See the introduction and the video for the terms gold basis, co-basis, backwardation and contango.

A Plethora of ReasonsWe’ve gone through a succession of events and processes that were supposed to make gold go up. The following list is by no means exhaustive:

We knew it! The darn thing is simply too heavy to go up! But it is going to get a boost now, because the vast majority of mainstream analysts who turned bullish as the rally earlier this year was close to ending have turned bearish by now…[PT] Each has been good for a little blip that has been forgotten in the noise. We are seeing articles now that have moved on to the next old-new story. It seems that Trump is going to spend a lot on infrastructure. This will require massive deficits. But the market will distrust that the government can pay. So we will see a twin sell-off of the US dollar in terms of other currencies, and Treasury bonds in terms of dollars. This will cause the masses to discover gold and the gold price is going to skyrocket. Click here to buy our fine gold, we have the very best gold. We get it. Everyone thinks that interest rates are going up because inflation because more spending. Actually not quite everyone — our view is that the drivers which have caused interest rates to fall for 35 years are still in full, deadly effect. Nor are the folks who are bidding on junk bonds, or stocks for that matter. But most everyone. Rates have to go up, because they’re lower than ever before in history. Right? And if rates are going up, then so is gold, right? The Treasury bond is payable only in US dollars. The US dollar, which is a liability of the Federal Reserve, is backed by treasuries. It’s a nice little check-kiting scheme. But besides that, the two instruments have the same risks. If you don’t like the bond, then you won’t like the dollar either. The day will come when, the market decides en masse it doesn’t like either of them, and gold will be the only acceptable money. With due respect to our old friend Aragorn, today is not that day! We believe interest rates are headed lower, not higher. But that said, we do not see any particular causal relationship between interest rates and the price of gold. The former is the spread between the Fed’s undefined asset and its undefined liability. It is unhinged and while it could shoot to the moon from Truman through Carter, it’s sailing in the other direction now. Down to Hell. The price of gold is the exchange rate between the Fed’s liability and the metal. So long as people strive to get more dollars — most especially including those who bet on the price of gold, and those who write letters encouraging the bettors — there is no reason for this exchange rate to explode. Again, to plagiarize the Ranger from the North, the day will come when gold goes into permanent backwardation. But today is not that day! |

|

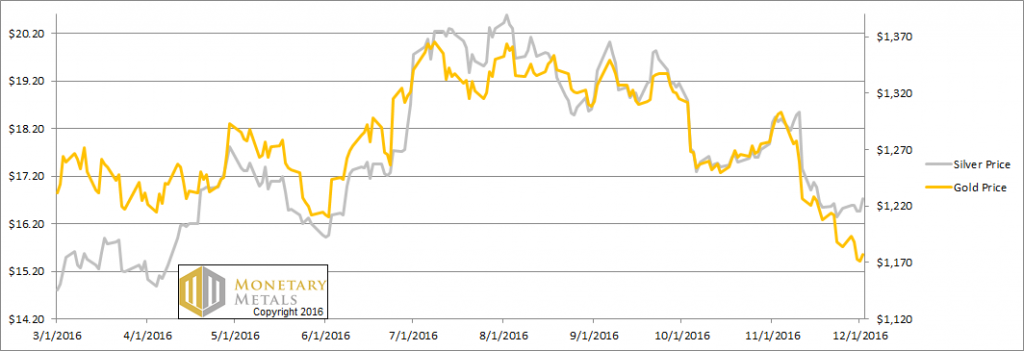

Fundamental DevelopmentsAt the close on Friday, the price of gold is was down seven Federal Reserve Notes from where it was a week ago. So where to from here? Are those dratted fundamentals moving? We will update those fundamentals below. But first, here’s the graph of the metals’ prices. |

Gold and Silver prices(see more posts on Gold and silver prices, ) |

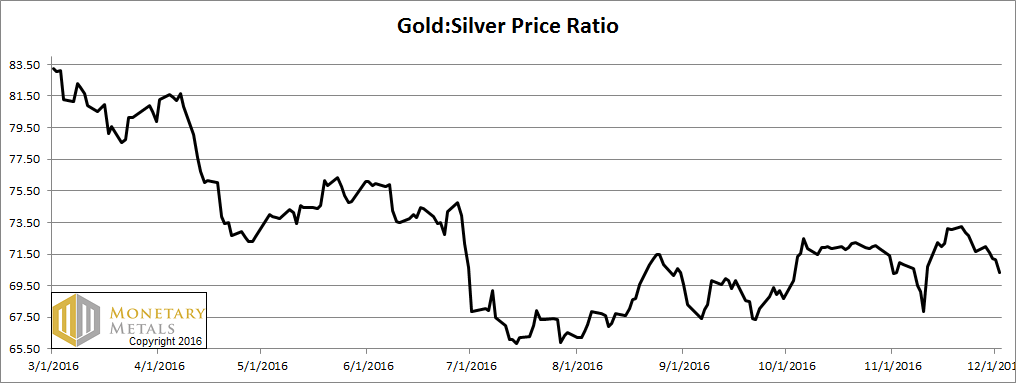

Gold:Silver Price RatioNext, this is a graph of the gold price measured in silver, otherwise known as the gold to silver ratio. It fell a bit more this week. |

