Gold in EUR in 2016 What drivers will gold respond to in 2017? Italian, Greek, Irish, Spanish and other banks and risk of bail-ins Dutch, German, French elections ... Eurozone contagion Continuing ultra loose monetary policies by Fed, BOE, BOJ and especially ECB Trump policies and tweets ... Geo-politics, cyber war & terrorism, conventional war & terrorism - Click to enlarge |

|

President Trump has already shown himself as a man who likes to tweet and knows the power of the short sound bite and the medium that is Twitter. His skill in this regard was one of the factors which helped him become President. However, this asset may become a liability for him and for markets when he becomes President. The art of diplomacy will become more important and 140 characters of unfiltered Trump is likely to create tensions with America’s largest trading partners such as China. This has been seen with China recently and his accusation that China “stole” the U.S. drone on Twitter. It has already impacted markets as seen when he tweeted about Boeing and Boeing shares fell sharply. Should he continue in this vein, it could lead to jitters in markets and a safe haven bid for gold in the event of ‘inflammatory’, tension creating and damaging tweets. His capacity to comment without fully understanding all the facts may be his ‘Achilles heal’ in this regard. Overnight Trump’s tweet regarding Toyota saw the Japanese car maker lose $1.2 billion in value in five minutes. Shares plummeted after the president-elect vowed in a tweet to stop the car manufacturer from moving abroad. Stocks, bonds and property markets have performed very well in recent years. However, there gains are artificial and are based on near zero percent interest rate policies and from being bloated by monetary stimulus on a scale that the world has never seen before. These bubble like conditions look increasingly vulnerable and will likely burst – the question is when rather than if. Indeed, the turmoil that we have seen on international markets in 2016 appears a foretaste of a very volatile 2017. We continue to see conditions akin to those seen in 2007 and 2008. Many leading experts have echoed these concerns. Geopolitical risk intensified in 2016 with Brexit, the Italian referendum and of course the election of Trump. The risk of terrorism and war remain ever present and gold will continue to act as an important hedge against geopolitical risk. The risk of contagion in the EU – both political and financial and monetary now looms large. Today there is the added risk of bail-ins and deposit confiscation which will be see savings and capital confiscated from savers and companies in the next financial crisis. |

|

|

Gold and Silver Bullion – News and Commentary Gold Traders Most Bullish Since 2015 on New Year Concerns (Bloomberg.com) Gold holds near 1-month highs ahead of U.S. jobs data (Reuters.com) Gold at four-week high, palladium set for 9.2 pct weekly rise (Reuters.com) Yuan Slides, Dollar Steadies as Europe Stocks Drop: Markets Wrap (Bloomberg.com) 2017 American Eagle Now Available at Bullion Exchanges (CoinWeek.com) |

Gold vs Treasury Yield Percent |

|

Gold Technically Oversold, Ready For Price Reversal (Forbes.com) Own gold because Fed can’t figure out Trump (MarketWatch.com) JPM’s gold buy hints at changes in world financial system (AveryBGoodMan.com) China Can’t Quit the Dollar – Yet (Bloomberg.com) Rally or Crash? Bitcoin Buyers Are Nervous About China (Bloomberg.com) |

