Summary:

US developments have driven the dollar rally and bond market decline over the past three weeks.

Attention shifts to European politics and the ECB meeting.

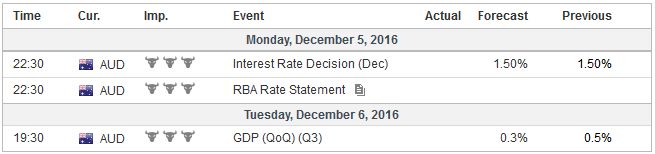

Bank of Canada and the Reserve Bank of Australia meet but are unlikely to change policy.

United StatesThere were significant moves in interest rates and currencies last month. The drama was primarily spurred by the solidification of expectations of a Fed hike in the middle of this month and the stimulus promised by President-elect Trump. After years of falling budget deficits, the prospect for fiscal stimulus by the new President may have forced up long-term yields in any event. However, the prospect of stimulus while the US economy enjoys trend growth and full employment, which as a percentage of GDP appears to rival the 2009 stimulus when the US economy was in the throes of a deep economic downturn implies a greater demand for capital than the 1.80% yield on the US 10-year Treasury that prevailed before the election reflected. Part of the increase in yields is due to an increase in the inflation premia, and partly reflects an increase in the real cost of capital. At the same time, evidence has accumulated indicating that the inventory and manufacturing-led economic soft patch has been overcome. Business investment also appears to have bottomed, and the recession in corporate profits have eased. There is little doubt that the Fed will hike rates for the second time in the cycle in a couple of weeks. The rise in US yields at both ends of the helped drive a sharp widening of the interest rate differentials. These developments have helped fuel a strong dollar rally. The Federal Reserve’s real broad trade-weighted index, which is the measure to be used to assess economic impact, rose by almost 2.3%, just edging out the January rise to be the biggest advance to Lehman failed. The yen was the weakest of the major currencies, depreciating by 8.4%. The euro lost 3.6%. The Canadian dollar fared better than most, losing only 0.2%, underscoring one of our rules of thumb: in a strong US dollar environment, the Canadian dollar typically outperforms on the crosses. The table is set. Fed officials will draw confidence from the drops in the unemployment and underemployment rates, and the continued solid even if not spectacular job growth. Average hourly earnings disappointed, but the trend has been good, and many will expect more wage pressure going forward. The economic calendar turns light in the week ahead. There are several Fed officials who speak before the cone of silence is invoked ahead of the FOMC meeting. Separately, with the announcement of the Treasury and Commerce Secretary nominees, non-economic news is likely to dominate in the days ahead. |