Gold:Silver Price Ratio(see more posts on gold silver ratio, ) |

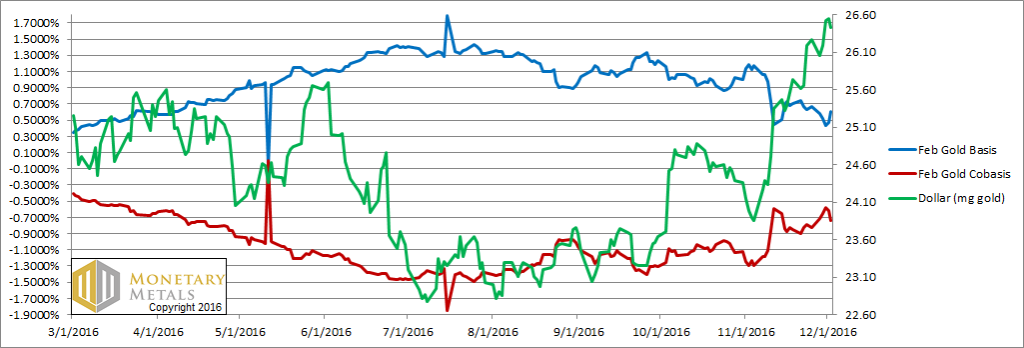

Gold Basis and Co-basis and the Dollar PriceHere is the gold graph. The price of gold fell (i.e. the price of the dollar rose, green line), and the basis (abundance) fell and co-basis (scarcity) rose just a bit. Our calculated fundamental price of gold fell about ten bucks, now about $1,200 even. |

Gold basis and co-basis and the dollar price(see more posts on dollar price, gold basis, Gold co-basis, ) |

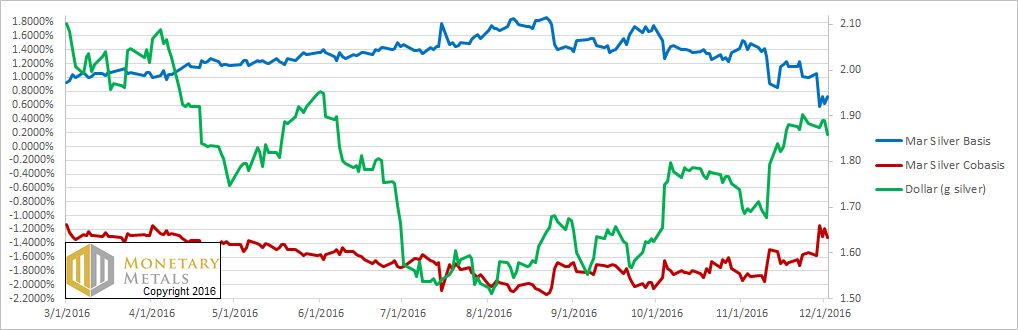

Silver Basis and Co-basis and the Dollar PriceNow let’s look at silver. In silver, we see a 14-cent rise in price but the co-basis is up. The fundamentals got ever-so-slightly tighter. And our calculated fundamental price moved up to just under $15. We note that speculators bid silver up on Friday evening (Arizona time) in the wake of the Italian vote, some 30 cents to just under $17. But as of this publication, they couldn’t hold the line and the price fell back and is now below Friday’s close. |

Silver basis and co-basis and the dollar price(see more posts on dollar price, silver basis, Silver co-basis, ) |

Charts by: Monetary Metals

Full story here Are you the author? Previous post See more for Next postTags: dollar price,Gold and silver prices,gold basis,Gold co-basis,gold silver ratio,newslettersent,Precious Metals,silver basis,Silver co-basis

1 comments

Vlad

2016-12-21 at 19:46 (UTC 2) Link to this comment

Dear Keith,

What do you know about the new restrictions on gold purchases imposed by Swiss banks? It turns out that over night banks will only sell gold to bank account holders and even then it requires substantial registration and a maximum threshold of 5’000 CHF (about 125g). The only players left on the market are the coin shops that still sell coins and bullion, but that will probably be phased out as well. If this doesn’t sound like a few banks declaring major losses and demanding bail ins I don’t know what does.

Do you know the name of the specific legislation ? I think it kicked in on November 15th.

Cheers