Bad MondaySome Monday mornings are better than others. Others are worse than some. For one Amazon employee, this past Monday morning was particularly bad. No doubt, the poor fellow would have been better off he’d called in sick to work. Such a simple decision would have saved him from extreme agony. But, unfortunately, he showed up at Amazon’s Seattle headquarters and put on a public and painful display of madness. From what we gather, upon arrival, he blasted out an email to hundreds of coworkers, including Chief Executive Officer Jeff Bezos, outlining several reservations he had with the terms of his “Performance Improvement Plan”. After that, he executed a flawless swan dive off Amazon’s 12-story Apollo building, presumably to his death. Yet, somehow, he didn’t die. He lived. What now? Quite frankly, we don’t quite know what this has to do with the economy by and large. But we have an inkling there may be some relevance. Perhaps it has something to do with an economy that is approaching self-destruct velocity, where every action has a far more negative reaction. |

Good-bye cruel world! On this our planet, ignoring air friction, wind and other buoyancy-enhancing obstacles for the sake of this example, someone jumping off a building that is high enough will eventually attain a terminal velocity of 122 miles per hour. The acceleration is 32.2 feet per second², which is why one has to start from an appropriate height (a skydiver in a spread-eagle position will typically reach terminal velocity after about 12 seconds, traversing a distance of 1,483 feet). Jumping without a parachute may provide an especially pronounced adrenaline high, but is generally not advisable; more often than not it will be a one-off experience. |

Trump!President-elect Donald Trump was blessed with a stout sounding last name. An onomatopoeia, of sorts. Various synonyms for Trump include winner, decider, trump card, outdo, undermine, outmaneuver, outplay, surpass, beat, go one better, and the like. Throughout his life, Trump has always lived up to his name. As a reality TV star, for example, the stout man with a stout name made millions of dollars telling people, “You’re fired!” People loved it. They couldn’t get enough of it. |

The Donald fires people left and right… |

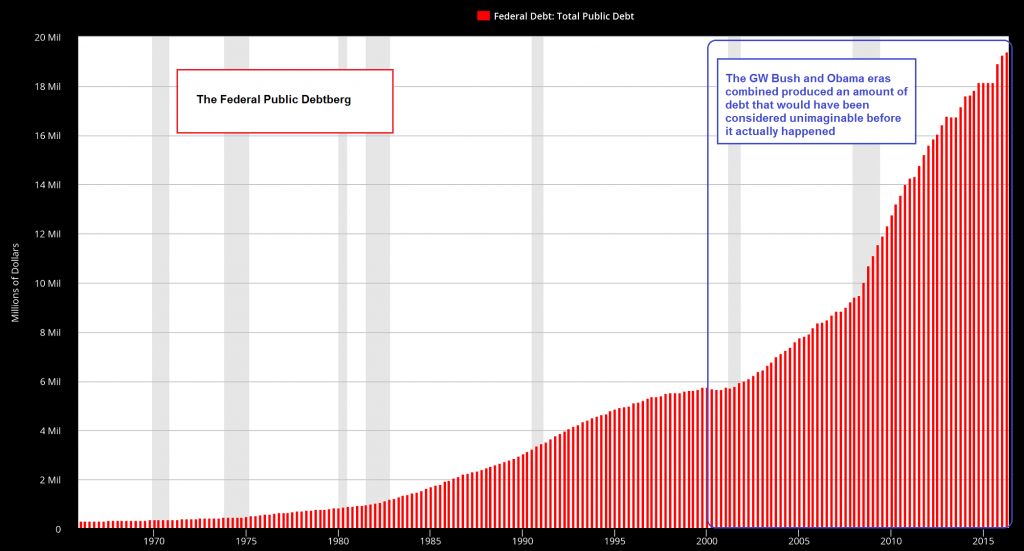

| However, as President, Trump will inherit a steaming hot pile from his predecessors. After a combined 16 years of George Dubya and Barry Big Ears, the U.S. National Debt has jumped from approximately $5.5 trillion to about $20 trillion. That amounts to a 363 percent increase.

|

Federal Debtberg The Federal debtberg in all its glory. What seems “normal” now was considered unimaginable when GW Bush’s reign began. At the time, some people were actually worried that we would “run out” of treasury bonds, just because debt growth had flattened for a while under Clinton – which was primarily a bubble artifact. - Click to enlarge |

