Monthly Archive: December 2016

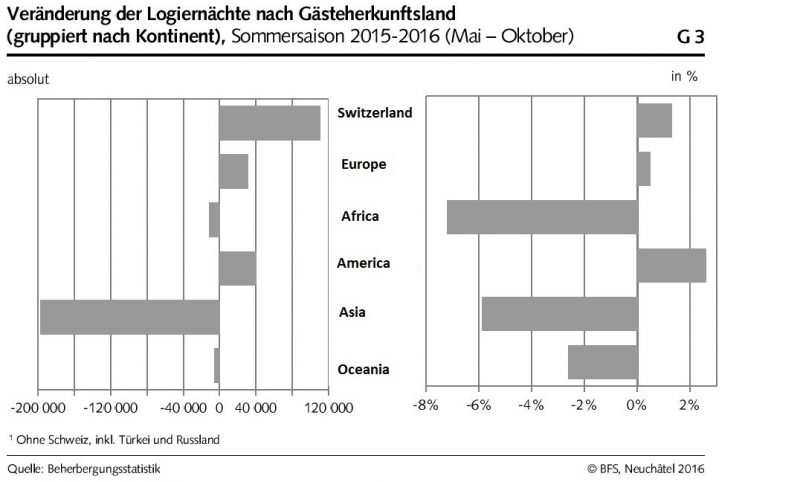

Swiss Tourism this Summer: More Swiss Guests, Less Asian Guests

In the summer months, the Swiss hotels registered more guests from Switzerland. from the United States and from Europe. But there was a sharp decline of guest from Asia.

100'000 more overnight stays from Switzerland could not recover the decrease of 200'000. One important reason for decline is the weakening Chinese currency, that reduced their purchasing power, in dollar but also in CHF.

Read More »

Read More »

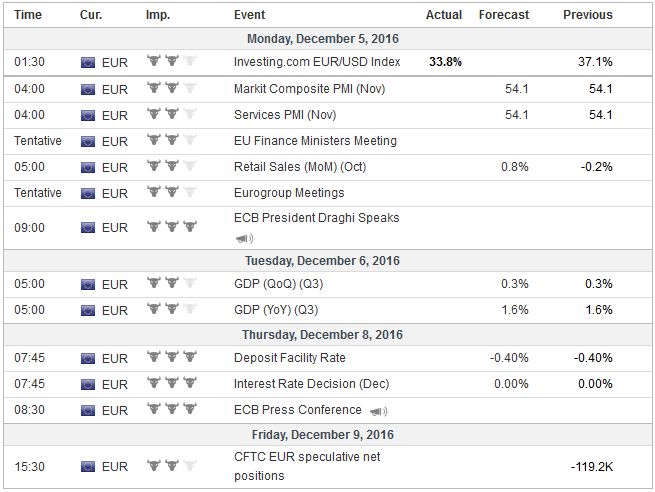

FX Weekly Preview: Focus Shifts toward Europe

US developments have driven the dollar rally and bond market decline over the past three weeks. Attention shifts to European politics and the ECB meeting. Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

Read More »

Read More »

Emerging Markets: Preview of the Week Ahead

EM remains a mixed bag. Despite the negative connotations of a rising US rate environment, EM gathered an element of stability last week as the dollar consolidated its recent gains. Rising commodity prices are also helping EM at the margin, with RUB and COP amongst the best last week on higher oil and CLP on higher copper.

Read More »

Read More »

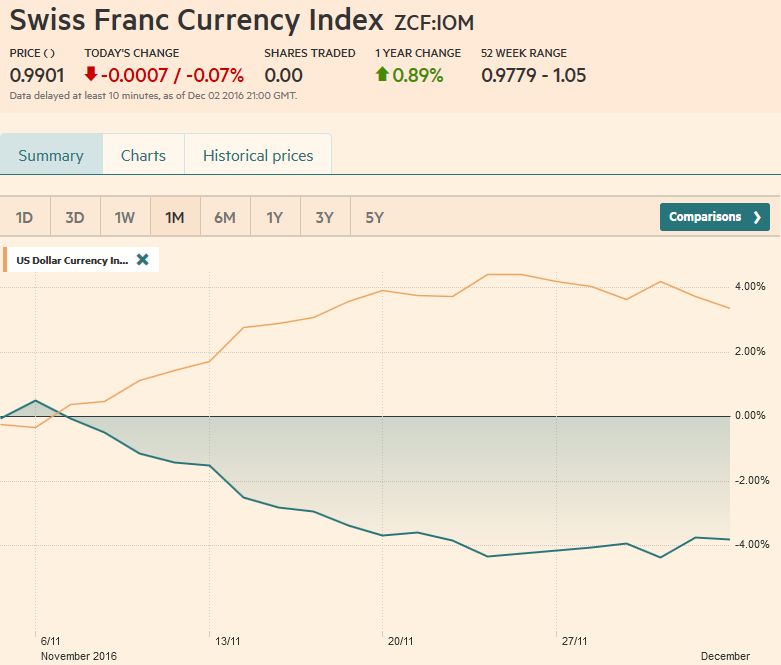

FX Weekly Review, November 28 – December 02: CHF Index still at its 4% loss since U.S. Elections

The Swiss Franc index continued around its 4% loss since the U.S. elections, while the US Dollar index had a 4% increase. The focus shifts to the ECB meeting, where participants are wary of a "hawkish ease".