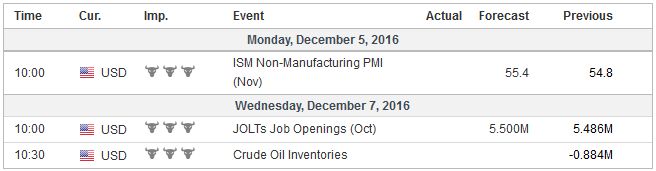

Economic Events: United States, Week December 05 |

EurozoneThe absence of new impulses from the US, and given its events, the market’s focus will turn to Europe. First is today’s events in Europe, the Italian referendum, and the Austrian presidential election. Ironically, there seems to be much confidence in the outcome of the former, and only slightly less so in the latter. The referendum is widely expected to lose, and the Freedom Party’s Hofer is likely to become the next Austrian President. ItalyOur key point about Italy is that it is Italy. We are talking about a country that is on its 64th government since the end of WWII. It too much of the commentary and analysis is this apocalyptic view. A defeat of the referendum seeking constitutional change is not the same as a populist/nationalist victory. Elections are not imminent elections and even if they take place before 2018, when they are current scheduled, the political rules for the election of the lower chamber is being reviewed the judiciary. A referendum on EU or EMU membership is also not imminent or particularly likely over the next 18-24 months. We suspect that after the referendum very little will change. Win or lose; Renzi may stay on as Prime Minister with a cabinet reshuffle. It would not be the first time a politician changes their mind, and Renzi has acknowledged his error. The point is that it does not automatically trigger a snap election. If he steps down, another member of his party, and perhaps a sitting minister will slide over a few chairs over. The two big issues are the preparation for the 2018 election, which involves electoral law, and the banks. More important than the referendum for Italian banks may be the administrative court ruling before the weekend that froze part of the government’s banking reforms pending a decision by the Constitutional Court. The reforms involve turning the large mutual banks into joint stock companies. The court took exception with the central bank’s regulation that would allow the banks to limit or eliminate the cash reimbursement to shareholders that opposed the reform and chose to exercise a withdrawal right. The logic of the Bank of Italy’s regulation was to prevent the capital base of the banks from being drained by shareholder demand for reimbursement. AustriaThe Austrian election is a different story. If Hofer is elected, it is clearly a victory for those nationalist and populist forces. It is Brexit, Trump, Hofer, not Brexit, Trump, Grillo. If Hofer is elected Austria’s President, nothing will change Monday. The post is mostly ceremonial, but the drama will be set into motion even if it takes several months to play out. The rise of the Freedom Party may be more about the demise of the traditional political elite rather than support for an anti-EMU or anti-EU agenda. From another angle, the nationalist-populist forces first appeared in eastern and central Europe, Hungary, Czech, Slovakia, and Poland. The election of Hofer sees this bloc grow within the EU. After this weekend, many observers turns to France, where Le Pen is widely expected to make it into the second round after no candidate gets 50% in the first round and the top two compete in a run-off. The center-right Republicans have sent into retirement Sarkozy and Juppe again, and have gone for self-described French Thatcher. That is radical in France. The Socialists will have their primary next month. Hollande indicated he would not seek re-election, leaving the right-wing of the party, whose policies are not so dissimilar from some French Republicans, to take the mantle. In the past, when faced with a potent challenge from the National Front, the main two political parties find common ground. This seems like the most likely scenario again. Before France, the Dutch go to the polls. It is considerably more likely that the populist-nationalist forces serve, and possibly lead the next government than in France. The big event next ahead of the FOMC meeting is this week’s ECB meeting. This is a live meeting in the sense that policy announcements are expected to be forthcoming. What is at stake is not interest rates. The deposit rate will remain atminus40 bp. Instead, decisions are needed about its asset purchases. First is extending the program past the current soft end-of-March time frame. Most are focusing on a six-month extension, mostly on the basis that that was the length of time of the previous extension. The challenge here may be to do it in a way that makes it clear that it is not an open-ended program. There are many ways that this can be achieved, and verbally by Draghi is one such way. There is some speculation that the ECB could scale back the amount of monthly purchases (currently 80 bln euros). If this does materialize, we suspect it may be an operational tweak in the covered bond purchases. Second is adjusting the decision-making rules about the purchases. The capital key, which is currently being used, is based on the relative size of the economy so that the larger the economy, the greater amount of bonds the Euro-system buys. This is an important principle and one that is most unlikely to be jettisoned as some have suggested. Instead, we suspect the ECB can modify some of its own rules, like the individual issue cap. The ECB may also apply the minus 40 bp floor on the portfolio level rather than the individual security level, and this too would overcome or minimize the scarcity operational challenge. Third is measures relating to the securities lending program to address the stress in the repo market. The idea here is that when the ECB buys securities, it not only removes the securities as an investment vehicle but also as collateral. The ECB and the national central banks have securities lending programs, but they are not particularly user-friendly. There has been some speculation that the ECB will take measures to improve its ability to provide the securities it buys back to the market. |

