(Originally published in December 2015)

In December 2015, the ECB announced a further „easing“ of monetary policy. In order to stimulate the economy in the euro zone you will take the following measures:

First, the ECB will cut its deposit rate from -0.2 per cent to -0.3 per cent. Second, the rate for main refinancing operations will remain unchanged at 0.05 per cent. Third, the ECB will expand its stimulus program by buying government bonds until March 2017.

However, the size of the ECB’s monthly bond-buying program will be unchanged at 60 billion Euros per month. With those measures you would like to boost the inflation rate in the euro zone up to two percent.

Unfortunately, the argumentation of the ECB is based on several fundamental errors. Please let me try to explain to you the three most severe misunderstandings.

The deposit rate of the ECB is an interest rate on the liabilities side of the balance sheet of the ECB as deposits are liabilities of the ECB. If the ECB is lowering its deposit rates further into negative territory this is not an expansive but rather a restrictive monetary policy.

Lowering the Deposit Rate means Depressing the Economy

By lowering the deposit rate further into minus territory, this means, that the banks must pay more interest rates to the ECB. Therefore the ECB is not supplying the economy with additional capital („lender of last resort“) but rather raises foreign capital from the economy. This clearly is restrictive.

Lowering deposit rates further into negative territory by the ECB has got the same impact on the economy as if the ECB is raising its rate for main refinancing operations on the asset side of its balance sheet.

The ECB therefore is not at all stimulating the economy by lowering deposit rates but rather is depressing it.

ECB does a Dangerous Null-Sum-Game

Second misunderstanding. The balance sheet of the ECB is always balanced. The ECB can only invest as much into government bonds on the asset side of its balance sheet as it raises foreign capital on the liability side of its balance sheet.

In other words: The ECB raises capital on its liability side and this very capital it reinvests on its asset side. Therefore the so called „stimulus program“ of the ECB which you, Mr. Draghi, announced yesterday is merely a zero sum game.

However, this is a dangerous zero sum game. Why?

ECB takes the Risk when it Buys Greek Bonds

Commercial banks and institutional investors must not take the risk themselves anymore of investing directly into government bonds, for example of Greece. They rather invest into „secure“ deposits of your ECB with a better rating. The ECB then is taking the risk on their behalf of investing into government bonds of Greece.

By this the quality of the ECB rating is diluting.

In the end tax payers are taking the ultimate risk of the investments of the ECB into government bonds of countries with a lower credit rating than the ECB.

If interest rates rise and/or prices of government bonds are falling as a result of a lower rating, it may happen, that the equity ratio of the ECB is falling to zero and below. In case equity of the ECB is falling into negative territory, those credit institutions which gave credit to the ECB must write down their investments at the ECB accordingly.

When the ECB Equity Ratio falls under zero, then European banks write must write-down their ECB Deposits

This may lead to bankruptcy of commercial banks in Europe. In such a case the ECB cannot „print money“ to pay back its debt as central bankers, politicians and journalists often pretend. In contrary: Bankruptcy of commercial banks, as a result of negative equity of the ECB, may lead to a severely economic and even political crisis.

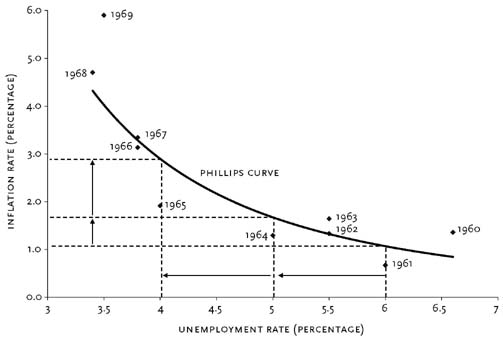

Do We Need to Worry about lower Prices?Third misunderstanding: The ECB as well as other central banks are worrying about low inflation rates or even slight deflation. However, there is no reason for worrying about lower prices. Why? Let me explain. The famous so called „Phillips Curve“ is showing a „trade-off“ between inflation and unemployment. If unemployment is high, inflation is low and vice versa. By reading Phillips original text „The relation between the unemployment rate and the rate of change of nominal wage rates…“ in „economica“ (1958) carefully it becomes clear, that Phillips stressed the point, that his curve was correct only in times of a change of aggregate demand when aggregate supply was constant. Having said this, the Phillips Curve is, in economic words, nothing else than an aggregate supply curve along which the demand curve is shifted. In this case all intersections of supply and demand lie on the stable supply curve. However, if there is a supply shock and oil prices rise, the supply curve is shifted upwards itself. The result is stagflation i.e. inflation and unemployment rise together. On the other hand, if oil prices fall, inflation and unemployment fall together. Therefore „deflation“ does not automatically mean „depression“ as todays central banks misunderstand. |

We have Good Deflation and not Bad Deflation

There is a „good“ deflation and a „bad“ deflation. In case of a „good“ deflation the economy is stimulated. This happens today by lower energy prices. They stimulate the economies.

The conclusion is: Falling prices do not necessarily mean a higher unemployment rate. If prices fall as a result of falling supply, unemployment falls as well.

Nowadays prices do fall as a result of lower energy prices. Therefore central banks must not worry about lower prices as they stimulate the economy.

ECB Has Severe Misunderstandings in Economic Theory

Dear Mr. Draghi, I hope I was able to show to you some severe misunderstandings in economic theory. Economics is a very important science. And it is necessary that there are no such misunderstandings as I tried to figure out in my letter to you.

It cannot be the duty of the central banks to invest in government bonds of lower quality just because they do not get credit themselves from commercial banks and institutional investors.

Of course commercial banks and institutional investors prefer to invest in liabilities of the ECB rather than in risky government bonds. On their behalf the ECB and tax payers take the risk of the subprime government bonds. This is a free lunch offered by the tax payers and the ECB.

By taking credit from credit institutions and investing this very capital into bonds of governments with a lower rating, the quality of the ECB is diluting.

The ECB is throwing good money after bad.

In worst case this may lead to bankruptcy of credit institutions and in the end tax payers will have to recapitalize the ECB.

Full story here Are you the author? Previous post See more for Next postTags: newslettersent,Standpunkte