Conclusion

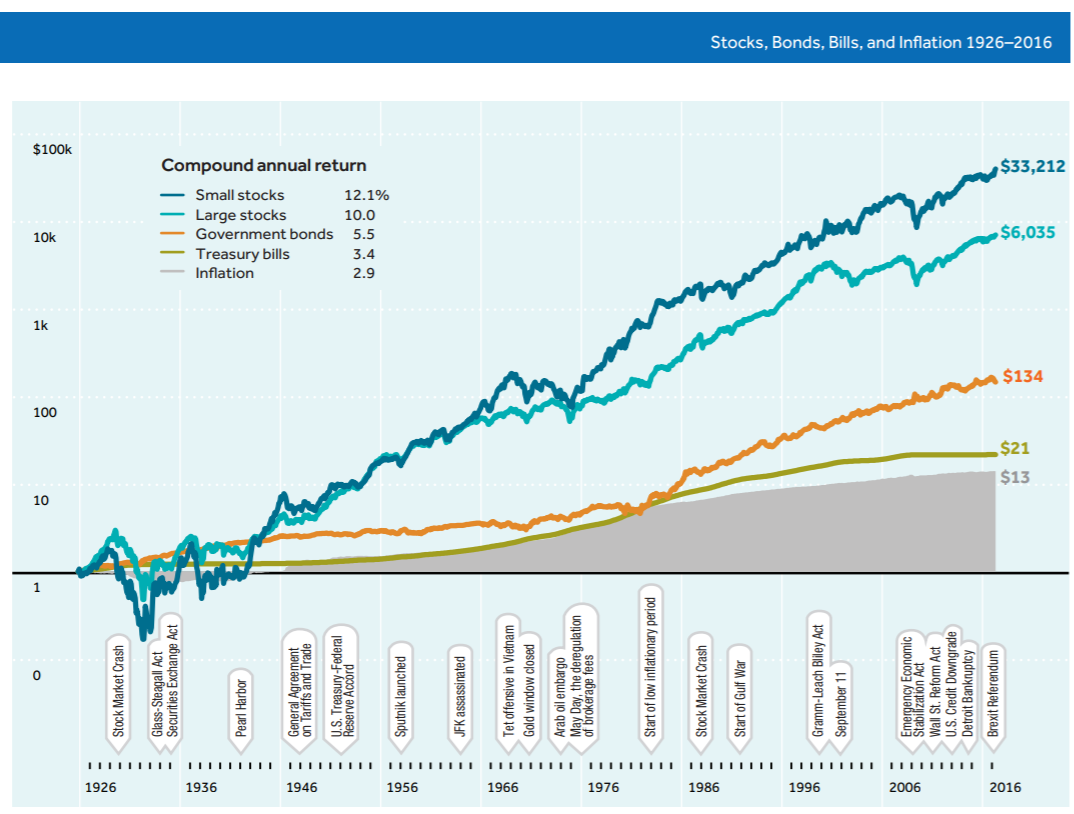

It is worth remembering – as many seem to have forgotten – that gold was one of the few assets to rise in the financial crash of 2008 and in the debt crisis in the 2007 to 2012 period. It has under performed since as stocks and bonds roared to artificially induced record highs.

The strong performance of gold in all currencies including the very strong dollar in 2016 bodes well for 2017.

It is due a period of out performance and we believe it will outperform other assets in the coming Trump Presidency years from 2017 to 2020.

KNOWLEDGE IS POWER

For your perusal, below are in order of downloads our most popular guides in 2016:

10 Important Points To Consider Before You Buy Gold

7 Real Risks To Your Gold Ownership

Essential Guide To Storing Gold In Switzerland

Essential Guide To Storing Gold In Singapore

Essential Guide to Tax Free Gold Sovereigns

Please share our research with family, friends and colleagues who you think would benefit from being informed by it.

Thank you and wishing you a healthy and fulfilling 2017

Gold Prices (LBMA AM)

06 Jan: USD 1,178.00, GBP 951.35 & EUR 1,112.27 per ounce

05 Jan: USD 1,173.05, GBP 953.55 & EUR 1,116.16 per ounce

04 Jan: USD 1,165.90, GBP 949.98 & EUR 1,117.40 per ounce

03 Jan: USD 1,148.65, GBP 935.12 & EUR 1,103.28 per ounce

30 Dec: USD 1,159.10, GBP 942.58 & EUR 1,098.36 per ounce

29 Dec: USD 1,146.80, GBP 935.56 & EUR 1,094.85 per ounce

28 Dec: USD 1,139.75, GBP 931.29 & EUR 1,091.88 per ounce

Silver Prices (LBMA)

06 Jan: USD 16.45, GBP 13.30 & EUR 15.54 per ounce

05 Jan: USD 16.59, GBP 13.47 & EUR 15.80 per ounce

04 Jan: USD 16.42, GBP 13.36 & EUR 15.74 per ounce

03 Jan: USD 15.95, GBP 12.97 & EUR 15.34 per ounce

30 Dec: USD 16.24, GBP 13.20 & EUR 15.38 per ounce

29 Dec: USD 16.06, GBP 13.10 & EUR 15.36 per ounce

28 Dec: USD 15.85, GBP 12.96 & EUR 15.22 per ounce

Recent Market Updates

– Trump’s Twitter “140 Characters” To Push Gold To $1,600/oz in 2017?

– 2017 – The Year of Banana Skin

– US: Five Must Gold See Charts – Gold Miners Are “Running Out” of Gold

– Royal Mint And CME Make A Mint On The Blockchain?

– China Gold and Precious Metals Summit 2016 – GoldCore Presentation

– Trumpenstein ! Who Created Him and Why?

– Bail-Ins Coming? World’s Oldest Bank “Survival Rests On Savers”

– Fed’s “Fool Me…”, Silver Suppression, Euro Contagion In 2017?

– Fed Raised Rates 0.25% – Rising Rates Positive For Gold

– Shariah Gold Standard Is “Revolutionary” – Mobius

– Silver Fixing By Banks Proven In Traders Chats

– Euro Crisis and Contagion Coming In 2017

– ECB ‘Bazooka’ Reloaded Until At Least December 2017 – Euro Gold Rises 1%; 13% YTD

Tags: $CAD,Bank of England,Bank of Japan,Bitcoin,Business,China,economy,Economy of the European Union,Euro,European central bank,European Union,Eurozone,Finance,France,Germany,Gold as an investment,Hedge,International trade,investment,Japanese yen,money,newslettersent,Precious Metals,Reuters,Sovereigns,Switzerland,Twitter,US Federal Reserve,yuan