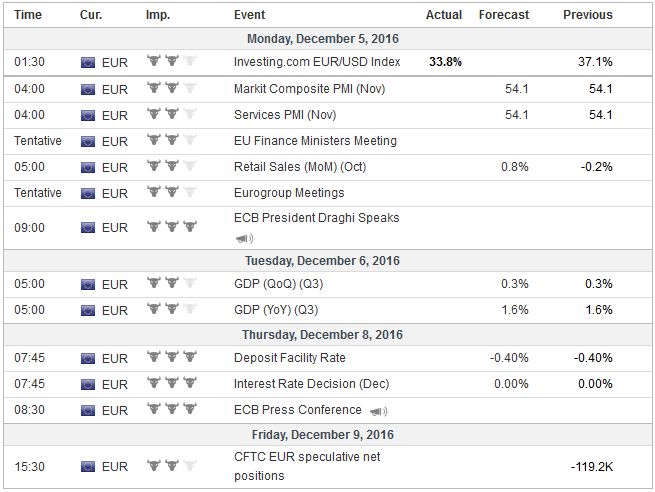

Economic Events: Eurozone, Week December 05 |

United KingdomTurning to the UK, its Supreme Court hears the government’s appeal of the Constitutional Court ruling that protected Parliament’s authority to trigger Article 50. A decision is not expected until the middle of next month. Many expect it to uphold the Constitutional Court’s decision. This is important in the markets because Parliament involvement is associated with a soft Brexit rather than hard. And a soft Brexit is seen as sterling positive. Moreover, it may delay the triggering of Article 50 by three or four months. Still, through the cacophony, it appears that on balance, access to the single market is possible, at a price. Last month, sterling was the only major currency to appreciate against the dollar (~2.15%). Sterling’s gains came despite the fact that interest rate differentials moved dramatically against it. The US premium on two-year month rose from 58 bp at the end of October to a little above 100 bp before the end of November. It is the most in at least a quarter of a century. Many argue that the resilience of the UK economy shows that those favoring Brexit were right and the economic risks were exaggerated by the Remainers. However, the sterling’s decline was a shot in the arm, a dramatic one-off devaluation. Against the dollar, sterling has fallen by about 17%, and on a broad trade-weighted index it is off by about 10%. The currency depreciation, coupled with the low interest rate loans by the Bank of England, its rate cut, and the resumption of its asset purchases, mean that the UK economy got a large dose of monetary stimulation. Lastly, outside of Europe, the Reserve Bank of Australia and the Bank of Canada hold policy-making meetings. Both are most likely leaving policy on hold. The strengthening of the US economy (the Atlanta and NY Fed models have the economy tracking 2.7% here in Q4) and rally in oil prices buy Canada time. And it needs that time. It has lost fully time jobs this year (~25k). The 3.5% annualized growth in Q3 was largely driven by the recovery from the disruption from the earlier fires. |

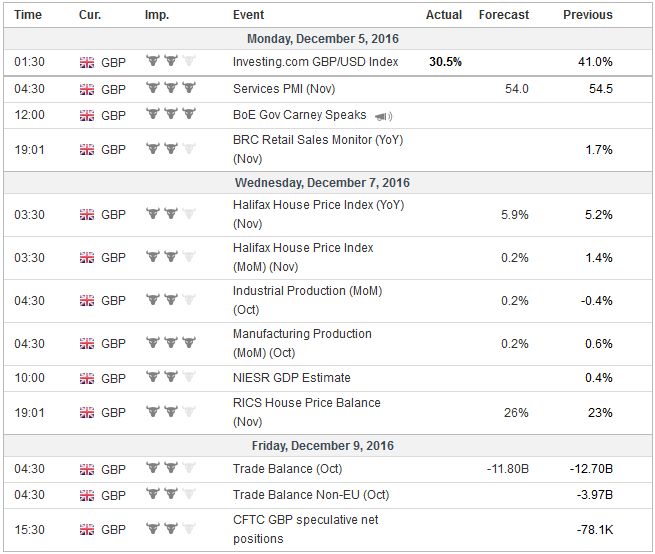

Economic Events: United Kingdom, Week December 05 |

ChinaThe RBA is on hold, but many continue to look for a rate cut next year. The rise in metal prices and the apparent stabilization of the Chinese economy are helpful. China releases a host of data next week, including reserves, trade, and inflation. The broad picture is unlikely to change. China continues to experience capital outflows. The trade surplus remains large though the value imports and exports are lower than a year ago. Its trade surplus with the US has eased a little this year from a record last year. Consumer inflation continues to hover a little above 2%, while producer prices are beginning to get traction after an extended period of deflation. |

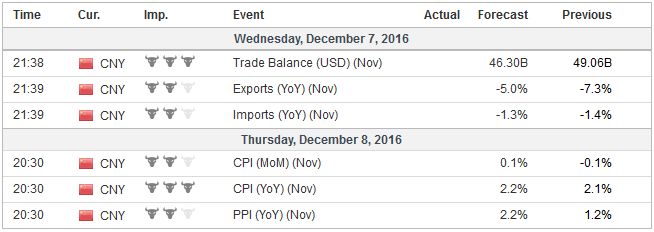

Economic Events: China, Week December 05 |

AustraliaThe day after the RBA meeting, Australia will report Q3 GDP. It is expected to have slowed to 0.2% in the quarter from 0.5%, while the year-over-year pace eases to 2.5% from 3.3%. The year-over-year pace is will likely fall to near 2.0% here in Q4. |

Economic Events: Australia, Week December 05 |

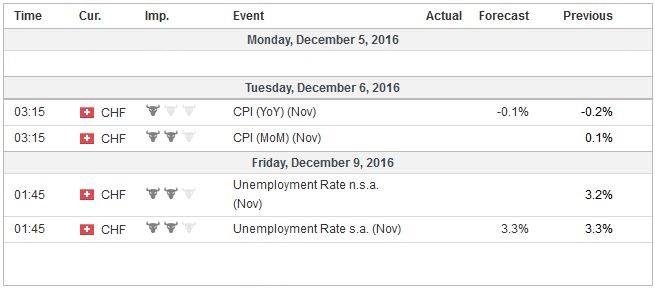

Switzerland |

Economic Events: Switzerland, Week December 05 |

Tags: #GBP,#USD,$AUD,$CAD,$EUR,Austria,ECB,Italy,Netherlands,newslettersent