Read More »

Read More »

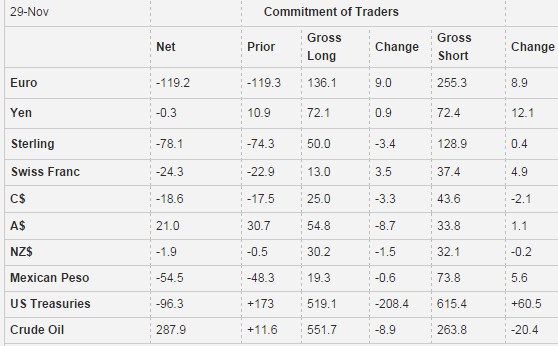

Weekly Speculative Positions: Short CHF Are Increasing

The net short CHF speculative position is close to reaching new records. Shortly before the end of the peg, speculators were net short CHF by 26K contracts. Now we are at 24.3K.

Read More »

Read More »

The War On Cash Is Happening Faster Than We Could Have Imagined

It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos.

Read More »

Read More »

Sunrise beats Swisscom on mobile network coverage

After seven years on top, Swisscom has been beaten by Sunrise. The German telecommunications expert and magazine publisher, connect.de and its partner P3, travelled roughly 7,000 km by car around Switzerland testing Swiss mobile networks. Tests were also made while walking and on trains. The results were published on Tuesday.

Read More »

Read More »

Gold Price Skyrockets in India after Currency Ban – Part IV

The Indian Prime Minister announced on 8th November 2016 that Rs 500 and Rs 1,000 banknotes would no longer be legal tender. Linked are Part-I, Part-II and Part-III updates on the rapidly encroaching police state. The economic and social mess that Modi has created is unprecedented. It will go down in history as an epitome of naivety and arrogance due to Modi’s self-centered desire to increase tax-collection at any cost.

Read More »

Read More »

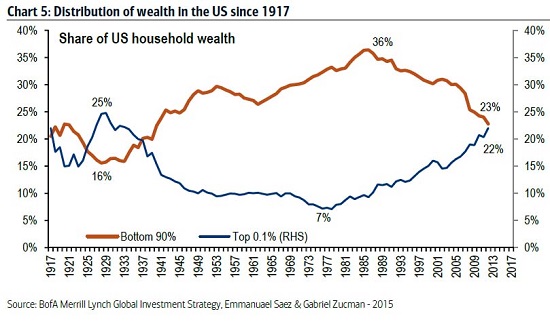

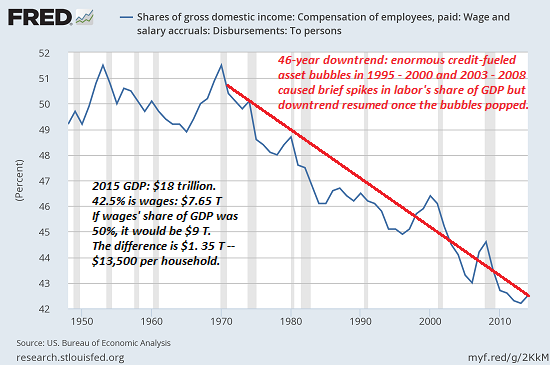

Beyond Income Inequality

Judging by the mainstream media, the most pressing problems facing capitalism are 1) income inequality, the basis of Thomas Piketty’s bestseller Capital in the Twenty First Century, and 2) the failure of laissez-faire markets to regulate their excesses, a common critique encapsulated by Paul Craig Roberts’ recent book and 2) the failure of laissez-faire markets to regulate their excesses, a common critique encapsulated by Paul Craig Roberts’ recent...

Read More »

Read More »

Attaining Self-Destruct Velocity

Some Monday mornings are better than others. Others are worse than some. For one Amazon employee, this past Monday morning was particularly bad. No doubt, the poor fellow would have been better off he’d called in sick to work. Such a simple decision would have saved him from extreme agony. But, unfortunately, he showed up at Amazon’s Seattle headquarters and put on a public and painful display of madness.

Read More »

Read More »

What Would Make This Dollar Bull Nervous

USD had a large rally in November. We had been looking for a short and shallow pullback. Here are thoughts about what would signal an outright correction.

Read More »

Read More »

FX Daily, December 02: Is it About US Jobs Today?

