The Trump TradeAfter 35 years of waiting… so many false signals… so often deceived… so often disappointed… bond bears gathered on rooftops as though awaiting the Second Coming. Many times, investors have said to themselves, “This is it! This is the end of the Great Bull Market in Bonds!” And then, at the appointed hour, expecting the rapture… they took the leap of faith only to come crashing down on the rocks below. In 2008, in 2012, in 2014 – Each time, the market made fools of them. Now, weary, wary and nearly broke, they make their bets as though they were setting an explosive charge at a federal building. “Bond rout accelerates as Trump stimulus vow spurs inflation bets”, reports the Financial Times. |

Bonds Long Term The long bond’s long cycle – red rectangles indicate when the post 1980 bull market was held to be “over” or “over for sure” or “100% over”, etc. We have repeatedly seen bear percentages close to or even exceeding 90% in the Barron’s “smart money” poll over the years. There can be no doubt that Donald Trump’s election has boosted inflation expectations in the short term – but will the momentum persist? - Click to enlarge |

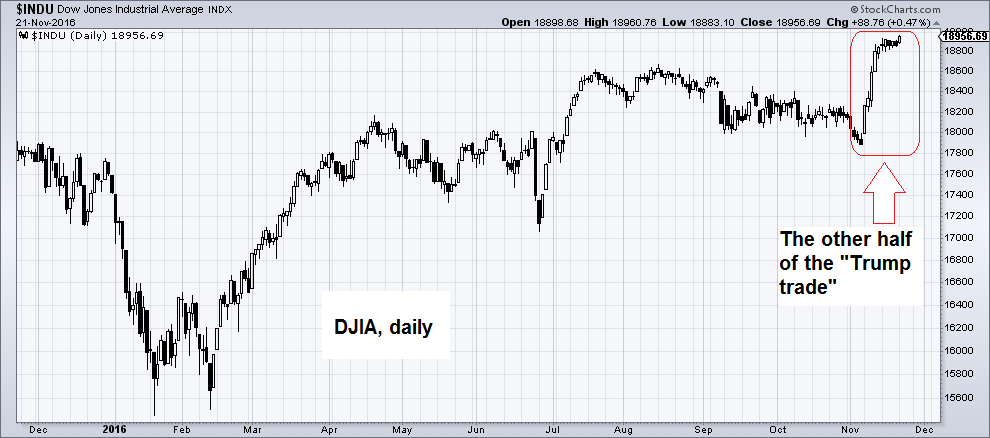

| More than $1 trillion has been clipped from global bond values in the last week. Meanwhile, the Dow continues to move up, closing in on 19,000 and a new all-time high. This is the “Trump trade” – the bet that the incoming administration will be good for stock prices and bad for bonds.

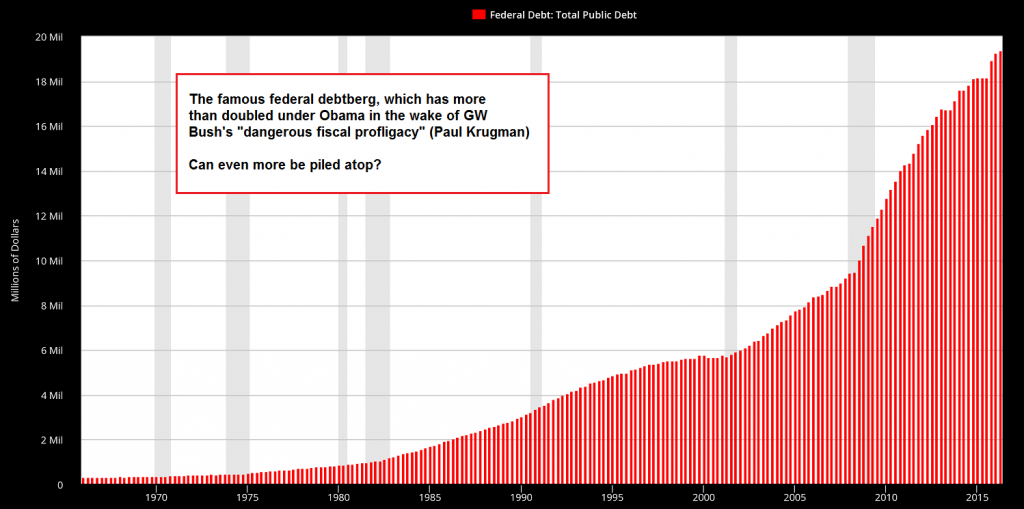

It will be good for stocks, they believe, because “The Donald” proposes to lower corporate taxes, remove regulation that stifles certain sectors, and reward other sectors – infrastructure and the military – with more money. It will be bad for bonds because all this new spending will have to come from somewhere. Where? The federal government’s budget deficit is already running at 3% (of GDP). You can see where that leads. The economy is growing at only a 1% rate. That means it is adding three times as much debt as output. Hmmm… The Trump plan calls for increased spending, while cutting taxes. Let’s see: Lower taxes plus even higher spending… hmmm. We’re getting a deja-vu feeling all over again. As colleague Chris Lowe points out to readers of our global “big trends” advisory Inner Circle, estimates for the U.S. government spending under a Trump presidency call for an increase in the national debt over the next decade of $5.3 trillion. |

Dow Jones Industrial Average IndexAlthough our own guess that the market was in danger of declining after producing what looked like a “false breakout” turned out to be spectacularly wrong (next time we’ll flip a coin), we are still enjoying this. Almost no-one expected the stock market to react in this manner to a Trump election victory. When DJIA futures were down 900 points overnight in Asian trading on election day, leftist European mainstream media gleefully shouted the news about “Trump’s first ‘success’” from the rooftops. Naturally, it’s been crickets on that particular point ever since. Anything that makes these socialist dunces squirm is fine by us (to be sure, Trump is not exactly a paragon of free markets, but we are still enjoying the discomfort of his most vociferous detractors). |

Blithering Nonsense?Those are the dots that we’re looking at. And what we see are higher rates of inflation. We’re not so sure about high stock prices, though. We suspect that the stock market is going to take a tumble in the not-too-distant future. As to bonds, however, the “Trump Trade” looks to us like a sure winner. But wait. It can’t be that easy. Even the newspapers, major investment advisers, and cockamamie, Nobel prize–winning economists see the same thing. They’re all recommending the “Trump Trade.” |

Total Public Debt |

| And when everyone sees the same thing, we must all be going blind. One of the objections to the “more inflation” hypothesis comes from our friend and colleague David Stockman, who served as President Reagan’s chief budget adviser.

He believes the “reflation trade” (that is, betting that more phony “stimulus” will continue to boost the market) is for chumps. Why? Because the fiscal stimulus program won’t happen. It will run headlong into the black hole of U.S. government finances – and disappear. He has a point. Just because “The Donald” calls for more spending, it doesn’t mean Congress will go along. Here’s David:

Yes, the feds are broke. And yes, Republicans did block previous efforts at fiscal stimulus. But we wouldn’t give up on the “reflation trade” completely. This may or may not turn out to be the best time to refinance your mortgage and jump off… But it is time to look for the ladder… More on this to come. |

Charts by: StockCharts, St. Louis Federal Reserve Research

Chart and image captions by PT

The above article originally appeared at the Diary of a Rogue Economist, written for Bonner & Partners.

Full story here Are you the author?

Previous post See more for Next postTags: newslettersent,On Economy,On Politics