Summary:

Italy is the epicenter of the next potential populist “shock.”

A defeat of the referendum is seen as intensifying the political risk.

Renzi has wavered again regarding his political future if the referendum loses.

Many investors are closely watching Italy. It is seen as the next flashpoint for the wave of populism after Brexit and Trump’s success. The constitutional referendum will be held on December 4. Although the center-right Republican Party in France holds its first primary this weekend, ahead of next spring’s presidential election, the Italian referendum poses a greater immediate risk.

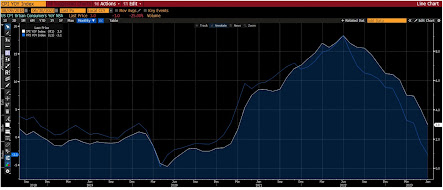

Without exception, the 32 polls from 11 companies reported since October 21 all showed the referendum would be rejected. There is widespread mistrust for polls after the UK referendum and US election, but the common element was under-estimating the populist sentiment. In Italy, it is tempting to read the polls as showing the populist ahead.

The problem with that interpretation is that it is not just the populists that are opposed to Renzi’s constitutional reforms that, especially in light of earlier political reform, would strengthen the prime minister. Italy has had over 60 governments since the end of WWII. Most recently, Renzi is the third unelected Prime Minister.

The argument is that without political reforms, and the ability to form stronger governments, Italy cannot mount the kind of economic reforms necessary to revive the moribund economy. Yet all the opposition parties, some unions, and even some members of Renzi’s own center-left coalition are opposed.

Nevertheless, a defeat of the referendum is understood as strengthening the populist threat because of how Renzi has handled it. At first, he threatened to resign if the referendum failed. Then he seemed to backtrack and recognize the faux pas of linking his government to the referendum results.

Just yesterday, he was again suggesting he would leave: “If I have to stay on in parliament [after the defeat of the referendum] and do what everyone else has done before me, that is, to scrape by and just float there, that does not suit me.” The reasons that the defeat of the referendum is seen as a boost for populist forces is that it weakens Renzi and the PD, and therefore strengthens the second biggest party in Italy, the populist 5-Star Movement, who wants to have a referendum on EMU membership.

There are a couple of things working in Renzi’s favor despite him. Still, may not be enough to stem the tide. First, there is more than four million expats eligible to vote. They are thought likely to support the referendum. However, only around a third are expected to vote. This could make a difference in a close contest, but the recent polls show a 5-7 point lead by those wanting to reject the referendum.

Second, the wording of the referendum has been subject to much dispute and legal challenges. It is worded in a way that focuses on the favorable element. Some think this could be worth a few percentage points in Renzi’s favor depending on the number of undecideds there are at that late date who decide to vote. Note that most recently the undecided have been breaking to the “No” camp.

Third, Italy reported an unexpected 0.3% growth in Q3 after a flat Q2. Consumption and industrial output were the key drivers. However, with unemployment at 11.7% (despite labor reforms in 2015), many Italian’s may have not yet experienced the growth, which in any event remains less than 1% year-over-year. Moreover, early Q4 data warns that even the modest growth momentum may not be sustained. Nevertheless, the fact that Italian growth in Q3 outstripped German growth is noteworthy.

Fourth, Renzi has challenged the EC and submitted a mildly expansionary budget for next year. The EC pushed back, wanting more details about the additional expenditures stemming from the earthquakes and migrant/refugee relief. The EC says it still wants more information, but it will give Renzi more time to make his case, and won’t make a final decision until early next year.

As we have argued, the European project is predicated on greater integration and the erosion of national sovereignty. If the populist moment is truly here, the European project is at risk. This is a force, as much as the prospect of tighter Fed policy or more US inflation, that is weighing on the euro.

Tags: $EUR,Italy,newslettersent