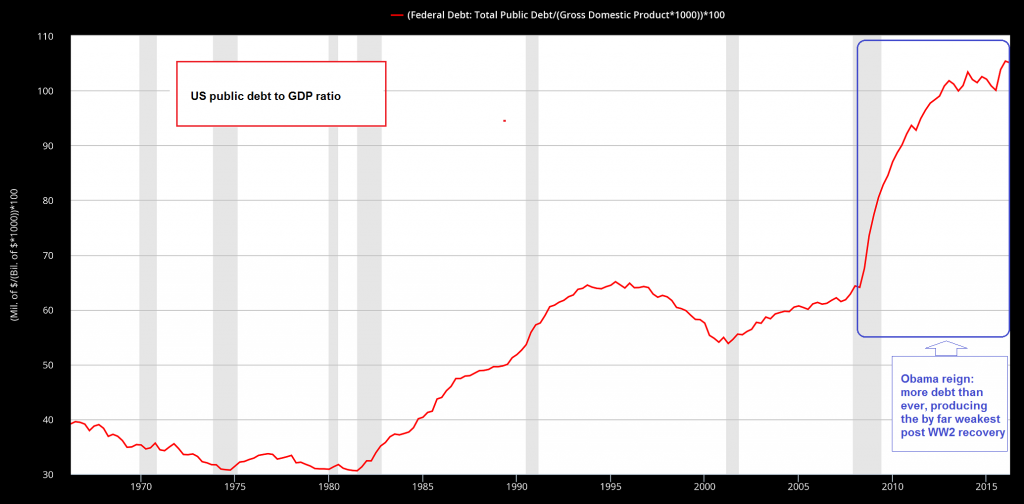

| Yet, over this same time, U.S. GDP has only increased roughly 77 percent from about $10.5 trillion to about $18.6 trillion. In other words, debt is increasing 4.7 times faster than GDP. Similarly, the percentage of debt to GDP has more than doubled from about 52 percent to over 107 percent.

As President, part of Trump’s stated vision is to “create a dynamic booming economy that will create 25 million new jobs over the next decade.” To do this, Trump intends to run massive deficits. To finance the massive deficits, Treasury Secretary nominee Steven Mnuchin may have to issue 100 Year Treasury notes. But what if this just accelerates the trend of rapid debt growth and lethargic GDP growth? Wouldn’t that, in a sense, be a policy of economic self-destruction? |

US Public Debt to GDP Ratio US public debt to GDP ratio. The level it has now reached has historically been highly inimical to economic growth, not least because the much poo-pooed “Ricardo effect” is very likely quite real. We are referring to the idea that once government debt grows beyond a certain threshold, people in general, but especially entrepreneurs and capitalists, will take fewer risks and be more concerned with wealth preservation than wealth creation – for the simple reason that they all know the government will eventually have to get the money to pay for this debt from somewhere. Obviously, the entire citizenry will be in its cross-hairs – whether by taxation, debt default or inflation, the money will be forcibly taken. Prior to the advent of the modern welfare/warfare State, this was colloquially referred to as “theft”. - Click to enlarge |

Attaining Self-Destruct VelocityOne popular literary device of headline editors across the western world of late is to fuse the name Trump with another word. Just this week, for instance, we discovered that Bernie Sanders – the socialist with a grumpy face – is an expert on Trumpism. We also learned about the effects of Trumpflation and Trumpnado on the bond market. Here Forbes clarifies the landscape with unequivocal certainty:

Since the election, the approach to selling Treasuries has been to sell them. Hence, yields have gone up, prices have come down. For example, since the election the yield on the 10 Year Treasury note has risen from 1.86 percent to 2.44 percent. |

US Treasury Yield Index |

Of course, rising interest rates will make financing the national debt more expensive. Moreover, as deficit spending ramps up – maybe even to $2 trillion per year – the cost to finance the debt will compound.

One popular rationale for deficit spending by economic policy makers is that the effects of the fiscal stimulus will allow the economy to achieve escape velocity. Under such a scenario, the economy would, somehow, be able to grow its way out of debt; the percentage of debt to GDP would come down.

However, over the last sixteen years, and even more so over the past eight, the grasp for escape velocity has come up empty handed. Debt has mushroomed while GDP has stagnated. Yet, regrettably, the effects of Trumpflation and Trumpnado will likely accelerate this trend.

Thus, rather than attaining escape velocity, like the Amazon jumper, the economy would attain self-destruct velocity. Prepare accordingly for the extreme pain and agony that are coming.

Charts by: St. Louis Federal Reserve Research, StockCharts

Chart and image captions by PT

Full story here Are you the author? Previous post See more for Next post

Tags: newslettersent,On Economy,On Politics,The Stock Market