The capital markets are finishing the week amid speculation that the driving forces of the past three weeks are ebbing. Global equities and the dollar may be snapping three-week advances. The issue is whether it is a consolidation or trend change. The former is a more prudent assumption until proven otherwise. As a rough and ready signal, the 100.60 level in the Dollar Index, which corresponds to the lows November 22 and November 28 is reasonable.

Read More »

Read More »

Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. The unemployment rate dropped to 4.6%, the lowest since 2007.

Read More »

Read More »

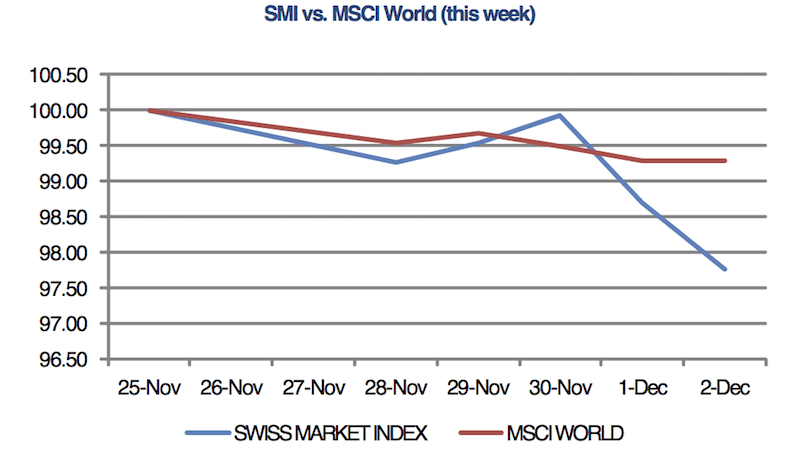

Swiss stock market awaits result of Italian referendum

Investors appear to be staying on the sidelines this week ahead of the weekend’s Italian referendum. Swiss stocks are set to finish the week lower, underperforming global equities as food giant Nestle and pharmaceutical heavyweights Roche and Novartis drag the index down. It’s been a volatile trading week across financial markets. Oil prices jumped almost 9% on Wednesday after OPEC members finally agreed a deal to cut production while upbeat US...

Read More »

Read More »

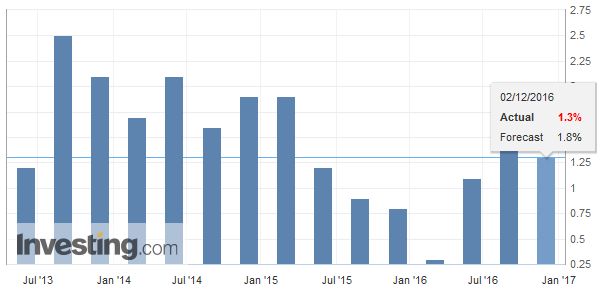

Swiss Q3 GDP: +0.0 percent QoQ, +1.3 percent YoY

Switzerland's real gross domestic product (GDP) has remained almost unchanged in the 3rd quarter of 2016 (+0.0%). Consumption was nearly stagnated, while net exports had a decline. But investments increased by 0.5% on the quarter.

Read More »

Read More »

Cool Video: Bloomberg TV-Italy and Austria this Weekend

I was on Bloomberg Television with Joe Wisenthal this afternoon. I explain what I have been suggesting for the past couple of weeks, namely that the Austrian presidential election this weekend is the third point in the populist-nationalist wave, not Italy.

Read More »

Read More »

FX Daily, December 01: Dollar is on the Defensive, though Yields Rise

The US dollar is trading heavily against most of the major currencies, but the general tone appears consolidative in nature. Despite a disappointing UK manufacturing PMI (53.4, a four-month low), sterling is near a three-week high above $1.2600.

Read More »

Read More »

Six Narratives on the Ascendancy of Trump

A remarkably diverse array of "explanations" of Donald Trump's presidential election victory have been aired, representing both the conventional political spectrum and well beyond.

Read More »

Read More »

Brexit Minister Sends Sterling Higher

UK could pay for single market access. UK's position still seems fluid. The Supreme Court will hear the government's appeal next week.

Read More »

Read More »

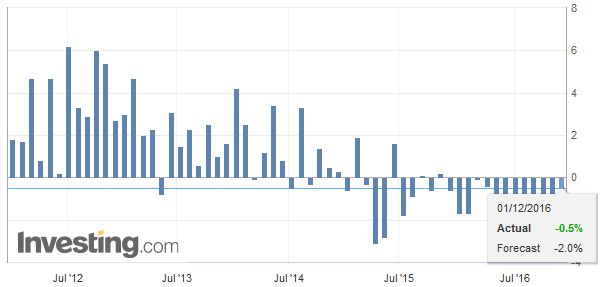

Swiss Retail Sales -0.9 percent nominal (YoY) and 1.3 percent real (YoY)

Turnover in the retail sector fell by 0.9% in nominal terms in October 2016 compared with the previous year. This decline has been ongoing since January 2015. Seasonally adjusted, nominal turnover rose by 1.3% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO).

Read More »

Read More »